Sunrise or sunset for the era of the ultra-class hauler? The bigger trucks

Sunrise or sunset for the era of the ultra-class hauler? The bigger trucks

hit the market in the upswing of a commodities super cycle and now, after

the bust and the bottom, the

economics of ownership are on the books for

review. Experts agree on factors favoring bigger trucks, but diverge on

outlook. Above, a hauler casts long shadows. (Photo: Liebherr)

Ultra-class trucks have now been around

for almost two decades, a timeframe ample

for meaningful reflection. Beyond the

data, there are now plenty of case studies

and stories to consider that can make the

case both for and against their deployment.

A couple of mining engineering professors

from Canada said after glancing

back it becomes apparent the ultra-class

hauler does have its place, which is also

to say that there are mines where it definitely doesn’t belong. A handful of variables

determine which is the case for a

particular mine. Where they diverge is if

there is now a trend at play reflecting this

reality and what that trend looks like.

In a lecture at Haulage and Loading

2017 on his study, Is Bigger Still Better?

Considerations for Increasing the Size

of Haulage Equipment, Dr. Tim Joseph,

University of Alberta mining engineering

professor, pinpointed the late 20th century

as the dawning of the age of ultra-class

haulers. The zeitgeist was “bigger has

to be better,” he said. “We saw a lot of

people from the industry pushing to see

bigger equipment. Everybody had the

thought that if we went bigger, our costs

would drop.”

The resulting push teetered on recklessness,

he said. “We made a huge leap

of faith at that time. We jumped from

240-ton class suddenly to 320 and 360,”

he said. “We’d come from jumps of 20 to

30 tons. Suddenly we jumped 100, 120

tons in one go.” In retrospect, at certain

mine sites that faith was redeemed, Joseph

said. A handful of factors made bigger

better. Those same factors also made

bigger more problematic than beneficial

at others.

“Overall, I still believe that bigger is

better because you are able to do more

relative to the actual ratio of the payload

to the gross vehicle weight,” Joseph,

who is also director of the Alberta Equipment-

Ground Interactions Syndicate, said

in an interview after the lecture. That belief

comes with a caveat, he said. “It becomes

a function of how big the mine is.”

Dr. Anoush Ebrahimi, principal mining

engineer at SRK Vancouver and author of

The Evaluation of Haulage Truck Size Effects

on Open Pit Mining (2004), agreed.

“In theory, bigger is better if we can manage

the side effects,” he said. Ebrahimi,

who teaches mine planning and design at the University of British Columbia, said

those side effects can prompt some miners

to deploy mixed fleets, limiting the

use, routes, and value of the loads of the

bigger haulers.

Both said that while ultra-class

haulers may haul more using less fuel,

they place specific demands on mines

and operations that some cannot meet.

Breaking that statement down, Joseph

said under the right conditions, the bigger

haulers live up to expectations when

it comes to fuel consumption. “In terms

of fuel consumption, the larger trucks

are doing better,” Joseph said. “As payload

size increases, fuel consumption

went down per ton.”

Ebrahimi agreed, saying “the basic

data shows that larger trucks burn less

fuel per tonnages moved.”

Both said ideal fuel economy occurs

under ideal conditions.

Ideal conditions for ultra-class haulers,

Joseph said, were large mines with

gently sloping, wide ramps and roads

made of hard rock. If the slope is more

pronounced or if the roads turn to mud,

a number of new calculations are required

to determine the point of diminishing

returns.

First, he said research reveals the

ideal ramp gradient is below 8%. “If

you have a mine with a fairly shallow pit

and 4% to 6% ramp grades in your

mine, you could probably say bigger is

better,” he said. As for mud, the ideal

rolling resistance was that found at hard

rock mines, which in research conducted

in Australia averaged between 3.5 and

4.5%, he added.

Bigger is still better, but only in certain circumstances. Komatsu’s 980E-4, above, offers a 400-short-ton payload.

Bigger is still better, but only in certain circumstances. Komatsu’s 980E-4, above, offers a 400-short-ton payload.

Ebrahimi said that while roads and

ramps might typically have limited

rolling resistance problem spots, “the

ground conditions at the face are a completely

different issue.” The larger the

truck, the more the potential problems

could arise from “issues with soft ground

conditions,” he said.

If the ramp is too steep and the road

too soft, among the first noteworthy problems

to arise is that of emissions. “We

were starting to get down this path of the

rising tier engines, which was supposed

to give us better fuel consumption and

better control,” Joseph said. “Looking at

those vehicles that operate on ramps or

ground that is really soft with high rolling

resistance, like the oil sand companies,

we really have struggled to see any

improvement at all. The reason for that

is, when the engine has to work hard

when the rolling resistance gets higher

when the road deterioration is higher,

then you not only are having a bad fuel

burn, but what goes out of your exhaust is

not just NOx, carbon monoxide and carbon

dioxide, it is also the hydrocarbon itself.

