One of the Atlas Copco drill rigs used for development at Bell Creek. (Photo: Simon Walker)

Lake Shore Builds its Reserves

In an area of northern Ontario with a century of gold production, Lake Shore Gold is working hard to turn new-found resources into bullion in the bank

By Simon Walker, European Editor

Over time, old camps attract attention from new generations of explorers, with Timmins being no exception. Since 2002, Toronto-based Lake Shore Gold has been focusing on an increasing portfolio of prop-erties there, with its Timmins West mine commissioned in 2011. Work is currently under way to expand mineable reserves there, and to convert large resource bases into initial reserves at the company’s Bell Creek and Fenn-Gib projects. It also owns several other exploration targets in the dis-trict. In October 2012, E&MJvisited Lake Shore’s Bell Creek mine and mill as part of a tour sponsored by the Ontario Ministry of Economic Development and Innovation.

Lake Shore’s 10-year Focus

Mark Utting, Lake Shore Gold’s vice presi-dent for investor relations, provided E&MJ

with some background to the company and

the stages in which it has developed its

resource base. “Lake Shore was formed in

2002 with the aim of focusing on precious

and base metals in northern Ontario and

northern Québec,” he said. “We gained

access to a number of gold prospects—

including what is now Timmins West—

through an option agreement with Holmer

Gold Mines in 2003. We were able to fulfill

our commitment by upgrading and increas-ing the resource there, and by December of

the following year, we had completed a

business combination with Holmer to get

full ownership of Timmins West.

“We continued defining the resource at Timmins West, and by the end of 2007, we had got an NI 43-101-compliant indicated resource of over 3 million mt grading 8.6 g/mt, for more than 900,000 oz,” Utting said. To put this into perspective, that was 175,000 oz more than Lake Shore had estimated in 2004, and the fig-ure at that time was four times what Holmer had defined in 2002.

With Timmins West clearly the principal focus for the company, it is perhaps worth-while pointing out that the property was by no means a new discovery. In fact, gold had been found there as early as 1911, with the claims having passed through a num-ber of different hands before ending up with Holmer Gold in 1964. Several compa-nies, including Noranda and Chevron, had undertaken drilling campaigns there before Lake Shore’s 2004 program that ran to over 31,500 m of coring, mainly on down-dip extensions to known mineralization between 400 and 800 m depth.

Utting picked up the story again. “We had finished a prefeasibility study on Timmins West in August 2007,” he said, “with the NI 43-101 resource filed soon afterward. We then began an earn-in with West Timmins Mining, which had staked areas all around the property, and that gave us access to Thunder Creek and some other potential prospects along the same geological trends. Our initial agreement with West Timmins Mining was for a 60:40 joint venture, but after we had made a major discovery at Thunder Creek in the middle of 2009, we moved to acquire West Timmins Mining and gain full ownership of all of these claims.”

While having its main focus on Timmins West during this time, the company had not been idle elsewhere. In 2005, it bought out Black Hawk Mining, bringing it the Vogel property in the east of the Timmins camp, and signed a 20-year lease on the Schumacher property, one of the original producers there. Of more immediate signif-icance was its acquisition of the Bell Creek mill, just outside Porcupine, from the joint venture between Goldcorp and Kinross Gold, which brought it an established but mothballed concentrator and, importantly, the Bell Creek underground mine.

Win-win Financing

All of this, plus going ahead with develop-ment at Timmins West, came at a cost, and

at the beginning of 2008, the company

was able to seal a deal with Hochschild

Mining under which Hochschild took an

initial 20% stake in return for a C$64.5-million cash injection. By the end of 2009,

Hochschild had increased its holding to

36%, with no less than C$343 million pro-vided to Lake Shore through a series of pri-vate placements, giving the company the

financial foundation it needed to bring

Timmins West into production and expand

capacity at the Bell Creek mill.

“In late 2010, Hochschild made a decision to focus on organic growth, and sold out its Lake Shore holdings in two transactions, one in November 2010 and the second in February 2011,” Utting said.

“It was a complete win-win situation. Hochschild provided valuable financing for Lake Shore Gold, then made a good profit on the shares when it sold them.”

