Maptek’s deep-learning algorithm leverages drill hole data to quickly model grade

distribution. (Photo: Maptek)

Friendlier Models Try to Bare All, Faster

With little room for error, miners seek resource modelling solutions that are quick,

easy and accurate

By Jesse Morton, Technical Writer

Risk drives the miners to innovate and it compels them to seek innovative solutions from suppliers. It also drives them to seek to do “more with less,” Fogarty said. “What companies are realizing is that to drive down the cost of acquisition of resource isn’t reducing, it is increasing, which means that there is a higher focus on productivity in the acquisition of data. The ability to come to the right decision more quickly means that a company may not drill that drill hole or may proceed in areas where they may not have historically.”

When you throw in the pervasive climate of uncertainty that followed the decline of the super cycle, these days could prove to be boom times for tech companies that can promise accurate models. Seizing the opportunities now available, several suppliers are promoting solutions that they say offer clarity, calm nerves and speed tough decisions.

Feed the Need for Speed

Maptek reported Roy Hill in the Pilbara

will adopt its new resource modelling and

reporting solution starting in Q1 2019.

“Roy Hill geologists will provide valuable

feedback to the ongoing research and development,

all of which is being undertaken

by Maptek,” Steve Sullivan, geologist

and product manager, Maptek, said.

Maptek described the system as a deeplearning solution, powered by Maptek’s machine-learning engine. The company envisions it revolutionizing the grade estimation process by allowing geologists to transform database information to resource reports in dramatically reduced time. At the Western Australian iron ore mine, resource database information will be uploaded to a Maptek cloud server. There, “data analysis leads to automated assignment of estimation parameter settings, followed by geological domain interpretation, grade interpolation and uncertainty analysis,” Maptek reported. Resource modelling and post-process analysis using the Maptek machine-learning engine will be available in Maptek Workbench applications, like Vulcan.

The results will then be downloaded in standard Maptek block-model format for resource reporting and collaboration with other users of the geological resource model, such as geotechnical, mine planning and mine scheduling engineers. “The resulting block model file is a binary file with .bmf extension,” Sullivan said. “This format allows fast data access for the 3D visualization and reporting and integration with geotechnical data and mine planning and mine scheduling functions.”

The sub-blocked block model offers key visualization capabilities. It can be interrogated with standard analysis and validation tools provided in Vulcan 11, Sullivan said. “Data can be visualized as 2D slices, 3D blocks, 3D isosurfaces, 2D charts as histograms, box plots, retrospective variograms, 2D swath plots comparing drill data with machine model and reserve reports generated,” he said. The key benefits are accuracy, speed and ease of use, Maptek reported. The system features functions that enable the user to dial in their acceptable margin of error, Sullivan said. Input data is validated prior to modelling and results are validated with standard variogram charting techniques.

Sullivan said tests revealed the system architecture provides repeatable results within customer tolerances and expectations. “In addition to modelling parameters, the uncertainty in the estimation of each parameter is provided to the end user for analysis and audit purposes,” he said. “The results from the Maptek machine learning engine have been compared with the results, including uncertainty factors from existing techniques such as ordinary kriging,” Sullivan said. “The results have been compatible.”

The results have also been generated in a fraction of the time normally required. In at least one trial, a resource report was generated from a geological database within a half hour. Such speed is made possible by a deep-learning process that models multi-variable and multi-domain data simultaneously, Maptek reported. “The 30-minute scenario is indicative of the gains in speed that can be made,” Sullivan said. “There’s no hard and fast rule, since connection to cloud processing services allows users of the solution to run as many computers as are available for processing.”

One effect could be cost savings, he said. “Reduction in costs results from the speed of processing, allowing fewer people to work more efficiently.” Ease-of-use could further add to those savings, Sullivan said. “Deep learning for grade control embeds the resource geology and modelling workflow inside the system ensuring consistent outcomes,” he said. “The mine manager no longer is at the mercy of having the right skills, as the skills are provided through use of the Maptek machine learning system.”

Other benefits include increased automation optionality in grade modelling and, in turn, mining, Sullivan said. “Data can be collected from autonomous drill rigs with onboard analytical capability and fed direct into the machine learning engine for grade estimation, followed by automated grade control optimization and then uploaded into fleet management dig control systems for mining,” he said. Maptek reported the system is optimal for companies with projects with close-spaced resource drilling and grade control data. It is also ideal for miners who are “reviewing potential acquisitions or investment into new mining projects, whether internal or external,” Sullivan said. “Often the technical review team has limited time to review each project and make their investment recommendation to management. Deep learning compresses the evaluation time, allowing more time for analysis prior to decision-making.”

Any miner, however, with sufficient data for a prefeasibility study could benefit from at least “an assessment of their project for its potential to benefit from machine learning,” Sullivan said. Adoption and deployment of the software requires no prior relationship with Maptek, Sullivan said. “The only dependency is having data ready to upload into the system,” he said. “Deep learning for grade estimation is available to the entire market,” Sullivan said. “Data upload formats are generic, and outcomes can be provided in formats compatible for third-party systems.”

