In 2012, Antofagasta’s Chilean operations pushed the company’s copper output up by nearly 11%

year-on-year, with the Esperanza mine’s first full year of production key to the overall rise.

(Photo courtesy of Antofagasta plc).

World Copper: New Projects Arrive as Prices Slide

While copper prices have been falling for a year, the market balance is heading for

oversupply. E&MJlooks at the implications in the short term and further ahead.

By Simon Walker, European Editor

On the plus side, of course, it is important to remember that the world economy is not in recession, and that the slowdown in demand stemming from consumers having to take a more realistic look at their spending habits and credit lines, is just that: a slowdown, not a stop. Demand trends are likely to take some time to adjust to the current economic environment with, if the optimists are to be believed, a return to greater stability in the not too distant future. In the mean time, copper producers are having to watch their costs carefully, while the pruning of projects that no longer fit properly within portfolios has already begun. Rio Tinto’s recent sale of its Northparkes block-cave mine in New South Wales is one such example.

Capacity Continues to Climb

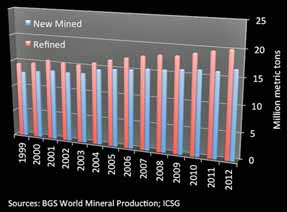

According to statistics collected by the Lisbon-based

International Copper Study Group (ICSG), world mined copper production has continued to rise year-on-year since the

mid-2000s, despite the downturn in the world economy during that period. The ICSG reported that new-mined output

rose from 15.5 million metric tons (mt) in 2007 to 16.7 million mt last year, and although annual growth had been relatively small for several years, production increased by

625,000 mt between 2011 and 2012. This reflects the commissioning of a number of expansion and development projects that had been given the go-ahead in previous years, and

which hit the market together.

However, when one looks at the picture from the point of view of capacity utilization, things are not so positive, the ICSG pointed out. In 2007, mine capacity utilization was running at 87.6%; by 2011, this had fallen to 81.1%, with a slight recovery to 81.9% last year. This means, of course, that some high-cost projects have been mothballed, while others are running at less than name-plate capacity—which in turn often pushes them higher up the operating cost curve.

For the refining sector, the picture is even more challenging. The ICSG data show that refining capacity utilization was running at 78.9% last year, compared with 82.2% in 2007, while world copper refinery capacity has grown from 21.8 to 25.5 million mt/y over the period. Actual refined output grew from 17.9 to 20.1 million mt in the six years from 2007 to 2012, with secondary feed (scrap and other sources) accounting for nearly 18% of the refined output last year.

In terms of demand, world refined copper usage of 20.5 million mt in 2012 was 2.3 million mt higher than the 18.2 million mt reported in 2007, but with refining output continuing to be out of balance with demand, the level of refined stocks grew from 970,000 mt to 1.4 million mt by the end of 2012.

Taking the longer view, new-mined production data provided by the British Geological Survey are shown in Figure 1. With only a minor exception in 2002, world primary copper production grew consistently between 1999 and 2012, rising from 12.8 to 16.7 million mt/y. During the same period, refined output—including feed derived from secondary sources—rose from 14.8 to 20.1 million mt/y, with the increasing difference between refined output and primary production clearly showing the greater role that recycled scrap is playing in the overall market.

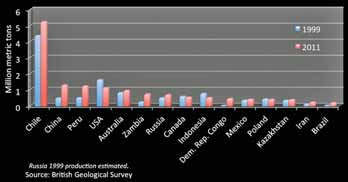

The Big Producers

BGS data reinforces the long-standing dominance of countries such as Chile, Peru and the U.S. in supplying the

world’s new-mined copper, which totaled 12.8 million mt in

1999 and 16.2 million mt in 2011, out of which the top 15

countries accounted for 11.5 million mt and 14.7 million

mt, respectively. For comparison purposes, the top 15 producing countries are shown in Figure 2, together with their

respective production for 1999. Some interesting points

quickly become apparent.

Not surprisingly, given the investment that has poured into the country, Chile’s leading position has remained, although taken as a direct proportion of world primary production, its dominance has slipped by a couple of percentage points. U.S. production has declined even more on a proportionate basis, while both Canada and Indonesia produce less copper now than they did at the turn of the 21st century.

On the other hand, there are some big winners as well. Responding to both export and domestic market-driven industrial demand, China has developed its copper industry significantly, which may come as little consolation to producers elsewhere in the world who have been relying on Chinese concentrate and metal imports. And two of the big names from earlier times—Zambia and the DRC—have rejoined the list of major producers as inward foreign investment has resuscitated previously moribund copper industries there. Not, of course, that everything has been plain sailing, especially in the DRC where some of the deals involving the rump state producer, Gécamines, have ended up in costly litigation.

