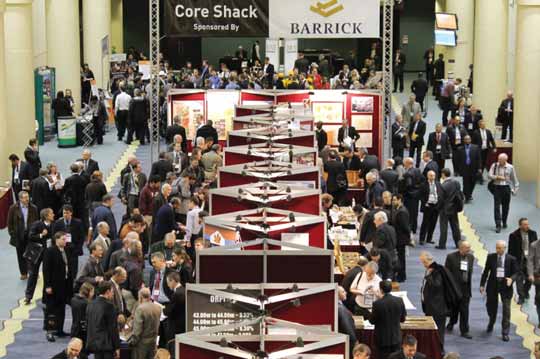

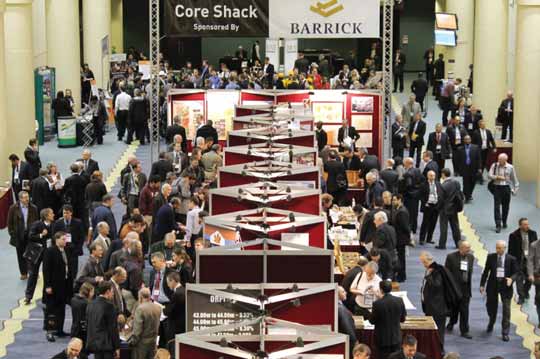

The Core Shack at PDAC allows junior explorers to showcase core samples and talk about their prospective properties.

Despite Challenging Conditions, Record Crowd Turns Up for PDAC 2013

Annual prospectors and developers convention showcases the best in Canada

By Steve Fiscor, Editor-in-Chief

Glenn Nolan, president, PDAC, summed it up best by saying that PDAC is a juggernaut of international propor-tion. It is a trade show, an investor exchange, and a place where the world’s mineral industry meets. The technical program, short courses and workshops offer the latest in professional development. The association has an active stu-dent-industry program with networking events. “PDAC is probably best known for its convention, but there is also a tremen-dous amount of work performed by the PDAC staff and volunteers throughout the year,” Nolan said.

The PDAC actively promotes greater understanding between the aboriginal communities and the mining industry. In his opening remarks, Nolan acknowl-edged the convention was held on the traditional lands of the Mississauga and asked Elder Alex Jacobs to conduct a traditional welcoming and blessing ceremony.

The association is also instrumental in promoting the mining industry in Canada. It supports taxation policy including investment incentives, like the mineral exploration tax credit that encourages Canadians to invest in early stage projects. Through parliament, PDAC addresses legislation and regula-tions that affect the resource industry, land management and environmental protection. It also responds to constitu-tional obligation with respect to aborigi-nal rights and encourages economic development through training initiatives and investment in infrastructure and geo-science research. “The PDAC recognizes this important role and represents its members in making recommendations to the government regarding policies, legis-lation and the upcoming federal budget,” Nolan said.

Nolan introduced the Honorable Joe Oliver, minister, Natural Resources Canada, who delivered the keynote address for the convention. Prior to his election to parliament, Oliver had a career in the investment banking indus-try. He also served as the director of the Ontario Securities Commission and pres-ident and CEO of the Investment Dealers Association of Canada. He knows first-hand the value that commodities bring to Canada’s economy.

Leading the World,

the Canadian Way

Mining has been driving Canada’s eco-nomic development for years, Oliver

explained. In 2011, the sector con-tributed $63 billion in nominal GDP or

3.9% of the total Canadian economy—

that’s $2,000 for every man, woman and

child in the country.

According to the Mining Association of Canada, in 2011 alone, mining and processing companies paid $7.1 billion in corporate taxes and royalties, which means mining is a key source of revenue for the government. “With more than 200 active mines producing 60 different met-als and minerals, the sector is the key economic driver for dozens of rural, remote and aboriginal communities across the country,” Oliver said. “Though we are seeing near-term softening of mar-kets, the long-term outlook shows healthy long-term prospects for the industry.”

