Effective machine maintenance is an important factor in achieving

Effective machine maintenance is an important factor in achieving

operational goals such as improved

productivity, safety and availability.

A well-planned approach that combines sensible implementation with

useful

emerging technologies can bring benefits in maintenance-related

cost, time and resource outlays.

When it comes to planning, the mining

industry takes a back seat to no one.

Scoping, prefeasibility and bankable feasibility

studies and financing plans guide

a company’s path toward commercial

development of a mineral deposit, while

production, ESG, closure/reclamation

and other plans outline strategies for operating

a mine within the bounds of business

and regulatory constraints.

In an industry where it may take 20

years to bring a major mine into production,

nobody has to sell a CEO, CFO or

even CIO on the value of project plans.

They’re simply part of the fabric that connects

a promising concept to eventual

operational reality. It might be a harder

sell, however, when it comes to planning

initiatives such as large-scale computerized

asset management (AM) or equipment

maintenance programs (CMMS),

which are entirely optional and require

top-to-bottom management commitment

of time, resources and money to achieve

goals that, to a skeptical observer, might

seem more aspirational than empirical.

Yet, it’s generally recognized that mine

design, equipment maintenance and production

scheduling should be considered

equally important elements in the overall

planning process if the goal is to obtain

optimum benefit from production equipment

throughout the life of the mine.

Making the business case for enhanced

maintenance planning is getting

progressively easier, though, because it’s

an area in which mining companies now

have the opportunity to obtain unprecedented

value through the convergence of

the industry’s move toward digitalization

with recent advances in technology that

enable enhanced data collection and robust

analysis. This makes it simpler to

get a handle on machine-health trends,

and along with the increasing unpredictability

of external events that have the

potential for affecting production, seems

likely to push mining companies even

more strongly toward adopting innovative

methods for eliminating uncertainty in

mine operations that are under their control.

Maintenance falls into that category.

Looking industry-wide, mining-company

maintenance programs are scattered

along the spectrum of scope and

sophistication, starting from those that

depend on basic reactive maintenance

strategies to others committed to predictive

maintenance and PdM’s more intelligent

offspring, prescriptive maintenance

(RxM). In fact, a 2021 GlobalData survey

indicated that about 75% of the mining

companies responding to the survey had

made at least some level of investment in

PdM for their fixed and mobile assets.

Without careful preplanning, however,

organizations can run into problems right

from the start of a maintenance-improvement

initiative. Consultant firm McKinsey

& Co., in an article aimed at explaining how

companies can realize more value from

their PdM efforts, highlighted several things

that can stand in the way of a successful

large-scale program, with most companies

facing issues in one or more of these areas:

• Data is insufficient, inaccessible or of

low quality;

• Technology is inadequate, with too few

sensors or poor IT infrastructure;

• Prioritization is difficult, as companies

lack a clear view of which assets to include

in their PdM programs;

• Capabilities are missing, such as data

engineers and data scientists required

to build advanced analytical models;

• Change management is weak, often because

of user-unfriendly design;

• Economic return is low, due the high

cost of developing models to cover diverse

assets and numerous potential

failure modes.

Having an incomplete understanding of

program elements and objectives was also

identified as a basic issue by participants

in a virtual workshop on asset management conducted by the Global Mining Guidelines

Group (GMG) in 2021. The factors

listed as necessary to overcome common

obstacles in the way of establishing a

strong management framework — failure

to include all departments, siloing, lack of

integration between strategic planning and

operational activities, etc. — included:

• Better articulation of the framework

business value proposition;

• Pragmatic examples (of a simple asset)

to demonstrate benefits to operational

crews;

• Understanding the relationship between

asset and maintenance management;

• Linking asset management and value

drivers to financial incentives;

• Agreement on the ROI of a framework

approach;

• Effective change management and

communicating business value.