Elsewhere, both Peru and Brazil have benefited from increased exploration and investment in copper projects, and while world media (and military) attention has been focused on Iran’s uranium industry, it has managed to double its annual copper production—from 130,000 mt to 260,000 mt— over the past 15 years.

Prices Reflect Economy Worries

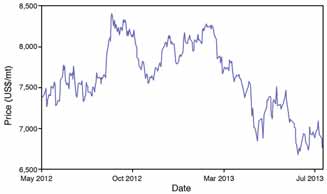

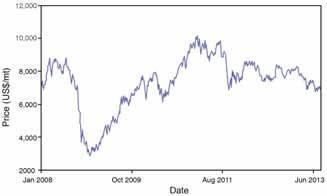

With metal stocks increasing despite a nearly 400,000-mt

negative imbalance last year, it is hardly surprising that copper prices have taken a hit recently. As shown in Figure 3, the London Metal Exchange three-months price has been on

a steady slide since March, with the price at the beginning of

August standing at just more than $7,000/mt. In point of

fact, that was actually an improvement, since it had been

down to near $6,700 mt within the previous month, whereas

its recent peak—in mid-2012—pushed it to more than

$8,400/mt.

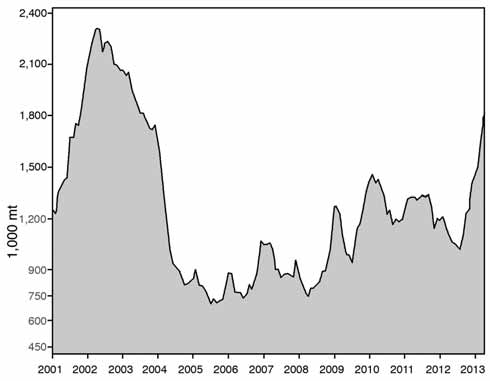

Again, this has to be seen in perspective, since when the market bottomed out in late 2008, copper could be bought for around $3,000/mt. Figure 4 illustrates this, together with the suggestion that the current down-trend did not just begin last year, but in mid-2011 when the price peaks occurred.

Figure 5 illustrates the fluctuations in stocks held in warehouses, and by merchants, producers and consumers, since 2001. Not surprisingly, the steady rise in stocks over the past year has corresponded with the slump in prices, showing that producer inflexibility (or unwillingness to trim output) is still a major factor in the supply-demand equation.

The Top 10 Copper Companies

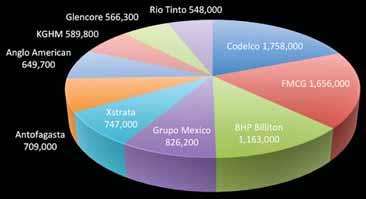

The top 10 leading copper companies produced 9.22 million

mt of copper between them last year (See Figure 6), accounting for more than 55% of the world’s total output of 16.7 million mt. The 1.8 million mt attributable to Codelco includes its

shares of production from Anglo American Sur and El Abra;

without these, its own-sourced production was 1.6 million mt,

placing it second in the world ranking to Freeport McMoRan

Copper & Gold. In addition, a combined Glencore and Xstrata

would have produced more than 1.3 million mt, promoting the

newly merged company to third place.

Codelco’s output has plateaued since 2009, following a sharp rise from 2008. The company is faced with a declining grade profile, and was only able to keep production up in 2012 by increasing ore throughput. Put in perspective, its average grade has fallen from more than 1% in 2000 to 0.73% last year, with a 9% relative drop in grade between 2011 and 2012. This has affected Chuquicamata in particular, where production was 20% down year-on-year.

Codelco has also been challenged by rapidly rising costs, which have gone up by 57% in two years. It is by no means unique in the Chilean mining sector in this respect, although cost rises for other companies have not been quite as marked. What this has done, in effect, is to whittle away Codelco’s long-standing cost advantage over its competitors, such that the playing field was more or less level at the start of 2013.

The company’s 183,000-mt/y Ministro Hales mine is on course for commissioning this year, having cost $3.1 billion. El Teniente’s new production level remains under construction, and will help maintain output there at 434,000 mt/y from 2017. Codelco’s investment commitment there is $3.5 billion, while development of an underground operation at Chuquicamata carries a price tag of $4.2 billion. Designed to produce 366,000 mt/y of copper from 2018, this has yet to get the final green light, although preliminary development work is under way. Other longer-term projects include phase two at Andina, where detail engineering is in progress, while Codelco is undertaking feasibility studies on phase two of the sulphides project at Radimiro Tomic.

