Exploration spending rebounds as the world recovers from COVID-19.

Exploration Activity Increases With Improved Metals Demand

Modern technology aids in improving the search for new deposits

By Steve Fiscor, Editor-in-Chief

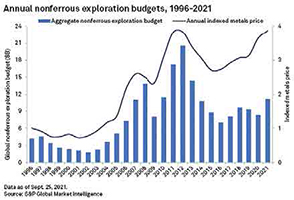

S&P Global Market Intelligence recently reported that global exploration budgets for metals jumped 35% year-on-year to $11.2 billion. The group cited strong metals prices and easier access to financing as the prime movers. S&P’s annual Corporate Exploration Strategies (CES) study showed that exploration has emerged from the downturn caused by the COVID-19 pandemic.

“A faster-than-expected recovery in market conditions and easing of lockdowns allowed explorers to reactivate programs by mid-2020, which caused some programs to carry over into 2021,” said Kevin Murphy, principal analyst with the S&P’s Metals & Mining Research. “Along with higher metals prices and increased financing activities, this has led to a strong budget recovery in 2021. As we move into the last quarter this year, metal prices and financings remain robust, and the risk of further pandemic-related shutdowns has declined. As a result, we expect the aggregate exploration budget to increase between 5% and 15% year over year for 2022.”

While budget allocations to all regions increased in 2021, the CES study said Canada had attracted a particularly large share of the global budget with an increase of more than $800 million yearover- year to $2.1 billion, hitting its record high since 2012. Africa underperformed with allocations up just 12% to $1.1 billion, returning the region to its 2019 level.

The report also showed how the budgets for junior explorers surged, but majors still drive exploration. The junior sector has increased their planned allocations by 62% year over year to a total of $4.1 billion. Despite this increase, the majors continue to account for half of the global exploration budget at $5.6 billion.

The study also reported that early-stage exploration budgets remain low. In 2020, greenfield’s share of budget allocations hit an all-time low of 24%, while budgets for mine-site activity hit an all-time high of 41%. While greenfield’s share recovered modestly this year due to increased activity in Australia and Canada, its global budget share is the second lowest on record at 26%, according to the CES report.

The pandemic and the lack of funding clearly impacted large-scale greenfield programs. The expected metals demand related to the electrification of the automotive and greener power initiatives, however, will drive the next wave of greenfield exploration programs for base metals.

Improving the Odds

One company experiencing a great deal

of success in the exploration space is

Windfall Geotek. Combining data mining

techniques with artificial intelligence, the

company has located new resources and

narrowed the scope of drilling programs

for exploration companies.

“We started as a geotechnical services firm in 2005, primarily working on data normalization,” Windfall Geotek Chairman and Interim CEO Dinesh Kandanchatha said. “We were gathering data sets for base metals across many years in different formats, standardizing it, importing it into our geographic information system (GIS). Our goal was to bring together non-correlated data sets to make inferences. That has since evolved into a data model that allows us to generate signatures.”

Within a certain geologic context, Windfall Geotek could tell a client that they noticed a geologic formation based on geophysical and satellite data, and soil samples. “We look for both positive and negative signatures for base metal deposits,” Dinesh said. “Where a sampling or a drilling program was completed, we could identify contextual variables that point to a similar geologic setting within a claim area.”

Many geologists believe the days of walking a claim and making that big discovery are gone and tomorrow’s major undiscovered deposits lie at depth. Windfall Geotek has developed a system that may assist in refining that search. For more than 15 years, the company collected data on nearly 100 base metal projects. They also pulled public data from Canada, the U.S., Chile, Peru, Norway and Australia. Now they are performing target generation to try to find the signatures of successful discoveries and recreate them within the same geologic context, which could expand the resource for an existing mining company or provide a new opportunity for a junior explorer.

When Windfall Geotek approaches a client, they usually engage with vice presidents of exploration. “We start with public data in a double-blind approach,” Dinesh said. “We ask for drilling assays and soil samples. We don’t know what they are thinking and we don’t ask. That’s the best way to build the potential target. We go away, run the data through our model, we return and show them where the data overlaps. We have had a lot of success and the usual response is ‘I thought something was there and we were going to look over there.’” Beyond affirmation of the exploration team, this is also a great tool for the CEO because it’s independent validation and it builds confidence with stockholders, Dinesh explained. “Investors are trying to prioritize their investments with early-stage exploration companies,” Dinesh said. “The tools in this area are limited and there are almost always more projects than money, so they naturally gravitate toward the people who have independent validation and thus more likely to be successful.”

