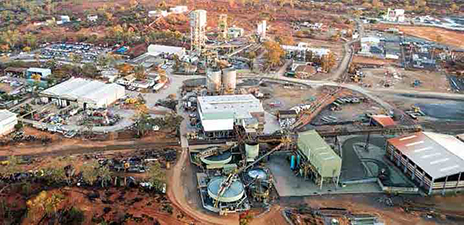

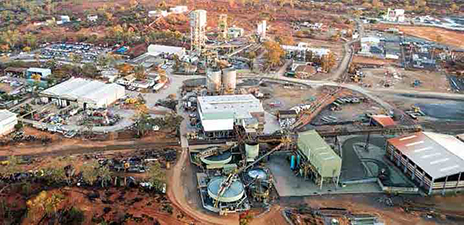

The CSA mine is one of Australiaís longest operating mines (nearly 150 years) and itís also one of the

deepest (1.75 km deep).

Glencore, MAC Amend Terms for CSA Acquisition

The terms of the amended agreement are: $775 million cash (with the ability to scale up to $875m cash); up to US$100 million of common equity; US $75 million deferred to be paid out of half the proceeds of any future equity raise, with an equity back-stop provision for Glencoreís benefit; $75 million contingent payment payable when copper averages more than $4.25/lb for 18 continuous months over the Life of Mine (LoM); $75 million contingent payment payable when copper averages more than $4.50/lb for 24 continuous months over the LoM; and a 1.5% copper NSR.

MAC is a Special Purpose Acquisition Co. (SPAC) listed on the New York Stock Exchange. The transaction is expected to be completed in the first quarter of 2023, subject to the approval of MACís shareholders and other customary closing conditions, including regulatory approvals. Patrice Merrin is a director of Glencore plc and is also a director of MAC. She holds less than 1% voting interest in MACís shares. MAC is not a related party of Glencore within the meaning of the UK Listing Rules.