His thoughts echoed those expressed by Ignacio Bustamante, Hochschild Mining’s CEO, at the time of the holding sale. “Since we identified the geological potential of Lake Shore Gold in 2007, we have supported the company in moving toward production,” he said. “We are delighted with the progress achieved to date, which provides us with a profitable return on our investment.”

Meanwhile, Lake Shore remained active on the acquisition front, buying the former producing Marlhill mine and surrounding exploration prospects from Goldcorp in late 2009, and the Fenn-Gib and Guibord Main prospects (60 km east of Timmins, on the highly significant Destor-Porcupine fault zone) from Barrick Gold in August 2011. It also entered into an option agreement for a 50:50 joint venture with Aurizon Gold over exploration around Aurizon’s Casa Berardi mine in Québec, while reaching an option agreement with Revolution Resources over the potential sale of some or all of its explo-ration prospects in Mexico, obtained as part of the West Timmins Mining acquisition.

Over the past three years, the company has filed NI 43-101 resource statements for its combined Vogel-Marlhill project (2.6 million mt at 2.17 g/mt indicated), Fenn-Gib (40.8 million mt at 0.99 g/mt indicated), and a combined Timmins West/ Thunder Creek complex (5.8 million mt at 5.99 g/mt indicated)—plus, in each case, further inferred resources. It has also been able to transfer resources to probable reserves at the Timmins West complex, where it has 4.9 million mt grading 5.21 g/mt for 823,800 oz, and increase measured and indicated resources at Bell Creek to 4.25 million mt at 4.73 g/mt, containing 646,400 oz. New discoveries have included the 144 and Gold River prospects, both within the boundaries of the Timmins West complex.

Greenstone Belt-hosted

Resources

Studies on the Timmins-Porcupine gold

camp over the past 100 years have shown

that there were a number of mineralization

phases within this Archaean greenstone-hosted resource. Much of the area is

underlain by Abitibi-Wawa metavolcanic

rocks, comprising a division of the exten-sive Superior province of the Canadian

shield. This consists of east-west trending

alternating belts of predominantly vol-canic, sedimentary and gneissic rocks,

fractured by major features such as the

Porcupine-Destor fault zone that acted as

corridors for gold mineralization emplace-ment. Vein-hosted gold occurs in associa-tion with quartz, carbonates and tourma-line, with pyrite and pyrrhotite the major

sulphides present.

The geology of individual deposits can be very complex, with mineralization often found at the hinges of fold structures. In general terms, the fault zone that runs through the Timmins-Porcupine camp sep-arates the district’s metasedimentary rocks and mafic volcanics from intermediate, fel-sic and mafic volcanics to the north and south, with large areas of intrusives to the south and west that may have been involved in the mineralization emplace-ment. Some areas of ultramafic volcanics are also found within the fault zone.

Thus, for instance, the area containing the Timmins West complex forms the con-tact zone between mafic metavolcanic rocks to the northwest and metasediments to the southeast. Dipping steeply, the con-tact contains folds and shear zones that are associated with gold mineralization. The area between the Timmins West and Thunder Creek also contains a number of ultramafic metamorphosed pyroxenite and porphyritic intrusions.

The gold occurs here in steeply plung-ing mineralized zones that lie parallel to the local folding and structures, typically within 100 m of major shear zones. Lake Shore’s exploration to date at Timmins West, Thunder Creek and Bell Creek has shown all of the mineralized shoots to be open at depth.

Timmins West: The First

into Production

Lying 18 km west of the city, the Timmins

deposit at the Timmins West mine was offi-cially declared as being in commercial pro-duction at the beginning of 2011. Having

established the project’s viability with its

2007 prefeasibility study, in 2008 Lake

Shore began the development of an access

ramp as well as sinking the 710-m-deep

production shaft. This was completed and

equipped by mid-2010, with stoping begin-ning in the primary Ultramafic 1 zone. By

the end of 2010, the mine was producing

ore at an average rate of 1,600 mt/d.