It’s also a big confidence builder for the project. The company has the geologist’s interpretation of the data and the size of the resource. This independent assessment doesn’t tell the whole story, but it informs the conversation, Dinesh explained. “We normally work with funded companies looking for a better return on their drilling programs and we work with investment firms who are trying to decide where to place investments. It’s about prioritizing limited capital and resources,” Dinesh said. In some countries, such as Canada and Chile, much of the drilling data is available publicly for free. In other regions, however, it’s proprietary. Much of the drill assays resides with the mining companies, especially the majors. “A lot of these companies just don’t know what they have,” Dinesh said. “One of the ways we work with them is through data licensing agreements. They are not getting any value from it and now they can. In the case where we are trying to do our own greenfield work, we would come back to them with a first-right of refusal.”

Windfall Geotek also actively participates in projects. “When we get involved with an exploration project, we will take equity in the firm,” Dinesh said. “If it’s a private firm, it’s usually performance based, where we would receive a net smelter return (NSR) royalty on any resource that references that target.” From the perspective of a geotechnical firm, it’s attractive because they do not have to put capital up front, Dinesh said. “They can use that money for drilling,” he said. “At the end of the day, it’s just a dot on a map until someone sinks a drill hole.”

As far as examples of successful projects, Dinesh pointed to Playfair Mining and its nickel-cobalt resource in Norway. “We provided them with 24 drill targets and they hit on 17 of them,” Dinesh said. “They reduced a 200-km2 set of claims by 90% using our technology. Noron was another big discovery for us. We have 50 to 60 projects we can talk about. Playfair is a good example because it did come full circle.” The exploration business is going through a generational transformation that is founded on technology, Dinesh explained. “People aren’t going to spend two weeks in the bush like they did in the old days,” Dinesh said. “Expectations have changed. Capital requirements have changed as well.”

The future will leverage more technology. Where Windfall Geotek brings value is that it costs nothing to do this type of research, especially from a carbon/ESG perspective. “However, when a company is considering a drilling program and they find nothing, it’s not only expensive, but it impacts the environment,” Dinesh said. “The world needs the resources. If the explorer scores one in 100 and destroys 99 other places in the process, they will not be viewed as favorably as the one who scored one in 100 and only disturbed 10 places.” The upside is that exploration companies want to show ESG components and demonstrate that they too have contributed as society advances toward an electrified future.

NEXT Project Exceeds

Expectations

The European Union’s Horizon 2020

project NEXT recently concluded with

some exciting results. “The NEXT project

has not only been successful but exceeded

expectations,” said Vesa Nykänen,

science coordinator from Finland’s Geological

Survey (GTK). The NEXT consortium

was coordinated by the GTK and

consisted of 16 partners from research

institutes, academia, service providers

and the mining industry from the six EU

member states.

“Several outcomes from the project brought innovative methods into mineral exploration and, most importantly, improved target generation and have the ability to increase the exploration productivity,” said Torsten Gorka, exploration manager from DMT GmbH. Independent experts from the European Commission on Innovation Radar ranked the Novel Electromagnetic (EM) survey system on a UAV for mineral exploration as a top innovation product. “This survey system is a remarkable result of the NEXT project,” Nykänen said. “Radai Oy started the development of it within the NEXT project and already it has proven to be highly versatile. Now the team at the Radai SME are developing the system further for commercial use.”

The other remarkable achievement of NEXT are the Self-Organizing Maps (SOMs) software tools. The aim in the NEXT Project was to develop a new modern software and tools for data processing and integration. A new open-source software tool, GisSOM, for geoscientific data integration in combination with artificial neural works and self-organizing maps is available in GitHub. Social License to Explore (SLE) is nowadays an important element of exploration activities. In the NEXT project, three case studies in different contextual settings in Sweden and Finland were explored. Interviews with local organized actors and surveys among the local residents were conducted to investigate which factors shape a local communities’ attitudes toward mineral exploration. The outcomes of the research on the SLE thematic, write-ups on the new tools, and improved insights on the way ore deposits are formed were collected in the NEXT Practical Toolkit addressed to mineral exploration and mining companies.