Data Dependence

With the exception of reactive maintenance,

which requires no data at all to

function as intended, all subsequent

maintenance approaches from preventive

maintenance (PM) and condition-based

maintenance (CBM) on through to PdM

and RxM require machine data, beginning

with simple historical information on

time and usage needed for PM and expanding

to the massive volume of input

demanded by RxM to learn root causes

of machine failures and make suggestions

for specific corrective action. This need

for timely and comprehensive data might

be a stumbling block in the industry’s

drive toward digitalization, according to

some recent studies, because the likelihood

of success depends on connectivity

of IIoT systems. A 2021 report by satcom

provider Inmarsat indicates that despite

the accelerating speed of IoT deployment

over the course of the COVID-19 pandemic,

poor or unreliable connectivity is still a

widespread problem in the mining sector.

According to the report Industrial IoT

in the Time of COVID-19, 92% of all mining

businesses experience connectivity

challenges when trialing IoT projects and

72% don’t find public terrestrial networks

completely suitable for their IoT needs.

Where terrestrial connectivity, such

as cellular or fiber, is either limited or

non-existent, mining respondents prioritize

reliability (51%), latency (41%) and

bandwidth/speed (40%). This focus on

reliability of IoT connectivity is even more

pronounced in certain countries such as

Canada (60%) and Australia (57%), as

both have vast remote territories with limited

terrestrial connectivity. Additionally,

only 10% of mining respondents in Canada

said public terrestrial networks were

completely suitable for their IoT needs.

Overall, the Inmarsat report said there

is still a considerable amount of work

to be done to improve IoT connectivity

strategies, with only 39% of mining organizations

using some form of backup

connectivity to continue collecting IoT

data in remote areas away from terrestrial

communications. Again, there is a notable

geographical variance here, with only

21% of mining businesses in Latin America

electing to use some form of backup

connectivity when they cannot access

their chosen connectivity type.

An IDC 2021 Worldwide Mining Decision

Maker Survey revealed that 86% of

mining companies plan to invest in wireless

infrastructure in the next 18 months,

with most of them naming 5G as their priority

because of its lower latency and higher

bandwidth. Cellular and networking service

vendors are aggressively refining and

improving their 5G cellular platforms to

handle industrial-grade demands in mining

environments, often working closely with

equipment suppliers to ensure integration

throughout a mine’s equipment fleet.

For example, Nokia and AngloGold

Ashanti Colombia, in collaboration with

Epiroc, Sandvik, Tigo and OSC Top solutions,

recently conducted the first underground

5G mining trial in Jerico, Colombia,

where AngloGold Ashanti owns and

manages the Quebradona copper-gold

project. According to Nokia, the successful

trial proves it is possible to deploy

multiple mining use cases over a private

5G industrial-grade network in a challenging

underground environment.

Four mining use cases were tested as

part of the trial including mission-critical

communications, connectivity and remote

teleoperation of vehicles, mining machinery

and systems, and inspection and monitoring

with drones and high-definition cameras.

Nokia deployed an industrial-grade

5G private wireless network with speed in

excess of 1 Gbps and ultra-low latency. The

network is powered by the Nokia AirScale

5G portfolio in the 3.5 GHz spectrum band

with the support of Tigo Colombia.

Nokia and Sandvik also are collaborating

with Finnish technical research

organization VTT to conduct 5G-powered

research on advanced connectivity in underground

mine applications. The Next

Generation Mining (NGMining ) project is

funded by Business Finland and is aimed

at bringing together industrial 5G private

networks, edge computing and AI solutions

to enable digital transformation in

mining. The project’s goal is to build Proof

of Concept experimental systems to evaluate

integrated connectivity solutions,

which will then be tested in harsh underground

mining environments. The objectives

cover spectrum usage in the underground

mining environment, 5G modems

integrated in relevant machinery and user

equipment, and edge computing.

For companies that already have a solid

connectivity setup, another potential

obstacle in the way of data-driven maintenance

planning can be how to handle

incoming data for maximum usefulness.

As industrial optimization software developer

AspenTech pointed out in a recent

white paper*, there are a number of prescriptive

maintenance solutions available

on the market, and it can be difficult to

know which one to choose. First, some

questions need to be answered:

• Does the solution work using existing

data and resources?

• How far in advance does the solution

alert users prior to potential equipment

breakdown?

• Does the solution provide precise failure

pattern recognition so operators can act

on predictions with confidence?

• How quickly can the solution adapt to

new operating modes and processes?

• Can the solution be easily configured by

a company’s internal team?