Oliver highlighted the country’s achievements at home and abroad. Canada remained the top destination for exploration spending in 2012, attracting 16% of budgeted spend. In fact, 60% of the publicly-listed mining companies are listed on either the Toronto Stock Exchange (TSX) or the TSX Venture Exchange (TSX-V). Since 2007, more than one-third of global mining equity finance was raised on these two exchanges. “Canada’s credit rating is a solid AAA,” Oliver said. “For the fifth straight year, the World Economic Forum has ranked Canadian banks as the sound-est in the world. We are the only G7 country to recoup all of the jobs lost dur-ing the last recession and have added 925,000 new jobs since July 2009.”

The OECD and the IMF have named Canada among the leaders in economic growth in the next two years. “Few coun-tries are generating natural resource projects on the scale or pace of Canada,” Oliver said. “Over the next 10 years, more than 600 major projects worth more than $650 billion will create a once in a generation opportunity for Canadians.”

Discoveries in Ontario’s Ring of Fire, Quebec’s North and northern Canada, mean that mining will play a pivotal role in Canada providing economic growth for years to come. The Conference Board of Canada recently released a study stating the metal and mineral output in Canada’s North will nearly double from $4.4 billion last year to $8.5 billion in 2020. That will create nearly 17,000 new mining jobs along with 50,000 new jobs in related industries.

“Realizing the potential of mining is essential to our government’s goal of jobs growth and long-term prosperity for Canadians,” Oliver said. “Our goal is to ensure that Canada remains the best place in the world to do business. We are working to ensure that Canada’s system of international taxation achieves an appropriate balance while protecting the tax base and maintaining Canada’s posi-tion as a leading jurisdiction for mining companies.”

The Canadian government under-stands that mining is not an easy busi-ness, Oliver explained. “During periods of financial uncertainty, investors are cau-tious and companies are left wondering if they will have access to the financing required to get necessary projects under way,” Oliver said. “With fluctuating com-modity prices, companies cannot risk a lengthy regulatory process. Our govern-ment’s plan for responsible resource development is making project review more predictable and timely, reducing duplication, improving environmental protection, and enhancing aboriginal consultation. This innovative plan is fun-damentally changing Canada’s regulatory regime for major natural resource pro-jects to ensure it is among the most effi-cient, effective and competitive in the world. Our system provides defined time-lines for approvals and allows provincial environmental assessment to replace federal assessment as a means to eliminate duplication.”

While the government is working to improve certainty, Canadian miners are also pursuing innovation to make the industry more competitive. “When oper-ating in a global marketplace, success depends on their ability to compete, sell and invest on competitive terms,” Oliver said. “Innovation is the key to improving our economic performance as well as environmental outcomes. Now is the time for the mining industry to demonstrate that economic prosperity and environ-mental responsibility are not a question of either or. We are working closely with the industry and the Green Mining Initiative to reduce the mining sector’s environmental footprint and position Canada as a global leader in responsible mining development.”

Maximizing Canada’s competitive advantage also means ensuring we understand where new opportunities exist, Oliver explained. “That is where geosciences can help,” Oliver said. “Since 2008 geo-mapping for energy and minerals has been providing the country with the public geoscience information to make informed land-use and resource management decisions. We have com-pleted 20 projects and finished 34 regional geophysical surveys, and pub-lished 644 open-file releases of geo-science data.”

The program’s latest release includes new geophysical data to guide explo-ration for base and precious metals in the Pelly Lake region of Nunavut as well as new geological maps that provide context for gold and copper occurrences in the Dawson Range of the Yukon’s White Gold district. “We are using a tar-geted geoscience initiative to provide the best geophysical data to point us to deeper mineral deposits critical to ensuring the industry’s long-term pros-perity,” Oliver said.

On a proportional basis, mining employs more aboriginal Canadians than any other sector in its economy. The gov-ernment is investing $690 million for training and education for aboriginal Canadians to help meet the growing demand for skilled labor for mining and other industries.

