Optimizing resource utilization has

always been a challenge for mine

designers, with nature still eminently

capable of throwing up surprises that

can both delight or confound. Brown-field exploration is often the key to the

former—take Neves Corvo in Portugal or

Garpenberg in Sweden as examples

here—while unforeseen stress regimes,

water or weak strata are often the cause

of forced changes in plan. Cameco’s

flood-related tribulations at Cigar Lake

are a case in point.

In consequence, mine design sys-tems have to be capable of addressing

sudden amendments as well as provid-ing the overall framework for getting

the most out of a given deposit, in both

tonnage and financial terms. Soviet-style planning focused on the former at

the expense of the latter, while exam-ples abound of operations that have

been run exclusively on financial rails

and have closed early, only to find new

leases on life under a different operat-ing regime.

The development of mine design

software, which has been on-going

since the first systems such as Data-mine were introduced over 30 years

ago, has resulted in a strong supply

base of competitive concepts. Not sur-prisingly, there has been a degree of

consolidation within the mainstream

players in recent years, as well as acqui-sitions of suppliers by larger companies

who have realized that the mining-sec-tor market is no longer a niche. Such

moves can, of course, bring significant

benefits in terms of having greater

development resources available, as

well as the potential to merge software

systems with different focuses into

more comprehensive packages. As with

machinery manufacturers, the goal is

often to be able to meet all of a cus-tomer’s needs from one source, rather

than risking part of the business (and

its potential for long-term support)

going elsewhere.

The Cost of Making Wrong Decisions

Looking first at greenfield project

development, one of the most obvious

trends of the past 10 years has been

the rapid escalation in capex costs that

companies worldwide have had to face.

One of the first examples to come to

widespread notice was BHP Billiton’s

Ravensthorpe nickel laterite project in

Western Australia, where the initial

$1 billion cost more than doubled

between 2005 and 2008. The mine

failed, and BHP sold it to First

Quantum Minerals for $340 million in

2010. First Quantum in turn spent

some $370 million on re-engineering it

and bringing it back into production,

which itself was nearly double the com-pany’s original $190 million re-engi-neering estimate.

In point of fact, cost overruns are

more of the rule than the exception. In

November, the management consultants Accenture published a report titled

Achieving superior delivery of capital

projects, which makes alarming reading

if for no other reason that it highlights

the scale of the overrun problem.

The survey that provided the founda-tion for the report sought the views of

31 senior industry respondents with

responsibility for capital projects

around the world. Of these, 22 respon-dents were involved with mining pro-jects, and the other nine with metals.

According to Accenture, “less than a

third (30%) of the respondents report-ed staying within 25% of approved

budgets for all projects, and less than a

fifth (17%) said they completed all

projects within a 10% budget range.”

Put in financial terms, the implica-tions—as well as the sums involved—

are huge. Accenture estimates that

capex for metals and mining projects

will have been more than $140 billion

last year, with the prospect of $1 trillion

to $1.5 trillion being spent between

2011 and 2025. “With $100–$200 bil-lion in annual spend, the impact of pro-ject delivery overruns on individual com-panies and the industry as a whole is

enormous,” the company commented.

“When asked what typically causes

delays in project schedules, survey

respondents cited the availability of tal-ent (57%), new or unconsidered regula-tory requirements (45%) and insuffi-cient detail during the planning stage

(42%),” Accenture added, while point-ing out that mining projects are often

more complex than metals projects, so

are more likely to experience longer

delays and higher cost overruns. In

some ways, though, that seems count-er-intuitive since smelter and metallur-gy projects in general can be highly

complex and, in consequence, risk

budgets being broken. The high capex

requirements for today’s nickel-laterite

treatment plants is a case in point,

relying as they do on autoclaves and

sophisticated hydrometallurgy.

