As an example of the increasingly sophisticated software available for exploration project planning

As an example of the increasingly sophisticated software available for exploration project planning

and design,

Micromine’s exploration module includes visualization, drillhole management, analytical

and modelling tools,

and statistical/geostatistical functionality. Shown here, the exploration module

uses drill hole solid traces to

visualize the location of high-grade ore within an orebody. The cylinders

are colored and sized by grade.

As digitization gathers speed throughout

the mining industry, the exploration sector’s

path forward seems likely to follow

a route increasingly dictated by numbers.

Recent industry announcements and reports

from sources along the exploration

spectrum — drilling service companies,

junior companies and major diversified

producers — point to a growing focus on

achieving better metrics in practically every

facet of exploration activity, at a lower

cost and with greater accountability.

That’s because recent numbers aren’t

good. Over the past decade, major deposit

discovery rates in some major metal

categories have dropped to zero, while

the cost of exploration activities continues

to rise. Potential finds may be under

deeper cover, located in more-remote regions,

and as the recent abduction and

killing of a Canadian geologist in Burkina

Faso illustrates, rising occurrences of local

conflict and political unrest heightens

the risk level. Major producers are under

pressure to replace reserves depleted by

mining, but discovery rates and tonnages

have dropped to levels that observers

predict won’t allow producers to maintain

production levels in the not-too-distant

future. Copper, for example, seems particularly

threatened by this trend.

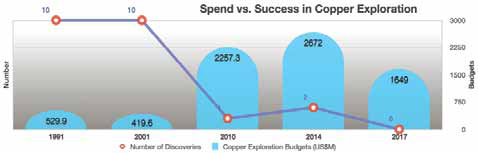

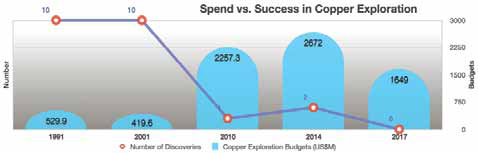

Kevin Murphy, senior research analyst

at S&P Global Market Intelligence, noted

in a recent report that “… increased copper

exploration budgets have so far failed

to identify more new discoveries, with

only about 140 million metric tons (mt)

of copper defined in 29 discoveries over

the past 10 years, compared with 862.8

million mt in 191 discoveries in the preceding

18 years.” According to his report,

current lead times for copper mines are

about 20 years for an asset to advance

from discovery to production: This timeline

“implies that the reduced discovery

rates of the past decade will limit the pool

of projects that could come online in 15

to 20 years, and there could be a lack of

quality assets available for development

in the longer term.”

Needed: Data Diligence

One of the traditional hindrances to exploration

success is that essential information

is almost always subject to

interpretation, leading to subjectively

based decisions and biases. “Important”

numbers can range from stats as clear

as grams-per-ton results from drill-core

analysis to fuzzy estimates of project risk

evaluations based on everything from a

target’s geological setting and mineralization

characteristics to commodity

prices and country risk. Any significant

item, or range of items, that is mistranscribed,

misinterpreted or simply missed

can alter the overall picture available

to an exploration team — and yet, the

amount of data requiring analysis is

growing at a remarkable rate. The latest

technologies and instruments available

for core logging, for example, can generate

as much as 122 gigabytes of data

from a single, typical drill hole.

Technological improvements in drilling

and sampling tools, field data collection

systems, global and local communications,

computing power and data visualization should enable exploration

teams and managers to make quicker,

better-informed decisions. If they can

meet the challenge of turning a rising tide

of available data into a pool of useful information,

free from subjective influences

and in a standardized format. There is a

rapidly expanding universe of hardware,

software, and data-service tools and resources

designed to help companies solve

this many-faceted problem. Solutions

range from systems and software that

allow exploration teams to bypass manual-

entry-on-forms and eliminate paper

maps and documents altogether, to Artificial Intelligence (AI) technologies that

not only can be trained to read, digest

and make recommendations from myriad

data sources but also can go back in time,

if necessary, to reinterpret historical data

and reports in accordance with more recent

developments and insights.

