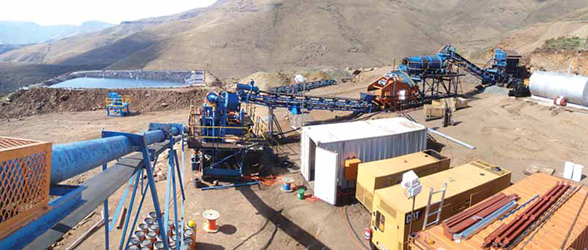

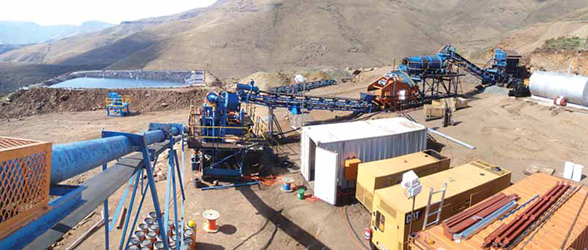

U..K.-based Paragon Diamonds plans to bring two projects into production in Lesotho in 2016. (Photo: Paragon Diamonds)

Paragon’s Lesotho Projects to Focus on High-value Diamond Production

U.K.-based Paragon Diamonds is developing the Lemphane and Mothae projects in the tiny mountain kingdom of Lesotho. Among the company’s backers is a consortium of well-connected Gulf Arab investors who intend to acquire gems as a store of long-term value.

“These investors are connected to the royal families of the UAE and Saudi Arabia,” said Hugo Philion, a member of the management team at Paragon. “Through them, we will be talking to some very interesting people who want to acquire our sizeable supply of large investment grade diamonds direct from the mine, and who are intent on making Dubai the number one diamond center in the world.”

Through Dubai-based International Triangle General Trading, the investors have made a debt and equity package of up to $28 million available to Paragon. The company expects to begin mining early next year.

Although regarded as precious, diamonds have generally been a commodity mineral, Philion noted. Sold to consumers for wedding rings and to industry for cutting tool bits, they have also been a notoriously poor store of value.

According to industry benchmark Rapaport Diamond Index, prices of stones have fallen by as much as 80% in real, inflation-adjusted terms over the last 30 years, as reported by the Wall Street Journal. At the same time, analysts have complained that that the scarcity of diamonds has long been an artificial construct devised by South African producer De Beers, which has dominated the industry for more than a century. A seller of a diamond ring, for example, will be lucky to get $0.10 on the dollar compared to what a jeweler originally sold it for.

Critics say there are gems aplenty, and besides, they can now be manufactured to a standard nearly indistinguishable from the real thing. “On a real basis adjusted for inflation, the performance of most diamonds has really not been that impressive compared to other asset classes,” said Paul Zimnisky, a New York-based independent diamond analyst and consultant, via email.

There’s another view, however. Some believe that diamonds—or at least their supply—may not be forever after all. In particular, the high-end quality stones could vanish from the market as fewer are found.

“Only the highest quality, rarest, most desired diamonds have outperformed: the blues, the pinks, the reds and larger flawless whites,” Zimnisky said. “With the price point of these diamonds starting in the high-tens and hundreds-of-thousands of dollars, the investor base is limited.”

“Limited” in this sense is a relative term. Paragon’s Philion is confident there are enough high-net-worth individuals out there who are looking for added investment items to add to their portfolios. He points to the opening in September of the world’s first exchange for physically-settled diamonds— the Singapore Diamond Investment Exchange. This is the first time that diamonds can be bought and sold through brokers in a similar way to other commodities; traditionally, sales have been through individuals and based on a handshake, with no trace of the actual price settled to help other buyers determine market level for different types of stones.

Presently around $22 billion worth of diamonds are sold at wholesale prices every year, but the introduction of a regulated exchange could push that to $100 billion, Philion said. He added that it has been 20 years since the last significant kimberlite pipe was discovered. Since then, overall diamond production has been in decline.

For investors, it’s those stones above 10 karats and that sport unusual colors forged by nature that are in demand, said Philion. “White or fancy colors such as pink, brown, red and green usually qualify as investment grade, Philion said. “There are not a lot being found but those that are, tend to appear in Lesotho.”

Diamonds are classified into two categories: Type I diamonds that contain nitrogen; and Type IIa diamonds, which are nitrogen-free. It is the latter that show colors, and is also the gem type with which Lesotho is particularly blessed.

Some of the largest diamonds ever discovered have been found at just one operation, the Letšeng mine run by Gem Diamonds not far from Paragon’s projects. Like Paragon’s planned operation, Letšeng comprises several kimberlite pipes and has steadily produced spectacular finds since excavation began in the late 1950s. The biggest stones range roughly between 500–600 karats uncut, or about the size of a chicken’s egg. These have gone on to be “named” diamonds—jewels so spectacular that they are given their own moniker.

For instance the 603-karat “Lesotho Promise,” discovered at Letšeng in 2006, ranks as the world’s 12th largest diamond. It was sold for $12.4 million, to Londonbased investment jewel specialist Graff Diamonds, and following a year of painstaking work was cut into 26 “Flawless D” jewels to be fashioned into a single necklace. Graff estimates its value at around $50 million.

Since Gem Diamonds began operating Letšeng in 2006, the mine has unearthed four of the 20 largest white gem-quality diamonds ever recorded. Last year’s major discovery was a 198-karat gem that made headlines around the world.

All in all, Lesotho has at least 39 discovered kimberlite pipes, of which 24 are diamondiferous. Most of these are already claimed and although there’s plenty of exploration going on, there are no guarantees that more will be found.

If Paragon and its Gulf backers’ gamble pays off, high-value diamonds could take their place with gold as a store of long-term value. “For the foreseeable future, I see the appeal of diamonds as an investment limited to high-net-worth individuals, those looking to store value, using diamonds as an additional portfolio diversification tool, with the added benefit being the very high value-to-weight ratio diamonds provide,” said Zimnisky.