The mining industry is a global busi-ness and it carries with it a responsibility and commitment to engage constructive-ly with local communities Oliver said. “Developing new mines in any country can take years and a massive investment in capital,” he said. “In addition to deal-ing with harsh frontiers and non-existent infrastructure, they have to contend with untested laws and uncertain govern-ments. We can address these challenges by working with local communities. As companies manage these risks, they are expected to operate responsibly. Our gov-ernment’s strong commitment to CSR is well recognized.”

Mining has the incredible power to be both a transformative economic force and driver for positive social change, Oliver explained. “Canadian mining companies are partnering with regional governments to build much needed infrastructure which is allowing a quality of life never seen before in some regions,” Oliver said. “This conference showcases Canada’s best assets from exploration geologists in remote areas, equipment suppliers in small towns, to the financiers and stock exchanges in big city centers, there is a reason why Canada’s mining sector is a model for the world and a magnet for investment.” The Canadian mining industry and its government are moving forward together, he added.

‘War for Talent’ at PDAC

Stronger than Ever

Despite investors’ lack of appetite for

exploration and the mining sector facing

tougher times ahead, Faststream

Recruitment returned from the PDAC

conference in Toronto with one large

observation—the war for talent in mining

is stronger than ever. The company took

on an unprecedented level of vacancies

during the conference showing that

there’s no shortage of demand for the

best people.

“The majority of demand for staff lies in employees who have experience at senior to principal level in designing mines and mineral processing plants,” said Mark Charman, Faststream Group CEO. “Companies are looking to operate their existing mines more efficiently and are focused on getting a better return on value. It’s people who are experienced in streamlining operations and can actively help organizations make a higher return without further investment that are in fierce demand.”

Faststream spoke to many employers at PDAC and it is the large EPCMs and mid-tier mining companies who are look-ing to invest in talent the most. “The per-ception that times are tough is only half of the story,” Charman said. “While junior mining companies are struggling to secure investment and therefore not looking for additional workforce, the larger organiza-tions have no shortage of jobs to fill.”

Not surprisingly, anyone involved in exploration is feeling the pinch on vacan-cies and many talented geologists were looking for work. “We met with plenty of geologists who were at PDAC with their resumes actively looking for work. Back in 2010-2011 these same candidates would have had their choice of jobs, had they been on the market for new employment then, however, once again it has been a case of ‘first hired - first fired’ for many geologists who have become victim of the hesitation in investment,” he added.

Canada may need to look further afield for jobseekers as it faces a large skill shortage. “We spoke to many employers looking to recruit in Canada who are continuing to struggle in secur-ing the people they need locally,” Charman said. “The reality is that they will need to look at the expat market-place and potentially candidates from the Commonwealth. However, as is the case with employees moving from one part of the world to another, the remuneration packages that will need to be offered will put an upward pressure on salary levels.”

Faststream picked up more than 100 jobs while at PDAC, and said metallur-gists, process engineers and mining engi-neers were the most commonly discussed vacancies with hiring managers.

Panelists Debate Strategies to Revive the Juniors

An International Panel Luncheon was held

on Tuesday, March 5, at the PDAC conven-tion. The theme of the discussion was:

Strategies to Revive the Juniors. The three

panelists were Eric Sprott, CEO and chief

investment officer, Sprott Asset Manage-ment; John Kaiser, editor, Kaiser Research

Online; and Ned Goodman, president and

CEO, Dundee Corp. Raymond Goldie, vice

president and senior mining analyst,

Salman Partners, moderated the discussion.

