Using new tools and a benchmarking program, mines could improve shovel performance.

Data, Digability and Downtime

Using shovel performance data, mine operators can readily target areas for

improvement and prevent costly unexpected events

By Steve Fiscor, Editor-in-Chief

To get the greatest rate of return on its capital investment, miners can essentially pursue one of two production strategies. They can try to produce at the lowest cost per ton or move the most ore. When commodity prices (and profit margins) are high, as they were from 2004 to 2012, mining companies pursue a volume strategy and ramp up production. When the market softens, as it has recently, the volume strategy gives way to a cost strategy. Knowing when and how to make that transition is important. It’s also important to let the miners in the pit know that the mine plan has changed.

The amount of data that’s available to today’s mining engineers is astounding compared to what was available five or 10 years ago. It serves little purpose, however, if it’s unorganized or not reaching the key decision makers. Several companies have developed tools that allow mines to monitor shovel performance and make comparisons. Sometimes the information poses more questions than it answers. Hopefully, as miners become more familiar with these tools, they can close the gap between where they stand and what is seen as best practices.

Productivity and Reliability

Benchmarking

As the amount of machine-related data

increased, the mining industry’s ability to

collect and analyze it also improved. More

recently, however, the level of productivity

at the mines has been declining and the

data magnifies that fact. The declining productivity figures are even more troubling

for the mining business as it transitions

from a full production mindset to one that

is more oriented toward profit margins with

lower metals prices. Without a major upswing in prices, mine operators will have to

reverse this trend, and knowing where the

mine currently stands is the first step.

At the 2014 Society for Mining, Metallurgy and Exploration (SME) Annual Conference, Richard Adsero and Graham Lumley, mining consultants with PricewaterhouseCoopers (PwC), suggested benchmarking as a tool for miners to at least gain a foothold. For the miners to improve, they first need to know where they stand, how they stack up against what others are doing (best practices), and then develop a plan to close the gap. Many miners, however, contend that each property has site-specific conditions that render direct comparisons ineffective. These experts from PwC believe that the mines have more in common than they realize, which includes scheduling, operator training, familiarity (or lack of) with the mine plan, and maintenance procedures, among others. Benchmarking, Adsero explained, will likely raise more questions than it answers and that could be healthy for mine management.

In 2006, the first comprehensive, global benchmark of trucks, loaders (electric shovels and hydraulic excavators), and drills was compiled by a multinational mining company. This work, according to Adsero, framed the development of the GBI Mining Intelligence productivity and reliability database. PwC acquired GBI and the database in 2013. The PwC database covers data from five continents; including 136 mines, 308 makes and models of equipment, 4,670 machines, and more than 12,000 operating years of data. Even though PwC is not extracting ore from the earth, it understands operations that are through its database.

Adsero explained that achieving performance levels equal to best practices for both shovels and trucks in the same pit is difficult. Loading tools perform best when they are over-trucked and vice versa. An over-trucked production plan maximizes output and usually incurs a higher cost per ton. It’s a strategy that prevails when profit margins are high and volume is driving the return on investment.

In a case where the return on investment is driving production, Adsero explained, the cost strategy requires minimizing the number of trucks. In an under-trucked scenario, trucks will not be lining up to load and the shovel may have to wait to load. The mine operator can reduce the size of the truck fleet so that trucks are constantly cycling. They could also reduce the number of shovels or the operating schedule.

A number of mines have recently switched from a volume strategy to a cost strategy, which would be a prudent approach in the current environment of lower commodity prices, Adsero explained. “However, many of these mines are still executing a volume strategy on the mine level,” Adsero said. “Executive management has been quite alarmed when presented with this information.” Benchmarking studies help the mine and the executive management team understand where the operation stands as far as meeting mine plans and production strategies internally, as well as how it stacks up externally.

