Miners who can prove that they are building a better

world and are critical to a net-zero future, can improve

their recognition within global markets and society.

(Photo: NASA/Unsplash)

Building Better Mining Companies

Through ESG

We explore how and why mining companies should make environmental, social and

governance a pivotal part of their organizations

By Carly Leonida, European Editor

Accordingly, ESG-related issues formed the cornerstone of key reports published this year by various consultants and advisory firms including EY, Deloitte, KPMG and Egon Zehnder. This article will examine the insights that some of these offer, and how making ESG a central part of companies’ structures, strategies and cultures could generate greater trust; something that is vital in securing a license to operate as well as wider social acceptance. But first, some background…

Putting ESG on the Map

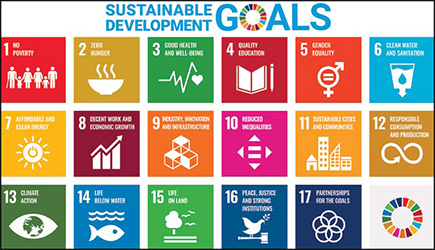

In 2015, the UN Sustainable Development

Goals (SDGs) was released and the

Paris agreement was adopted. These provided

frameworks for collective action to

solve global sustainability challenges and

served as an impetus for sustainability

to enter the mainstream of management

discourse. (To clarify, ESG originated as

investor terminology to describe the sustainability

risk related to investments, but

the term is now used interchangeably with

sustainability itself.)

Two years later, some of the major diversified miners released purpose statements aiming to make a positive contribution to people and the planet. By 2017, these companies were firmly under the scanner of shareholder resolutions for climate action. Though the focus was mostly on the “E” of ESG, this sent a clear message to the industry that investors were paying more attention to sustainability matters.

In early 2018, BlackRock CEO and Chair Larry Fink made waves with his sixth annual letter to CEOs titled, “A Sense of Purpose,” and a year later, he asked all portfolio CEOs of the world’s largest asset manager to “link profits and purpose.” In 2019, the Business Roundtable followed suit, issuing an open letter titled “Statement on the Purpose of a Corporation,” which declared that: “Each of our stakeholders is essential. We commit to deliver value to all of them, for the future success of our companies, our communities and our country.”

Meanwhile, the Brumadinho tailings disaster in Brazil served as a watershed moment, leading to urgent global investor engagement with the mining industry to develop a universal tailings dam standard. Later that same year, outgoing BHP CEO Andrew Mackenzie pledged to invest $400 million over five years to address climate change. Though many applauded Mackenzie for leading by example, this sparked debates about whether the CEO went far enough. Heloise Nel, global mining and metals practice leader at Egon Zehnder, and her colleagues Christian Schmidt, a partner in London, and Sameera Sandhu, global head of research for mining and metals, joined E&MJ for the discourse.

“During 2019, research for our first ESG report, revealed that market forces more so than regulatory intervention were fostering an ESG-centric ecosystem,” Nel explained. “This was also evident from client discussions about board and leadership solutions to improve corporate governance under pressure from investors. However, the limited emphasis placed on the ‘G’ of ESG mainly focused on improving diversity and making disclosures. “At that time, most companies were in the ‘Unconsciously Reactive’ phase of the Sustainability Initiative model developed by Daniel Goleman, and our former colleague, Christoph Lueneburger. In other sustainability maturity models, these companies would fall under the ‘pre-compliance’ or ‘compliance’ stages of the maturity curve.” By 2020, miners were busy releasing 2030 roadmaps for climate action and identifying which reporting standards for ESG disclosure would best position them for higher ESG ratings.

“Some had also appointed a chief sustainability officer (CSO), though their scope often varied. Our view is that it is critical for the CSO to be given a clear mandate from the CEO, who should ultimately be accountable for a company’s sustainability agenda,” Schmidt said. “Some recent high profile and tragic accidents in the industry, and the resulting organizational fallout, societal uproar and scrutiny further strengthen the rational for the appointment of a CSO who has no commercial responsibilities or interests.” Companies serious about ESG are now graduating to the next phase outlined in the Sustainability Initiative model of becoming “consciously reactive” as they translate vision into action. “Very few appear to be further ahead in becoming ‘consciously proactive,’ engaging externally with investors, local communities and across industry supply chains to improve ESG performance and collectively solve systemic challenges,” Sandhu explained.

