Mine Water Management: No Simple Recipe

Mining must become more adept at finding

acceptable water-source solutions in an

increasingly complex, thirsty world

By Russell A. Carter, Managing Editor

Although the gasoline/water analogy falters a bit when applied to mining— which mostly runs on diesel fuel—experts predict that water issues will generate a lot of heat for the global mining industry in the coming years.

Perhaps the most vivid recent example of water’s ability to incinerate carefully laid plans is the controversy surrounding the $4.8-billion Conga gold/copper project in Peru, a property held by Minera Yanacocha S.R.L., in which Newmont Mining owns a 51.35% interest. Conga is an important element for Newmont, which concedes that failure of the open-pit mining project to advance to production could have an adverse effect on its future growth if it were unable to replace Conga’s anticipated out-put, which is in the range of 600,000– 700,000 oz/y of gold and 160,000– 240,000 lb/y of copper.

But Conga, located 24 km away from the joint venture (Newmont/Buenaventura) Yanacocha gold mine, has been the target of local political and community ire, lead-ing to suspension of construction activities at the Conga site in late 2011 at the request of Peru’s central government fol-lowing increasing protests by anti-mining activists led by the regional president.

At the core of the controversy are con-cerns about water. The initial plan called for draining of four high mountain lakes, with one to be used as a slag pit. Opponents claim the project would harm the water supply, both in quantity and quality. Protests led the government to seek an independent assessment of the project’s environmental impact study, lead-ing to recommendations that two of the lakes be left intact and that water storage capacity of the reservoirs be increased. However, the local opposition is convinced that the water supply will be adversely affected even with that revised approach.

In the wake of the protests and mine-construction shutdown, Minera Yanacocha has adopted a “water first” philosophy that is focused on building water reservoirs prior to the development of other project facili-ties. Newmont said the project’s plans for 2013 call for spending about $150 million in capital expenses, including approxi-mately $110 million on equipment, own-ers’ costs and engineering support; $20 million to complete reservoir construction; and another $20 million or so for commu-nity costs, roads and water systems.

However, Newmont also warned that development of Conga is contingent upon generating acceptable project returns and getting local community and government support. Should it be unable to continue with the current development plan at Conga, Newmont said it “may in the future reprioritize and reallocate capital to development alternatives in Nevada, Australia, Ghana and Indonesia, which may result in an impairment of the Conga project.”

Fighting the Battles

Newmont also has conducted a running

battle of words against what it sees as mis-leading or incomplete accounts of the pro-ject and its approach to water management

in the world press (see below). And, look-ing beyond the Conga conflict, it’s quite

clear that industry adversaries will contin-ue their efforts to increase pressure on

public-land stewards to suspend or curtail

mining projects in other areas of the world

as well, based on water concerns.

