During the 1920s, the size of open-pit mining equipment

grows appreciably.

Miners Persevere During Good Times

and Bad

E&MJ reports on advances between the two world wars

By Steve Fiscor, Editor-in-Chief

In the U.S., for the first time, more Americans were living in the city than rural areas where farming and mining were taking place. A huge disconnect grew between these two societies, which resulted in the gain and loss of some freedoms related to a wide-spread anti-immigrant movement. By the end of the 1920s, 12 million American households had radios. Fashion swept the nation with the fl appers and it and the Red Scare found its way into the pages of E&MJ.

During the 1920s, the world witnessed a mining engineer and self-made mining magnate, Herbert C. Hoover, make the leap from industrial titan to humanitarian to U.S. president. The Guggenheims sold the Chile Exploration Co., which operated the Chuquicamata mine, to Anaconda Copper. Newmont became a publicly traded company. A major copper deposit was discovered in Rhodesia (Zambia) just to the south of the border with the Belgian Congo, which set off an epic battle between copper cartels. Dr. Hans Merensky discovered the platinum reef in the Transvaal (the Republic of South Africa). Harnischfeger made its fi rst mining shovel and Bucyrus merged with Erie Steam Shovel to form Bucyrus-Erie.

The excitement that had been building through the 1920s would wane as the U.S. stock market crashed in October 1929 and banks begin to fail. Similar to the recent global financial crisis, the mining industry thought it was insulated from the loss of paper wealth. As the economic depression set in, the mining business discovered it was a lagging indicator. Copper consumption declined precipitously, causing market shifts. Kennecott Copper acquired Utah Copper. De Beers idled its diamond mines as demand dried up. Hoover couldn’t save the economy and he was replaced by Franklin D. Roosevelt, who put in place several programs to restart the U.S. economy, one of which was fi xing the price of gold at $35/oz up from $20/oz.

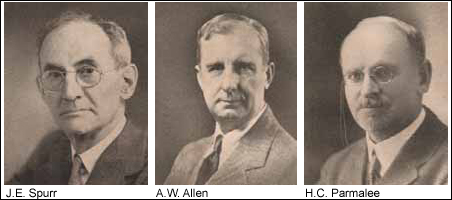

Shortly after E&MJ celebrated its 50th anniversary (1916), John Hill died and the remaining Hill Publishing Co. properties, which included E&MJ, merged with McGraw Publishing Co., to form McGraw-Hill Publishing Co. E&MJ would remain with McGraw-Hill until 1988. Rossiter Raymond saw E&MJ celebrate its 50th before he passed in 1919; the journal was his life’s work. That same year, J.E. Spurr took over as editor from Walter R. Ingalls. Following World War I, he sensed the importance of the international aspects of the mining industry and refl ected that conviction in the pages of E&MJ. He expanded the market reporting service of E&MJ, and publicized the marketing of metals and minerals. In 1927, A.W. Allen was appointed editor. He launched a series of special issues of E&MJ devoted to great mining enterprises and important mining regions. During his tenure, the frequency of the publication changed from weekly to monthly and he launched E&MJ Metal and Mineral Markets as a weekly market information and metal price service. In 1933, H.C. Parmelee was appointed editor and he was still managing E&MJ when the title celebrated its 75th anniversary in 1941.

A Historical Year

E&MJ January 17, 1920—NINETEEN-NINETEEN was the “Year

of the Armistice” following the Great War. In the United States,

superfi cial war prosperity has continued, with rising prices and a

rush for luxuries on the part of those people able to buy, and reacting

from war thoughts and duties. In Europe, there has been

the exhaustion, which is the aftermath of war fever, industrial

paralysis threatening bankruptcy, and starvation. The swing of

the pendulum from German and Russian militarism, and from

all militarism, into which Germany

had forced the world, and the

United States with it, brought on

violent reactions toward theories

of radical reorganization of society,

which reacted again swiftly to

militarism and tyrannical methods

for enforcing these theories of antimilitarism

and anti-tyranny…

The great activity in American mining during the war subsided suddenly with the armistice, what, with the stocks on hand and the great falling off of the demand. The war-mineral industries— manganese, chrome, graphite, and others—were partly or entirely paralyzed. During the year, with all the flurry of high prices, the demand has centered on things to wear and to eat, which the mining industry does not supply. The high cost of supplies of all sorts has raised the cost of mining. The margin between the producing costs and selling price of copper is less than at any other recent period, with a consequent low level in the prosperity of this great industry. Gold mining, with fi xed price of product and rising costs, is being exterminated, with no help in sight. Income and excess-profi t taxes promise to absorb the reward of the occasional successful mining venture… For the industrial situation, we believe one of the main factors in checking the rising fever of high prices, and in hastening deflation, would be an in creasing emphasis on the necessity of real money—gold and silver...