Since its $25.9-billion acquisition of Phelps Dodge in 2007, Freeport has grown to the extent that it can realistically challenge Codelco for the world No. 1 spot. It currently operates seven mines in the U.S., four in South America, Grasberg in Indonesia and Tenke Fungurume in the DRC.

The company’s problems at Grasberg earlier this year have already been well documented. Freeport has estimated that the temporary suspension of mining and processing activities there cost it some 56,700 mt of copper output, while it expects its production this year to be some 95,300 mt lower than previously predicted as its ramp-up to full underground capacity and accessing higher-grade ore in the open pit are delayed.

The transition from open-pit to fully underground production at Grasberg is now scheduled for 2016. Some of the underground orebodies are already producing, with the Grasberg block cave due on stream in 2017.

In the U.S., the mining rate at its Chino operation is being ramped up, while the company is spending $1.4 billion on expanding sulphide-ore capacity at Morenci. It is also working on a $4.4-billion expansion project at Cerro Verde in Peru to triple concentrator capacity to 360,000 mt/d, with construction scheduled to begin this year, while a prefeasibility study on a large-scale sulphide-ore milling operation at El Abra in Chile is in progress.

Meanwhile, a $850-million project at Tenke, including mill upgrades, additional mining equipment, a new tankhouse and new sulphuric acid plants, is aimed at increasing output there by some 68,000 mt/y of copper.

Escondida Underpins BHPB

Reporting on its results for the financial year to the end of

June, BHP Billiton noted that while its attributable copper

production was up 10% year-on-year, production at

Escondida in Chile was 28% higher, reaching 1.2 million mt

on a 100% basis. Key factors in this achievement included

an increase in mined grade to 1.4% and higher milling rates,

with the company expecting a similar performance during

2013/2014 before a further increase to 1.3 million mt the

following year.

On a calendar year basis, Escondida (in which BHPB has a 57.5% holding) produced 1.05 million mt of copper in 2012, comprising 740,000 mt of metal in concentrates and 310,000 mt of cathode. Recent investment has included the Escondida Ore Access project to provide access to highergrade ore, and the Laguna Seca Debottlenecking project to give additional processing capacity. The $3.8-billion Organic Growth Project 1 (OGP1), begun last year, involves replacement of Los Colorados concentrator to access higher-grade ore and increase throughput, while the $720-million Oxide Leach Area Project (OLAP) is scheduled for commissioning in mid-2014 with a new dynamic leach pad and materials-handling system. In July, the Escondida partners gave the goahead for a $4.3-billion seawater desalination plant that will help maintain process water supplies to the operation without having to rely on local aquifers, with the system due in service in 2017 (see E&MJ, August 2013, p.14).

Elsewhere, BPB Billiton is still taking a second look at its proposals for a new open pit at Olympic Dam, trying to find a cheaper option. In April, the company announced the sale of its Pinto Valley operation to Capstone Mining for $650 million, having spent $195 million there last year in restarting production. The sale ends its involvement in U.S. copper production that BHP acquired with its purchase of Magma Copper.

Most of Grupo Mexico’s output is obtained from its holdings in Southern Copper Corp., which operates in Mexico and Peru. SCC contributed 651,800 mt of copper to the company’s total, with the remainder being sourced from its U.S. subsidiary, Asarco. Grupo Mexico’s output in 2012 reached a new record, supported by production increases at Buenavista in Mexico, Cuajone in Peru and Ray in the U.S.

Having already spent more than $1 billion in capex during 2012, SCC will be investing the same amount this year at Buenavista, plus further amounts for expansions at Toquepala and Cuajone. In addition, Asarco has a $32-million budget for capacity increases at its Mission operation. Overall, Grupo Mexico is aiming to increase copper production to 1.4 million mt/y by 2017, of which 1.18 million mt will be obtained from SCC.

Glencore Xstrata Starts Las Bambas Sale

In July, Glencore Xstrata put its Las Bambas development

project in Peru up for sale. Not, of course, that it wanted to,

but the disposal was one of the merger conditions imposed

by China’s Ministry of Commerce. The company noted at the

time that it had already “received numerous expressions of interest in the project from a diverse group of international

mining companies and potential investors.” Under construction and scheduled to come on stream in 2015, Las Bambas

has a 10.5-million mt copper resource.

