Coal Exporters and Buyers Meet in Istanbul By Mungo Smith

Coaltrans was visiting Istanbul for the first time since 1997 and found a coun-try transformed. Turkey’s GDP growth over the past decade has been closer to that of China than to its European neigh-bors. Istanbul glistens with smart new cars, new hotels and glamorous shop fronts atop of the majestic ruins of former empires, and beyond which lies the ram-shackle dwellings of massive urban sprawl testifying to the rapid demograph-ic growth that has accompanied that of the economy.

On the periphery of this vast city, Turkish industry is flexing its muscles all around the world. Turkey is Europe’s fourth largest economy and its second producer of iron and steel, and is expect-ed to overtake German production by 2015. Domestic consumption is booming and, miraculously, Turkey seems so far to have escaped the economic gloom that prevails in Europe.

The producers, exporters, traders, transporters and buyers of coal attending Coaltrans 2012 felt reassured by what they saw. Here before their eyes they could witness a version of the Asian mir-acle that they hope will provide enough economic growth to keep their mines open, their ships sailing and their coal burning. For in many respects they are a beleaguered bunch; growth in the West has stagnated, prices for coal and ship-ping have fallen, their own governments are squeezing them with regulations and environmentalists maligning them, but the sunny and vibrant view over Istanbul encouraged optimism.

An Unclear Future

The subjects under discussion were the

global state of energy markets, growth in

India’s steel market, new scenarios for

power generation, the shifting dynamics

of U.S. coal and a look at the German

and UK markets. Turkey’s industry was

also examined and a session was devoted

to coal transport and logistics.

Going straight to the heart of the matter, Dr. Fatih Birol, chief economist at the International Energy Agency in Paris, set about the theme of the future of global energy generation. With Ger-many and Japan suddenly phasing out nuclear energy, North American shale gas usurping its rivals, regulations and renewables confounding expectations, and an erratic oil market, never has it been more difficult to make predictions for the future, as Dr. Birol bravely proceeded to do.

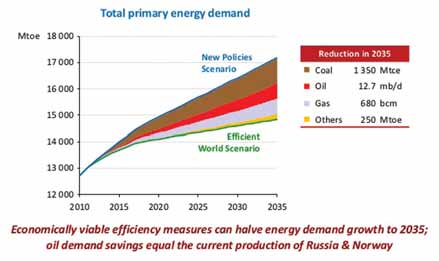

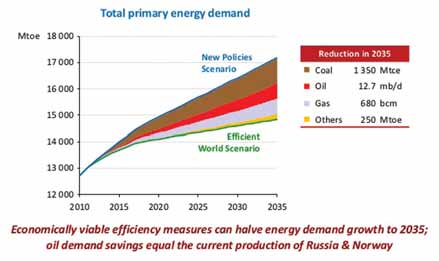

He expects global energy demand to grow by one-third by 2035, but there will be almost no increase in the developed world. Increased energy efficiency, stag-nating economies and environmental pressures will ensure that coal consump-tion will remain static in the West. Emerging economies are expected to lead growth and China and India alone will account for half of future growth in demand. India is expected to overtake China as the leading importer of coal. Here he introduced a theme that echoed throughout the conference; the names of China and India sounded throughout each session like a kind of mantra to encourage confidence for the future.

The energy sector is experiencing unusually uncertain times. Energy policy, Dr. Birol laments, has taken second place to immediate economic concerns in the wake of the global economic crisis; carbon dioxide levels are at an all time high, the Durban agreements seem to have made no impact on investment, while Fukushima has placed a large question over the nuclear sector. Nevertheless, Dr. Birol pre-dicts that renewable and natural gas will account for almost two thirds of incremen-tal energy demand between 2010 and 2035. This is in stark contrast to the past decade, during which coal accounted for nearly half of the increase in global energy use, with the bulk of the growth going into the power sector in emerging economies.

Emerging economies will remain the only drivers of growth. India’s coal production will fail to keep pace with domestic demand, boosting imports from 61 million metric tons carbon equivalent (Mtce) in 2009 to 305 Mtce in 2035— by far the largest volume of any country. Elsewhere, “we are entering the golden age of gas,” Dr. Birol declared. Shale gas he considers to be a revolution. At current low prices, further developments in shale gas production are unlikely, but if prices rise, “that would change the framework for competition for coal,” he said. “Combined unconventional gas out-put growth from North America, China and Australia could surpass that of all conventional producers.”