Source: Selected data from S&P Global Market Intelligence, ‘Copper Discovery Rates Plummet.’

Source: Selected data from S&P Global Market Intelligence, ‘Copper Discovery Rates Plummet.’

Customary practice in most exploration

programs involves initial data

collection — compiling pertinent information

from existing records or manually

by field studies, or both, followed by

mapping at various levels of detail. From

an information technology perspective, a

paper-based approach to this process is

unacceptably inefficient, and improvements

based on eliminating paper forms

and maps have been low-hanging fruit for

IT companies, which have been quick to

develop solutions more in line with corporate

digitization initiatives and objectives.

To illustrate the progress made in

this area, Mark Gabbitus, product strategy

manager for software developer Micromine,

presented a paper at the inaugural

Australian Geoscience Council Convention

(AGCC) held last year in Adelaide

that described his company’s strategy for

optimizing the process using connected

devices and edge computing.

Gabbitus said Micromine’s focus on

exploration began in the early 2000s with

the release of Field Marshal, a field data

capture product designed to replace paper

log sheets, and has continued into the

present with recent releases of Geobank

Mobile, which facilitates integration with

data capture devices such as magnetic

susceptibility readers, portable XRFs

and geotechnical measurement devices.

These devices, according to Gabbitus, are

often connected to a service or database

in the cloud, but “someone, somewhere

still needs to merge it into the master

database at some point.” Issues also can

arise when there is no network connectivity,

a common issue on the edge.

“If an exploration geologist can collect,

validate and access their data in

a single platform, while they are in the

field, real-time insights can be drawn, enabling

smarter decisions at the rig,” he

said. “Having this data available would

then allow a geologist to make decisions

in the field, to end a hole early or justify

extending a hole beyond its planned

depth. This adds immediate value, either

by reducing planned drilling costs or preventing

costly re-drills later.”

The computing power available to field

personnel in a ruggedized format has improved

to the point where not only can a

geologist run Geobank Mobile, said Gabbitus,

but also can run Micromine, the

company’s flagship modular exploration

and mine design suite, on a tablet.

Join the SRK.IS

Maps have always been essential in the

exploration process, likely starting with

crude “X marks the spot” diagrams used

by prospectors in past centuries and progressing

to the detailed prospect maps

produced by exploration teams today. But,

as Jason Beltran, a senior GIS consultant

for SRK Australia, pointed out in a recent

exploration newsletter, traditional paper

maps are static, limited to the size of the

paper on which they are printed, and difficult to read when they contain dense detail.

The solution: either split a map into

separate sheets or remove some of the features,

which lessens the map’s usefulness.

Now, in a digitally connected world,

smart devices can be used for collecting

and sharing mapping data, enabling geologists

to produce accurate digital maps collaboratively

and more quickly, and without

the limitations of size and scale. SRK has

leveraged a customized in-house mapping

portal using ArcGIS technology initially developed

by ESRI using IS for “information

system,” it’s called SRK.IS (pronounced

“circus”). SRK.IS works with Web apps

that are customized for a particular client

or project. Essentially, SRK.IS integrates

digital data collection in the field with a

centralized database, making it possible to

access maps and other geographical information

in real time and viewed by a variety

of users simultaneously.

The advantage of SRK.IS, said Beltran,

is that it provides different connection options,

whether the data is collected in the

field or viewed and/or edited in a client’s

office. Using ESRI’s ArcMap or ArcPro, the

data is transferred to maps in the SRK.IS

Web app and published as a map service

to SRK.IS, so users can interact with the

map service. The level of accessibility is

subject to the map service requirements

and user permission settings.

For collecting data, SRK.IS connects

to a dedicated ESRI application called

Collector for ArcGIS, which works on Android,

iOS and Windows mobile devices.