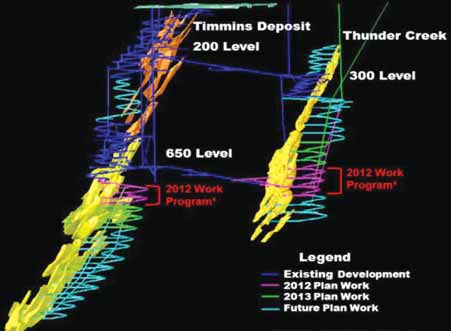

The mineralization here typically lies at the contact between mafic and sedimenta-ry rocks, as well as within ultramafics. The utramafic-hosted ore begins at around 525 m below surface and, from deep drilling results achieved in 2011, the com-pany believes the structure extends to at least 2,400 m depth here and at nearby Thunder Creek—the other key deposit at the Timmins West mine. The two deposits are now linked by 800-m-long haulages on both the 200 m and 650 m levels, with Thunder Creek having been declared in commercial production at the start of 2012, following the release of an initial resource estimate in November 2011. At the same time, Lake Shore merged the two deposits as its Timmins West complex, under common operational management.

As Lake Shore’s senior vice president for operations, Dan Gagnon, pointed out to E&MJ, “the mine has a 10-year resource base at the moment, and a five-year reserve. To place that in context, the Dome mine has had a 10-year life for the past 100 years.”

While waiting for development to reach the Ultramafic ore zone, during 2009 Lake Shore began ore production from the Footwall and Main zones, which contain lower-grade, less continuous mineralization but which are closer to surface. From there, production progressed deeper, using long-hole stoping on sub-levels 30 m apart, until the first Ultramafic stopes became ready during 2010. The mining focus then switched, with production from the more challenging upper levels being suspended once the higher-grade ore was available, with the first 20 m-high longhole stope measur-ing over 75 m long by up to 35 m wide.

During 2012, the company focused on extending the existing spiral ramps at both Timmins West and Thunder Creek, with the aim of reaching a depth of around 800 m on each by the year-end. All of the ore pro-duced is trucked by a local contractor about 42 km to the Bell Creek mill for pro-cessing and gold recovery.

Bell Creek Mill: Key to

Conserving Capex

The availability of the Bell Creek mill and

mine at a cost to Lake Shore of around

C$10 million in cash, shares and warrants

was instrumental in providing the compa-ny with a ready-made processing plant

that could underpin development at

Timmins West. With a conventional car-bon-in-pulp circuit, the mill had been

built by Canamax Resources when it oper-ated Bell Creek between 1986 and 1991.

Subsequent operators, Falconbridge Gold

and Kinross Gold, ran the mine for a fur-ther three years before it was shut in

1994. Total output during the eight years

it was in operation came to some 575,000

mt grading 5.6 g/mt, giving nearly

113,000 oz of gold, all of which was han-dled by the existing mill.

After acquisition, Lake Shore refurbished the plant to a throughput of 800 mt/d, then increased this first to 1,500 mt/d in 2009, and to 2,000 mt/d by the start of 2012. At the time, the company pointed out that the refurbishment cost was significantly lower than the capex involved in building a whole new mill from the ground up. In addition, the quicker start-up enabled it to begin pro-cessing development ore and so generate some cashflow.

Bell Creek is an Archaean-aged meso-thermal gold deposit, hosted in a metavol-canic/metasedimentary fold/fault sequence that itself lies between two significant faults. The gold mineralization is typical of that found in the district, being found in association with quartz veins, in fine-grained pyrite and in association with amor-phous carbon. High-grade gold mineraliza-tion occurs within quartz veins contained in prominent alteration zones that provide a well-recognized exploration target here.

A number of separate orebodies have been identified, including the North, North A, North B and West. In the West zone, around 90% of the gold is associated with disseminated sulphides, mainly pyrite, with minor arsenopyrite, pyrrhotite and chalcopyrite. The North A zone, by con-trast, is centered on a prominent quartz vein that contains visible gold, with a sur-rounding alteration zone hosting dissemi-nated sulphides that carry around 30% of the gold in this zone. Overall, there is a direct association between the gold and sulphide grades, explained mine geologist Ivan Langlois. “The more sulphides, the higher the gold grade,” he said.

The company is now drilling to better define North A’s potential at depth, with drill drifts established on the 535 m and 610 m levels to give access to the structure down to 1,000 m. According to Langlois, North A Deep is separated from the main section of the zone by a barren shear zone, with North A Main bottoming out at around 420 m depth, and North A Deep only beginning some 25 m below that.