With an eye toward providing a solution

for companies that might have limited

data-analysis resources, the most

recent version of AspenTech’s Mtell RxM

software includes Aspen Maestro, a feature

that automates the development

of better models by guiding less-experienced

users on how to build a particular

model or agent. Maestro, according to the

company, is an AI-based agent that can

quickly and efficiently perform data analysis

tasks that might take humans days or even months to perform. These include

identifying multiple failure modes that

share identical root causes, searching for

different operating states that result in

similar outcomes, distinguishing cascading

failure modes where one event causes

others, explaining failure modes using

first principles, and identifying failure

modes that may take months to evolve.

Potential savings from this level of

analysis can be sizable. AspenTech highlights

several examples of how Mtell can

potentially pay off for users, involving

repair and lost production costs for both

mobile and plant equipment applications:

Continuous Miners – Monitoring cutter

motors to schedule planned maintenance.

Potential savings: $300K/yr.

Haul Truck – Using machine learning

to optimize scheduled maintenance for

ultra-class haul truck engines. Potential

savings: 10% reduction in maintenance

spend.

Conveyor Belt – Identifying gearbox oil

imbalance on startup in advance of actual

problem occurring. Potential savings:

$1 million per failure.

Crusher Conveyor – Taking early, lessdisruptive

action to decrease the likelihood

of a major asset breakdown. Potential

savings: $500,000.

Pump – Using data to replicate the wear

pattern of faulty pumps and apply it to

additional pumps, demonstrating scalability.

Potential savings: $2.5 million/yr.

Back to Basics

Two of the most essential maintenance

activities at any mining operation are tire

care and equipment lubrication. The task of

administering these basic services to mine

equipment fleets that face unique combinations

of high payload demands, long shifts

and wide exposure to extreme weather conditions

is a formidable challenge to any

maintenance organization or plan – but potential

solutions are available from a variety

of sources. Here are just a few examples.

As part of an overall maintenance plan, a tire management program like

As part of an overall maintenance plan, a tire management program like

Kal Tire’s TOMS can be implemented to establish

and maintain benchmark

tire care strategies including inspection frequency and guidelines, tire

rotations,

target cold pressures and rim non-destructive tests (NDTs).

Haul truck “hot tire” incidents can be

highly detrimental to production, and their

detection often depends on an operator

smelling smoke or seeing some other indication

of a problem. But what happens

when a mine turns to autonomous haulage

and operators are no longer needed?

Kal Tire’s Mining Tire Group and Australia-

based computer vision specialist Pitcrew

AI have developed a tire monitoring

system designed to offer mines autonomous

detection of hot tires, tire separations

and other tire and mechanical damage

without the vehicle needing to stop.

Inspection anomalies are automatically

transmitted into TOMS, Kal Tire’s proprietary

Tire Operations Management System.

“Tire pressure monitoring systems

(TPMS) can give a strong picture of what’s

happening inside the tire, but so much

that can indicate the potential for tire failure

happens outside the tire. We knew if

we wanted to give customers the ability to

make better operational decisions – and be

a part of the future of autonomous mining

– we’d need to add external telematics to

the mix,” says Dan Allan, senior vice president,

Kal Tire’s Mining Tire Group. “Pitcrew’s

AI, and their vision for the technology,

supports our goal of solving customer

challenges in practical, impactful ways.”

“Autonomous inspection will be a requirement

for the autonomous fleets of

the future,” said Tim Snell, managing director

of Pitcrew AI.

The automated inspection stations monitor

front and rear tires of mining trucks

passing by. The AI software searches the

thermal imaging video footage for anomalies

such as hot spots, belt edge and tread separations

and other mechanical problems.

These findings are reported into TOMS. The

system then automates inspection work orders

as part of a self-reinforcing feedback

loop and then schedules tire change work

as necessary based on damage severity.

“We are really excited by the potential

of what we might find when we combine

the Pitcrew data with TPMS and our other

data streams. Together, these tools bring

incredibly valuable information about how

the tires are performing and we intend to

build predictive models that will enable

Kal Tire and our customers to make better

and earlier decisions about preventive tire

repair or replacement, and that will have

a significant impact on driving haul truck

productivity and safety,” said Christian

Erdélyi, TOMS system and implementation

manager at Kal Tire.