“Client conversations are evolving as companies mature and this can be gauged from their willingness (or resistance) to solutions designed for improving sustainability. Leading companies realize that aligning purpose, strategy and culture is essential to truly embed sustainability into how they think and operate.” Going forward, culture will be a major driver for companies seeking to become “unconsciously proactive” in ESG, harnessing entire market systems to create shared value at scale. But transforming culture is complex and takes time, as well as visionary leadership and changes to organizational operating systems and structures.

Need for Social Acceptance

Given this backdrop, gaining and retaining a social license to

operate has been high on mining companies’ agendas for some

time. It was voted the No. 1 risk in EY’s annual Top 10 Business

Risks Opportunities for Mining and Metals report for three consecutive

years before being relegated to third in 2022. This year,

for the first time, environmental and social risks topped the list,

followed by decarbonization. Paul Mitchell, EY’s global mining

and metals leader, spoke about this shift.

“What has changed [over the past five years] is the increased

focus by investors, consumers and governments on ESG, with a lot

of focus placed on climate change risk and the path to net zero,”

he said. “Capital markets have moved from fringe investors to major

funds and advisors and, with Generation Change now at the top

of mining companies, ESG has now garnered even greater focus.

“From a stakeholder perspective, the sector has faced greater scrutiny from end consumers, demanding a transparent ethical supply chain as well as a smaller carbon footprint, and miners have adapted their focus accordingly. Shareholder activists have also driven many miners, particularly those with coal assets, to reshape their portfolios by either reconfiguring existing operations or executing divestments.” Research by EY has found that 91% of investors now view nonfinancial performance as “pivotal” in their investment decisions. Accordingly, miners are beginning to integrate ESG factors into corporate strategies, decision making and stakeholder reporting. “The mining sector will play a critical role in enabling the energy transition globally,” Mitchell said. “As such, the sector is not only looking at decarbonizing while continuing to maintain a social license, but it also needs to define for global stakeholders its critical role as a sustainable and responsible source of the world’s minerals, and collectively achieving positive ESG metrics is key to achieving this.” Meghan Harris-Ngae, global ESG mining leader at EY, also joined the discussion.

“Many mines are in remote or underdeveloped parts of the world with local communities that rely on mining for economic growth,” Harris-Ngae said. “Miners have a role to play in ensuring the long-term, sustainable economic growth and social progress of these regions by working with governments, nongovernmental organizations and communities to leave a positive legacy both during and beyond life of mine.” This is an issue that will increasingly come to the fore as the energy transition accelerates, and miners move away from reliance on fossil fuels. Biodiversity and the focus on circular mining have yet to receive the same attention as other ESG topics, such as climate change or gender diversity. But momentum on these subjects is building as more businesses realize that the benefits of protecting natural capital can outweigh the costs.

Evolving Business Models

With future mines set to be carbon neutral and more sustainable,

the majority of the sector’s environmental risk and liability

will lie in closed assets. Tailing dams and contamination are two

significant risks requiring ongoing monitoring and hence a laser

focus on closure and value beyond life of mine has emerged

(more on this later).

Harris-Ngae said: “ESG is a huge challenge for mining companies

to navigate, although it isn’t new for the sector. However,

it presents opportunities to build a positive legacy. To be

successful in managing these risks and advancing the opportunities,

ESG needs to be an integral part of corporate strategy

rather than an add on. It requires an approach that is both bottom-

on and top-down, with a focus on creation of long-term value

for all key stakeholders, not just shareholders. Miners need to

quickly identify issues that will drive — or destroy — value and

manage this accordingly. The best ESG strategies are inclusive

and focused on value-creation for key stakeholders.”

The increase in societal participation and partnership in the mining sector over the past decade has not only brought into focus the rights of groups, such as indigenous communities, but has also allowed for the amplification of these voices through the combination of smaller groups. Even when miners operate in accordance with the law and their formal license, issues can arise and executives can and will be held accountable. The importance of regular reviews and transparent communication with all stakeholders is essential. “There are increasing expectations of true shared value outcomes from mining projects, and miners will need to transform their business models to remain more competitive and bring all their stakeholders along on the journey,” Mitchell said. “New business models whereby national or even community-owned operations could be favored over traditional models. The increase in nationalization in some regions may also lead to an expectation that there are shared value outcomes from mining beyond tax and employment opportunities.

