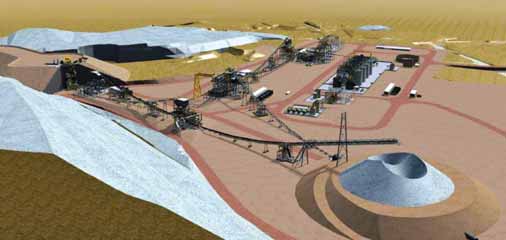

Proposed layout of Vista Gold’s Mount Todd gold project in Northern Territory, Australia. (Photo courtesy of Vista Gold)

Vista Reports PFS and Reserve Increase for Mount Todd

The Mount Todd project is located approximately 300 km southeast of Darwin, Northern Territory. Access is via 15 km of high-quality, two-lane paved roads from the Stuart Highway, the main arterial highway within the territory.

Highlights of the 50,000-mt/d base case include estimated proven and probable reserves of 5.90 million oz of gold in 223 million mt, grading 0.82 g/mt at a cut-off grade of 0.40 g/mt. The current estimate represents a 44% increase over reserves previously reported in January 2011. Lifeof-mine gold production would average 369,850 oz/y over a 13-year operating life. Production during the first five years of operation would average 481,316 oz/y.

Initial capital requirements for the base case are $1.05 billion. Life-of-mine average cash costs are estimated at $773/oz, including average cash costs of $662/oz during the first five years of operations.

Highlights of the 33,000-mt/d alternate case include estimated proven and probable reserves of 3.56 million oz of gold in 124 million mt, grading 0.90 g/mt at a cut-off grade of 0.45 g/mt. Life-of-mine gold production would average 262,826 oz/y over an 11-year operating life. Production during the first five years of operation would average 294,502 oz/y.

Initial capital requirements for the alternate case are $761 million. Lifeof-mine average cash costs are estimated at $684/oz, including average cash costs of $676/oz during the first five years of operations.

Both scenarios call for gold to be recovered through a traditional carbon-inleach circuit.

Vista President and CEO Fred Earnest said, “By completing the PFS analysis on two separate development scenarios, we have the option to develop the mine most appropriate at the time a development decision is made.”

Vista anticipates receipt of environmental approvals for the Mount Todd project by year-end 2013. Because of the advanced state of the PFS, with most technical work already at feasibility levels, the company estimates that a feasibility study would require four months to complete and would cost approximately $2.5 million.

Vista is working with the communities of Katherine and Pine Creek to develop a community-based project at Mount Todd, as opposed to a fly-in, fly-out project that would likely be more expensive and would limit the economic benefits of the project to the local communities.