Existing ‘legacy’ mine data networks were typically

Existing ‘legacy’ mine data networks were typically

designed to facilitate better communications across

a specific site. The latest generation of networks

are

geared toward handling the increasing volume

of

noncommunications data generated by new digital

assets and technologies.

The speed, volume, quality, and nature

of information collected and distributed

over mine data networks is evolving at a

rate that more closely resembles speedof-

light rather than speed-of-business —

which in itself is a fast-lane traveler on the

technological highway. At one end of the

data spectrum, it’s now routine for a major

mining operation to receive as much

as five terabytes of equipment health and

performance data daily from each of its

large mining trucks. At the other end, it’s

also technically possible for mine management

to quickly determine the physical

status of workers in remote or extreme

environments from real-time sweat-analysis

data collected by a wearable sensor.

Mining’s march to a digital future began

decades ago as a leisurely stroll down

the networking path, watching with wary

interest as other core industries such as

telecom, chemicals, oil and gas, and even

agriculture adopted emerging technology

at a much faster pace. Although digital

data generation and management have

been used to some degree in various mining

applications for decades, it wasn’t long

ago that operational information was commonly

gathered for review and analysis by

painstakingly transcribing it to PC spreadsheets

from clipboard forms and other paper-

based sources — or in the next phase

of digital evolution, stored on memory

cards that had to be physically retrieved

from the field and, yes, plugged into PCs

for spreadsheet entry and analysis.

That has changed. As a recent report

by EY (formerly Ernst & Young)* pointed

out, the mining sector has embraced the

introduction of mainframe and personal

computing, processing plant control systems,

computer-assisted dispatch, Global

Positioning Systems, mobile broadband,

affordable and available sensors and data

storage, and cloud computing, to name

just a few. And mining robots are now on

the horizon — electromechanical workers

that will subsist entirely on a diet of bits,

bytes and binary code.

Mining has claimed special circumstances

for its you-first approach, citing

cultural differences, the difficulty of dealing

with data from remote locations and the

uniqueness of each operation — and this

has resulted in what the EY report called

a “digital disconnect” regarding the industry’s

technology uptake rate compared with

other industrial sectors. This disconnect is

defined as the gap between the potential

from digital transformation and the poor

track record of successful implementations.

It exists, the report stated, not because of

a lack of engagement from the sector, but

because of a range of practical issues that

continue to challenge the industry.

These issues have been, and remain,

formidable (see sidebar), but the world’s

leading mineral producers have largely

stopped using them as excuses for technological

tardiness. Companies such as

Barrick Gold, Rio Tinto and Vale, for example,

have determined that just because

they excel at their job of finding and extracting

value from the Earth, they’re still

not immune from the fate of famous but

now-extinct brands such as Kodak, Enron

or any number of former airlines that also

were once considered to be sector leaders.

These mining majors, along with a number

of intermediate producers, have committed

their future to the digital realm,

adopting new thought and action patterns

and applying both established and emerging

technological tools to ensure that the

data needed to conduct their business in

an efficient manner is available quickly,

widely and in usable form.

The industry is reaching out to other

industrial sectors for assistance. For example,

Atlas Copco just signed a letter of

intent with the defense and security company

Saab and its subsidiary, the technology

consultancy Combitech. The collaboration,

said Atlas Copco, goes “hand

in hand” with its aggressive investment in

secure digitalized mining operations. The

effort will draw on Atlas Copco’s knowledge

of the mining industry, as well as

Combitech’s experience from digitalization

of aeronautics, defense and telecommunications

operations.

The new collaboration includes digitalization

efforts related to autonomous

mining control tower, cyber security and

ecosystem solutions. The collaboration will

build upon Saab’s technical platforms and

on the working methods and experience

that Combitech gained in the course of

digitalizing the Gripen E fighter aircraft —

an effort that reportedly cut development

time in half while radically reducing costs.

Wenco’s Readyline machine-health solution will take advantage of Lumada, parent

Wenco’s Readyline machine-health solution will take advantage of Lumada, parent

company Hitachi’s latest IoT platform..