There are three characteristics of benchmarking that must override all other considerations, according to Adsero. The mine must act on identified gaps. Every benchmark must be tailored to the mine’s specific requirements to be meaningful. It must be focused on the equipment that will deliver improved profitability to the mine.

MineWare consolidated its full cycle decomposition to an easier-to-use one-number manager.

A New Take on Digability

While the number of trucks assigned to a

shovel or hydraulic excavator will certainly

influence productivity, so too will the digging conditions or the muck pile’s digability. Advancements in technology now allow

very accurate measurements of the shovel’s payload, energy consumption and cycle

times. Correlating this data with muck pile

digability has allowed a new look into how

rock strength and fragmentation affect

shovel productivity. Mines could benefit by

analyzing digability as it applies to the performance of the bucket (dipper), ground

engaging tools (GET), and the drill & blasting (D&B) program.

The term digability was coined by English coal miners as a term to help with equipment selection in the 1970s. They assigned a numeric value to geological parameters, such as weathering, rock strength, joint spacing and bedding planes. The total score, the digability index, would correlate with an excavation principle and equipment selection.

In the 1980s and 1990s, mining engineers and blasting professionals began to incorporate digability into discussions that related to shovel performance with blast analysis. They correlated drill logs with excavator performance and fragmentation studies. By cross-referencing fragmentation analysis with the digability index, they showed a real correlation between digability and fragmentation.

Speaking at Haulage & Loading 2013, Stephen Lochner, manager-mining systems with MineWare Pty. Ltd., discussed how the company was putting the digability index to work for mine operators today. He explained how computing improvements and the ability to store and share massive amounts of data allow modern monitoring systems to:

• Record accurate data for almost every aspect of shovels (and draglines);

• Make complex calculations within milliseconds of cycle completion; and

• Share and store all data on the machine, in the mine office and at the corporate office for easy trending.

The MineWare system produces a full cycle decomposition. “We gather data on payload, fill time, swing time, return time, cycle time, swing angle, return swing, stress index, truck payload compliance, production rate, and fill energy for each cycle,” Lochner said. “A mine operator could use this information to benchmark production.”

Mine operators do not have the time or patience to weigh all of these different categories against each other. “At first we were asked for a one-page manager, where everything is compiled on a single sheet of paper so that a manager can look at it and make informed decisions,” Lochner said. MineWare has taken that that one step further and boiled these values down to a single number simplifying the analysis of shovel performance. The system determines an average digability index for each cycle. If the data is sorted by digability, the mine can compare the performance metrics of shovels in similar digging conditions.

A production manager could look at the information and quickly determine which operators need additional training. “Targeting the operators who show the greatest need for improvement will yield the greatest amount of improvement,” Lochner said. “Generally, we will see a 10% productivity gap in payload and 15% productivity gap in cycle times between the top tier and bottom tier operators. A percentage point increase in production equates to millions of dollars for some mining companies.”

In the future, Lochner believes this same technique could be used to evaluate dippers, GET and the D&B plan. Reliability improvements reduce maintenance costs by avoiding major structural repairs and large component failures. He also sees the possibility of integrating the digability index with front camera systems monitoring fragmentation. The next step now is to be able to correlate fragmentation and digability data. This will be useful to both the D&B and production management teams to determine what is causing the production issue. To do this, MineWare and Split Engineering are looking at how to integrate their respective systems.

Today, MineWare has upgraded the digability index to a more comprehensive metric that incorporates several aspects of a shovel (or dragline) operation. It allows for an easy, single score comparison of: operators, buckets and dippers, GET, hoist and drag motors, and gives much-needed feedback to the D&B crews. Lochner hopes this tool will become more of a leading indicator than a lagging one.

