Centerra Targeting 895,000 oz of Gold Production From Öksüt

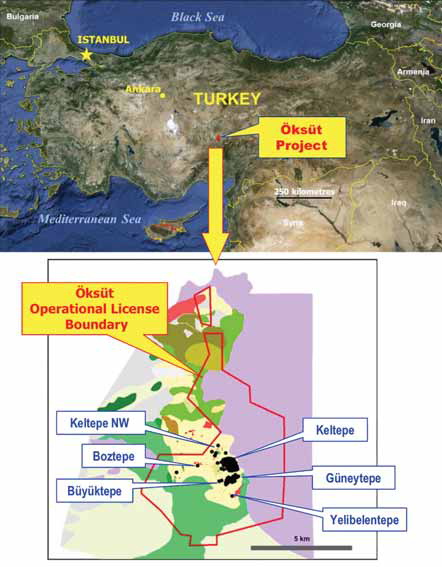

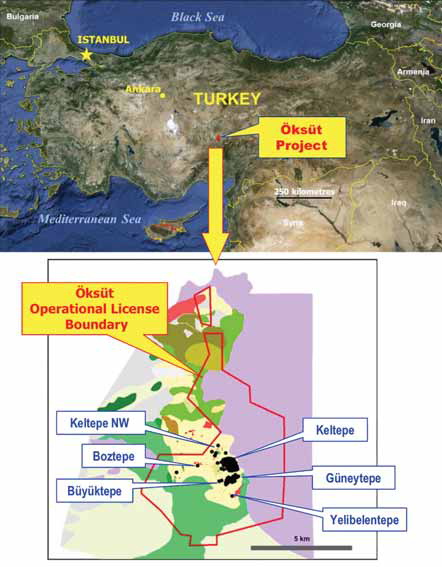

The Öksüt project is located about 295 km southeast of Turkey’s capital city of Ankara in an area of excellent infrastructure. Centerra expects to begin detailed engineering and ordering of long-lead items for the project in the second half of 2015, with project development beginning in the first quarter of 2016.

The Öksüt feasibility study envisions a conventional open-pit and heap-leach operation. Electrical power is expected to be supplied by a dedicated 28-km power line tied into the local power grid. Water will be sourced from two company-owned wells, which have been fully permitted.

Öksüt’s probable reserves are estimated at 1.2 million oz of contained gold in 26.1 million metric ton (mt) at an average grade of 1.4 g/mt using a cut-off grade of 0.3 g/mt gold. Mining is planned to be conducted by a local contractor, using a conventional truck and shovel fleet of small, selective loading equipment and 36-mt trucks. The life-of-mine strip ratio is expected to be 2:1.

The ore will be crushed to 38 mm through two stages of crushing and will be placed on the heap-leach pad at a rate of 11,000 mt/d. Life-of-mine gold recovery is expected to be 77%.

Royalties applied in determining the economic results of the Öksüt feasibility study include a Turkish government state royalty of 2% and net smelter return royalties payable to Stratex Gold AG (1%) and Teck Resources. The Teck royalty is a sliding-scale NSR based on cumulative ounces produced over the life of the mine and is estimated at 0.6% of total gold revenues. The total effective royalty rate used for the purposes of the Öksüt feasibility study is 3.6%.

The project will be subject to a 20% income tax rate, though Centerra expects, and the feasibility study assumes, that an investment incentive certificate will be obtained that will allow a tax credit of 50% of eligible capital expenditures.