Leading Attributes and Recommendations

However, that is by far from being the

whole picture, since a host of other fac-tors can come into play. Looking purely

at the key reasons for cost overruns,

and setting aside the question of

whether or not a company can attract

competent staff and contractors (which

is an issue in its own right), it is diffi-cult to understand how projects can fall

foul of factors as obvious as ‘unconsid-ered regulatory requirements’ and

‘insufficient detail during the planning

stage.’ Those, frankly, are fundamen-tals that any company considering a

major investment should be capable of

addressing, and it begs questions that

shareholders should be posing if they

feel that their interests (and invest-ments) are not be husbanded properly.

Still, there are some companies that

can and do deliver projects on schedule

and budget, even faced with the pres-sures of skilled-labor shortages and ris-ing equipment costs. According to

Accenture, a number of common attrib-utes identify them:

• They make fewer revisions to the

approved schedule;

• They make significantly fewer

changes during construction; and

• They have greater confidence in their

own culture in delivering projects.

In addition, these companies make

wider use of analytics, including key

performance indicators, and have bet-ter access to performance data across

multiple dimensions, such as timeli-ness, accuracy, range and source.

In its report, Accenture defined five

key recommendations for effective pro-ject delivery:

• Establish strong project governance

and risk-management tools;

• Proactively manage external stake-holders’ increasing expectations for

sustainability;

• Optimize scarce talent through port-folio management, organizational

flexibility and training;

• Integrate information systems among

capital project players; and

• Accelerate operational readiness.

“Addressing cost and time objectives

of capital projects is a prime opportunity

to achieve competitive advantage,”

Accenture concluded. “Ideally, capital

projects should be run as high-stakes

businesses with targeted objectives, clear

delivery strategies and careful monitoring

to track progress toward high perform-ance.” And this, of course, is where good

design has a major part to play.

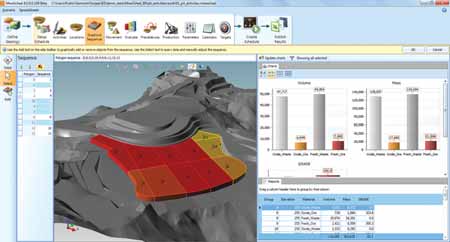

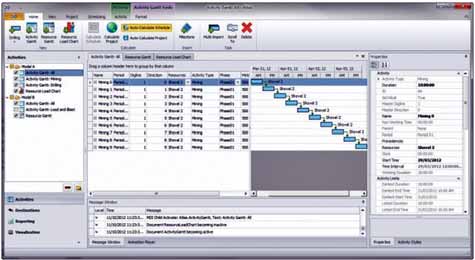

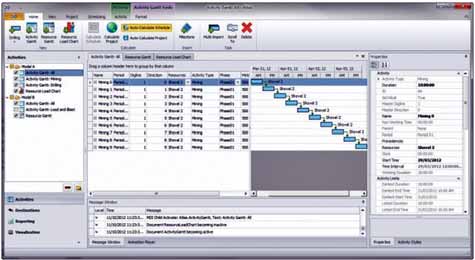

Mintec’s new activity and resource-based scheduler, MineSight Atlas, is one of several products scheduled for

Mintec’s new activity and resource-based scheduler, MineSight Atlas, is one of several products scheduled for

release in 2013.

Sector Movements

Among consolidations that have recent-ly taken place within the mine-design

software companies, the current wave

of acquisitions seems to have started in

April 2010 when CAE bought out The

Datamine Group. It followed this in

January 2011 by adding Century

Systems Technologies to its portfolio,

thereby boosting its capabilities in geo-logical data-management and gover-nance systems.

Shortly afterward, Switzerland-based ABB acquired the Australian

mining-software developer, Mincom,

bundling it into its existing software

systems unit as Ventyx. During 2012,

meanwhile, the major change came

with the French 3-D specialist,

Dassault Systèmes’, $360-million pur-chase of Vancouver-based Gemcom,

now part of Dassault’s Geovia brand. At

the time, its CEO Rick Moignard

explained the potential benefits of the

move: “Advanced technologies in 3-D

modelling and simulation will not only

enable engineers and geologists to

model and visualize resources but also

improve sustainable mine productivi-ty,” he said.