Progress by Cooperation

January 19, 1929—“The outstanding event

of 1928 of especial signifi cance and gratifi cation to the members of the mining industries

of the world was the selection of

the Hon. Herbert C. Hoover as the next

President of the United States. With abundant

hope, with ample justifi cation for that

hope, E&MJ looks forward to an immediate

future of orderly progress and steady advance

in the industries it serves and represents,

confi dent that Mr. Hoover’s translation

to a post of the highest responsibility and the greatest

world influence will stimulate confi dence and engender mutual

respect among the elements of a far-fl ung group of technologists

and engineers.

Mining and Milling Methods Advance

The management of multiple mines by large companies draws

signifi cant interest. In October 27, 1928, E&MJ published

a special Phelps Dodge edition, which detailed the manifold

phases of a large mining organization. “Satisfactory coordination of such a number of operating mines involves large-scale

financing, purchase of equipment and supplies, transportation,

and milling and smelting of ores, and can be achieved only by

efficient management.”

The increasing size of equipment brings economies of scale. “In open-pit mining, the employment of a new 15-yd electric shovel shows the trend toward the use of larger units·with greater radius of action and higher dumping level. Completion of the electrifi cation of the Utah Copper mine by the addition of electric motor haulage on the benches in place of steam indicates that excavation and haulage in open-pit mines where tonnage is important will be on an electric power basis. Simplification and economy in operation and maintenance are the factors that induced this change in equipment.”

In the area of ore dressing, an article in E&MJ discussed more economical crushing, progress in flotation and greater simplicity of flowsheets. “The Symons cone crusher is now generally accepted as a machine of outstanding merit. With its wide range of reduction, it replaces two or three intermediate crushers and rolls with accompanying screens, and reduces the feed from a coarse crusher to a size suitable to feed to a ball mill or rod mill. It does this with less power, and, it is claimed, with less production of fi nes. At the Chino mill, a 7-ft unit reduces 10-in. feed to 1 in. at the rate of 200 tons per hour (tph). At Anaconda the same size of unit handles 1,000 tph, but the reduction is from 5 in. to 3/4 in. A new 7-ft unit at Miami receives 14-in. feed and reduces it to 3/4 in. at the rate of 300 tph, using a 250-hp. motor.”

Flotation evolved to the point where Phelps Dodge eliminated the use of tables in its mills. With the introduction of more fine grinding for flotation, however, comes the problem of the greater increase in power consumption.

Mining and the Great Depression

In an article titled, “Metal Industry Suffers Little from Wall

Street Crash” on November 2, 1929, it’s clear in hindsight that

the E&MJ editorial team has not grasped the magnitude of the

situation. “More persons felt the shock of the drastic decline in

securities in Wall Street, which occurred late in October, than

ever before in the history of the stock market...

“Wall Street, observers frequently point out, has a way of curing its own ills, but unfortunately the process of restoring the market to a healthy condition is not always a painless one… “The mining industry, and more particularly the non ferrous metals division, is in position to face the future with composure. At no time in the history of the industry has more intelligence been applied to the production and marketing of metals. Some errors in judgment may have been made in carrying out the plans for placing the mining industry on a sounder economic basis, but, everything considered, the industry has made substantial progress, which should continue despite any Wall Street speculative crashes.”

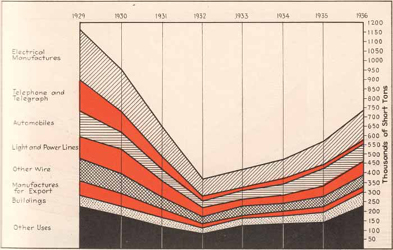

Little did the editors of E&MJ know how wrong they were; by 1933 half of the U.S. banks would fail. Fast forward to 1937 and E&MJ Editor H.C. Parmalee opened the year with “The Trend is Upward.” In it he discussed how the mining business was fi nally seeing signs of recovery. “In 1936 [metal mining] enjoyed the best year since 1930. At least one must go back that far to fi nd comparable prices for the common non-ferrous metals. And even the markets were declining, while now they are rising. In fact, they have more than me the prophecy of a year ago.

He discussed price increases in cents per lb of about 50% and declining stocks of a similar rate, and compares it to the dark days of 1932-1933. He cautions E&MJ readers that the increase in prices has been brought about by a speculative boom in Europe, which is becoming engulfed in what will be World War II.

“World gold production in 1936 rose to 35.5 million oz and established a record for the fi fth consecutive year. It showed a rise over 1935 of about 13.5%, the most important increases occurring in the U.S.S.R., the U.S., the Transvaal, and Canada. The past year was relatively uneventful for silver, except for a marked increase in production. World output of silver is estimated at 246 million oz, and increase of about 15% over 1935.

“More than any other industry, metal mining is international in scope and infl uence. Pools, cartels and agreements testify to this fact, as does the investment of capital. Hence the well-being of the industry depends more and more on the play of international forces. The present outlook, barring the catastrophe of war, which observers are inclined to agree is not imminent, is for a prosperous year in mining throughout the world.”

The hardship brought about by the Great Depression eventually fuels a rise of extreme political movements. FDR supported Britain and France as they geared up to defend themselves against the Axis Powers. The situation overshadowed E&MJ’s 75th anniversary in 1941. A few months later, the Japanese would bomb Pearl Harbor and drag the U.S. into the conflict.