Earlier this year, Atlas Copco also acquired

a stake in Mobilaris MCE, a business whose software solutions provide

users with a comprehensive picture of a

mining operation that includes real-time

positioning, and status information about

vehicles, equipment and personnel.

And, somewhat surprisingly, other sectors

are starting to reach out to mining for

insight. A case in point: Hitachi Group

recently merged three digitally oriented

companies — Hitachi Data Systems, Pentaho

and Hitachi Insight Group — into a

single entity named Vantara, which in September

announced the release of Lumada

2.0, Hitachi’s newest commercial internet

of things (IoT) platform offering. The

Lumada IoT platform has been updated

with a portable architecture that enables

it to run both on-premises or in the cloud

and to support industrial IoT deployments

both at the edge and in the core.

Wenco, a subsidiary of Hitachi Construction

Machinery and a well-known developer

of fleet management systems for

mining, participated in Hitachi’s NEXT

users conference, held in September, to

develop and promote the interoperability

benefits that could be exploited in the

Lumada platform by Wenco’s Readyline

real-time equipment health solution.

However, a Wenco product manager

mentioned in the company’s blog that

Wenco’s industry experience also drew interest

from organizations throughout the

parent company, stating that “…a lot of

the other Hitachi Group companies are

looking into developing mining solutions,

but they need some guidance on the mining

side of things. There are data scientists looking to build things, but they’re

not sure about mining. There are other

analysts trying to create solutions, but

they don’t know how the industry works.

That’s where we come in.”

Next-gen Networks

Underlying the industry’s critical need to

“get it right the first time” by applying

useful analysis to timely information is

the development of increasingly sophisticated

and flexible data network solutions.

The latest generation of data networks,

as illustrated by Innovative Wireless

Technologies’ (IWT) HDRMesh solution,

include wireless packages that reliably

carry real-time data from working areas

to enable effective management and improvement

of production operations.

IWT said HDRMesh was specifically

designed for underground use and solves

data retrieval issues facing that type of operation.

Traditional Wi-Fi-based solutions

do not reliably transmit in non-line-of-sight

conditions, and lack the range for continuous

coverage. Traditional wired data solutions

are difficult to maintain, difficult to

advance and often do not survive the mining

process. IWT’s data solution comprises

a series of rugged High Data Rate (HDR)

wireless nodes that “hop” data from mine

equipment to the mine’s fiber backbone.

Each node contains a proprietary high

data rate mesh component and a Wi-Fi

Client Access Point.

Eric Hansen, IWT’s CEO, spoke with

E&MJ earlier this year at a trade show

just prior to the commercial rollout of

HDRMesh. Hansen said the system had

been tested in three different mining environments

and the first operational installation

would occur before the end of 2017.

Hansen traced the evolution of

HDRMesh from the success of the company’s

existing underground communications

solutions. “Our legacy systems introduced

prior to HDRMesh were designed to meet

the requirements of the 2006 MINER

(Mine Improvement and New Emergency

Response Act) in the U.S., which focused

mainly on communications and miner

safety. However, we started getting comments

from our customers on how much

of an impact just having those communications

capabilities available had on overall

productivity — they were able to talk

with underground workers they could never

reach before, and respond to underground

problems and bottlenecks much quicker.”

HDRMesh is designed to accommodate

the growing need for data transmission

beyond the basic needs of communications,

Hansen explained, as mines

ramp up data collection from video sources,

machine-mounted sensors and other

information nodes. It was also designed

to be easier on the checkbook: “It is

available in two configurations — a standalone

version for customers who do not

have one of our legacy systems installed;

and a retrofittable version for those that

do,” said Hansen. “It doesn’t require fiber optic, Ethernet or leaky feeder cabling

and thus doesn’t have the maintenance

requirements associated with those systems,

but still works with traditional communications

client devices such as smartphones,

tablets and laptops.”