Data are customized according to the requirements

of the mapping task, and data

pre-filling options can be activated to

save time and reduce exposure to human

error in data entry. Digital photos can be

attached to a datapoint to automatically

georeference the location of each photo.

Users can download maps beforehand,

so data can be collected in remote locations

with no internet or mobile connection.

Later, when internet connection is

available, the offline data can be synced to

SRK.IS and integrated with existing data.

The data on SRK.IS is accessed via a

portal, using a Web browser, or by a direct

Web App URL. The Web browser interface

works like the Google Earth application

by toggling between different map layer

options, users can control the geospatial

information to view. Office-based ArcGIS

administrators can log in to the SRK.IS

portal to view mapping progress in real

time. The data can be edited and synced

back to the SRK.IS user in the field, reducing

any delay from waiting until the

map is produced before processing any

edits and enabling faster map creation

than previously possible.

Portable Productivity

The latest generation of handheld or

transportable XRF analyzers, which allow

quick identification of minerals on-site,

work well with digital data-capture solutions

that eliminate paper-based forms

and documentation and provide quick

information turnaround. These include

units such as Malvern Panalytical’s ASD

Terraspec Halo, Spectral Evolution’s oreXpress

and SR-6500, Bruker’s S1 Titan

and Thermal Fisher Scientific’s line of

Niton analyzers. X-ray fluorescence, or

XRF, is a process whereby electrons are

displaced from their atomic orbital positions,

releasing a burst of energy that is

characteristic of a specific element. This release of energy is then registered by the

detector in the XRF instrument, which in

turn categorizes the energies by element.

Handheld analyzers are convenient

and adequate for a range of in-the-field

identification requirements, but if greater

accuracy, flexibility and worker safety

(protection from accidental X-ray exposure)

are desired, a range of so-called

benchtop analyzers are available as well.

These can vary in size and configuration

from units the size of a laser printer that

can be used and stowed in the back of

a vehicle or in a site office, to trailer or

containerized setups that are touted as

“laboratories in the field.”

Recent offerings in this area include

Boart Longyear’s TruScan, comprising a

trailer-mounted module fitted with sample

handling and XRF scanning equipment.

According to the company, TruScan

is designed to provide same-day continuous

analysis of the drill core and provide

non-destructive, accurate, high-density

elemental concentration data. Boart

Longyear’s Drilling Services utilizes TruScan

for elemental and photo scanning

of core at the exploration site, providing

geologists access to real-time geological

data as the core is drilled.

Boart Longyear says its TruScan systen can provide same-day continuous analysis of drill

Boart Longyear says its TruScan systen can provide same-day continuous analysis of drill

core and quickly return

non-destructive, accurate, high-density elemental concentration data

In addition, TruScan offers high-definition

wet, dry, and spot-scan photos of the

retrieved rock core. Same-day TruScan

data, according to the company, can be

used by a geologist to log core more accurately

the first time, identify alteration

zones, and determine where to sample

and where not to sample for lab analysis.

In a similar vein, the Swedish-Australian

company Orexplore launched the Geo-

Core X10, a digital drilling cores laboratory,

which analyzes element concentrations

and minerals contained in a drill core and

provides a 3D representation of the rock’s

internal structure. Orexplore said the Geo-

Core X10 is designed to work in remote locations

and has several flexible options for

data storage and data transfer. Normally,

the data generated by the GeoCore X10’s

high-resolution scanning engine is sent to

a central server where it can be accessed

by Orexplore’s Insight analysis software.

At sites that have access to a fast network

connection, this is done automatically. In

locations where there is either a very slow or

no network available, the GeoCore X10 can

store data locally on removable SSD (Solid

State Drive) hard drives, which can then

be transported and uploaded to a central

server when a fast network is available. The

drives also can be shipped directly to an

Orexplore office for immediate uploading.

