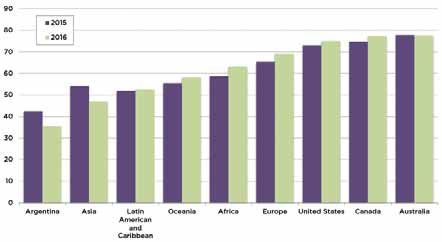

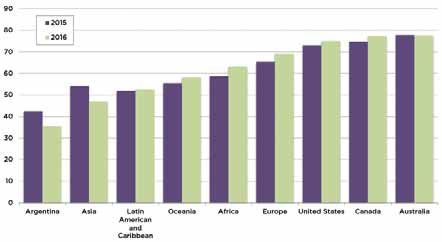

Regional median investment attractiveness scores 2015 and 2016.

Saskatchewan Tops Fraser Mining Survey

The survey assesses how mineral endowments and public policy factors such as taxation and regulatory uncertainty affect exploration and mining investment. The 2016 survey ranks 104 jurisdictions worldwide, including countries, states and provinces, on their attractiveness to investors based on responses from mining executives.

A total of 350 responses were received for the 2016 survey. The companies that participated reported exploration spending of $2.7 billion in 2016, down from $3.2 billion in 2015.

The overall Investment Attractiveness Index is constructed by combining the survey’s Best Practices Mineral Potential index, which rates regions based on their geologic attractiveness, and its Policy Perception Index, a composite index that measures the effects of government policy on attitudes toward exploration investment.

In a summary overview, the report noted that analysis of regional trends indicates a stark difference in investment attractiveness between Australia, Canada and the United States, and the rest of the world. Australia continues to surpass both Canada and the United States as the most attractive region in the world for investment, although both Canada and the United States gained ground on Australia in 2016.

Only two sets of jurisdictions, Argentina and Asia, saw their relative investment attractiveness decline. Argentina experienced a 16% decline in its regional median score from 2015, while Asia experienced a 13% decline. Africa experienced the largest improvement, with an 8% increase in its regional median investment attractiveness score.

“In general, the climate for investment appears to be slightly improving,” the report stated.

Policy factors examined by the survey included uncertainty concerning the enforcement of current regulations, environmental regulations, regulatory duplication, the legal system and taxation regime, uncertainty concerning protected areas and disputed land claims, infrastructure, socioeconomic and community development conditions, trade barriers, political stability, labor regulations, quality of the geological database, security, and labor and skills availability.

The Fraser Institute survey includes numerous quotes. Among these comments: “Sweden has a very transparent system, with excellent access to historic exploration and drill core data,” said an exploration company manager.

“There is corruption on every level in the Democratic Republic of the Congo,” said a producer company manager.

Fraser Institute’s Survey of Mining Companies 2016 is available as a free download at www.fraserinstitute.org/sites/default/files/ survey-of-mining-companies-2016.pdf.