Ramp Development

Preferred

During its previous period of working, the

mine was accessed solely by its 300-m-deep vertical shaft. Today, the headframe

still overlooks the mill and other surface

facilities, but access and all of the pro-duction is handled through the ramp that

Lake Shore began developing from surface

in May 2009. A separate vent shaft sup-plies 146 m3

/s (310,000 cfm) of fresh air

into the mine, with the ramp acting as the

main return.

Eighteen months later, the ramp had reached the 320 m level, allowing access to the mineralization beneath the old work-ings for the first time. By September 2011, it had been extended to the 460 m level, below the top of the North A Deep zone, and at the time ofE&MJ’s visit it was down to 565 m and the 535 m-level hang-ing-wall exploration drift was in full use for drilling the structure down to 775 m. By the end of 2012, the ramp had been extended to 610 m below surface.

Two stoping zones were in operation in October 2012, between 300 and 320 m in the North A, and from 460 to 475 m in the North A Deep. The ore zone here runs up to 3 m wide, allowing longhole stoping on 15 m-high sub-levels, with a strike length on the 445 m-level of about 35 m. However, as Langlois told E&MJ, by the time the mineralization reaches the 580 m level, the ore zone is some 150 m long, with clear indications that the orebody becomes more extensive at depth.

The mine relies largely on Atlas Copco LHDs and trucks for its production. A 2-yd3 ST2G is used to move broken ore from the stopes to a transfer point on the ramp, where larger 6-yd 3 and 8-yd3 machines load it on to the mine’s fleet of three, 42-mt-capacity MT42 trucks for the haul to surface. Bell Creek is also taking delivery of an MT50 truck to compensate for increased haul distances, the ramp hav-ing been developed large enough to handle this size of machine.

For drilling, the mine has a number of Atlas Copco Boomer drill rigs for develop-ment, while contracting out its stope work to Taurus Drilling, which uses its own spe-cially designed longhole rigs.

Optimizing the Mill

Given its dependence on the mill to handle

ore from both Bell Creek and Timmins West,

the company’s plans have centered on

increasing throughput again to 3,000 mt/d,

which has involved building a new crushing

plant, 6,000-mt-capacity fine ore bin, SAG

mill, carbon-in-leach tanks and a new thick-ener. While its initial schedule envisaged

achieving this by the end of 2012, the pro-gram was later revised to give a staged

expansion, initially to 2,500 mt, then to

3,000 mt in the second quarter of this year

in line with the increasing availability of ore

from the two mines.

Meeting the 2,500-mt/d target by the end of 2012 involved upgrades to most of the recovery section of the mill. The new thickener and water-handling system was commissioned in October, followed by the CIL tanks, a leach tailings screening plant and pump and piping upgrades to the sec-ondary grinding circuit. The second stage, to achieve 3,000 mt/d, is focusing on the mill’s ore receiving, crushing, storage and grinding sections. Overall, the company expects the expansion to cost just over C$100 million to complete, compared with its initial C$83 million estimate, although its rescheduling has helped to minimize the overall increase.

At the other end of the plant, the bullion room produces roughly 85% doré bars that are shipped to Johnson Matthey in Mississauga for refining. Recoveries have improved steadily as the mill has run at reg-ular rates, and were standing at over 97% in late 2012, while per-ounce cash costs have fallen. Lake Shore is now targeting a figure of less than US$700/oz by 2014 as feed grades become more consistent.

Exploration Potential

Being Realized

Quite aside from the two mines, Lake Shore

has a substantial exploration portfolio, both

within the Timmins camp and further

afield. The company spent C$26 million on

exploration during 2010 and C$32 million

in 2011, with about C$10 million on sur-face drilling on various prospects last year.

“We have a full pipeline of projects, and we

have invested a lot to prove up our resource

base,” Utting told E&MJ. “Our current

focus is on bringing the Timmins West mine

to full production, but there is no question

that we have many attractive options to

support our future growth.

“We are doing less surface drilling at Timmins West, with more underground drilling there to get a better understanding of the deposits,” he explained. “We have spent C$12 million there this year [2012] on underground ‘in-mine’ drilling to support pro-duction and resource definition.” In all, the company’s 2012 underground and surface drilling programs totaled around 120,000 m, including over 18,000 m at Fenn-Gib.