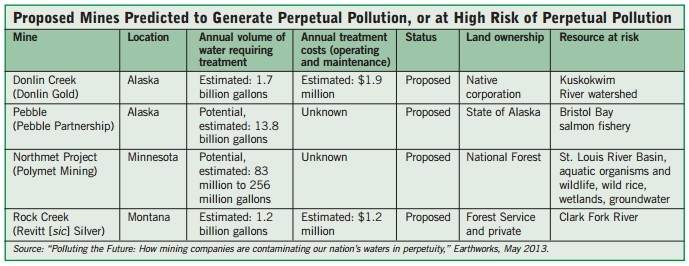

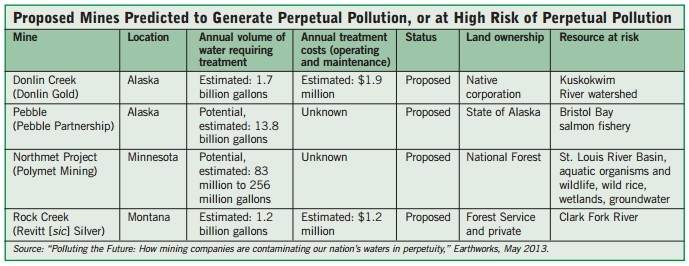

For example, a report released on May 1 by Earthworks—a Washington, D.C.-based nonprofit organization that describes itself as “dedicated to protecting commu-nities and the environment from the impacts of irresponsible mineral and ener-gy development while seeking sustainable solutions”—claims that existing U.S. hard rock mines will pollute up to 27 billion gal-lons of fresh water per year, and cost as much as $67 billion per year to clean, in perpetuity. The study, titled Polluting the Future: How mining companies are pollut-ing our nation's waters in perpetuity, also claims that four proposed new mines could annually pollute billions of gallons more.

The study lays blame on acid rock drainage (ARD), which can occur when sul-phide-bearing materials are excavated, exposed to air and water, and then react with oxygen and water to create sulphuric acid. The press release accompanying the release of the Earthworks study quoted Dr. Glenn Miller, a professor of environmental science at the University of Nevada—“No hard rock open pit mines exist today that can demonstrate that acid mine drainage can be stopped once it occurs on a large scale”—and went on to state that “be-cause acid mine drainage can’t be stopped, once started it must be treated until the acid generating material runs out. As acknowledged in government mine per-mitting documents, this can take hundreds or thousands of years.”

In addition to listing existing U.S. mines that “are known to generate perpetual water pollution,” the study also identifies what it terms “existing mines likely to gen-erate perpetual water pollution,” as well as four proposed mines at which it says per-petual water pollution is predicted or con-sidered at high risk (see table, p. 44). These mines, according to the study, could generate an estimated 16 billion gallons of contaminated water per year.

The 52-page report, downloadable at http://www.earthworksaction.org/files/pub-lications/PollutingTheFuture-FINAL.pdf, makes several policy recommendations:

• The U.S. Environmental Protection Agency (EPA) should use Section 404c of the Clean Water Act to protect Alaska’s Bristol Bay, which it identifies as “the nation’s most productive and valuable wild salmon fishery,” facing possible degradation from development of the proposed Pebble mine.

• Reform federal law to require hardrock mines to demonstrate, at the outset, that the mine can meet water quality stan-dards without perpetual treatment. • Reduce perceived risk by restoring feder-al regulations to prohibit mine waste dis-posal in waters of the U.S.

• Hold corporations accountable by put-ting the cost of AMD cleanup on the in-dustry, not on taxpayers.

Looking at the Problem

The foreword to the International Council

on Mining and Metals’ (ICMM) 2012 report

titled Water Management in Mining: A

Selection of Case Studies, spells out, in

broad terms, the future of the global mining

industry and its relationship to water man-agement: “In mining, water is used within a

broad range of activities including mineral

processing, dust suppression, slurry trans-port and employee requirements. Over the

last several decades, the industry has made

much progress in developing closed-circuit

approaches that maximize water conserva-tion. At the same time, operations are often

located in areas where there are not only

significant competing municipal, agricul-tural and industrial demands, but also very

different perspectives on the role of water

culturally and spiritually.

“Together, these characteristics lead to tough challenges and there is no simple recipe for water management in mining, particularly because the local environ-ments of mines range from extremely low to the highest rainfall areas in the world. Regardless, responsible management of water by mining companies is a key ingre-dient in ensuring their contribution to sus-tainable development is positive over the long term.”

Left unsaid is the fact that responsible management of water by mining compa-nies also is a key ingredient in profitable production: flooded pits can’t be mined, processing effectiveness can be reduced by poor-quality water, and sloppy heap leach operations may draw regulatory fines that could affect bottom lines, for example. Savvy mine operators understand the dual nature of water’s value. It can be an asset or a liability, depending on its location and use: water residing within a managed sys-tem can generally be regarded as an asset or resource; while water leaving the system can often be considered a liability.