Defeating Downtime with

Automated Monitoring

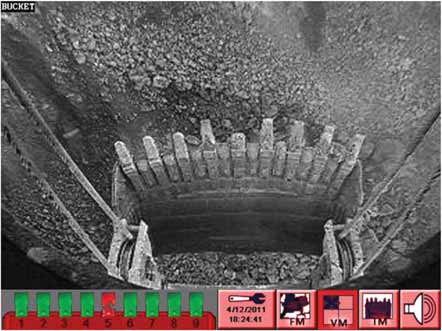

Automated systems for monitoring bucket

teeth, payloads, proximity to other equipment, and fragmentation have been developed to help mines operate more safely and

efficiently. For this to happen though, the

right people have to have access to the right

information, according to Motion Metrics

International Corp. The company is currently

developing a system that streamlines equipment management by feeding all of that

information into a central server and then

redistributing it to the engineers and management to initiate proactive and reactive

responses to avoid or minimize downtime.

Breaking a tooth on the dipper is a prime example. Automated systems have been developed to spot excessive tooth wear or a broken tooth. Obviously, the shovel does not operate effectively with a broken tooth, but more importantly, that tooth can wreak havoc on downstream operations. The trucks that might be hauling the broken tooth could be diverted before they dump their load, but the window for that opportunity is the travel distance from the shovel to the dump point.

Motion Metrics has developed a video tooth monitoring system that detects missing teeth or those with excessive wear. Before issuing an alert, one of the more challenging steps is identifying key information, according to the company. Identifying and notifying the responders is relatively straightforward, especially if the mine has a wireless network. The system sends the information to the server and the dispatcher is alerted. The shovel operator also has a warning signal in the cab. If the mine does not have a wireless network, then the operator has to manually alert the dispatcher and drivers by radio.

Diverting the trucks is a difficult decision. If the mine has no network, they must rely on the operator’s judgment based on a visual inspection. With an automated wireless system, an additional responder can review time-stamped video adding another layer of protection that prevents further downstream damage or better identifies occasional false alarms.

The logic behind collision avoidance systems for shovels and excavators follows a similar path with a much shorter timeframe for discovery and reaction. Motion Metrics uses a radar system for loading tools and explained that it’s more worried about the rear of the machines. Because the operator is focused on engaging the face and loading the trucks, collision avoidance should not be a problem for the front of the machine. The danger zones on the shovel are on the left and right sides. When it rotates, the counterweight swings into these areas, colliding with whatever is in its path. The shovel’s collision avoidance system collects key information, such as objects in its swing radius, and notifies responders. The operator will be alerted in the cab. On the outside of the shovel, vehicles are informed as they approach with warning lights.

As mentioned previously, muck pile fragmentation directly impacts shovel performance. Automated fragmentation analysis offers feedback for blasting crews. Using detailed fragmentation data from dozens of sample points in the last blast, blasting crews can use that information as a performance benchmark. Motion Metrics uses an excavator-mounted camera to capture an image of the top layer of material in the bucket during the dig cycle. In addition to capturing information periodically as it works the muck pile, no workers need to enter the pit to capture the fragmentation data.

Monitoring systems on shovels use different techniques, such as current draw from the motors and mechanical stress measurements, to determine payloads. Hydraulic excavators use pressure sensing technology related to the bucket position. The data can be used to measure total tons loaded and the rate (tons per hour), which could help the mine establish performance benchmarks.

Today’s mines have access to mountains of data, but it’s useless unless the right information is collected and distributed to the right people. Once a system has been developed, the mine can begin to embark on a path of continuous improvement based on benchmarks. Operations have the ability to act on this information, whether it is an optimization plan or avoiding downtime through proactive programs.

References

• Adsero and Lumley, (2014) A Valid

Approach to Equipment Productivity and

Reliability Benchmarking, SME Annual

Meeting (Preprint 14-105).

• Lochner, (2013) Digability: A New Take on an Old Target, Haulage & Loading 2013 Conference & Exhibition (www.haulageandloading.com)

• Baumann, Parnian, Chow, Quon and Tafazoli, (2014) Streamlining Open-Pit Operations with Automated Equipment Monitoring, SME Annual Meeting (Preprint 14-087).