Data Management

acQuire, a software company specializing

in geoscientific information management,

recently launched its GIM Suite

5, which includes a raft of new features

plus a transition to a new license model.

The system has been built for the future

of data management, with the aim to improve

the way geologists and miners manage

their geological data. The new release

streamlines data collection from the field

to sample submission and provides a way

to seamlessly manage their entire field

data collection workflow across mobile,

desktop and web.

Steve Mundell, director of products at acQuire, said the company is focused on continually evolving the GIM Suite software to ensure miners are always working with the most powerful geological data management tools on the market. “We’ve focused on providing dynamic and interactive tools for geologists to match the way they work,” Mundell said. “GIM Suite 5’s new interface is designed for drillhole logging and sampling across a range of drilling methods, from exploration to production, whether you’re collecting data in remote field locations or logging in the core shed.

Multipurpose Sonic Drill

The compact, powerful Hydracore 5000S

multipurpose sonic drill can be easily broken

down into components weighing less

than 2,000 lb that can be moved by helicopter.

The drill comes standard with a

70-Hz Boart Longyear LS250 sonic drill

head. The jib crane and Hydracore Quick

Change Head System allow the Sonic head

to be interchanged with a Hydracore P or

H coring head. Hydracore also offers head

adapters to suit most manufacturers products

if operators intend to use the drill for

other purposes. Rod holding, and break-out

is managed by a Fraste 2-3/8 in.-11 in.

double break-out clamp. To aid in geotechnical

projects, the machine has been fitted

with an industry leading MARL SPT system,

which allow operatos to accurately acquire

in-situ standard penetration test (SPT) data.

The typical breakdown/setup time for

the Hydracore 5000S is 30 minutes.

Head changes can be in achieved in 15

minutes, which makes the system ideal

for projects where both sonic and core

drilling are used on one hole.

The feed frame is a simple, strong, and compact design. The side mounted cylinder provides 15,000 pounds of pullback force at 2,500 psi hydraulic pressure, and has an 11.5-foot (ft) stroke. A lightweight mast can be provided for the wireline cable when coring, which allows 20-ft runs to be pulled. A small hoist jib mounted is provided to lift the drill head into position and also to lift the SPT hammer. The mast slide liners can be replaced without any dismantling of the drill, and can also be adjusted for wear. The hydraulic powerpack has a 200-hp diesel engine driving a stack of two hydraulic pumps. One pump is load sensing which is used to power the vibration, rotation, water pumping, and cylinder fast feed. The second pump is a smaller pressure compensated pump which is used for feeding, clamping and mixing functions. The hydraulic reservoir is made from aluminum. The reservoir also has an oil level gauge, a temperature gauge, and two tank top return filters. An air to oil heat exchanger is fitted in front of the engine radiator. The power pack is made so the engine can be quickly and safely removed. The pack can be flown in two loads both less than 2,000 lb.

Expedition Uses Ground-penetrating Radar to Find True Height of Mount Everest

An expedition of Nepali surveyors and mountaineers who recently

climbed to the top of Mount Everest, used ground penetrating

radar (GPR) equipment to establish the true height of the

world’s tallest mountain. The surveyors and Sherpa guides set

up a GPS antenna to help record their precise position using

a satellite network. They then used an SIR 4000 control unit

from Geophysical Survey Systems Inc. (GSSI) combined with a

900-MHz antenna to measure snow depth, a key requirement

for establishing the true height of the mountain.

The mountain is a source of extreme national pride in both

Nepal and China, and a new evaluation was needed to resolve

a decade-long controversy on how tall the mountain really was.

Each country conducted its own survey to establish the mountain’s

height and worked collaboratively to share the information

that was collected.

The data acquisition system that was used by the Nepali team provided surveyors with the confidence and reliability that it would perform to optimal levels on the top of Mount Everest. The SIR 4000 control unit has a rugged design and with its stable temperature performance and IP65 rating, makes it ideal for operating in extremely challenging conditions. “We are proud that our GPR equipment played a role in this exciting expedition,” GSSI President Christopher Hawekotte said. “Our systems have been used all over the world in thousands of applications, but this time I can truly say we climbed the highest mountain.”