In the U.S., Nevada is the driest state of all, averaging less than 10 in. (250 mm) of rain per year. It is also regarded as prob-ably the most extensively mineralized state based on current geological information, containing in addition to its gold and silver deposits other commodities such as cop-per, lithium, vanadium, molybdenum, tungsten, niobium and 17 rare earth min-erals, among others.

With its robust mining industry, rapidly expanding population centers, and compe-tition for scarce water supplies by industry, agriculture and municipalities, Nevada could serve as a bellwether for the global industry in recognizing and, hopefully, finding ways to resolve water management issues in resource-limited regions. The annual meeting of the Nevada Water Resources Association, held January 29-31 in Reno, confirmed the state’s mine operators are cognizant of the challenges and are actively seeking solutions to slake the industry’s thirst.

Allan Biaggi, former director of Neva-da’s Department of Conservation and Natural Resources and administrator of the Nevada Division of Environmental Protec-tion, listed a number of the challenges fac-ing the industry in his presentation at the NWRA event.

• Water is not going to be any less scarce or less precious;

• New and existing uses of water will com-pete with mining for Nevada’s water resources;

• The cost and value of water will increase;

• Water will become more politicized;

• Mineral extraction/production will in-crease and concurrently water demand will increase;

• Litigation over water issues will increase;

• Public land managers will have a greater say over water within their jurisdictions;

• The environmental impacts of mine de-watering will continue to be of concern;

• Post mining features such as pit lakes will face increased scrutiny and focus; and

• Bonding and other financial assurances will play a greater role in the long-term protection of water resources.

Given these prospects, there are specific steps that can be taken to accommodate them and ensure the health of the state’s mining industry in the coming decades, Biaggi noted, and suggested a few, including:

• State water policy must be adaptable and capable of responding to changing demands, economics and technologies for all users.

• Mining should undertake an effort of long-term water planning in conjunction with other users. The goal: optimize water use and consumption.

• Mining will continue to pursue the reuse and recycling of process waters.

• When possible, low-quality water should be used for mining production.

• Mining will develop technologies to re-duce volumes of water extracted as mines go deeper.

• Mining will continue to innovate on the reinjection/restoration of dewatered aquifers.

• Federal and state agencies must ensure consistent, fair and predictable water allocation requirements and permitting processes.

• Renewed policy direction to recognize mining as being valuable to Nevada.

Taking Steps

If the importance of water management

in the long list of a mine’s typical eco-nomic and regulatory issues is accepted,

then how is it defined? According to

Matthew Setty, senior project manager

and global mining client manager for

engineering firm CH2M HILL, it compris-es “the sourcing, conveyance, diversion,

storage, reuse, treatment, and/or dispos-al of all water associated with the mine

and mill operation, regardless of use, and

adapting to flow and quality changes

both seasonally and throughout the mine

life cycle.”

It’s an important part of any sustain-ability program, said Setty, noting that a company’s mine water management must be structured to deal with the harsh reali-ties of today’s operating environment; i.e.:

• “No water, no mine.”

• Lower grade ores increase water con-sumption.

• Climate change and population growth are increasing competition for water.

• Water and environmental issues must be addressed to obtain or maintain a social license to operate.

Setty said close attention to water man-agement will be necessary to comply with increasingly stringent water-discharge requirements coming from a variety of reg-ulatory sources, such as conductivity limits proposed by the U.S. EPA, new water qual-ity criteria (e.g., selenium, sulfate, nitrates) proposed by the EPA and Canadian author-ities, and whole effluent toxicity (WET) requirements from both the EPA and Canadian agencies.

Water issues change at each stage of the mining life cycle, and the water man-agement plan must adapt accordingly, he explained, and starting out with a compre-hensive plan is necessary for success. A plan would typically involve:

• An accounting of all water inputs and outputs and changes in storage.

• Attention to evaporation and transpira-tion factors.

• Initial development as part of the En-vironmental Impact Assessment.

• Realization that corporate reporting of company-wide water balance is becoming more common.

The plan would ideally be subject to ongoing refinement and redefinition, and used throughout the life cycle of the mine.

