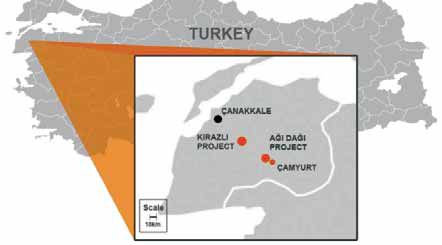

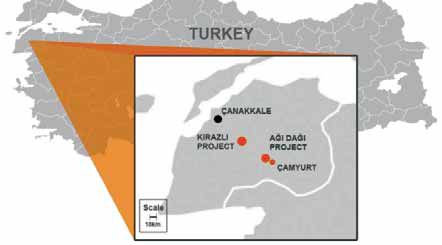

The three projects in northwestern Turkey will be low cost, open-pit, heap-leach operations.

Alamos Sees Potential in Turkey

All three projects will be open-pit, heapleach operations. “We now have three of the highest-return, undeveloped gold projects in the world,” said John A. McCluskey, president and CEO, Alamos Gold. “With Kirazli, followed by Agi Dagi and Çamyurt, we own a pipeline in Turkey that can provide lowcost production and free cash flow growth for more than a decade. Kirazli is one of the highest-return, undeveloped gold projects in the world in any price environment and it represents our next phase of growth.”

Kirazli development is based on an initial proven and probable mineral reserve of 26.1 million metric tons (mt) grading 0.79 grams (g)/mt gold and 12 g/mt silver, containing 670,000 ounces (oz) of gold and 10.1 million oz of silver. Production over a five-year mine life is projected at 540,000 oz of gold and 3.1 million oz of silver. Mine-site all-in sustaining costs are estimated at $373/oz.

Plant throughput at Kirazli is planned at 15,000 metric tons per day (mt/d). Pregnant solution from the leach pad will be processed through an adsorption-desorption-recovery (ADR) plant, where gold and silver doré bars will be produced. Initial capital to develop Kirazli is estimated at $152 million. Following a construction decision, Alamos anticipates that the project will require a 24-month development The three projects in northwestern Turkey will be low cost, open-pit, heap-leach operations.

Planning for Agi Dagi development is based on an initial proven and probable mineral reserve of 54.4 million mt, grading 0.67 g/mt gold and 5.4 g/mt silver, containing 1.17 million oz of gold and 9.5 million oz of silver. Production over a mine life of six years is projected at 937,000 oz of gold and 2.4 million oz of silver. Mine-site all-in sustaining costs are estimated at $411/oz.

Processing plant throughput is planned at 30,000 mt/d. The processing flow sheet is similar to the Kirazli flow sheet. The initial capital to develop Agi Dagi is estimated at $250 million. Following a construction decision, Alamos expects a 36-month development timeline for Agi Dagi.

The PEA for Çamyurt was conducted on the basis that the project will have minimal stand-alone infrastructure. Ore will be trucked to Agi Dagi and processed through Agi Dagi infrastructure. The mine plan in the PEA incorporates measured and indicated mineral resources of 16.6 million mt grading 0.92 g/mt gold and 6.3 g/mt silver, containing 490,000 oz of gold and 3.4 million oz of silver.

Çamyurt has been designed as a 15,000-mt/d mining operation. Production over a mine life of four years would total 373,200 oz of gold and 1.6 million oz of silver. Mine-site all-in sustaining costs are estimated at $645/oz. Initial capital is estimated at $10 million.