IWT’s Vice President of Engineering

Steve Harrison added that the freedom

from cabling is a distinct cost advantage

in hard rock applications. “You can take

our equipment into a mining area, use it

and remove it for blasting or when mining

is completed — you don’t have the cost

of traditional cabling that’s been installed

and then damaged or abandoned from

mining activities.”

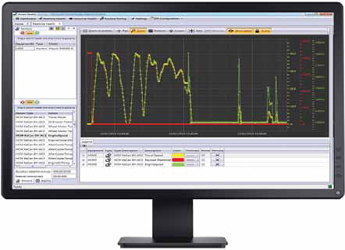

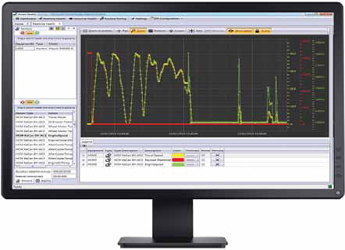

IWT will supplement its new HDRMesh underground mine data network with a suite of

IWT will supplement its new HDRMesh underground mine data network with a suite of

data analysis tools designed

to enable quicker, better-informed decision-making for

its customers.

Hansen said IWT also is developing

a suite of data-analytics software tools

that will complement the high-speed data

HDRMesh network, providing customers

with real-time information from underground

operations, enabling them to make

quicker and more accurate decisions.

Other data-management software

solution suppliers are plotting their future

avenues for product development

and engaging their clients in the process.

Maptek Chief Technology Officer Simon

Ratcliffe recently noted in the company’s

Forge newsletter that offering a technology

roadmap allows its customers to have

confidence in working with Maptek to

meet their own goals.

“Core technology common to all Maptek

products enables an environment where

customers can create integrated technical

operating models across a range of systems

and data sources — in a way that reflects

the reality of their mine,” he explained.

Basic areas include data sharing and

management, workflow modeling and business

process management. The roadmap

guides the integration of all the company’s

desktop applications into the Maptek

Workbench to provide a platform for these

processes. The Workbench, introduced in

2016, also improves license management

and flexibility, according to the company.

“The inputs to various pieces of software

will no longer be constrained to that

software — you’ll be able to open multiple

pieces of software and have the data

flow from one to the next,” Ratcliffe said.

“Another project involves creating a

new spatial platform. This is going to allow

the kind of data that we deal with in

our software, such as large block models,

triangulated data structures, grids and

big laser scans, to be efficiently stored

and communicated between machines.

“Once you put those two concepts together,

you can start getting data from different

disciplines, or different machines,

onto the one machine and into a range of

software,” he explained. This enterprise

connectivity allows multiple users to

share data for multiple functions across

multiple applications, which enhances

collaboration, efficiency and accuracy.”

Internal Sources

It’s not uncommon for producers, particularly

larger companies with dedicated

resources, to develop specialized data

management apps in-house, generally

using corporate IT personnel; however,

even nontechnical workers with talent,

basic programming skills and an interest

in improving productivity have made important

contributions. Rio Tinto has benefitted from both sources: For example,

Bold Baatar, chief executive–energy and

minerals for Rio Tinto, told an audience

at the Natural Resources Forum held in

London in July that “…one of our haul

truck drivers with a passion for computer

development used his self-taught skills

to develop an integrated real-time digital

monitoring system for the entire pit. This

brought together all the existing streams

of data in a highly useable, 3-D touchpoint,

visual platform — integrating drill,

dig, load and haul data, equipment performance

and availability as well as safety

management all in one place.

Software developers at Barrick Gold’s Codemine

Software developers at Barrick Gold’s Codemine

hub

in Nevada work closely with operational

personnel to

develop in-house technological

solutions at a pace

that often can’t be

matched by outside vendors.

Baatar continued: “An example of an

outcome [of this project] would be an

increase in speed and decrease in haul

cycle time, which means we can park a

truck and still achieve the same volume.”

