A haul truck dumps ore into the primary crusher at the Eagle mine.

Yukon Attracts Renewed Interest

Production and development activities gear up in a favorable mining district

By Steve Fiscor, Editor-in-Chief

What has not changed is the seasonal daylight, climate, terrain and geology. Today’s prospectors are still learning about Yukon’s geology. The climate and mountainous terrain as well as the amount of daylight dictates what activities can take place and when, which runs counterintuitive to the quarter- to-quarter performance expectations for publicly held companies. Working on these projects still requires a hardy spirit and high level of dedication.

This year, Yukon’s snowpack levels were unusually high, which had an obvious impact on operations during the winter and maybe more so now during the spring snow melt. One government report said snowfall levels ranged from between 150% and 400% of the normal annual snowfall levels. The Yukon-based operations that persevere are seeing their efforts bear fruit. Others are still trying to establish a foothold. What follows is a compilation of some recent reports.

Eagle Mine Posts Record Numbers

Production slowed during the first three months of 2022 as it

always does at Victoria Gold’s Eagle mine. The coldest temperatures

occur during the first quarter and, as conditions improve,

so does production. The numbers during the second half of the

year always look better than the first half. If the trend continues

as it has the past couple of years, the Eagle mine should post

record numbers again this year.

“Similar to previous years, the Eagle mine’s gold production profile during 2022 will continue to be seasonal in nature,” Victoria Gold President and CEO John McConnell said. “As summer approaches in the Yukon and the days get longer, we expect increased ore stacking and gold production to result in greater earnings and cashflows.”

Last year, the Eagle mine produced a record 164,222 ounces (oz) of gold, a more than 40% increase over the 116,644 oz produced in 2020. Roughly 9.2 million metric tons (mt) with an average grade of 0.85 g/mt were stacked on the leach pad in 2021. Production at the Eagle mine began during the second quarter of 2019. It is located on Victoria’s Dublin Gulch property in the Mayo Mining District of Central Yukon. An open-pit, truck-shovel operation, the mine uses 22-m3 front shovels, 12-m3 wheel loaders and 136-mt haul trucks to work 10-m-high benches.

“Our increased 2021 production led to other record highs for Victoria including revenues of $356 million and net income of $108 million,” McConnell said. “Capital expenditures and all-in sustaining costs were higher as the company not only dealt with the impacts of COVID-19 and inflation, but continued advancing growth initiatives. These growth initiatives, which include Project 250 and exploration at Eagle and Raven, will continue through 2022 and are expected to lead to material increases in production and reduction in unit costs for 2023 and beyond.” As part of a $40 million expansion initiative, Victoria Gold has started Project 250 to increase average annual gold production at the Eagle mine toward 250,000 oz/y during 2023. The two primary opportunities to increase production are the scalping of fine ore from the crushing circuit and adjusting the seasonal stacking plan.

Diverting fine ore from the crushing circuit to the leach pad is expected to reduce wear and energy requirements as well as increase overall capacity of the crushing circuit. The company said the potential exists to increase design throughput of the crushing circuit by approximately 15%, thereby increasing ore stacking on the heap leach pad by approximately 1.5 million mt/y.

Detailed engineering and procurement of equipment is under way to enable construction to start in the second half of 2022 to benefit 2023 production. Victoria Gold intends to reduce the winter stacking curtailment down to one month, increasing annual stacking to 11 months. Project 250 will also require two additional haul trucks and a loader. Gold production for the Eagle mine for 2022 is estimated to be between 165,000 oz and 190,000 oz.

Hecla Acquires Alexco, Yukon’s Keno Hill

As this edition was going to press, Hecla Mining Co. announced

plans to acquire all of the Alexco Resource Corp. shares it did not

already own. The all-stock transaction implies a consideration of

$0.47 per Alexco common share. Hecla said it was also entering

into an agreement with Wheaton Precious Metals to terminate

its silver streaming interest at Alexco’s Keno Hill property in

exchange for $135 million of Hecla common stock conditional

upon the completion of Hecla’s acquisition of Alexco.

The center piece of the transaction is Keno Hill, a high-grade silver property. The operation is fully permitted with infrastructure that includes a 400-mt/d mill, on-site camp facilities, all-season highway access, and connection to the hydropower grid.

Hecla is providing Alexco with a $30 million secured loan facility and is purchasing nearly 9 million Alexco shares at C$0.50 per share. The loan and share purchase are intended to provide Alexco with immediate working capital to continue development work at Keno Hill and are not conditional upon the completion of the transaction. The timing for Alexco was fortuitous. Prior to the Hecla announcement, Alexco reported that mining activities were continuing to ramp-up at its Keno Hill operations. Even though underground development improved during May with better equipment availability at both the Bermingham and Flame & Moth mines, Keno Hill was not able to meet its goal of 400 mt/d.