After a successful demonstration of

system operation in hot weather regions

in Western Australia, Kal Tire worked with

Pitcrew to develop a cold weather version

capable of withstanding temperatures of

-45C. A test ‘winter model’ is now operational

in northern Canada.

“There is also great potential for this

real-time inspection technology in underground

mines where doing regular equipment

inspections can be challenging as

well as to support the growing move towards

autonomous mining. We recognize

that this is new technology and how important

it is to get it right, especially in the

autonomous space,” said Erdélyi. “That’s

why we’re investing resources so heavily in

this solution. Our vision is to offer Pitcrew

as an integrated solution along with TOMS

as part of Kal Tire’s service offering.”

2021 was a grim experience for highvolume

lubricant consumers, with prices for oil, grease, chemicals, coolant, DEF

and related products rising in double-digit,

multiple increments throughout the year.

But however important the price of lubricants

may be, the financial impact of poor

choices or incorrect usage can eclipse the

purchase cost of these products. When a

major piece of equipment breaks unexpectedly

from a lubrication problem and

immediate replacement of that asset isn’t

possible, the total cost of the failure from

lost production, expedited parts delivery,

unscheduled labor and related expenses

can reach into the million-dollar range at

large-scale mining operations.

Various levels of lube-service management

and monitoring services designed to

help customers achieve total cost of ownership

(TCO) savings through lower maintenance

costs, reduced equipment downtime,

and productivity improvements

are available from every major lubricant

supplier, such as ExxonMobil’s Mobil Serv

suite, Chevron’s Lubewatch oil analysis

service or TotalEnergies’ TIG 6 system.

Here’s how Thejas Srinivasan, commercial

brand advisor–fuels and lubricants,

for Canada’s Imperial Oil Corp.,

explained Mobil’s approach during a

show-floor interview at MINExpo 2020

(Imperial is 69.6% owned by ExxonMobil):

“Our Mobil Serv suite covers various

types of services and part of that is our

field engineers working with maintenance

managers to optimize their strategies.

We’ve been able to work closely with customers

to help extend their PM intervals.

If you don’t have to bring equipment in

for an oil change or a filter change [as frequently],

and if you can eliminate half the

PMs that you’re doing, that’s more time

that the fleet can be out in the pit.”

“Under our Mobil Serv umbrella, we’re

launching a new digital product called Mobil

Serv Asset Management. It’s a product

that’s really meant to enable maintenance

managers to look across the entire fleet to

understand how compliant they are with

their maintenance tasks. This new system

also integrates with legacy systems,

some of which can be very cumbersome

and difficult to use. This is an app-based,

mobile-friendly product. When you have a

technician out in the field who completes

a task, he clicks a button to record that

it’s been done. If he sees a piece of equipment

that needs work, he can click a picture

and you can set it up so it automatically

generates a work-order. It’s a very

slick new technology and a lot of mines

are expressing interest in it.”

Upgrade to Minimize Upkeep

Although not technically a “plan,” one

of the most effective ways of reducing

maintenance is simply to buy wisely – not

just consumables, but primary production

equipment, repair parts or service

upgrades, as well – with a goal of minimizing

maintenance concerns by taking

advantage of improvements in equipment

design and available services.

The potential benefits of upgraded machine

design are illustrated by Caterpillar’s

recently-introduced D10 dozer, which features

a larger engine oil sump that extends

oil change intervals, and new push arm

bearing inserts that are claimed to improve

reliability and reduce overall rebuild time.

In addition, Cat said its new 992 wheel

loader offers extended major component

life and up to 10% lower maintenance costs

through features such as improved hydraulic

systems filtration and pump prognostics

for the implement pump that reduce machine

downtime. The new loader displays

the remaining useful life for the engine air filter, allowing technicians to plan ahead

for machine servicing. S·O·S fluid sampling

ports are accessed from ground level and

filters are organized by type and change interval

to increase maintenance efficiency.