Orebody modelling led the way in

bringing computerization into mine

design. Today’s mine engineers have a

plethora of competing products to

assist them in interpreting geological

data and optimizing resource extrac-tion. Some software focuses specifical-ly on geological resource data; other

packages address surface-mine layouts;

yet more take specific mining methods

such as block caving, providing the

design department with the tools to

model the resource and apply ‘what-if’

tests to determine the effects of pro-duction schedule changes or commodi-ty-price movements on the operation’s

viability and resource utilization.

In the remainder of this article,

E&MJ looks at some of the mine-design

software packages that are currently

available. There are, of course, many

other providers; the common thread

here is that each of the suppliers men-tioned was among those that exhibited

at last year’s MINExpo.

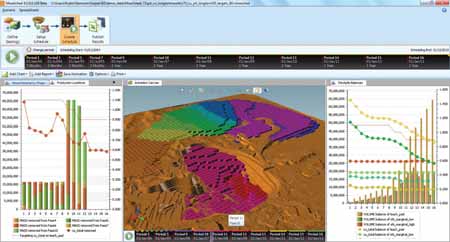

RungePincockMinarco

In 2005, the Australian software devel-oper, Runge, took the unexpected step

of buying out U.S.-based mining con-sultants, Pincock, Allen & Holt, with

the subsequent addition of Minarco-MineConsult boosting its consultancy

arm. In December, the company, which today claims to be the world’s largest

independent group of mining technical

experts, announced a change of name

to RungePincockMinarco (RPM).

The company’s software suite in-cludes FRACSIS for visualizing geo-logical data, XPAC and XACT for

mine scheduling, TALPAC, HAULNET,

DRAGSIM and FACETS for simulating

loading, haulage, dragline and longwall

face operations, and XERAS for finan-cial analysis. At MINExpo 2012, it

released an update for its TALPAC

haulage and loading software which, it

says, is used by mining operations

world-wide to evaluate the performance

of mixed fleets.

According to RPM, it now has a

database of more than 500 trucks and

400 loaders, allowing virtually any

truck and loader combination to be

simulated and evaluated. The up-date includes Caterpillar’s Unit Rig

MT4400D AC and 777G trucks,

Komatsu’s 750E (AC) truck and

Hitachi’s EH 5000AC-3 truck, all of

which were launched at MINExpo,

together with newly introduced or

upgraded equipment from other manu-facturers such as Liebherr, Bell, Volvo,

Belaz and P&H.

Geovia: A Raft of Upgrades

At MINExpo, Dassault Systèmes’ sub-sidiary Gemcom (now Geovia) intro-duced updates to its Surpac, GEMS,

InSite, Whittle and MineSched mining-industry applications. “With the mining

industry facing higher costs and more

pressure on commodity prices, it is

imperative that they can unlock addi-tional efficiencies and economic value

from their mining operations,” said

Moignard. “The new features will pro-vide additional tools and functionality

for mining professionals to better quan-tify, plan and manage extraction of

their orebodies.”

Surpac 6.4 (geology and mine-plan-ning software) will be available in the

first quarter of 2013, and has a new

integrated Dynamic Shells tool for sig-nificant time savings when initially

evaluating deposits, Geovia said. It also

has increased memory handling for

faster working with very large datasets,

and a new stereoscopic 3-D visualiza-tion capability. The company is also

introducing a Dynamic Shells tool for

its GEMS 6.5 collaborative geology and

mine planning application, which will

launch in early 2013.

Whittle 4.5, for open-pit mine plan-ning, now has the capability of produc-ing more practical mine plans through

the use of a new mining direction fea-ture and alternative pushback creation

capabilities, while MineSched 8.0 pro-vides users with much faster response

times, with production scheduling up to

50-times faster and development

scheduling 10-times faster than before,

according to Geovia.

The upgrade to its InSite mine-pro-duction management software, version

4.2, has improved reporting and analy-sis capabilities, the company adds,

helping to give users a closer view of

material balances and stockpile man-agement for faster reconciliation and

end-of-the-month processes.