Applying AI

Recognizing the need for overall improvements

in exploration data management and

analysis capabilities, IT companies both

large and small see it as an opportunity

for application of Artificial Intelligence (AI)

technology. Goldcorp and IBM, for example,

have been collaborating since 2017 on

a project aimed at teaching IBM’s Watson

AI platform to “think like a geologist” in order

to make AI-based recommendations on

where the company should focus its exploration

efforts in the Red Lake gold district

in Ontario, Canada. Other companies, such

as Goldspot Discoveries, headquartered in

Toronto, Ontario, and Earth AI, an Australian

company, are recent startups that apply

a branch of AI known as machine learning

to develop and refine mineral targeting

systems that more effectively handle and

analyze the growing volume of data associated

with exploration programs.

Describing the Goldcorp/IBM AI collaboration,

Mark Fawcett, partner, Global

Business Services at IBM, said, “One of

the biggest challenges facing geologists is

interpreting the vast amount of data that

includes field mapping data, geochemical

surveys, drill hole data, geophysical surveys,

geological maps, Landsat imagery,

aerial photographs, mine level plans, alteration

models, resource model data and

reports in order to make the best decision

on where to drill next.

“Inputting that information into

Watson and educating Watson on the process

of exploration, gives the system the

capacity to make more informed exploration

decisions to improve the probability

of discovery.”

The first phase of the IBM/Goldcorp

program involved providing Watson with

structured data from a wide range of

sources, such as geophysical and geological

surveys, drillhole datasets, reports,

academic papers and conference

proceedings, providing insights into Red

Lake’s geology, current and historic mining

and exploration activities and successful

exploration techniques.

“Phase two is where we start to educate

Watson to refine and build the exploration

model the system will use to

make predictions and provide recommendations

on where Goldcorp should direct

its exploration activities,” said Dariusz

Piotrowski, global leader of cognitive and

analytics development for Natural Resources

at IBM.

Exploring New Partnerships

In addition to in-house corporate initiatives

aimed at improving exploration

efficiency and chances for success, companies are forming agreements and

alliances with universities and research

organizations with an eye toward expanding

and/or refining exploration techniques

and knowledge.

As an example, a new four-year, $3.6

million research partnership between the

University of Western Australia (UWA) and

Rio Tinto Iron Ore will lead to improved efficiency in geological modelling, through

innovative data science solutions.

Building on a collaboration that started

in 2010, a new partnership called

Data Fusion Projects involves UWA’s geodata

algorithms team working with a Rio

Tinto Iron Ore team led by Resource Evaluation

Manager Thomas Green.

Green said the challenge faced by Rio

Tinto’s resource evaluation group was to

quickly and consistently interpret and

integrate increasing volumes of different

types of data collected. “We were actively

seeking automated solutions not to replace

but to assist our interpretation to

model geology and resource, which can

be inconsistent and uncertain,” he said.

The partnership involves diverse

themes including the development of

machine-learning-based methods and

tools to integrate diverse drill hole data

to model stratigraphy, their material compositions

and geomechanical proxies for

resource evaluation and mining.

The research also aims to incorporate

advanced machine learning methods to

improve certainty in modelling the spatial

extent of subsurface geological interfaces.

The team will develop image analysis and

visualization methods and tools to assist

the interpretation of large volumes of 2D

and 3D data from satellites and drones for

planning and geological mapping.

UWA and Rio Tinto’s past collaboration

resulted in UWA’s commercialization

of automated downhole image analysis

software in 2015, and a RTIO-driven joint

patent application in 2017 on Automated

Validation Assistant (AVA) for geological

and mineralogical composition logging

from rock samples from drill holes using

machine learning.

In North America, Vancouver Island

University (VIU) recently announced a

mapping-related research project focused

on the glacial landscape of Canada’s

North regions. The project, funded

by Natural Resources Canada’s Earth

Sciences Sector, is aimed at assisting in

the development of better remote predictive

mapping (RPM) methods for mineral

exploration.