In his opening remarks, Goldie explained that one of the panelists has forecast a mass extinction among junior mining exploration companies. “Our purpose of the discussion today is to determine how we can avoid such an outcome,” Goldie said. “Are unforeseen forces causing shenanigans in metal mar-kets? How much are metal stocks being driv-en by metals prices? “Traders see the long-term prices for copper remaining above $3.50/lb forever, Goldie explained. The average long-term copper price implied by the prices of stocks on the TSX is $2.43/lb—the long-term prices it would take to make a company’s net asset value per share equal to its share prices. “So you could buy copper more cheaply on the stock exchange than on the LME,” Goldie said.

Can juniors take advantage of the discon-nection between metals markets and stock markets? Goldie asked. “Yes they can,” Goldie said. “One of the things the CEO of a junior can do that seniors cannot is auction the com-pany to the highest bidder. In the past, for a takeover to occur, you needed a 30% premi-um. Now no one will look at it unless it’s 50% to 75%. Does this still stand true?”

Goldie presented a third option: Raising money on the stock exchange. “One of our panelists [Kaiser] says that fundamentals-ori-ented investors have withdrawn from the stock market and that makes equity financial diffi-cult,” Goldie said. “He also said that traders have been replaced by machines. So do we need more regulation of equity markets?”

As a fourth topic for debate, he proposed debt financing as as an alternative. Seniors use debt financing with interest rates of 7% and they raise hundreds of millions of dol-lars, Goldie explained. “But, the debt mar-ket seems closed to juniors or they have interest rates in the teens,” Goldie said.

Should juniors consider royalty and off-take deals? If you have a zinc mine, should you ask a smelter or a royalty fund for financ-ing based on an off-take agreement? Goldie asked. “If you produce a metal that doesn’t trade on an exchange, a third party off-take agreement is almost obligatory,” Goldie said. “For other metals, royalty deals are an increasingly popular form of financing. So is Rob McEwen correct in blaming royalty financing for the negative correlation between the price of gold and gold equities?” After setting the tone for the discussion, he opened the forum with the panelists.

Topic 1: Are there dark doings in metals

markets? And how closely do metals mar-kets drive the prices of mining stocks?

Sprott, who manages $10 billion and

recently won the Absolute Return Award for

2010 Hedge Fund of the Year, fielded the

question first.

Sprott: Do stock prices follow the metal prices? They will follow the metal, but the metal must have some momentum in a particular direction. It’s unsatisfactory to say that gold is trading at $1,600/oz, a stock price should be this price. People are more concerned about where the metal prices are headed. If they think it’s going up, they will buy metal stocks. If they think it’s going down, they won’t buy metal stocks. In the last 18 to 20 months, we have seen prices go down. That has taken interest away from the stocks.

I believe that the stocks will under- or out-perform the metal by 2:1 or 3:1. If we get a 10% decline in metals prices, you could see a 30% drop in metal stock prices and vice versa. There is a relationship but you have to establish a pattern.

I am a huge nonbeliever in Comex mar-kets. The trading data is an absolute joke. They are trading 1 billion oz of silver a day and we are only mining 800 million oz/y. There is no physical metal. We see these wild gyrations in the paper markets, where the metals crash and all of this volume takes place. As much as 30% of the year’s silver supply is sold in five minutes. Those traders do not have that supply, they are just affecting the market.

Why are they affecting the markets? There are way more buyers of gold than there is physical supply. I believe the central banks have supplied that gold surreptitious-ly. They want to suppress the price of gold because their monetary policies are ridicu-lous and irresponsible. They are printing money and buying up bonds. We get that. But, they do not want to see that ridiculous-ness manifested in gold and silver markets.

Kaiser is an independent analyst who has been covering the junior sector since the early 1980s. He founded Kaiser Research Online, which covers 1,800 resource compa-nies and their relationship to macro trends.

Kaiser: Gold and copper are still pretty high compared to 10 years ago. Yet, since 2011 we have seen the equities, in the junior market in particular, decline substantially. Part of the problem is that this sector is held prisoner by a counterproductive narra-tive—the gold bug narrative of imminent apocalyptic collapse and fiat currency debasement. All of this stuff would result in arithmetically higher gold prices.