Micromine 2013 Available Soon

From its headquarters in Western

Australia, Micromine provided visitors

to its MINExpo exhibit with a preview of

the latest edition of its namesake explo-ration and mine design software.

Micromine 2013 is scheduled for

release early in the year, having still

been at the development stage at the

Las Vegas show.

The company reports that new fea-tures within Micromine 2013 will

include capabilities for rotated block

models, with one, two or three-dimen-sional rotations being supported.

Orientating the blocks to match the ore-body means they are a better fit with

reality, producing a smaller model and

saving processing time and disc space,

Micromine says.

The new version will also contain

tools to simplify the creation of seam

block models, including splits, plies,

overburden and interburden, even in

stratigraphically complex areas. The

company says that Micromine’s strati-graphic modelling tools honor the origi-nal data, with smart tools that handle

seam pinching and missing holes, pro-ducing a geologically correct model.

There will also be a range of new

features and improved functionality for

Vizex in Micromine 2013, including

seam correlation, annotation layers,

seismic SEG-Y, drillhole solid, color/

hatch/symbol sets, line styles and

stereo 3-D.

At MINExpo, Micromine presented

its Coal Measure software which, it

said, is coal-industry specific in terms

of terminology, features and functional-ity. The suite combines the data man-agement features and benefits of

Micromine’s Geobank geological data-handling software, integrating coal

database management with three-dimensional geological modelling, grid-ding, seam block modelling, resource

categorization, resource reporting, pit

optimization, pit design and plotting.

The software is also suitable for other

stratified resources, such as tin, miner-al sands, uranium and potash, as well

as those with complex tectonics or mul-tiple splitting and merging of seams.

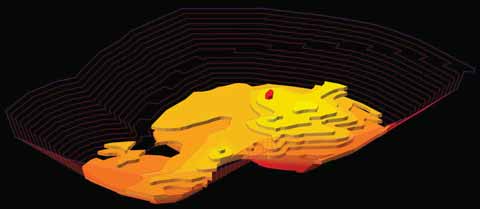

Maptek Vulcan 8.2 was released to customers in November 2012. Standout features include new rapid pit design

Maptek Vulcan 8.2 was released to customers in November 2012. Standout features include new rapid pit design

tools and improved grade estimation.

Post-mining Design from Carlson Software

With its center in Maysville, Kentucky,

USA, Carlson Software draws its mine

design credentials from its background

in surveying, and now offers a complete

software suite that covers data collec-tion, surveying, engineering design and

drafting, mine planning and modelling,

construction estimation and machine

control. The company claims to be the

largest provider of design software for

mines in the U.S., with increasing

applications in other countries.

From its initial focus on U.S. coal

mining, Carlson Mining software is now

used in designing operations for miner-als such limestone, trona, clay, phos-phate and other sedimentary deposits,

with routines for block modelling gold,

silver, copper, nickel, iron and other

orebodies having been added to its

capabilities. The company also offers a

basic version of its mining package,

allowing access to computerized design

for operators who only need a low-cost

tool for simple mining practices.

Aside from mine operating design,

Carlson said its Natural Regrade soft-ware is unique as a tool for reclaiming

mine sites, regrading surface mines

back to natural land-forms. Natural

Regrade provides an affordable and

natural way to achieve sustainability,

with its GeoFluv fluvial geomorphic

design method bringing back natural

landforms while establishing stability

against erosion and enhancing water

quality. The software enables users to

build with on-site materials, save costs

on material moving, reclaim steep slopes in a stable way, handle water

and sediment naturally, and produce a

self-maintaining, natural-looking result.

New features include the ability to visu-alize vegetation growth in 3-D at vari-ous stages throughout reclamation.

Mintec Adds New Plug-ins

Mintec took the opportunity afforded by

MINExpo to launch MineSight 7.5

which, it said, provides better visualiza-tion and compatibility between products.

Version 7.5 includes improved versions

of MineSight 3-D, Schedule Optimizer,

Torque, Basis and Data Analyst.