“Climate change is another critical driver of why and how companies are evolving their strategies, cultures and models. With the focus on the energy transition globally and pathways to net zero, companies are looking at technology investments and decarbonization strategies that will have an impact on governance, capital allocation, mergers/acquisitions corporate strategy, operating models and culture.” Ultimately, miners that can demonstrate their societal value will strengthen their relationships with stakeholders and be rewarded in the marketplace with cheaper capital and financing costs, command a premium on sales, lock in loyal customers, and in the long run, improve their market value. Companies that can demonstrate they are operating in the best interests of a broad group of stakeholders could even gain a competitive edge in the fight for capital and new resources.

Realizing Decarbonization Goals

ESG was also featured heavily in the 2022 edition of Deloitte’s

Tracking the Trends report, where its integration with core business

functions was cited as a key driver, alongside the ongoing

impact of the COVID-19 pandemic on the world of work, digitization

and the green energy transition, for transformational

change in the mining industry.

Global Mining and Metals Leader Andrew Swart gave his

thoughts. “We have also seen substantial movement within the

sector over the last 2-3 years, with this issue moving high up

the priority list of most companies,” he said. “Like all issues

though, there is a spectrum of maturity amongst companies. The

key driver for much of this is the underlying investor base, which

clearly varies from organization to organization.

“Our annual Tracking the Trends report provides insight as to how this issue has evolved across our client base: three years ago, we highlighted it as a key future trend, the year after we decoupled the E, S and G to clarify where we believed the market was moving and, this year, we have put a greater emphasis on operationalizing ESG.” John O’Brien, partner at Deloitte’s Financial Advisory Practice, who has a special focus on decarbonization, added: “Five years ago, the Task Force on Climate-Related Financial Disclosures (TCFD) framework had just been released, and mining companies were starting to set their long-term emissions targets with no real understanding of how they were going to be delivered. Most executives were only just starting to think through the financial risks and opportunities of climate and ESG issues more broadly.

“In 2022, we’re seeing sophisticated implementation plans emerge and capital allocation being delivered on emissions abatement. We’re also starting to see a more complete understanding of the interconnectedness of ESG issues and companies are expanding their thinking on how they can create value for their shareholders and stakeholders at the same time.” Although most companies have now announced their 2050 and 2030 ESG targets, for these to be seen as authentic and not just “greenwashing,” there needs to be tangible progress toward their delivery. “To do this in the most effective way requires ESG to become part of every capital, operational and management decision process — just as safety was embedded into the industry in the 1990s,” O’Brien explained. “It’s no longer sufficient for a small sustainability department to provide high-level advice. This is an issue that needs to be owned by every line manager and seen as a critical measure of success.”

Reflecting ESG in Capital Allocation

Like any corporate initiative, moving from goal to action requires a

change in behavior and accountability throughout the workforce.

Swart explained: “ESG cuts across the organization, touching

every major function. And, as a result, companies need to

align their operating models to their ESG goals — breaking down

silos, creating transparency, aligning incentives and driving accountability

across the functions.”

Internalizing ESG in this way will ensure that corporate commitments

around issues such as decarbonization translate into

meaningful and measurable actions over the long term.

“This is where it’s important to see these goals reflected in the capital allocation framework of the company,” Swart said. “We believe that we will see a spectrum of actions across different companies. In Tracking the Trends 2022, we highlight example portfolios where companies are prioritizing near-to-term technologies where investment decisions meet key capital allocation criteria. We also highlight other situations where companies are allocating capital to technologies, which may not meet the key hurdle rates, but where companies might believe that these are important investments lest they get excluded from downstream markets over the longer term. “We also see examples of companies allocating capital to circular business models going forward. Many of these choices ultimately come down to risk tolerance. All of these actions are worthy of consideration if the sector is to make meaningful progress on these decarbonization goals.”