It is the fuel.” Emissions and failing

to meet legislated standards are among

“the first and foremost things we are being

dinged on in the industry by government,”

Joseph said.

Worse, a problem spot causing

heightened rolling resistance repeatedly

traversed by ultra-class haulers could set

off a negative feedback loop. “If you have

a higher pressure from your tires, you are

going to get more ground deformation.

The ground is going to deteriorate more.

That means more road maintenance.

That means higher rolling resistance,”

Joseph said. “Higher rolling resistance

means longer cycle times, more fuel

burn, higher emissions. This could actually

cost us a lot because we’ve got a

larger truck putting down more load on

the running surface.”

Knowing this, miners are forced to

plan for it, widening roads that must

be constructed with better materials.

All that represents additional costs and

impacts the stripping ratio. “The fundamentals

never change, but mining

methods change,” Ebrahimi said. “Larger

trucks need wider ramps, which results

in shallower wall slope angle, increased stripping ratio and increased

mining costs.”

Joseph agreed, saying the bigger

trucks require longer ramps, which

mandates the miner “set back the pit

walls. The more you have to set back

the pit wall, the more you have to cut

into it to create what essentially for a

much larger mine is a more permanent

road system of ramps, the more volume

you’re taking out.”

In road and ramp planning, “most

mines are going 3.5 to four times the

width of a truck just because of safety

issues and to be able to accommodate a

safety berm on the bench going up the

ramp,” Joseph said. “So, the bigger the

truck, the wider the roads, the more volume

we’ve got to take out. The cost of

moving all that additional waste you’ve

got to be able to balance against the ability

to carry more load out with one single

unit.”

This may be the foremost concern of

a miner planning on deploying ultra-class

haulers, Ebrahimi said. “Ramp geometry

and configuration play a big role in mining

costs,” he said. “We shouldn’t forget

that mine geometry also affects the way

we ‘selectively’ mine ore.”

Another concern is fleet management

complications that can arise with a reduced

fleet size and with increasingly

expensive and technologically advanced

haulers. “Having fewer trucks in a fleet

reduces flexibility,” Ebrahimi said. “This

challenge can be addressed by purchasing

additional or spare trucks, which can

be expensive.”

Ramp slope, road conditions, maintenance costs,

Ramp slope, road conditions, maintenance costs,

and fleet management challenges should all be

considered when

planning to deploy an ultra-class

truck, two mining engineering professors say.

Above, a Caterpillar 794 AC tops off.

Again, Joseph agreed, saying, “The

advent of the ultra-class was mines saying

‘we’re tired of having to deal with

such larger fleets, can we go to a smaller

fleet and do the same or better?’” The

dream of smaller fleets was one of the

driving forces behind the demand for ultra-

class haulers. “Moving in that direction,

we’ve lost some of the redundancy,”

Joseph said. “If we lost a 240-ton truck,

no big deal. We have lots of them. You

lose a 360- or 400-ton truck, it is now an

additional 120 to 200 tons per cycle that

we’re starting to lose out of the system.”

Not only is production hit when one of

the bigger haulers is sidelined, research

revealed the bigger the truck, the costlier

the repair, Joseph said. “What we found

was when we got into the bigger units,

there were bigger types of problems and

they happen more often,” he said. Automation,

energy recapture, and integrated

digital mine tech add to the complexity

of the larger haulers. “And those different

things require higher levels of expertise,”

he said. “The costs of labor have

gone up. The tools they require, and the

diagnostic systems they use, have gone

up in cost.”

At least for a time, another similar

cost and challenge was centered on

tires. “When we jumped from a 40R57

tire to a 55R51 tire, we made a huge

jump in size class,” Joseph said. “We

had the manufacturer create a tire class

that didn’t exist. It was literally a demand

overnight. The manufacturers

learned very hard on what would work

and what didn’t.”

Other cost considerations also enter

the equation. For example, the size of

the haulers used can affect processes,

and thus costs, downstream, Ebrahimi

said. “Employing larger trucks requires

bigger benches and that means coarser

ore fragmentation,” he added.

Combined, for some miners the abovementioned

costs and potential challenges

are greater than the expected returns

on investment. “When you consider all those things, the whole question of is bigger

better is still up in the air,” Joseph

said. “When you are looking at the cost

of maintenance, the redundancy in the

system, you start to question that and

bite your lip, and say maybe it isn’t everything

we’ve considered if we look at the

complete cost of ownership, including

the cost of moving all that waste, and the

creation and maintenance of these much

larger road systems, wider road systems,

longer road systems.”

