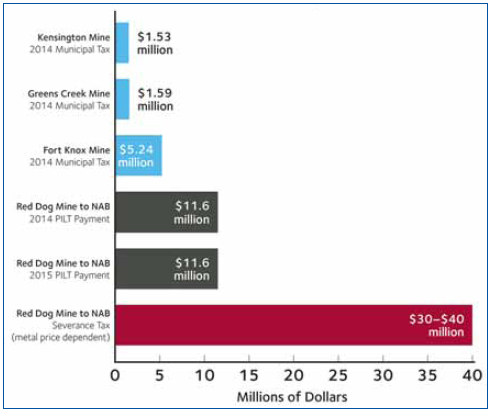

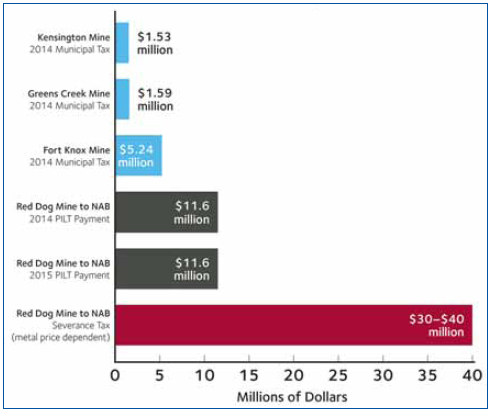

Red Dog payments to Northwest Arctic Borough vs. other Alaskan mine payments. (Source: Teck Alaska)

Red Dog Files Tax Complaint

The company said Red Dog has provided annual contributions to the Northwest Arctic Borough (NAB) under a negotiated Payment in Lieu of Taxes (PILT) agreement for more than 25 years; these averaged about $11.5 million per year over the past five years, more than double the average borough tax payment for an Alaskan mine. However, as of January 1, in place of a negotiated PILT the NAB has levied a substantial severance tax. If legal, this tax would increase the payment to an estimated $30-40 million annually over the next five years—about seven times greater, on average, than the next highest municipal taxes paid by any other mine in the state.

The complaint filed by Teck requests an injunction against enforcement of the severance tax and a requirement for the Borough to meet with Teck to negotiate a new payment agreement.

Teck Alaska said Red Dog is the largest private-sector employer in the NAB, with about 715 jobs in the region being minerelated, and about $75 million in wages paid each year. Annually, Red Dog spends about $160 million on goods and services within Alaska. Since mining began, about $140 million has been provided to the NAB, more than $880 million to state government agencies and more than $695 million to federal government agencies.