This kind of employee and management

initiative, he added, was “central to

our plan to deliver an extra $5 billion of

value through productivity over the next

five years. Productivity is about sweating

our assets — bringing them to peak performance.

We can only do this if we understand

where our performance is best

in class so we can replicate it.”

Earlier in the year, Chris Salisbury, Rio

Tinto’s chief executive–iron ore, described

to an audience at the Austmine 2017

conference the scope and rate of advance

the company needs to maintain to develop

digital solutions for its Western Australia

iron ore operations. The scope is massive:

“It has cost us $40 billion to build our

iron ore export machine — a flexible set

of 15, soon to be 16 mines, an integrated

privately owned rail and port network and

a cutting edge operations center in Perth

that controls our operations. And, at the

next level, 370 haul trucks, 50 production

drills, 200 locomotives, 450 kilometers

of conveyors and 1,700 kilometers of

rail — the list goes on.”

Conceding that “Rio Tinto is a big organization,

and at times we have been

slow to move,” Salisbury said that, nevertheless,

the corporate culture is changing:

“What if I told you that I’ve got a mine

site in the Pilbara with a crusher that is

now capable of calling trucks to maximize

throughput? What if I told you a team of

six people delivered this capability within

two weeks? You might be surprised. But,

having a crusher calling trucks to improve

productivity is exactly what we achieved

last month at Hope Downs.

“This new system analyzes real-time

data being captured at the crusher such

as bin levels and run-rate, and overlaid

real-time truck data such as location,

payload and grade. The end result is continuous

optimization of equipment utilization,”

he said.

“We now plan to replicate the crusher

capability at Hope Downs across our

business. As you can imagine, there are

many thousands of points within the operational

footprint where some type of improvement

could be made. And, each day,

I want my 11,000 employees to think

about how improvements can be made to

their area of the business.

“Operators and tradespeople have the

opportunity to say, ‘look, we’re wasting

money on this,’ or ‘this particular bit of

gear doesn’t run well,’ or ‘if I could have

a bit of money or time to fix this, I could

improve our productivity.’ We have 2,000

of these new ideas in the pipeline and recently

I was briefed on the top 50. I have

a live dashboard on the status of each.”

Driving Digital Initiatives

On the other side of the globe, Barrick

Gold essentially committed itself to a

digital future in 2016, when John Thornton,

the company’s executive chairman,

announced that Barrick would partner

with networking giant Cisco for the “digital

reinvention” of Barrick’s business.

The first step of that collaboration is development

of a flagship digital operation

at its Nevada, USA, operations. During a

June investor tour of the Nevada facilities,

Barrick pointed to the complexity of decision-

making required to run those facilities

efficiently after combining the Cortez

and Goldstrike mines. The need for decision-

making speed and clarity to manage

processes and assets across the expanded

site was an important driver in the company’s

move toward a digital-first philosophy.

Leading the list of Barrick’s digital

initiatives for the Cortez complex are:

• Underground short interval control,

• Underground automation,

• Digital maintenance work management,

• Digital processing,

• Predictive maintenance,

• Consolidated data platform,

• Analytics and unified operations center

and

• Integrated planning.

The estimated productivity boost of

just the top two or three items on the list,

according to the company, is significant —

Short Interval Control in the underground

operation is expected to add roughly 260

t/d in 2018, and Automated Process Control another 280 t/d. Mill uptime improvements

were anticipated to add another 2.8

hours of operation per month as well.

Barrick also said its Goldrush underground

project, scheduled for completion

by the end of 2017, presents many opportunities

for automation of stationary

equipment such as rail haulage, automated

chute delivery, engineered bin systems,

automated hoisting, smart conveyors, auger

feed systems and ore pass delivery as

well as ‘in motion’ activities that include

autonomous drilling and mucking.

Australia-based mine contractor Pybar intends to implement automatic data capture from

Australia-based mine contractor Pybar intends to implement automatic data capture from

every machine in its

fleet, ranging from basic production data to mechanical alerts.