Fenn-Gib is a different type of target for Lake Shore, representing a low-grade, bulk-tonnage open-pittable resource. It has been evaluated at various times over the past 90 years, with companies such as Cominco and International Corona Re-sources having drilled there. The most recent work was done in the late 1990s by Pangea Resources, with Barrick having acquired it in 2000. Barrick has a limited-time 51% buy-back option on the property, which applies for 90 days once Lake Shore reaches a 5 million oz resource base.

At Bell Creek, meanwhile, the complex now includes the Marlhill, Vogel-Schu-macher and Wetmore exploration prospects. Lake Shore has drilled all of these and has compiled initial resources estimates at Vogel and Marlhill. All of the prospects lie within easy trucking range to the existing mill.

However, the Timmins West complex remains the company’s priority target, not only within the existing mines, but on structures such as the Gold River Trend, which lies about 3 km to the south of them. Running from 50 to 200 m wide, this has now been traced for over 3 km, and is interpreted as a branch of the Porcupine-Destor fault. Equally, the 144 deposit, close to Thunder Creek, carries strong similarities to Thunder Creek in terms of grade and mineralization type. Lake Shore has published an initial resource estimate for the Gold River Trend, and is continuing with deep drilling to define the structures there.

Lake Shore produced 7,700 oz of gold in 2009 as it processed development ore. Production increased to 43,500 oz in 2010 as Timmins West came on stream, and jumped to 86,565 oz in 2011. The compa-ny’s output last year totaled 85,782 oz, with plans in place to increase production in 2013 to between 120,000 and 135,000 oz.

Commenting on the production figures, Lake Shore President and CEO Tony Makuch said: “We finished 2012 strong with higher production and improved grades during the fourth quarter. For the full year, we achieved our production guidance. Equally important, we met our key mine development and mill expansion objectives.

“The progress we achieved in 2012 has positioned us for significantly higher pro-duction, reduced spending and improved cash operating costs in 2013,” he went on. “Capital spending on mine development and mill expansion projects is forecast at approximately C$80 million, with an addi-tional C$10 million budgeted for explo-ration, largely in-mine drilling. Cash operat-ing costs in 2013 are targeted at US$800-$875/oz, including royalties.”

By focusing on a district with known gold-producing pedigree, Lake Shore believes that this has major benefits as it transforms from exploration to production. “Timmins is a mining town with a mining culture,” Utting told E&MJ. “In a tight labor market, it’s a good place to be, since we don’t have to rely on fly-in, fly-out.

“We benefit significantly from the avail-ability of the things you need when you’re building a new mine,” he added. “When we ran a power line into Timmins West, we only had to put in nine poles to link in to the grid.”

The focus now is for Lake Shore to increase the mill’s processing rate to 3,000 mt/d by the middle of the year, and to increase production from Timmins West to reach that level by the year-end, with additional mill feed being drawn from Bell Creek in the interim. It is also continuing to evaluate the deep zone at Bell Creek, Fenn-Gib and a number of other prospects. The glory days of the Timmins-Porcupine camp may be in the history books now, but it looks like another chapter is in the process of being written.

Quartz veining in the North A Deep orebody at Bell Creek. (Photo: Simon Walker) In late January, Lake Shore Gold reported the results from over 27,000 m of drilling at its 144 property during 2012. Highlights included the discovery of a new area of mineralization, 850 m south of Thunder Creek in 144 Gap, together with an area of shal-low mineralization at 144 South. Company President and CEO Tony Makuch, said: “The results highlight the significant potential to continue to grow and expand the Timmins West mine operation, including exploring the gap between Thunder Creek and 144 as well as the 144 North and South zones. We have discovered new areas of mineralization in the 144 Gap, dou-bled the depth of known mineralization at 144 North and intersect-ed new mineralization at 144 South. We have also gained important new information regarding controls for the mineralization and identi-fied large syenite stocks at both the 144 North and 144 South areas that are similar to that found at Thunder Creek.” The company states that the main focus of future drilling here will be to test the projected down-plunge extensions of the newly identified mineralization at the 144 Gap and South areas. |