So the bias in the market is the expec-tation that things are going to fall apart soon, which will be bad for the global econ-omy. Junior miners are all about the future. The system is biased toward the downside. Metal prices do affect junior stock prices. Anytime gold or copper prices move a little bit, even though it is meaningless in per-centage terms, it is used by traders to ham-mer down or crank up the juniors. They are using small movements in metal prices to extract trading profits from the junior sector.

Because of the downward bias created by this harmful narrative, we are seeing everything pressured down. At some point, we will see a massive binge of buyout from overseas, probably China, that clears out all of these worthless ounces and pounds in the ground, using U.S. dollars in the Chinese central bank that they would like to swap for title in long-term assets. Hopefully we won’t lose all these projects at ridiculously cheap prices from the low bottoms that are being engi-neered by the market bias to the downside which is linked to the gold bug narrative.

Dr. Ned Goodman is the president and CEO of Dundee Corp., a geologist, a securities analyst, an asset manager, a senior execu-tive and a professor at the school he found-ed, the Goodman Institute of Investment Management at Concordia.

Goodman: If Eric Sprott believes there are dark doings in the metals markets, I agree with him. I have no clue, but he spends his time there and probably because there is dark doings in every market. If he blames governments for being part of the prob-lem….That’s the most likely culprit. Central bankers are given their jobs to tell lies and use inside information. We don’t have that advantage.

What drives metals markets and metals prices is the expected future prices of met-als, not what’s happening today or tomorrow. According to the Mackenzie Resource Report, which is an in-depth report, the world definitely needs more metals and com-modities and we simply do not have enough of them. The future, what’s going to happen, is good for mining companies that have the right geology or corporate structure. I’m a long-term investor and I don’t really care too much about what the commodity traders and central bankers do to themselves day in and out. Are they dark? Yes, probably.

The market is driven by Mr. Market. Mr. Market was created by Benjamin Graham in the 1920s It puzzled him that stocks commanded such a radically different val-uation from one investment phase to another….Goldie cuts him off; he’s over his time limit.

Topic 2: How can a junior arrange to have

itself taken over?

Sprott: The junior is beholden to the mar-ket. There are junior explorers and junior

producers. Fortunately, the junior and sen-ior producers can do something about their

fate. Their fate right now is that nobody

likes you anymore. But, we’re in a zero

interest rate world. We have companies with

huge long-life reserves and huge amounts

of cash flow. The problem is that they like

to invest that cash flow in the next MINE.

If you take a small company, one with $20 million of free cash flow [after Capex and local exploration]…if they paid a $20 million dividend, they would have $200 mil-lion market cap because you would yield 10%. But, if you say I’m going to take my $20 million for this year and the next three years and put it back into the ground in a $100 million project, your market capital-ization will go down because investors do not want to wait five years to see whether the project will be successful. In a zero interest rate world, those people in a position to con-vert cash flows to dividends will change their market cap dramatically, which then allows them to reconsider buying exploration prop-erties, which still might be cheap. They will be able to fund a dividend paying instru-ment in the market place. That’s what investors buy now. If mines paid dividends, people would buy those stocks too.

Goldie: How many of those juniors will sur-vive long enough to be taken over?

Kaiser: Of the 1,800 companies I follow, 675 have less than $200,000 in working capital. That’s enough to stay alive for 1 more year doing absolutely nothing. Here at PDAC, where the cream of the crop exhibits, there are 527 companies and 114 of them (22%) have less than $200,000 in working capital remaining. Why are they here? Nearly half (47%) are trading at less than $0.20 per share and 48% of them have less than $20 million in market capitalization.

Building on what Ned said. The junior miners are all about the future. Long term, the destiny of gold and copper prices are twinned, premised on a growing global econ-omy, where the U.S. undergoes relative decline as growth accrues overseas in places like China leading to a very potentially unstable world in 2030. There is structural demand in place for gold and copper.