Glencore’s copper output last year totaled 376,700 mt from own sources plus 189,600 mt derived from third-party feed. Its holdings encompassed operations in a range of countries, including the DRC, Peru, Kazakhstan and Australia, while its position as one of the world’s leading commodity traders gave it opportunities for widespread concentrate offtake agreements. Xstrata, meanwhile, won its 747,000 mt from its wholly owned operations in Argentina, Australia, Peru, Chile and Canada and from its holdings in Collahuasi in Chile and Antamina in Peru. A capacity expansion was commissioned at Antamina last year, while Xstrata also brought Antapaccay on stream and switched production from open pit to underground at Ernest Henry in Queensland. Copper production began at Mount Margaret, also in Queensland, during 2012, with the Lomas II expansion in Chile completed at the year-end.

The merged entity is now not only one of the top-flight copper producers, but also has a significant portfolio of projects at various stages of study or development. Projects include Agua Rica and El Pachón in Argentina, Tampakan in the Philippines and Frieda River in Papua New Guinea, while Coroccohuayco in Peru has the potential to add capacity at Antapaccay.

Polish-based KGHM has finally been able to broaden its horizons with its 2012 takeover of Quadra FNX Mining. Writing in the company’s annual report, Chairman Aleksandra Magaczewska said, “The transaction has undoubtedly been the biggest challenge in the history of the KGHM Group to date but, at the same time, clear evidence that the significance of the Polish economy on global markets is constantly growing.”

The acquisition has given KGHM access to operations and projects in Canada, the U.S. and Chile, where it sees development of the Sierra Gorda deposit as being key to its longterm growth. In the meantime, the company immediately gained a 25% increase in production capacity, with 110,500 mt of copper coming from the newly formed KGHM International during 2012, adding to the 479,300 mt that it won from its long-established operations in Poland.

However, KGHM is by no means abandoning its domestic base in favor of international projects, with work continuing on development of the Głogów Głęboki Przemysłowy (Deep Głogów) deposit adjacent to its existing mines, and exploration now under way for copper resources in the country’s “Old Copper Belt.”

UK-based Trio Perform Strongly

In 2012, Antofagasta’s Chilean operations pushed the company’s output up by nearly 11% year-on-year, although production at its flagship mine, Los Pelambres, was down slightly in response to lower-grade ore. Esperanza’s first full year

of production was the key to the overall rise, with both higher grades being mined and improved plant performance.

While up to now the company has maintained a steady stream of development projects, in December it temporarily suspended construction work at Antucoya in order to undertake a review in the light of “existing and potential levels of cost escalation.” Work resumed three months later, with the $1.9-billion, 85,000-mt/y operation now scheduled to come on stream in 2015.

By contrast, Antofagasta’s involvement in the Reko Diq joint venture with Barrick Gold in Pakistan seems to have ended badly for all concerned. With Tethyan Copper’s agreements with the government of Balochistan having been declared void, the companies are now seeking arbitration decisions against the Pakistan and Balochistan governments in order to protect their rights in the project.

Anglo American reported a 10% increase in its copper output last year, having reached an agreement with Codelco over the future ownership of its Anglo American Sur operations. Writing in Anglo’s annual report, former CEO Cynthia Carroll said, “In Chile, our joint ownership of Anglo American Sur with Codelco, Mitsubishi and Mitsui firmly aligns our interests in one of the most exciting producing and prospective copper ore bodies in the world—the Los Bronces district.” The Los Bronces expansion contributed 196,000 mt of copper in 2012, she added. However, not everything went as planned at the company’s operations, with lower production at Collahuasi stemming from lower grades and a plant failure. As a result, the operation’s project to increase throughput to 160,000 mt/d was scaled back and studies into further expansions put on hold until operational stability had been restored.

Anglo’s copper exploration efforts are targeted at opportunities in Argentina, Chile, Colombia, Greenland, Indonesia, Peru, the U.S. and Zambia. Projects in its development pipeline that still have to be approved include Quellaveco and Michiquillay in Peru, which have the potential to produce 225,000 mt/y and 222,000 mt/y of copper, respectively, a third expansion at Collahuasi to bring output to 469,000 mt/y, and the Pebble project in Alaska (187,000 mt/y). An investment decision for Quellaveco is expected this year.

As reported in previous editions of E&MJthis year, Rio Tinto’s copper business has had its ups and downs recently. On the positive side, the first shipments of concentrates left Oyu Tolgoi in Mongolia; less good news was the major rock slide at Bingham Canyon. However, despite the company having initially put the potential loss of output at more than 100,000 mt, it has subsequently revised this downward, while analysts are suggesting that the eventual loss in production this year may be markedly less.