Cat also announced in 2021 that it was

expanding its portfolio of Customer Value

Agreements (CVAs), a selectable package of

support and maintenance agreements that

can be tailored to meet specific customer

needs. Among the new CVA offerings are

Maintenance for Mining, with which Cat will

deliver the right parts at the right time, kitted

for each maintenance interval, lowering

total cost of ownership by optimizing drain

intervals; and powertrain, undercarriage and

hydraulic hose CVA options that variously

provide zero upfront cost, protection beyond

standard warranty coverage, inventory management

and other benefits depending on

the specific CVA, some of which are available

globally and others on a regional basis.

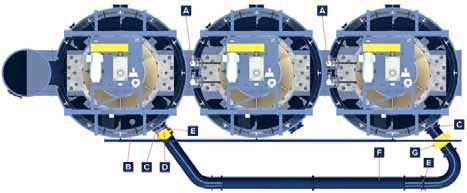

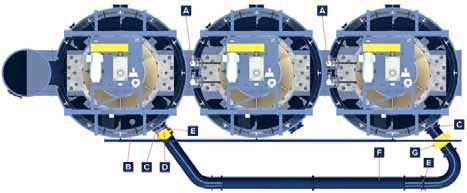

FLSmidth’s Flotation Bypass system provides a way to bypass a single flotation cell for service without need to shut

FLSmidth’s Flotation Bypass system provides a way to bypass a single flotation cell for service without need to shut

down the entire line. Major components include: (A) upstream/downstream isolation flange, (B) Multi-Sense level

sensor.

(C) modified manway hatch, (D) knife gate valve, (E) flexible expansion joints, (F) Piping segments,

and (G) pinch valve.

At MINExpo, Adam Kropp, senior product

manager–aftermarket at Komatsu,

called attention to the benefits offered by

OEM repair or replacement parts, which

may have been redesigned or upgraded

from the original and can often provide better

service life and improved performance.

Using the company’s line of large-capacity

mining shovels as an example, he noted

that Komatsu’s Delta Max crawler shoes

have a 20% life increase over the standard

Delta shoe, with design features that include

a solid roller path with a filled core

to help increase shoe life by increasing the

resistance to crush; raised roller path, to

improve overall system clearance to help

extend life; and larger pin size that is up

to 35% stronger than standard pins for

increased fatigue life. The shoes can be

installed on any P&H 4100 series shovel

with the Delta undercarriage system.

Kropp noted that the company takes

customer requests for machine improvements

seriously and pointed to a lubrication

system upgrade – in this case, a

positive pressure grease system that the

company designed in response to customer

input and recently added to the catalog

for its 2350 series hybrid-drive wheel

loaders – that in some applications has

provided up to a 200% increase in the

life of that model’s hoist cylinders.

Opportunities for improvements in

maintenance planning and performance

through parts and service upgrades aren’t

limited to the mining side of operations.

Inside the plant, grinding mill and

flotation cell maintenance, for example,

can be risky from both a safety and production-

loss viewpoint, as well as labor-intensive

if spillage or leakage occurs. Maintenance-

focused software and hardware

products designed to control and reduce

that risk are available for both applications.

ABB just released a new version of its

Ability™ Predictive Maintenance solution

for grinding, described as a unique advanced

digital service to maintain, assess

and analyze gearless mill drive (GMD) systems.

According to the company, the system

is now cloud-based instead of sited

on premises and includes a new mobile

application that allows real-time notifications

on fleet status. The Grinding Connect

mobile app, available for iOS and

Android, lets mine operators monitor performance

at any time and from any place.

ABB said the product provides easy

access to GMD system parameters and

allows visualization of performance considering

past activity and real-time data

and assesses future maintenance requirements.

It aims to extend the lifetime of

grinding assets through better use of resources.

It facilitates greater data gathering;

the data sample per mine is increased

and analytics and trends are more reliably

defined. The solution offers fully customizable

dashboards, alarms and events, all

available on the mobile app.

The company pointed to Predictive

Maintenance for Grinding’s successful use

at the Project Riotinto copper/silver mine

operated by Atalaya Mining in Andalusia,

Spain, where it’s being applied in combination

with a long-term service agreement,

or LTSA, to support Atalaya’s SAG

mill operation. In recent years, Atalaya

has depended on higher mill throughput

and metals recovery to offset lower grades

of ore, and the LTSA, according to ABB,

provides lifecycle management to plan,

coordinate and execute services, including

corrective, preventive and predictive

system maintenance, rapid response to

emergency calls and an adaptive approach

to meet modifications in production,

maintenance or shutdown schedules.