Marek Mierzejewski, CH2M HILL’s Water in Mining sector lead and co-pre-senter with Setty of the NWRA paper, wrote in the company’s Access Waterblog last year said, “As sustainability and envi-ronmental concerns have escalated, the mining industry faces increasing public, media, and regulatory scrutiny regarding how it sources, treats, and manages water. To comply with more stringent regulations and maximize efficiency, mining compa-nies now face the need for greater techno-logical and strategic approaches to water maintenance, treatment and reuse. Con-cerns of how water is used, recycled, waste is disposed of and residuals are managed, are boardroom issues for mining companies these days.

“So water, once considered a readily available and manageable resource, is now a major business concern, and frequently a deciding factor as to whether or not a mine is developed. This is particularly challeng-ing as mining often takes place in arid and semi-arid regions, like Chile and Peru, where water is a limiting factor for the development and continuation of mining operations. Many of the papers and pre-sentations at [a recent] conference provid-ed solid data on the benefits of desalina-tion in these areas to increase water sup-ply—important because a remarkable 40% of global mining projects over the next five years will be located in Chile and Peru.”

Mierzejewsk, along with four other staffers at CH2M HILL, authored a report in 2012 that examined the changing value of water in five industrial sectors: semiconduc-tor manufacturing, thermal power genera-tion, mining, chemicals, and oil and gas. The mining section focuses on the approach taken by two mining divisions within Rio Tinto to adopt water management strategies.

The examples presented in the paper illustrate what seems to be an emerging willingness among major mining compa-nies to step outside the confines of their various operations, look around and engage with organizations, regulators, other stake-holders and even competing companies to identify and resolve water-related concerns. It’s a strategy endorsed by a growing num-ber of mining advisory groups; the ICMM report referenced above, for example, states that “engagement with stakeholders is essential tor each consensus and agree-ment on the many water issues that affect the mining sector and the communities in which it operates.

“The industry’s engagement needs to be undertaken at global, regional and oper-ational levels, to ensure that it is a con-structive voice in the emerging policy debate,” it concludes.

Newmont Completes the Conga Picture In Peru, public protests over water issues associated with a proposed mine resulted in suspension of construction at the mine, pending a satisfactory resolution of the local population’s concerns about future water quantity and quality. From Newmont Mining Corp.’s website: On February 13, 2013, Bloomberg Markets magazine pub-lished a story about conflicts in South America related to natural resource development projects. The story featured Newmont’s pro-posed Conga copper and gold project in Northern Peru, near our existing operations at Yanacocha. There were a number of features of the article that neglected to provide a complete picture. Below, we detail some of those omissions and provide additional information that was left out of the story. Totoracocha Lake—The story prominently featured stark images of Totoracocha’s drying lakebed, falsely claiming the lake was drying due to blasting at Yanacocha. What the story neglected to mention is that drying and shrinking lakes are a natural occurrence at this elevation and location in Peru during the dry season. The photos used in the story were taken right at the beginning of the wet sea-son, not enough time for Totoracocha Lake to naturally refill fol-lowing a six-month dry season. Four Lagoons, Four Reservoirs—The story discussed the Conga pro-ject’s plan to replace four lakes, which contribute minimally to down gradient stream flows during the six-month dry season, with four engineered reservoirs. The reservoirs provide two benefits over the lakes. First, the reservoirs will more than quadruple existing water storage capacity. Second, the reservoirs will provide year-round water availability to downstream users. The lakes only pro-vide a source of water for downstream users when water overflows into the receiving streams, which is limited to the rainy season. During the dry season, the natural geologic materials underneath the lakes severely restrict the amount of water that seeps into the ground and re-emerges as water flow available to downstream users. Hence, the lakes are a very limited source of water during the dry season when downstream users need it the most. In addition to increasing the overall water storage capacity, the reservoirs will sig-nificantly improve the provisioning of water to communities since flows from the reservoirs will be regulated by engineered outlets that provide for the controlled and safe release of water, year-round. Mine Water Use—The story stated that Conga will consume 2 mil-lion cubic meters of water a year. The vast majority of this amount will be recycled or treated and tested to meet applicable water qual-ity standards before being released to downstream users. The water needed for the proposed processing operations will be repeatedly recycled and reused. The recycled water will be stored separately from rain water captured by the upper reservoir, which will have a capacity of 7,600,000 cubic meters. Fresh water in the upper reservoir will be utilized as “make-up” water for the limited losses and consumption associated with the processing operations and will also be used to fulfill community and social development com-mitments during operations. Water availability shortages in the Cajamarca region are the result of inadequate water storage facili-ties to capture and store water during the rainy season for use dur-ing the dry season. This is in part why we are pursuing a water-first approach focused on building reservoirs that will more than quadru-ple water storage capacity in the area. The first of these reservoirs, Chailhuagon, is expected to be complete during the second quar-ter of 2013 and will have a capacity of 2,600,000 cubic meters, more than double the current capacity of Chailhuagon lake. —www.newmont.com/south-america/press-releases/newmonts-response-bloomberg-markets-magazine-story |