Alexco started concentrate production and shipments in 2021 and is currently advancing Keno Hill toward steady-state production. Upon reaching commercial production, Keno Hill was expected to produce an average of approximately 4.4 million oz/y of silver contained in lead/silver and zinc concentrates. Underground advancement at Bermingham reached the 1120 level during May, where the upper portion of the high-grade Bear Zone has been cross-cut with two ore faces. Alexco reported that the block model that predicted grades of 1,900 to 2,000 g/mt of silver appear to be well supported with rib and face assays. Additionally, in May, the company milled approximately 5,750 mt of ore, representing an approximate 19% increase over April. The mill operated for 16 days in May, nine of those days operating at throughput above the nameplate capacity of 400 mt/d. The metallurgical performance continued to be robust, with more than 93% total silver recoveries to concentrate and in excess of 16,300 g/mt silver in the lead concentrate.

While the underground performance improvements are notable, Alexco acknowledged the supply of 150 to 250 mt/d of ore to the mill is not enough, saying that development remains insufficient to achieve the necessary number of production headings to sustain a 400-mt/d feed for the mill before the end of 2022. To rectify this imbalance, the company was considering temporarily suspending milling operations for five to six months to refocus all efforts on advancing underground development. Alexco was hoping to build 120,000 mt of ore inventory grading 1,050 g/mt silver at the Bermingham and Flame & Moth mines by year end. Then they would restart milling operations in January 2023. If everything went according to plan, the operation was expected to reach cash self-sufficiency during the first quarter of 2023. The company estimates that more than 4 million oz of silver will be delivered as ore feed to the district mill in 2023.

A few weeks before the Hecla announcement, Alexco Chairman and CEO Clynton Nauman reported that the operation’s ramp-up plan was running well behind schedule. “We need to get further ahead with underground development, and that requires five to six months of focused underground advance to ensure we have available, and can maintain, two to three levels of development ahead of primary production levels in each mine,” he said. With Hecla’s experience and expertise, the Keno Hill property will likely see success much sooner that it anticipated.

Minto Plans to Carry 2021 Momentum Forward

For the first quarter of 2022, Minto Metals Corp. produced 9.1

million lb of copper, a 70.7% increase over the first quarter of

2021, at a consolidated cash cost of $2.44/lb. “Our excellent

operating performance and cost containment in a higher copper

price environment has surpassed our expectations,” Minto Metals

President and CEO Chris Stewart said. “Our team has strong

momentum and has delivered a positive performance for the

second consecutive quarter.”

Located in Yukon’s Minto Copper Belt, the Minto mine uses the long-hole stoping method to mine ore underground. The long-hole stopes are retreated from an extraction development drive with rib pillars left between stope lines for ground stability. Ore is extracted from the mine with 50-ton haul trucks using a 15% ramp to surface. The underground operations are currently producing on average 3,000 mt/d of ore from the Copper Keel mining zone.

High snowfall levels during this past winter are generating a significant volume of water across the territory as it melts. The Minto mine at times saw daily water volume inflows exceed the mine’s discharge capacities, which caused the storage pond levels to rise. “At the beginning of 2022, Minto committed to spending $8 million to improve the mine water management system at the Minto mine,” Stewart said. “Our investment included an upgrade to our water treatment plant, the installation of a new microfiltration plant, and the purchase of evaporation units, all to support improved environmental stewardship.

As a result of the snow melt, the mill was temporarily idled, but underground mining operations continued uninterrupted, stockpiling ore ahead of the milling facility restart. The mill is permitted to process ore at an average rate of 4,200 mt/d. Minto expects no metal production impact on the 2022 guidance of 18 million to 31 million lb copper at cash cost of $2.90/lb. Last year, the mine produced 26 million lb of copper, a 46% increase over the previous year. Notably, in November and December, the mill processed 3,000 mt/d of ore to generate 6.1 million lb of copper.

To maintain its 2021 momentum in 2022, Minto anticipates investing more than $10 million on underground mine development. The plan is to operate the mill at an average throughput of 3,000 mt/d for H1 2022 and 3,250 mt/d for H2 2022 as the ore production continues to ramp up to toward the mill’s nameplate capacity.

