Mechanized mining in the predominantly narrow-vein South African

platinum industry has largely been successful, says Sandvik Mining,

despite a few well-publicized examples where its performance did

not meet expectations.

Sandvik: Mechanized Mining Makes Sense for Africa’s Platinum Industry

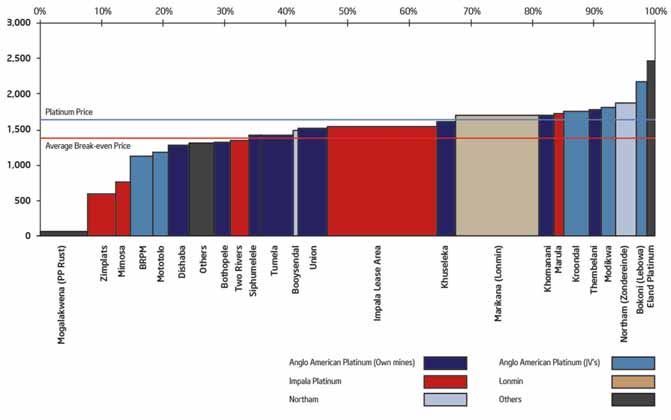

Sandvik refers to some highly publicized incidents where technology failed to deliver comparable yields to manual operations on certain shafts, and dissidents soon began proclaiming the failure altogether of mechanization in the sector. When examining the facts, that isn’t really the case, noted Sandvik: Five of the eight major underground platinum mines in the region that are profitable are mechanized, including Zimplats, Mimosa, Mototolo, Bathopele and Two Rivers.

“To claim that mechanization cannot work in narrow platinum mines is not true,” said Rod Pickering for Sandvik Mining. “Risks are inherent in both processes, but merely following a onesize-fits-all approach is more dangerous. Even despite the difficulty of extracting platinum in the narrow confines of platinum mines, we believe human hands do not always have to carry out the ‘dirty work’ in order to be profitable.”

Having worked in a broad cross-section of mines, both mechanized and “traditional,” Pickering believes that the answer to mining profitably is to do what is correct at a specific mine and individual shaft. In the future, with price pressures mounting, he said skillful mining will be required to extract the maximum efficiency out of each ton of ore mined. As orebodies are found at greater depths, mining operations will become more difficult and dangerous, forcing mine operators to adopt smarter approaches.

Pickering said, “We are already beginning to push the boundaries of human endurance underground in our platinum mines. Rock drill operators’ lives are not easy underground and the nature of the work is arduous and difficult. A rock drill weighs 23 kg and the thrust leg weighs 10 kg. This is connected to a pneumatic hose and a water hose and has to be manhandled into place and operated by a single person. As a result, operators are commanding far higher salaries that will in turn threaten the future sustainability of some traditionally operated mines.

“The challenge to prove the efficiency of mechanized mining is to begin using different measures to underpin the success or failure of mines or operations within a mine,” he continued. “A good example when measuring productivity of manually operated mines over mechanized mines has been the use of formulas relating to the cost per ton of ore removed from the mine. Modern mine managers, however, prefer measuring the cost per ounce extracted, as precision mechanized mining techniques are able to exclude unnecessary rock in favor of mining only rich deposits of ore.”

According to Sandvik, much has been said about operating cost comparisons between different techniques. Narrow reefs are typically less than 1 m in width, which means that mechanized room and pillar mines are about 1.8 m in height compared to conventional mines. With a tramming width of about 1.3 m, it is not practical to consider costs on a rand per ton basis, but rather on a rand per ounce of PGM material extracted. Based on a study by J.P. Morgan, mechanized mines, when measured in R/oz of PGM, are lowercost operations than conventional mines.

Capital costs, by comparison, can be divided between the cost to establish the mine and get it up to full production and the more direct capital cost of the equipment used to mechanize the mining operations. Mechanized mines are easier and quicker to start generating revenue. All development is on reef and pays for itself compared with footwall development in conventional mines that is a cost with no return. In startup mining operations, the time needed to begin revenue generation and ramp-up to nameplate tonnage has a direct impact on project NPV.

Sandvik said the capital cost of equipment is about 20%–25% of the lifetime cost of the equipment and its operation. In other words, the operating cost and utilization efficiency swamp the capital cost.

“In terms of risks, modern measures are more succinct and clearly examine all aspects of a mine’s operation, including health and safety,” said Bjorn Gohre, general manager, marketing and sales at Sandvik Mining. “For example, are injuries or lost lives tolerable and is the risk of incurring a mine closure due to unsafe practices conceivable? In time, putting lives at risk will push salaries up and this in turn will put undue cost pressure on mines and seriously compromise long-term sustainability.”

The company pointed out that overseas mines, with comparable conditions, have overcome similar challenges by introducing mechanization into some or all of the processes in their mines. Based on the premise that one glove does not fit all, South African platinum miners must find smart solutions on an individual basis. Examples such as Lonmin’s Saffy shaft, which de-mechanized and has since struggled to keep ore reserves open due to low manual development rates, can be compared with the success of the neighboring Hossy shaft, which has fully mechanized development and keeps ore reserves open due to higher development rates.

Arne Lewis, vice president–hard rock cutting at Sandvik Mining, said the company maintains its strong commitment to mechanization in order to rebuild the region’s competitiveness on a global scale. “Worldwide, Sandvik makes a significant investment in research and development and that is something it maintains even during tough economic climates. If you can mechanize, you can remove a person from an area that has certain dangers and put him in a much safer working environment. There is often productivity enhancement with automated or remote-controlled operations, which ultimately leads to an overall cost advantage, making operations safer, more productive and ultimately more sustainable.”

“The inability of some South African operations to mechanize successfully is often blamed on operator skill and literacy levels, yet our studies highlight the problems as being a lack of skill and reluctance to change at the supervisory level through to the senior ranks within mining operations,” said Andre O Smit, operational manager, Sandvik trans4mine.

“Our training and awareness programs are now targeting these levels with great success and we are eager to see those results materializing throughout our customer base in the next few years.”