The juniors need to disconnect from the current situation and focus on this future and help the market visualize what the deposit would be worth at these various prices. One problem that we have is that the companies are very restricted in helping the public understand the potential. They can present fantastic data-qualified dots, but they are not allowed to connect them. These companies intrinsically have a zero value in so far as they have real project and there is optionality value. The way to disconnect from the metal value is to focus on what you are doing on the ground. What is the funda-mental outcome? Plug in $3.50/lb copper and $1,600/oz gold because the trend in real prices is upward going forward.

Goldie: Can the junior miners use the disconnect? Goodman: They can try. I use the discon-nect to my advantage. When they show up looking for money and the market hates them, that’s when I want to buy them. Having answered that question quickly, I can return to my Mr. Market discussion.

Mr. Market is not only manic depres-sive, he also believes that there is an effi-cient market. When he loses or misses the market, he refers to it as a bubble. When he’s in and it’s going up, he calls the bub-ble a bull market. Mr. Market is pretty stu-pid and insane. That’s who you are going up against. The juniors can try it, but they are not going to make it.

Topic No 3: Equities? We have machines

trading stocks. Do we need more regulation?

Sprott: My answer is: No. Now, I can move

on to my soapbox.

I would love to see the people who run precious metals mining companies appreci-ate gold and silver for what they really are: alternate currencies. All of them should have kept their gold and silver instead of the trash cash they have now that generates nothing. These metals are up 500% and 600% since 2000. Instead, they are hedg-ing and doing all of these weird things. They are afraid of their earnings going up or down based on precious metals prices. They should realize what’s going on in the world.

What’s going on in the world? Most G6 countries are broke. They can’t possibly repay their debt. The U.S. Treasury released a report in September 2012 that said the deficit for the U.S. was $6.9 trillion in a $16 trillion economy. Last year it was $5 trillion and next year it will be $8 trillion. Who in their right mind thinks that those people who are entitled to these payments in the future are going to get them? If you do, then you don’t understand basic math. Underfunded liabilities, such as Social Security, Medicaid, civil service pension plans… these countries are broke and they will pay the people with funny money and that’s why you have to own gold and silver.

Goldie: The regulators we are worried about…Are they government ones or do some brokerage firms have in house regu-lators we should worry about? Kaiser: After Bre-X, the disclosure and qual-ity control regulations that created 43-101 have been very successful. We now have the most reliable data in the public domain. Everyone wants to list on the TSX and TSX-V so that they can make these disclosures.

Where we need less regulation is in the attitude of regulators to protect retail investors from themselves. The retail investors can max out lines of credit, buy lottery tickets, gamble and impoverish themselves, but they seem to be forbidden from putting money into speculative stocks. The brokerage firms, which are largely owned by the banking establish-ment, are turning their brokers into asset gatherers. The retail investors have their time horizon and risk requirements mapped out. Brokers are not allowed to take orders. The investors give them their money. They collect 2% and stuff it into the proper mix of structured products.

The retail investors are being forced out to the discount brokers who are order tak-ers. That’s a good thing because the junior sector is a form of gambling. It’s a produc-tive form of gambling where exploration is performed and real wealth is created.

The bad regulations are coming. They have cranked up the accredited investor threshold to $1 million, not including household equity. They have shrunk the pool of eligible investors. They are choking the juniors to death. They need to make it easi-er to flow money into companies via private placement and easier for public companies to market the existence of a private place-ment. Lower the threshold for eligibility and enable the discount brokers to flow the money to these private placement accounts.

Goldie: 43-101 good; helicopter-parenting of investors bad? What do you think?

Goodman: 43-101 is globally accepted as a great document. We do not need any more regulations. We need better regulations. When we have regulators who take apart a company like Sino Forest, and it takes 18 months and billions of dollars are lost, and with lawyers all over the place they find that nothing was wrong. That’s our regulation and it’s scary.

Topic No. 4: Should the juniors use the

debt market?