Ed Humphries, head of digital transformation

at Barrick, recently provided

some details of the digital initiative, as it

pertains to the underground operations in

Nevada, in the company’s Beyond Borders

blog. The Short Interval Control system at

Cortez, he explained, “allows our people

to see in real-time the locations and work

status of different personnel and equipment

which helps with planning. It helps

us avoid sending equipment to a heading

when it isn’t ready or is already being

worked. It has the ability to control workflows and condition of equipment through

apps, helping to increase efficiencies.”

He noted that Barrick recently implemented

a digital work management tool,

developed in-house, at Cortez. The tool

lets technicians check what maintenance

work is scheduled for the day, its status

and any issues or delays — all in real time.

In addition, it lets technicians quickly

order replacement parts via a tablet, reducing

the time it would have normally

taken them. Meanwhile, supervisors can

track the progress of maintenance tasks

on both mobile and stationary equipment,

to better manage their workflow and staff.

“The best part” of Barrick’s digital initiative,

said Humphries, “is our absolute

focus on user-centered design. Our people

are building our solutions and testing

them at a speed that none of the traditional

mining vendors can compete with.”

The Digital Contractor

Digital awareness now extends beyond

producers and equipment providers. Mining

contractors are also getting into the

game. Pybar Mining Services, for example,

is the third largest mining contractor

in Australia, specializing in underground

hard rock projects. It also owns subsidiaries

that perform specialist underground

core drilling programs, surface exploration,

and electrical design and construction.

Current projects are under way at

Auctus Minerals’ Mungana zinc/copper/

gold/silver mine, Red River Resources’

Thalanga zinc mine, New Gold’s Peak

gold mine, and OZ Minerals’ Carrapateena

copper/gold mine, among others.

Having determined that improved data

collection and analysis is key to future

business success, the company’s Business

Systems group has been testing a

number of solutions. These include:

QLIK — Qlik is a commercial data-

visualization dashboard reporting tool

accessed from within a web browser. It

provides an easy to use interface and allows

users to drill down and filter data to

quickly identify trends for benchmarking

and continuous improvement. Pybar said

it is currently in the process of installing

this tool on its servers.

WebBAR — WebBAR is a custom-built

production database intended to provide

a user-friendly means of capturing valid,

useful production statistics from Pybar

sites (e.g., tons hauled, meters drilled,

equipment downtime for availability calculations,

delays, etc. Recently it has

been expanded to include functionality

to post consumable usage into the

company’s inventory system, as well as

quantities required for invoicing, and

hours for employees.

Pybar said it will be implementing

a number of major improvements in a

phased upgrade to WebBAR, such as

offline capability for data entry; iPLOD

— electronic PLOD (production data);

processing prestarts from different sources

(iPLOD, machine data, paper PLODs);

shift planning module; and shift summary

reporting.

The company’s iPLOD initiative enables

operators to input their PLOD data

directly into a tablet, from which it is

then uploaded to the production database.

Supervisors will be given the ability

to validate this data before it is posted to

the main database and PDF copies can

be printed out. The app can be tailored

to different machines, allowing capture

of just the machine specific data needed;

e.g., tons and TKMs for trucking, drill

meters, holes, bolts and mesh for jumbos,

etc. The system will also allow operators

to input their prestart and daily safety

checklists directly to the tablet where

work flows can be organized, if necessary.

Pybar reported that it has trialed

devices at most of its sites and is now

ironing out remaining bugs and making

changes to site specific processes ahead

of an official roll out.

Machine Data Capture — Pybar is

working toward implementation of automatic

data capture from every machine in

its fleet, from basic production data (such

as engine hours and payload), to mechanical

alerts. The data will flow automatically back to the head office, where the

company said it is “close” to implementing

dashboard reporting for key statistics.

What’s Ahead

The latest market data shows a strong

and growing interest in digital innovation

among mineral producers. Four out of five

mining and metals companies expect to

increase their spending on digital technologies

over the next three years, with

more than one-quarter (28%) planning

significant investments and almost half

(46%) citing digital as the biggest contributor

to innovation, according to new

research from Accenture.