O’Brien added: “The capital allocation process is a critical component to achieving tangible outcomes. This not only applies to specific ESG initiatives, such as buying renewable energy or electrifying a fleet, but must be applied in every capital decision. This might be a procurement arrangement or a mine design decision that, while it will have no immediate impacts on ESG issues, might make commitments harder to deliver in 5-10 years’ time. By building in effective ESG consideration into every operational and capital decision, companies will find the most efficient and value-enhancing pathway to their future state.”

Allocating capital in this way will open up investment opportunities and create appeal among a wider group of investors. A strong ESG track record is also important to talent, communities and government. “Just as ESG touches multiple internal functions, it also touches multiple stakeholder groups,” Swart reminded us.

Leading the Way to Change

Until recently, many boards and CEOs have struggled to understand

what ESG means for them as leaders. How does it affect

decision making? How will an enhanced focus on ESG change

board compositions? What does this mean in the war for talent?

Should companies appoint a CSO? And, if so, where should the

CSO role sit within the organization structure?

“To answer some of these questions, we set about writing our

first report on this topic, From Risk to Reward, in 2019,” Egon

Zehnder’s Nel said. “But soon we realized that to truly transform

organizations, companies needed to embed sustainability into their

DNA. We therefore embarked on our most ambitious report to date,

interviewing 14 leaders with diverse perspectives to distil best

practice and lessons learnt into our latest publication, ‘From Compliance

to Commitment,’ which was published earlier this year.”

The report revealed that 58% of mining’s Top 50 companies had appointed “at least one board member with ESG relevant credentials” by 2021 — a 20% increase since 2019. Furthermore, companies with at least one ESG director in 2019 have since added more board members with ESG skills, ensuring a balanced representation at board level of the wide-ranging ESG landscape. “We noted that 65% of ESG directors on mining top 50 boards bring a strong ‘external perspective’ on sustainability that goes beyond traditional industry experience in health, safety and environment, and this is really important for any company looking to strengthen its ESG governance,” Schmidt explained. “In our work with clients, we have realized that the appointment of one or two key individuals is not sufficient to shift the dial,” Sandhu added. “The magnitude and timeframe of this transformation requires action from every employee in the organization, as well as collaboration with stakeholders across value chains and cooperation with communities where mining companies operate. Every person in an organization and its key stakeholders need to buy-in to the vision and align and adapt their behavior accordingly. Only once this happens will we truly see meaningful change.”

The tone needs to be set from the top, starting with the CEO, who must reflect — together with the board — the company’s true purpose. Strengthening governance at the board level paves the way for a strong sustainability agenda that should be intrinsically linked with core business strategy. As explained earlier, CEOs will need to reimagine their business models to ensure that the strategic links to sustainability are upheld. This is then cascaded down to executive leadership and management teams in the form of measurable targets, ideally with links to executive pay and more long-term incentives, as well as malus/claw-back provisions. “Structurally, companies need to ensure that accountabilities are clear, distinct lines of defense exist and conflicts of interest are separated out,” Schmidt said. “The board, executive committee and company management must ‘walk the talk’ and model the desired behaviors needed to drive the shift toward becoming a sustainability-led business. Communication and repetition of key messages from leadership are also essential to create the sense of urgency that is needed for any transformation to gain momentum.”

Transparency is another tenet that reinforces this commitment, increasing accountability and (re)building trust with society over the long term. It’s key to fostering a culture that is grounded in ethics, ensuring that the entire organization performs consistently around sustainability. It also conveys a willingness to engage, openness to feedback, and an inclination to collaborate with stakeholders and other actors for solutions to systemic challenges.

Transparency Equals Trust

To summarize, given the shifting societal expectations on the

mining sector, clear and transparent business models and strategies

are required for companies to demonstrate a proactive focus

on ESG and progress toward their goals. Miners who can

prove that they are building a better world and are critical to a

net-zero future, can improve their recognition within global markets

and society, and create value for all stakeholders.

“We are beginning to see progress in creating a greener brand

for commodities, which is a trend we expect to continue. Miners

need to be part of the solution, hence their engagement around

topics such as the circular economy and green mining of the

future are key,” concluded Mitchell. “Now is the time for greater

collaboration within the sector and for communities, associations

and governments to really help shape the messaging of the

societal contribution and value derived from the mining sector.”