Sprott: If the company is a producer, yes,

they can use the debt market. If you are not

a producer, you should never touch debt.

Debt is getting cheaper because of low inter-est rates. It’s something that should be con-sidered. Many of these companies have sub-stantive cash flows and they can take on a

little debt and avoid the equity dilution.

I still have a minute and I would like to talk about the U.S. economy. Everyone lost 2% off the top of the paycheck. That’s 3% after taxes because the one-third still comes off the top. Now we have the sequester. The American’s discretionary spending is down 4% or 5%. How can you have a recovery when people are earning less than they were the year before? It can’t be pretty down there. If 70% of the people are not doing well, you can’t have a strong economy. They are hold-ing it together with 0% interest rates.

Kaiser: Right now there is $8.7 trillion in household savings earning 0.5%, next to nothing. That’s more than the $7.5 trillion in net real estate equity that went down $7.4 trillion during the real estate melt down in 2008. That money at some point will be deployed. Once the U.S. is past these auster-ity measures, and back in a growing economy, the Fed will have very real concerns about inflation as credit expansion gets under way.

As far as debt for juniors, it’s not an option. There is a new craze: loan-to-own, which is a vulture capital, predatory lending system, where they want you to put your asset up as collateral for some sort of financing. For juniors, it costs so much to get the deposit to a feasibility study and production decision. You are going to need more and more money. If we have a lengthy sideways market with gold and silver, they are not going to be able to finance equity and they will be bankrupted. The mentality behind this loan-to-own is that we are stuck in a bit of bear market and they are putting a structure in place to cheaply acquire assets in which tens of millions of dollars in investments are stranded because of the capex explosion and this bias toward the downside and the negative outlook.

Goodman: Debt is an interesting thing. You lose your whole company if you can’t repay it. Sprott is correct. If you have cash flow and you can afford it, interest rates are low and they might be able to use it success-fully. When industry has the risk levels that it has, debt is the wrong tool to use. Equity is the more likely way it should happen.

Royalty companies: Loan Sharks or

Guardian Angels?

Sprott: They can be helpful in certain situa-tions. I would never encourage a precious

metals producer to accept an off-take agree-ment unless they are totally strapped for

money. I have no problem with off-take agree-ments for base metals because I’m more of a

believer in precious metals than base metals.

Investors buy gold because they have this vision of where gold should be. Whether it’s $3,500/oz or $5,000/oz, when prices get there, and believe me they will, these equities will be looking spectacular. I don’t want to look back and see these guys selling their gold at $1,200/oz to raise $25 million. I prefer to see them gut it out and fund it themselves.

Kaiser: This trend toward juniors selling a royalty, at the early stage of the project. They are not going to get much money. It might make sense to have a bridge financ-ing royalty agreement when you have an advanced project where you can calculate the value of the royalty.

One of the dangers of this royalty fad is that it doesn’t really apply to these emerg-ing markets where we are seeing these super royalties. For example, Guyana now has a 7%-8% gross royalty. When you start stacking up all of these royalties, all of these projects that are encumbered with private royalties are dead in the water. The royalty stream will never happen. I think this is a temporary fad that has no long term serious implications for fund raising in the junior sector.

Goodman: Having founded a couple of roy-alty companies, I do not want to speak against them. In certain instances they do not make sense. I have been on the board of a few companies where we refused to do royalty deals. We calculated that if we did-n’t have the price we needed we didn’t want to give up those precious metals and it would have made the difference between the company being bankrupt or alive. It’s an exercise in arithmetic.

Off-take deals are entirely different. You can usually get a bottom price from an off-take deal and that bottom price that will make money or keep you in business. I’m on the board of a company that is current-ly negotiating an off-take deal and I am insisting that the off-taker become a major shareholder of the company as well as get-ting an off-take agreement.

These deals are dangerous; Rob [McEwen] is not totally wrong. You’re not protected from a drop in the price of met-als. The company could go broke while paying these firms their royalties.