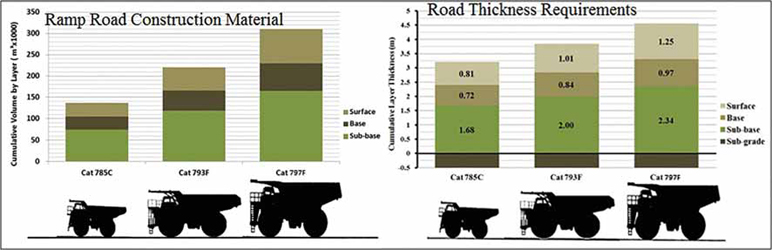

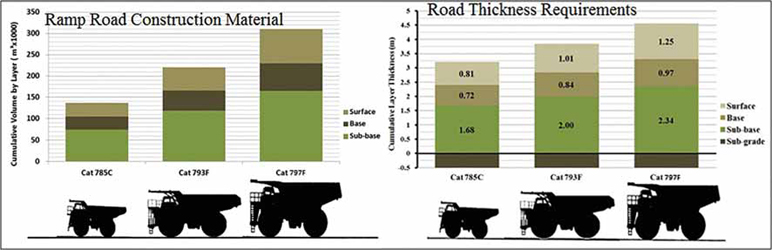

Bigger haulers mandate more planning, thicker roads and ramps made of better materials, and wider, shallower

ramps, the latter of which could impact mine geometry with effects

Bigger haulers mandate more planning, thicker roads and ramps made of better materials, and wider, shallower

ramps, the latter of which could impact mine geometry with effects

downstream. (Photos: Tim Joseph).

Ebrahimi said the costs and challenges

mandate extensive analysis and

planning before committing to deploying

an ultra-class hauler. “Mining is so

complex that scenarios cannot be copied

blindly,” he said. The optimal hauler fleet

for one mine may not be the same for

another quite similar mine, he said. “Every

single mining project must be evaluated

independently, under its own conditions,”

he added.

The professors diverged on their vision

for future demand for ultra-class haulers.

Joseph pointed to what he said could be

a trend in fleet management at Western

Australian mines as one example of what

the future could hold. “These guys have

stuck with the 240-ton class, or maybe

even the 220-ton class,” he said. “They

didn’t go ultra-class.” This has a lot to

do with the value of the ore mined. “The

actual value of the ore, they don’t need

to produce as much volume per day and

they’re still making money.”

That reality could play out globally,

Joseph said. “I think we basically have

two types of large mining operation developing,”

he said. “Those that have

high-value ore or fairly shallow mines,

the preference is toward the midrange

classes, the 240-ton classes, maybe a

little smaller.” Joseph said this is the

case in South Africa, China, Southeast

Asia and much of Europe. “You go into

Europe, you go into the metal mines

of Russia, you go into Kazakhstan and

maybe further north from there, you

suddenly realize they are concentrating

very much on the smaller size trucks,”

Joseph said. “They’re not going with the

trucks we know, they’re going with their

own brands. These operations are specifically

choosing and sticking with those

smaller size classes.”

Ebrahimi said whatever trend is at

play now is likely due strictly to global

economics and the metals bear that followed

the peak of what many referred to

as a mining super cycle. “In the past 10

years, the mining industry was in state

of extreme uncertainty and this prevented

the development of new systems,” he

said. “I see some indication that the mining

industry is coming back to its booming

state. With improved industry conditions,

we may see more discussion and

use of larger equipment.”

Bigger haulers will continue to have

a place in the larger operations fielding

bigger fleets, he said, but their assignments

may change based on the value

of the ore mined. “I believe the mining

industry will move toward larger equipment

for general earth moving tasks

such as waste mining in large open

pits,” Ebrahimi said. “However, when it

comes to ore, we will see a tendency to

use smaller equipment. In the future, we

will see more mixed fleet sizes in mines,

larger trucks working in waste, smaller

trucks working in ore.”

Doing such could, however, present

mine plan and management challenges,

Joseph said. “Invariably these generate

loading mismatches through needsbased

dispatch supplementary fleet

allocations that cross the waste versus

ore hauls,” he said. “Road design issues

develop where larger haulers find their

way onto narrower roads.” A mixed fleet

also presents unique availability dilemmas

and maintenance cost considerations,

he said.

As featured in Womp 2017 Vol 09 - www.womp-int.com