For flotation circuit maintenance,

FLSmidth offers Flotation Bypass, a custom-

designed system that provides a

means of bypassing an individual cell in a

flotation cell bank without the need to shut

down the entire line for extended periods.

The bypass system, according to the

company, is an uncomplicated operation

that works on the same principle as a typical

gravity-based dart valve system. It does

not need to be connected to the plant’s

main control system. The bypassed cell is

safely isolated from the others by installing

an isolation flange on the upstream

and downstream dart valve openings. Key

benefits of the system include reduced

downtime and improved safety, as maintenance

work can be performed on isolated

cells without risk of slurry overflowing the

cell. Its modular design allows the system

to be moved up or down the flotation bank

to bypass all but the first cell.

Conveyor Tech Can Cut

Maintenance Needs

A customer poll conducted a few years ago

by a major conveyor-component supplier

showed that conveyor systems are the

most problematic mine asset type in terms

of reliability. And, as R. Todd Swinderman,

CEO emeritus of bulk material handling

solutions provider Martin Engineering,

pointed out recently, conveyor systems are

getting wider, faster and longer, requiring

more energy to operate and needing better control of throughput. Plant managers

must closely review which new equipment

and design options align with their longterm

goals for the best ROI.

In most cases, with only a marginal adjustment

to belt speed, operators quickly

discover unanticipated problems in existing

equipment and workplace safety,

commonly indicated by a larger volume of

spillage, increased dust emissions, belt

misalignment and more frequent equipment

wear/failures. These problems – all

of which have direct impact on maintenance

requirements – often can be alleviated

by new technologies and improved

design, according to Swinderman.

For example, as belts get longer and

faster, modern tracking technology becomes

mandatory, with the ability to detect

slight variations in the belt’s trajectory

and quickly compensate before the

weight, speed and force of the drift can

overcome the tracker. New upper and

lower trackers utilize innovative multiple-

pivot, torque-multiplying technology

with a sensing arm assembly that detects

slight variations in the belt path and immediately

adjusts a single flat rubber idler

to bring the belt back into alignment.

Faster belt speeds can also cause higher

operating temperatures and increased

degradation of cleaner blades. Larger

volumes of cargo approaching at a high

velocity hit primary blades with greater

force, causing some designs to wear

quickly and leading to more carryback and

increased spillage and dust. In an attempt

to compensate for lower equipment life,

manufacturers may reduce the cost of

belt cleaners, but this is an unsustainable

solution that doesn’t eliminate the additional

downtime associated with cleaner

servicing and regular blade changes.

Swinderman noted the latest trend in

belt clean blades: Heavy-duty engineered

polyurethane blades made to order and

cut onsite. Using a twist, spring or pneumatic

tensioner, the primary cleaners are

forgiving to the belt and splice but are

still highly effective for dislodging carryback.

For the heaviest applications, one

primary cleaner design features a matrix

of tungsten carbide scrapers installed diagonally

to form a 3-dimensional curve

around the head pulley. Field service has

determined that it typically delivers up

to 4x the service life of urethane primary

cleaners, without needing re-tensioning.

Looking further ahead, an automated

system can increase blade life and belt

health by removing blade contact with

the belt any time the conveyor is running

empty. Connected to a compressed

air system, pneumatic tensioners are

equipped with sensors that detect when

the belt no longer has cargo and automatically

backs the blade away, minimizing

unnecessary wear to both the belt and

cleaner. Additionally, it reduces the labor

needed to constantly monitor and tension

blades to ensure peak performance.

It’s clear, he concludes, that automation

is the way of the future, but as

experienced maintenance personnel retire,

younger workers entering the market

will face unique challenges, with

safety and maintenance skills becoming

more sophisticated and essential.

While still requiring basic mechanical

knowledge, new maintenance personnel

will also need more advanced technical

understanding. This division of work requirements

will make it difficult to find

people with multiple skill sets, driving

operators to outsource some specialized

service and making maintenance contracts

more common.

As featured in Womp 2022 Vol 02 - www.womp-int.com