| Gauging the Value of Water

Engineering firm CH2M HILL released the report The Changing Value of Water to the U.S. Economy: Implications from Five Industrial Sectors in 2012, compiled for the U.S. Environmental Protection Agency as part of its initiative titled “The Importance of Water to the United States Economy.” The report, authored by Mike Matichich, Marek Mierzejewski, Bill Byers, Dan Pitzler and Sartaz Ahmed of CH2M HILL, examines the critical role water plays in industrial production and how the value of water is chang-ing in certain major industrial sectors. The information pertaining to the mining industry is excerpted here.

—Mining companies in the United States, and globally, are explor-ing proactive approaches to water that consider how to demon-strate the value of water, taking into account not only economics, but also considering social and environmental factors as well. At many sites, the operations make use of non-potable water, thereby avoiding the use of high-quality (potable) water and help-ing to conserve local water supplies. Although the minerals and metals industry is a small user of water on a national scale, it can be a large user at a local level. Some sites are located in water-scarce locations where mining companies compete with other water users, including local communities, agriculture and other industries, while in some locations companies need to manage sig-nificant water flows resulting from precipitation or groundwater sources. Many mining operations recycle significant amounts of water onsite, and water management, discharge, and use are sub-ject to comprehensive regulatory and legal requirements. Rio Tinto adopted a water strategy that provides a framework for managing water and improving business performance across the social, environmental, and economic aspects of water man-agement. The strategy has three main components: improving per-formance, accounting for the value of water, and engaging with others on sustainable water management. A key focus is to identify ways to minimize the amount of water removed from the environment, reusing it when possible, and returning it to the environment while meeting, at a minimum, regulatory limits. Rio Tinto has decided to invest in water conservation (for exam-ple, by making processes more efficient or using poorer-quality water in place of potable water) because it understands the value of water. The company looks beyond the cost of water to take into account nonmonetary aspects such as social and environmental values. Rio Tinto has observed that perceptions of value may also change; for example, communities, governments and business place great importance on water conservation during droughts. This concern often quickly diminishes when the drought ends. A longer-term approach that takes the full value of water into account would support decision-making on sustainable water use. While these approaches are still being developed and tested, two of Rio Tinto’s companies are taking creative approaches to valuing water. Rio Tinto’s Kennecott Utah Copper operations are located near Salt Lake City, Utah, where its business has been operating for 110 years. Increasing population and other factors are placing more pressure on water resources within the region, making sus-tainable water management critical to Kennecott. Greater than 90% of the water used at Kennecott is characterized as poor-(low) quality water, and an average of 60% of the water withdrawn is recycled to minimize importing additional water resources. The largest water user at Kennecott is the concentrator. However, more than 90% of the water used at that concentrator is from recycling. To drive water performance improvements, Kennecott is developing a water management approach that rec-ognizes that different waters have varied benefits and costs that support using different waters for different purposes. This water hierarchy approach recognizes the need to balance a number of considerations including availability of water and water quality; the location and type of infrastructure required to transport or treat water; energy use; and regulatory or legal requirements. Kennecott’s water hierarchy approach aims to do the following: • Use poorer-quality water first in operations to minimize the amount of new, clean water required for use. • Recycle process water where practicable. • Separate waters of different quality to optimize water use with-in the process. Maintain direct involvement and support with the scientific community in