The first concentrates left Oyu Tolgoi at the beginning of July, marking what the company described as “the culmination of a three-year, $6.2-billion project to build the first phase of one of the world’s top five copper mines.” Annual output is expected to be 430,000 mt of copper, plus gold. The CEO of its copper division, Jean-Sebastien Jacques, said at the time, “Oyu Tolgoi starts production at a time when undeveloped quality copper assets are scarce and the outlook for copper continues to be strong.” Nonetheless, the news that parliamentary approval will be needed for the financing for development of the underground section at the mine will have come as a disappointment to Rio Tinto, which has put work on hold until the issue has been resolved.

Rio Tinto has also been streamlining its copper interests, with the sale this year of its Northparkes mine in New South Wales, its holding in Palabora in South Africa, and its Eagle project in Michigan. The Northparkes sale to China Molybdenum has raised $820 million for the company, while Lundin Mining has paid $325 million for Eagle, which is still part-way through construction. Rio has also agreed to a $373-million price for the sale of its 57.5% holding in Palabora to a Chinese-South African consortium.

How Will the Markets Move?

Questions over the relative robustness of China’s economic

growth this year and next have been a major factor in the

recent weakening in copper prices. However, it is not just the

general situation in the country that is of concern; smelters

and refiners are having a difficult time there as well.

For example, in May, Bloombergquoted a Jinchuan Group source as saying that Chinese refined copper production may fall by 500,000 mt this year because of scrap shortages and delays in commissioning new facilities. Lower prices have led to copper scrap being in short supply, with scrap having made up 32% of the feed for China’s refineries last year.

Operational stability is another factor weighing against a price improvement. Thus far in 2013—Grasberg and Bingham Canyon excepted—the world’s major copper mines seem to have run smoothly, without significant technical or labor-related blips to cut output. No announcements have emerged from corporate offices of capacities being trimmed in response to weak markets, although there have been some cautionary notes about capex costs and the need for prudence in making investments.

So, with more copper likely to be coming out of the ground into a marketplace that is less than buoyant, what is the likely impact for prices? According to Paul Dewison, editor of IntierraRMG’s Copper Briefing Report, “prices have tumbled and, with looming oversupply, yet lower prices are probable over the next year or two.” However, he added a more positive view on copper stocks. “Although overall stocks are high, liquid stocks are at historically very low levels, with a growing likelihood of a real shortage of physical copper for spot purchase,” he said.

Looking further ahead, IntierraRMG’s latest Copper Snapshotpredicts a continuing downward trend for prices through 2014, bottoming out somewhere around $6,000/mt, with a subsequent improvement thereafter. The question remains, however, whether the current producers will be able to stay the course in the face of rising production costs and falling grades.

These were key points highlighted by SNL MEG in the most recent edition of its study Strategies for Copper Reserves Replacement. “From 2001 to 2012, the weightedaverage head grade at 47 producing mines with comparable data declined by almost 30%,” the company noted. “Not only are head and reserve grades declining at existing mines, but the average ore grades of copper in new discoveries and developing projects also declined over the period.

“With declining ore grades exacerbated by increasing energy and other costs, and significant deposits being found at greater depths or in more remote areas, the average capital costs for copper production capacity in new mines increased by an average of 15% per year over the past 20 years,” it added, pointing out that much of this increase has occurred since 2008. “Cash operating costs at major mines also increased significantly, more than tripling over the past 10 years, to an average of almost $1.50/lb in 2012.”

Even more worrying is the relatively small proportion of potentially viable discoveries that actually make it into production. According to SNL MEG, between 1998 and 2012, companies found 100 significant (500,000 mt-plus resource) deposits, containing almost 395 million mt of copper. From these, however, only 15 mines have been brought into production during the period.

Copper is widely perceived as a bellwether for the wider economy. Together with iron, its use is also intimately associated with population growth and increasing urbanization. With the developing world providing the driving force on both counts, the long-term outlook for metals is strong. Copper producers just have to get over the next few years.

| ABB to Supply New Kansanshi Substation

First Quantum Minerals has awarded ABB a $32-million order for the construction of a new substation for its Kansanshi mine in Zambia, together with upgrades to an existing unit there. Scheduled for completion by 2014, the substation will be a main node in a new 330 kV transmission ring linking the capital, Lusaka, and the Copperbelt. The turnkey project encompasses the design, engineering, supply, and installation of equipment that includes high- and medium-voltage air-insulated switchgear and power transformers. The substation will be equipped with automation, control, and protection systems conforming to international IEC 61850 standards, to enable local and remote monitoring and control the power assets. ABB will also supply telecommunications systems and solar photovoltaic-powered repeater stations to facilitate reliable long-distance transmission of digital signals via fiber-optic cables to a remoteend substation located some 400 km away. “These substations will enhance transmission capacity and improve the reliability and quality of power supply to the mining operations,” said Brice Koch, head of ABB’s power systems division. |