The partnership with Roy Hill and the upcoming 2019 product launch will further establish Maptek as a supplier of viable machine-learning-based solutions that enable advancements in automation in mining, Sullivan said. “There’s a lot of ‘buzzword bingo’ in the market, which makes it difficult to separate the hype from reality, especially around machine learning,” he said. “This work puts a peg in the ground from Maptek to say we’re doing this now, and we have a product that works.”

Full Spectrum Clarity

Approaching a year ago, a satellite the

size of a shoebox operated by a so-called

asteroid mining company completed its

first mission, which was basically to test

its equipment. Among the gizmos trialed

was hyperspectral imaging tech that

could determine the mineralogical makeup

of hurtling space bodies.

About the same time, Hexagon Mining was working with the University of Arizona’s Lowell Institute for Mineral Research and Headwall Photonics at deploying similar tech in the pit to assist in mapping orebodies, highwalls and leach pads. The results were promising. Hyperspectral imaging, according to Johnny Lyons-Baral, product manager, Hexagon Mining, could also have a bright future underground, which he hopes research will prove. “It allows you to get a really thorough characterization of the chemistry of an underground drift,” he said. “You can see clearly and characterize most of your geologic, mineralogic alteration classifications.”

The applications range broadly but the goal is the same: to capture an electromagnetic signature of something. “For geology we are looking at minerology,” Lyons-Baral said. “Really, we are looking at the chemistry, which is why hyperspectral works well,” he said. “We are going into the near-infrared and the short-wave infrared waveband range, up to about 2,500 nanometers for the spectra.”

The typical scanner captures a continuous measurement for a range of bands. For example, it generates a reflectance count for the 10-nanometer band, one for the 20-nanometer band, and so on. “Once you are done you plot it out across a graph,” Lyons-Baral said. “You have your wavelengths down on the X axis and your refelctance magnitude on the Y axis giving you the spectral signatures.”

Ground truthing samples taken from the rock face scanned provide the information needed to classify mineralogy, alteration and lithology. After that, the data can be streamed into models and mine maps, or to provide near-real-time grade estimates of muck piles or dumper loads. Hexagon was first approached by geologists from the University of Arizona roughly 18 months ago on the heels of some talks given by Lyons-Baral on tests the company did with hyperspectral scanner- equipped aerial drones. They agreed to coordinate on some future research.

Last summer, the team conducted research with stationary and airborne scanners at an open pit mine in Utah. “The university students and an intern at one of the mining companies processed the data,” Lyons-Baral said. The aerial drone-based scanner “worked well,” he said. “What is great about the UAV is if you combine it with LIDAR you can create the topography and the geologic mapping at the same time. With the pan and tilt tripod data, you need to either view as imagery in 2D or texture it to a 3D mesh after the imagery is created.”

The mining companies involved affirmed the viability of and need for the tech. Next steps, Lyons-Baral said, involve software development. “The work flow just needs a little help so that our customers can easily adopt it,” he added. Meanwhile, the research team is preparing to take the gig underground. The bottom of a shaft or the end of a drift may prove in some ways to be a more advantageous environment for use of hyperspectral imaging for a couple of reasons. “What is great about underground is we control the light source,” Lyons-Baral said. “We can always have a sensor with a light and we can adjust that lighting so we get very consistent results,” he said. “We see the full spectra; there is no masking in any band areas, as happens above ground.”

Similar to how it was bolted to a drone for a pit overflight, the scanner can be mounted to equipment to generate a constant feed of data for use in orebody modelling and mine planning. “It is like your robotic geologist is out there on your autonomous vehicle,” Lyons-Baral said. “It is sending the geology maps back to the office where someone can validate it and then say: This is that material and that is this material. We need to go this direction. This is higher grade. This is ore. This is waste.” On the software side, Hexagon already offers a platform, the GIS-leveraging Geospatial, that can assimilate hyperspectral data. For underground, however, currently the plan is to update, for example, MinePlan, the company’s mine planning software. “That way you can get it into your 3D drifts,” Lyons-Baral said. “We are going to work on bringing in this textured data, being able to manipulate the hyperspectral geology data on our geometries and then to be able to code that into our geologic models, our exploration models, our resource models, the block models, updating reserves.”

One example could be to use LIDAR to capture and map the geometry of a drift. The data from the hyperspectral scanner would be used to create a textured overlay. “You end up with a really beautiful 3D model like you see in a video game for example,” Lyons-Baral said. “The imagery looks as realistic as it can.” The benefits include increased accuracy, possible continuous data, and increased safety.

The precision offered by a robust hyperspectral scanner-based system would firstly eliminate much of the guesswork sometimes common in underground mine modelling and planning, Lyons-Baral said. “It gives you a more accurate view of what is really going on down there,” he said. More accurate modelling and mapping means more ore recovered. “A lost bucket of gold is a lot of money,” Lyons-Baral said. Continuous data will enable near-realtime 3D modelling and mapping. Being that the scanner can be programmed to operate unmanned or remotely, “it is safe,” Lyons-Baral said. “No one has to go up to the face.”

