Barrick’s Turquoise Ridge mine will get an

additional production shaft.

Barrick Looking to Nevada for Gold Production Growth

Turquoise Ridge: The Turquoise Ridge mine, located about 70 km northeast of

Barrick is advancing a project to develop an additional shaft at Turquoise Ridge that could bring forward more than 1 million oz of production, roughly doubling output to an average of 500,000 oz/y at all-in sustaining costs of about $625 to $675/oz. Key permits are expected in the third quarter of 2015. Pending approval by the joint venture partners, construction could begin in the fourth quarter of 2015, with initial production beginning in 2019.

Preliminary estimates indicate capital expenditures of $300 million to $325 million for additional underground development and shaft construction and a payback period of roughly 2.5 years, using a gold price assumption of $1,300/oz.

Drilling at the northern extension of the Turquoise Ridge deposit confirms the orebody is larger than previously known, at higher grades. Due to the substantial thickness of the mineralization, Barrick is also looking at the economics of introducing bulk underground mining in some parts of the orebody.

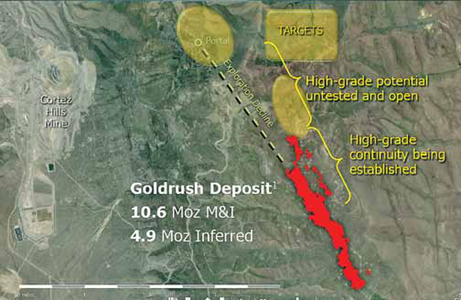

Goldrush: The Goldrush project is located 6 km from Barrick’s Cortez mine and is one of the largest gold discoveries of the last

Infill drilling in 2014 continued to demonstrate high-grade continuity and led to resource upgrades. A permit application for twin exploration declines that will allow the company to better explore the northern limits of the known deposit was submitted in the second quarter of 2014.

Cortez Underground Expansion: A prefeasibility study to extend underground mining at Cortez below currently permitted levels will be completed in late 2015. Mineralization in this Lower Zone is primarily oxide and higher-grade than underground ore currently being mined, which is sulphide in nature. The limits of the Lower Zone have not been defined, and drilling has indicated potential for new targets at depth.

An exploration drift has been extended to the south, enabling additional step-out drilling, which is anticipated to begin in June. Drill results to date include 36.6 m at 31.5 g/mt and 27.4 m at 20.9 g/mt, both oxide in nature, which compare favorably with the average grade of 13.8 g/mt in refractory ore above the 3,800-ft level.

Spring Valley: The Spring Valley project is located about 75 km west of the Cortez mine and is owned 70% by Barrick and 30% by Midway Gold. The low-capitalcost, oxide heap-leach project has the potential to become a stand-alone mine. Barrick expects to complete a prefeasibility study in late 2015.

Barrick reported an initial measured and indicated resource of 1.3 million oz (70% basis) averaging 0.66 g/mt and an inferred resource of 0.6 million oz (70% basis) averaging 0.62 g/mt for Spring Valley at the end of 2014. There is good potential to expand the current resource at higher gold prices.