Based on a survey of about 200 mining

and metals executives and functional

leaders worldwide, the Digital Technology

in Mining report showed the convergence

of information and operational technologies

and adoption of cloud computing are

advancing the digital agenda.

Mining and metals executives said their

companies have applied and will continue

to apply digital technology over the next

three to five years predominantly in mine

operations, but also in exploration, mine

development and other areas. Most of the

investments in mining operations target

robotics and automation, named by 54%

as a top spending area, along with remote

operating centers, drones and wearable

technologies, each at 41%.

Mining and metals companies are

also continuing to adopt cloud computing

technologies broadly. Four in five respondents

(81%) said their companies

have implemented some form of public,

private or hybrid cloud, and another 17%

said their company is exploring the use of

cloud technology.

Accenture’s research results underscore

a trend for miners looking to sophisticated

analytics to help them improve

operations and make data-driven

decisions. For example, one-third or more

of the respondents said the most widely

used digital technologies in mine operations

involved some type of analytics.

When looking at organization-wide digital

technologies, 31% of respondents said

they are making significant investments

in real-time data visualization, and 58%

are piloting or in the strategy stage with

that technology. About one-third said they

are conducting pilots with predictive/machine

learning analytics; artificial intelligence

and cognitive computing; virtual

simulation of physical environments; or

video analytics.

“As miners continue to face weak

global demand, excess capacity and increasingly

limited access to resources,

the desire to innovate through digital

technologies emerged as a key finding

of our research,” said Rachael Bartels,

global managing director for Accenture’s

Chemicals and Natural Resources practice.

“Cost reduction is still on the agenda

for miners, but the focus is squarely

on better performing operations. Digital

technologies enable operations to adjust

to changing geology and market conditions,

while still delivering returns.”

Avoiding Digital Difficulties

One of the basic premises of a recent study** on digital progress

— or lack of it — in the mining industry is that even though

“digital mining” has, in various forms, been around for several

decades, there is a perceived, and often real concern that technological

implementations haven’t always delivered their money’s

worth. Here are some of the common pitfalls that can lead

to project failure or shortcomings:

• Lack of detail on the implementation pathway: There is consensus

between stakeholders on the digital vision but little discussion

on how to practically and effectively move from current

state to this vision.

• Perception of high costs: There is a valid perception from

decision-makers that projects linked with IT systems often

over-promise and under-deliver, often with a significant budget

overrun. This perception delays decisions to commence

a digital initiative.

• Unclear accountability and disconnect with the current operating

model: Owners of digital transformation are often unclear,

and silo organizational structures are mismatched with

a fundamentally different way of operating.

• Ill-defined business model and business case: There is a degree

of skepticism from leadership as to the robustness of

the business case for digital and a lack of clarity on what

the new business model will look like.

• Lack of digital education and understanding: This can result

in behaviors such as:

o An aversion to change or the implementation of something

not fully understood.

o A naïve rush to implement something on promise often

through a misguided desire to appear progressive.

• Remote decision-making creates dissonance with local

leadership:

o Cultural difficulties of new remote operating models are

not fully recognized.

o Operating site leadership is reluctant to concede critical

process ownership to external teams, and the external

teams often fail to deliver positive outcomes due to a lack

of deep understanding of the site issues.

o Resourcing requirements to support a global business from

a single location are under-estimated, as are the difficulties

in gaining access to accurate data.

• Data systems lack maturity to support the future vision:

Perhaps one of the biggest disconnects with the vision of

the digital future is the quality of the data available for

decision-making. While in some areas there are massive

amounts of new data, there are other parts of the value chain

with gaps in data quality and issues in gaining access to

required information.

• Systems and processes are already in place but are not being

optimized: Business cases often do not recognize that there

may be a significant digital footprint already in place. Leaders

must understand why this footprint is not fully utilized before

implementing new approaches.

As featured in Womp 2017 Vol 11 - www.womp-int.com