During May, Minto extended its offtake agreement with Sumitomo Canada Ltd. Sumitomo agreed to purchase all the copper concentrate produced at the Minto for another four years based on 50,000 dmt/y of concentrate production or 200,000 dmt total. In conjunction with the offtake agreement, Sumitomo extended Minto’s debt facility to $17.5 million, which is repayable over 48 months or the remaining agreement term at the time of the draw. “Sumitomo has been a tremendous business partner since the restart of the Minto mine in 2019 and we look forward to continuing this relationship and providing Sumitomo with our high-grade-quality copper concentrate for an extended period of time,” Stewart said. The Minto mine started as an open-pit operation in 2007 and eventually moved underground in 2014. The previous owners, Capstone Mining placed the Minto mine on care and maintenance in 2018. In mid-2019, Minto Metals Corp. (formerly Minto Explorations Ltd.) purchased and restarted the mine.

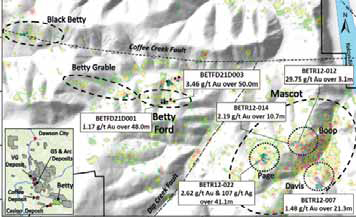

White Gold Begins Drilling the Betty Properties

White Gold Corp. recently initiated its 2022 drill program at

the Betty Ford and Mascot targets on its Betty property. The

Betty property is located in the southern part of the company’s

land package, approximately 15 km northeast of Western

Copper and Gold Corp.’s Casino porphyry deposit and 40 km

east of Newmont Corp.’s Coffee gold deposit. White Gold is

exploring a 350,000-hectare land package in Yukon’s White

Gold District, Yukon, with support from Agnico Eagle Mines

and Kinross Gold.

Sabre Gold Begins Permitting Process

for Brewery Creek

During early June, Sabre Gold Mines Corp., through its subsidiary,

Golden Predator Exploration Ltd., initiated the permitting process at the Brewery Creek Property, providing a project update

to the Yukon Environmental and Socio-Economic Assessment

Board (YESAB). Last year, Arizona Gold Corp. acquired

Golden Predator Mining Corp., which was working toward reopening

Brewery Creek, and changed the company’s name to

Sabre Gold Mines Corp.

Yukon’s policy required Sabre Gold to provide a 30-day written notice of its intent to submit an updated project description on Brewery Creek for Executive Committee Screening. The next step will be working with YESAB’s Executive Committee to draft the project proposal guidelines. The project proposal guidelines will frame the environmental and socioeconomic assessment for the project. Brewery Creek’s project description has been updated to reflect the project profile as included in the January 2022 Preliminary Economic Assessment (PEA), which further outlines details regarding the mine expansion and operational restart at the Brewery Creek mine.

The updated project description envisions mining nearly 18.7 million mt of ore from nine open pits with a mining life of approximately nine years. Ensero Solutions Canada Inc. assisted in writing the project description. The local Tr’ondëk Hwëch’in First Nation (THFN) were also consulted for purposes of the initial project description.

The submission of an updated project description commences the permitting process to bring the Brewery Creek mine back into operations with a timeline that is anticipated to be shortened as it was a former producer and fully permitted,” Sabre Gold President and CEO Giulio Bonifacio explained. “Sabre Gold looks forward to working with the local First Nations and YESAB to work through the assessment process in a timely and efficient manner. Sabre Gold is also renewing the Class IV Land Use permit at Brewery Creek for another 10 years. The Land Use Permit authorizes exploration activities across the claims including further drilling to test several highly prospective drill targets within and outside of the current resource areas for purposes of expansion of the current resource.”

With an average annual production of 60,000 oz/y for a total 473,000 oz gold over an initial eight-year mine life, the PEA determined an after-tax net present value at 5% of $112 million at an internal rate of return (IRR) of 27.6% at $1,700/oz gold increasing to $157 million at an IRR of 35.7% at $1,900/oz gold. Total cash costs and all-in sustaining costs are estimated at $850/oz and $966/oz, respectively. The operation would require a preproduction capital investment of $105 million with life of mine sustaining costs of $18 million. The payback period would be 2.6 years at $1,700/oz gold.

Sabre Gold said Brewery Creek also has excellent expansion potential to extend mine life and annual production with three open prospective resource areas and several targets within a 182-km2 project boundary.

The PEA was prepared in accordance with NI 43-101 and evaluated the economics of resuming mining at Brewery Creek through open-pit mining and heap leaching mined material for gold recovery to doré. The PEA study was prepared by Kappes, Cassiday & Associates of Reno, Nevada, in cooperation with Tetra Tech Inc. of Golden, Colorado, Gustavson and Associates of Lakewood, Colorado, and Wood Environment & Infrastructure Solutions, of Vancouver, British Columbia.