Currently, the research team is partnering with a miner in the southwestern United States. “We could end up at an underground gold, copper, zinc or moly mine, depending on the customer that wants to do it and which mine they want us to work at,” Lyons-Baral said. “We’ve talked to groups from Arizona, Colorado and Nevada so far.” While there is currently no pressing timeline to bring a product to market, the level of interest from customers could dictate the pace of progress, he said. “We have some market interest right now but if we see a strong demand we will ramp up,” Lyons- Baral said. “If the mines think they are ready to do this sooner, we will accelerate.”

Designed to Disrupt

Seequent Ltd.’s Leapfrog EDGE, released

a year ago and since then widely adopted

by consultants and miners, is now

field-proven, the company reported. Fogarty,

general manager, mining and minerals,

Seequent, warned that based on

feedback coming in from the field, the

software could be downright disruptive

to more than just the resource modelling

software space.

Part of the Leapfrog Geo suite, EDGE was in development for two years prior its release in Q4 2017. During that time, Leapfrog, focused on designing the software so it is easy to drive. “We got an independent senior geologist to go out on a bit of a round-the-world tour and we sent him to customers all around the globe,” Fogarty said. “He wasn’t talking about the product. He was asking them what they felt was broken in the entire approach to resource information modelling.”

The result is a solution that empowers the geologist over the workflow, instead of the opposite. “We built Leapfrog Geo and EDGE as workflow-based tools,” Fogarty said. “What that really means is geologists can then develop their own workflows and a process really aligned to their specific geology.” Another benefit is ease of use. “We have people in our team who really focus on how it feels to run the tools,” Fogarty said. “The feedback that we get from our customers is that apart from being intuitive, it is an enjoyable suite to use.” It is also easy to master, with the average user learning to operate it in a matter of days, rather than months, the company reported.

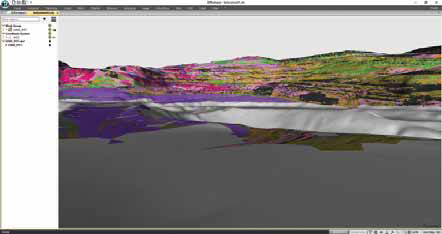

The primary feature, however, is modelling capability. “The visualization is what our customers have always expressed as being one of the key benefits,” Fogarty said. “With geologists just trying to get their head into the model and actually understand the geology, having really strong visualization is a critical part to that understanding.” Three dimensional models update almost at the rate at which data is uploaded and parameters tweaked, he said. “For us it is about high-quality data coming in, rapid modelling and visualization of the outcome,” Fogarty said, “and with the ability, with that speed, to then change parameters, introduce new data, and get very rapid, near-real-time updating of the information so that decisions can be made off the back of that.”

Speed and accuracy is made possible by a “back-end engine and underlying algorithm, which is incredibly robust,” Fogarty said. It is robust enough to process large and growing data sets, he said. It is also robust enough to allow the geologist to tinker with the model. “Iterations are really simple, partly because they are simpler to do in the workflow, but partly because of the speed of the product,” Fogarty said. “That comes down to teasing the parameters, which allows them to test hypotheses by introducing new data. Then, of course, with the visualization, whether it is within the product or exported to a viewer, it is really easy to not just see but share and collaborate on the results.”

EDGE also allows subsequent users to look back on the history of the incremental development of the model. The sum total of tools, features and capabilities offered by EDGE liberates the geologist and democratizes his or her team, Fogarty said. “It allows the geologist to really spend more time thinking about that model in the context of the geology in their specific situation,” Fogarty said. “The geologist can far more rapidly generate a hypothesis model and iterate on top of that, rather than spending their entire time developing a model over a long period of time. This allows them to spend more time being a geologist and interrogating the models that are generated to quickly get the best outcome.”

EDGE was developed for use by any geologist who develops resource information. “What we have found is that we believe there is a place for it in each and every organization right now,” Fogarty said. “We’ve had wide adoption throughout the year right across the value chain by consultants, junior miners and mid-tier and major mining companies.”

Adoption requires Leapfrog Geo, but can be used in tandem with other similar solutions. “We believe fundamentally in openness and interoperability as an organization,” Fogarty said. “We are clear that our users may be using multiple other software packages and they may jump between our products and other products.” The company offers a free trial. “We have a global team of experienced project geologists from all around the world who provide support and training to get people up and running,” Fogarty said.

The company reported EDGE is set to be developed into a stand-alone solution. Once there, it will likely continue to disrupt the status quo, Fogarty said. “We see EDGE changing how resource companies build estimation models in the same way Leapfrog Geo has changed how they build geological models,” he said. “Whether it is through speed or processing, whether it is through the ability to have a single workflow from the resource model on to the communication of that and collaboration on it, we’d like to think that, through EDGE, we changed the way that people were doing their resource models.”