The Tucson, Arizona, USA-based

company followed this in December

with the 2013 update to MineSight,

version 7.6, which features new plug-ins such as a surface resloping tool for

MineSight 3-D’s engineering open-pit

CAD. This allows engineers to reduce a

shape, such as a waste dump, to a

desired final slope while balancing cut

and fill requirements. MS3D also

includes plug-ins for auto cut genera-tion, used to create cuts starting from

polygons, polylines or solids, and

Digline Generator, used to assign a min-ing sequence for cuts on every individ-ual bench of each phase.

Mintec reports it also has four new

products scheduled for release early

this year.

MineSight Implicit Modeler is a

mathematical tool for geologists to take

drillhole, polygon, point and fault-plane

data, and then interpret new geological

scenarios. MineSight Performance

Manager is used to assess and report on

mining performance in near real time,

as well as providing analytical tools that

can answer why something has hap-pened. MineSight Atlas is a complete package for manual scheduling and

stockpile blending, while the company

describes MineSight Stope as being not

only a design tool, but also a very quick

first-pass scheduling tool for under-ground engineers to look at alternatives

for stope locations.

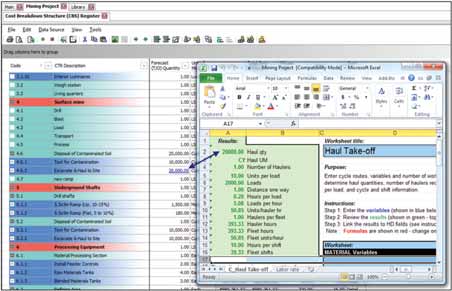

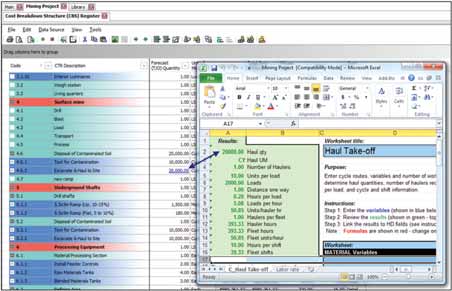

Hard Dollar says its Project Cost Management (PCM) package enables mining companies to make project

Hard Dollar says its Project Cost Management (PCM) package enables mining companies to make project

decisions that avoid cost overruns.

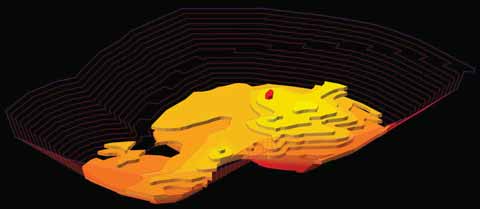

Maptek Moves Off-shore

Australia’s Maptek released the latest

version of its Vulcan geological model-ling and mine planning software at the

end of last year. The company noted

that a customer request for generating

strategic pit and dump designs led to

the development of a new rapid pit

design tool, which has been released in

Vulcan 8.2. Mine planning engineers

can quickly create mid-bench based

designs, it said, as well as generating

phases and reserve reports, and can

evaluate multiple designs in the same

amount of time previously needed for a

single design.

“The new tool helps engineers to

quickly create and analyze different

pit designs, allowing them to look at

many more alternatives before pro-ducing a final design,” said Steve

Uecker, Maptek’s Vulcan client experi-ence manager.

Maptek reports that AuruMar, the

South African-based joint venture

established between AngloGold Ashanti

and De Beers to evaluate off-shore min-eral resources, has adapted Vulcan 3-D

modelling software for its exploration

on 26 mining leases off-shore Nome,

Alaska. Vulcan GeoModeller provides a

complete set of tools for exploration

and mining geologists, and can be used

on both stratigraphic and non-strati-graphic deposits. The Vulcan platform

allows users to do resource modelling,

mine planning and reconciliation in the

same environment.

