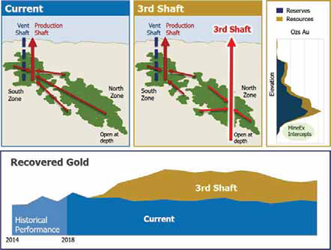

Construction of a third shaft and additional processing capacity are expected to

increase gold production at Turquoise Ridge by 500,000 oz/y.

Barrick Outlines Organic Investments

Turquoise Ridge was recognized as a core operation for exceptional growth potential, facilitated by the construction of a third shaft, productivity improvements, and an increase in processing capacity, Barrick Gold said. The construction of a third shaft at Turquoise Ridge, with an estimated initial capital investment of $300 million to $325 million has been approved by the company. Combined with additional processing capacity, this is expected to enable the mine to roughly double annual production to more than 500,000 oz per year.

The Cortez Deep South project will use infrastructure, which has already been approved under current plans to expand mining in the Lower Zone of the Cortez underground mine, including the new Rangefront twin declines and other underground infrastructure already under construction. A record of decision is expected in the second half of 2019, followed by two years of construction, with initial production from Deep South in 2022. Goldrush is on track to become Barrick’s newest mining operation in the company’s core district of Nevada. Decline construction, detailed engineering, and permitting (Environmental Impact Statement) are expected to take place between 2018 and 2020, with construction and initial production expected between 2021 and 2022, and sustained production expected from 2023.

The first component of the Lagunas Norte project contemplates the construction of a grinding and carbon-in-leach processing circuit that would treat remaining carbonaceous oxide material at the project. Environmental permits for these facilities are already in hand, while construction permits are pending. Complete detailed engineering is expected to be complete in 2018 and 2019. If approved, construction and commissioning are anticipated to take place in 2019 and 2020, followed by initial production in 2021.

Between 2019 and 2022, Barrick expects its average annual gold production to be between 4.2 million and 4.6 million oz, at an average cost of sales of $850/ oz-$980/oz, and average all-in sustaining costs (AISC) of $750/oz-$875/oz. Longer term (2023-2027), the company’s current plans indicate the potential for average annual gold production above 4 million oz. This includes contributions from projects at Cortez Deep South, Goldrush, Lagunas Norte, Robertson, Pueblo Viejo and Turquoise Ridge. It does not include any contributions from Alturas, Donlin Gold, Norte Abierto or Pascua-Lama.

Barrick also has 11.2 billion lb of proven and probable copper reserves. Its three copper mines — Jabal Sayid (50% interest), Lumwana, and Zaldivar (50% interest) — are located in some of the world’s most attractive and prospective copper districts. The company expects to produce 385 million to 450 million lb of copper in 2018, at a cost of sales of $1.80/lb-$2.10/lb, and AISC of $2.30/ lb-$2.60/lb.