“Traditional methods of surficial mapping,

employing aerial photographs and

field verification, are both time-consuming

and expensive,” said Brad Maguire, a

professor in VIU’s Geography department.

He and Professor Jerome Lesemann of

the school’s Earth Sciences department

are overseeing the project.

The research project aims to develop a

methodology for computerized detection

of the sediment components of eskers —

ridges of gravel and sand, which occur

in formerly glaciated regions of northern

Canada, and which can host diamond deposits

and other valuable minerals.

Currently, RPM is a promising avenue

of semiautomated mapping using widely

available digital datasets like multispectral

satellite imagery. “However, there

are gaps in the methodology,” said Lesemann.

“Part of the problem is that the

type of imagery used to date gives us

information about spectral characteristics

of the surface, which reflects mostly

the type of material on the surface, like

bedrock or sand and gravel. The imagery

does not contain information about the

three-dimensional shapes of landforms.”

The VIU project team proposes to develop

an esker element detection methodology

based on deep machine learning

supported by a Convoluted Neural Network

(CNN). CNN uses computer algorithms

to try and replicate complex cognitive

processes of the human brain. “We

will be using CNN to identify eskers from

newly available, high-resolution digital

elevation models (DEM) of the Canadian

Arctic,” Maguire said. Lesemann explained

the aim is to train a computer to

recognize patterns. “The form and structure

of eskers are complex and if we can

teach a computer to learn what an esker

looks like, we may then be able to identify

other eskers automatically,” he added.

Back in Australia, the newly established

MinEx Cooperative Research Centre

(CRC) began operating last July at

the University of South Australia and in

Western Australia. Supported by a $50

million grant from the Australian government

and more than $150 million in cash

and in-kind support from industry participants,

the MinEx CRC is tasked to develop

cost-effective and eco-friendly mining

technologies related to in-field sensing

and real-time data analytics.

David Giles, chairman of Minerals and

Resources Engineering at the Future Industries

Institute, University of South

Australia, and chief scientific officer for

the CRC, said the objective is to enhance

the efficiency of minerals exploration

nationally. “In the Australian context,

the cost of exploration for new deposits

has risen over the past 30 years and our

success rate has declined,” Giles said,

noting that cheaper and more effective

drilling technologies have the potential to

improve the discovery and affordability of

identifying new mineral deposits.

MinEx CRC is tasked to implement

the National Drilling Initiative (NDI), a

collaboration of government geological

surveys, researchers and industry that will

undertake drilling in underexplored areas

of potential mineral wealth.

Another part of of MinEx CRC’s focus

is to extend the capability of technologies

such as Coiled Tubing (CT) drilling so it

can drill deeper, is steerable and delivers

the highest quality sampling. CT technology

for deep rock exploration, developed

by Deep Exploration Technologies CRC,

holds promise of drilling at 20% of the

cost of conventional diamond drilling and

has been tested at a Barrick Gold site in

Nevada, USA.

In Europe, a consortium of research institutions

and commercial interests have

joined in the X Mine project to look for

increases in exploration efficiency by developing

equipment for scanning drill core

samples on site using new, highly sensitive

layered imaging technology based on

X-ray fluorescence, as well as composition

analyses. The consortium conducted rock

classification trials in late 2018 comparing

the mineralogical results obtained

from Orexplore’s XRF detector, Advacam’s

XRT detector and Antmicro’s 3D camera.

The X Mine project, with funding

through Horizon2020, is an EU research

and development program funded with 80

billion to award to European research initiatives

over a seven-year period (between

2014 and 2020). It is based on international

cooperation between research institutions

from Finland, Sweden and Romania,

sensor and equipment manufacturers

from Finland, Poland, the Czech Republic

and Sweden, and end users such as mining

companies in Bulgaria, Greece, Cyprus

and Sweden, along with Australian

drilling services and equipment supplier

Swick Mining Services.

As featured in Womp 2019 Vol 02 - www.womp-int.com