advancing technologies and education in improving best practices and methodologies. • Educate the workforce in best water management practices. For example, when a groundwater source used by the concen-trator became unavailable, Kennecott applied the water hierarchy approach to select a replacement source. Kennecott assessed several possible alternative sources, including: potable quality groundwater; surface water suitable for irrigation, and recycled water sources from its operation. The three replacement sources each carried distinct costs and benefits. No source was adjacent to the concentrator, so each source carried transportation infra-structure and operational costs, which differed according to rela-tive proximity. Although recycling required transportation across 13 miles compared to 3 miles for potable groundwater, existing infrastructure was available for recycling. The need for new infrastructure for the groundwater and surface water sources increased the “costs” of these water sources. Additionally, using recycled water pre-served potable groundwater to meet existing and future culinary purposes and saved the surface water for agricultural use. Capital and operational costs, however, were not the only con-siderations. Poor water quality can impact metals recovery during the milling process; therefore process changes were also needed to limit inhibited metal recovery. Kennecott ultimately replaced the original groundwater source with the lower quality recycled water. The decision considered tradeoffs among operational needs, ener-gy requirements, new infrastructure, and the economics of each option. However, the water hierarchy approach was the primary guide that led to the decision to use the recycled water source. The Resolution Copper project is located near Superior, Ari-zona. The large world-class copper resource lies one or more miles below the surface where a previous mine had been developed and later closed in the mid-1990s. A proposed underground mine is projected to produce more than 1 billion lb of copper per year over approximately 34 years. A 2011 economic and fiscal impact study estimated that the total economic impact of the Resolution proj-ect on the state of Arizona will be over $61.4 billion. To begin developing the new mine, more than 2 billion gallons of water that naturally accumulated in the old mine had to be removed. Resolution constructed a $20-million water treatment facility to prepare the water for discharge once it is pumped to the surface. Initial draining of the old mine took nearly three years to complete. One of the challenges was determining where the removed groundwater should go once treated, to ensure the water is fully used and the environment is not negatively affected. Resolution worked with the New Magma Irrigation and Drainage District (NMIDD) to supply the extracted water for agri-cultural use in Arizona. The project involved constructing a 44-km pipeline to transport the water from Resolution’s treatment facili-ty in Superior to Magma Junction. NMIDD will combine this water with Central Arizona Project (CAP) water for irrigation purposes. CAP delivers water from the Colorado River by canal to central and southern Arizona so surface water can be used instead of deplet-ing groundwater for agricultural, municipal, and industrial uses. In parallel with draining the old mine, Resolution has had to plan for operational needs of up to 20,000 acre feet (approxi-mately 6.5 billion gallons) per year, principally for the flotation process used to separate the valuable ore from the waste miner-als. While groundwater is the most readily available and least expensive water source for the mine, the company sought alterna-tive, more sustainable resources. In total, Resolution identified 25 potential sources and ranked them according to social, environ-mental, and economic criteria. Resolution identified three sources as future supply options for water: • Groundwater that was previously affected by mining: this would only satisfy about 10% to 20% of the new mine’s ultimate need. • Banked water with the CAP: Resolution is purchasing and “banking” excess CAP water with the irrigation districts for future use, minimizing its impact on water supply. • Treated municipal wastewater effluent: Resolution is working with the Science Foundation Arizona, the University of Arizona and Freeport-McMoRan on technology to use treated municipal effluent in the flotation process, thereby lessening demand on other sources, such as groundwater. |