Hard Dollar: Counting Cash Where it Counts

As noted earlier, plenty of mining com-panies are feeling the combined effects

of soaring capex costs, upward pres-sures on operating costs and uncertain-ties over commodity markets. In a pres-entation given in April last year, Scotts-dale, Arizona-based Hard Dollar com-mented that “mining companies must

take measures to manage cash flow and

conserve spending, while ensuring that

projects stay on schedule.”

The company went on to point out

that controlling costs and managing

mining resources requires a robust

tool, suggesting that its Project Cost

Management (PCM) package removes

common hurdles from cost controls,

allowing mining companies to make

project decisions that easily avoid cost

overruns.

While not specifically a mine design

package, PCM provides a way of pro-ducing detailed, timely project status

data, the company states. These data

immediately show what was estimated

and budgeted, versus actual project

performance. Through customizable

daily reports, an entire project overview

is displayed, clearly showing variances

and forecasts at completion.

In July 2012, Hard Dollar teamed

up with Canadian company CAE to

include its PCM in CAE Mining’s mine

design, planning and scheduling soft-ware suite. “Hard Dollar’s integration

with the new CAE Studio 5-D Planner

provides customers transparent delivery

of cost and productivity throughout the

entire project lifecycle,” the companies

said at the time, while pointing out that

by integrating the two products in an

industry first, they had provided users

with the opportunity to merge mine

design, scheduling, financial and pro-ductivity modelling for both study and

operational environments.

According to Hard Dollar, PCM can

reduce the time it takes to build, plan,

deliver and forecast cost and productiv-ity by more than 300%, while increas-ing profits by 15% or more.

CAE Moves Deeper into Mining

A relatively recent entrant into the

mine-design software market, in the

past CAE has perhaps been better

known world-wide for its simulator and

training technology. However, the com-pany’s purchases of Datamine and

Century Systems Technologies has

increased its interest in the mining sec-tor, such that it now has a dedicated

business area, CAE Mining.

CAE Mining supplies software tools

for underground mine planning, includ-ing Mine2-4-D and its successor, CAE

Studio 5-D Planner. The company’s

Mineable Reserves Optimizer (MRO)

package determines the optimal mining

envelopes within which stopes should

be designed, and can be used for pre-liminary underground reserve estima-tion. The Mineable Shape Optimizer

(MSO) automatically produces opti-mized stope designs that maximize the

value of recovered ore within the given

geometry and design constraints. It

supports massive, sub-vertical and flat

horizontal deposits and can quickly

generate individual stope designs with-in a resource model, CAE Mining says.

In terms of access design, Mine

Layout Optimizer (MLO) produces opti-mal decline designs to satisfy access

requirements and design criteria. The

company suggests that this can be valu-able with rapid engineering during the

analysis stages of a project, as well later

once designs become more detailed.

Good Designs Save Time and Money

With so much pressure on exploration

and mining companies to bring projects

on stream in a cost-effective, timely

manner, while working in increasingly remote and often logistically challeng-ing environments, it is hardly surprising

that there is a strong market for com-prehensive software tools that can take

some of the risk out of the design

process. Each of the major suppliers

has its own list of ‘satisfied customers’,

working in locations from Nevada to

Papua New Guinea, and from Australia

to Appalachia.

It is, of course, sensible to remem-ber that all of these software packages

rely on having accurate data to work

with, so it is essential that users ensure

that their input information is not only

clean, but is as accurate as can be

achieved. After all, the old maxim

‘garbage-in, garbage-out’ applies to

design software as much as it does to

any other data-reliant process.

In common with other sectors of

mining and exploration technology,

there appears to have been a steady

trend toward consolidation within soft-ware suppliers, usually with the aim of

amalgamating complementary prod-ucts. Most suppliers claim dominance

in one particular aspect or another,

although it is clear that no one compa-ny has an over-riding position in the

wider world market. Software develop-ment and computing power have gone

hand-in-hand here as elsewhere in the

industry, with 64-bit technology becom-ing mainstream where large amounts of

data have to be handled.

Shareholders should always be able

to see where a project’s design has

not met the mark. Whether they can

do anything about it is, of course,

another matter. Perhaps the best thing

about good design is that it just keeps

paying dividends.