Renewables, Dr. Birol considers, also represent a major threat to coal, particularly due to government subsidies. But he concluded on a more optimistic note; 20% of the world’s population (one and a half billion people) has no access to electricity. These people will be connected to power and he predicts that 80% of their electricity needs will be satisfied using coal. India will lead this growth. “In a world full of uncertainty, one thing is sure: rising incomes and population will push energy needs higher,” said Birol.

There was also, ironically, a bit of hope in the heart of Europe for coal exporters. Despite the persecution coal seems to attract in that area, European Union coal demand rose by 7% in 2011, benefitting from cheap U.S. imports. Erich Schmitz, managing director at Verein der Kohlenimporteure, gave a speech focusing on Germany, which has recently passed legislation that will close all nuclear power plants and hard coal mines in that country. While these energy sources are supposed to be replaced with renewable ones, the required infrastruc-ture is far from complete. This, combined with high gas prices, favors imports of hard coal to meet the gap in demand.

Matt Schicke, managing director of Americas Coal Trading and Mercuria Energy Trading, discussed how U.S. coal is shifting the dynamics of international trade. Over the past decade, both met and steam coal exports from the U.S. have been increasing at a steady rate, though steam is growing faster. As shale gas replaces coal in U.S. power genera-tion, U.S. producers are actively pushing exports, primarily aimed at Asia. The U.S. benefits from an installed export infrastructure as well as a variety of coal qualities for blending. He thus expects the U.S. to play a key role balancing the global market. The U.S. will shift from being a swing supplier on international markets to being one of the key suppliers to the global seaborne trade.

Steel production in India meanwhile has rocketed from 22 million mt/y in 2002 to 72 million mt/y in 2011 and is forecast to reach 150 million mt/y by 2017. This brings opportunities for U.S. exporters.

Australia will experience higher costs in new reserve areas due to government regulations and community impediments. Indonesian coal quality is declining while its domestic consumption increases and is facing major infrastructure bottle-necks that also affect Mongolia and Mozambique. Global seaborne demand will outpace supply in the next five years and the industry could see a cumulative met shortfall of 85 million mt for met coal and a 110 million mt deficit for thermal. The U.S. could be a beneficiary of this trend if its export capacity reaches an expected 245 million mt within five years. U.S. port expansions will more than double capacity during this time, particu-larly on the Pacific Coast.

Meeting Turkey’s Rising Demand

The host nation was also under discus-sion. Turkey’s GDP has been growing at

an average of 5% per year for the past

10 years and the country has big poten-tial for electricity consumption growth.

While electricity consumption per capita

is 3 MWh in Turkey, the EU average is

6.6 MWh. The additional installed capac-ity requirement is 4,000 MW/y and due

to limited local sources, imported coal

and gas will be required. At present, local

lignite accounts for 17% of Turkey’s elec-tricity generation, while imported coal

accounts for 10% (imported natural gas

and hydro make up the most important

elements). Currently, Turkey imports

30 million mt of solid fuel, but this num-ber will increase. Average annual addi-tional investment in imported coal-fired

power production is expected to be

75 MW which will result in an annual

increase in import coal requirements of

more than 2 million mt/y.

Current investments aim at increasing Turkey’s steel production to 55 million mt by 2015, which would make Turkey Europe’s largest producer. The most seri-ous bottleneck to this ambition is the security and cost of fuel to be consumed. 90% of the 6.5 million mt/y industrial consumption of coking coal is imported. Sabri Oral, chief executive of Turkey’s Coal Importers Association believes that Turkey will be one of the fastest growing coal importers worldwide. Turkey is eager to diversify its supply and due to its geo-graphical location, is reachable by almost all global coal resources. As all natural gas is imported, the Turks are eager to reduce dependence on it and are thus favoring development of domestic lignite production. To this end, this year a new law was passed permitting the privatization of lig-nite fields controlled by TKI (Turkish Coal Enterprise). Already the Soma field has been privatized. The country is also keen to attract investment in new thermal power plants, though according to Onder Kartal, a partner at Jupiter Trading, major obstacles stand in the way. These include difficulties in getting Environmental Impact Assessments, excessive red tape, high CAPEX requirements, uncertainties concerning the liberation of the market and carbon emissions costs, as well as general public antipathy toward coal. Nevertheless, the short term outlook for coal consumption in Turkey is bullish and imports are set to rise significantly.

The general tone of both speakers and attendees was one of optimism. Going forward, a great deal of volatility is expected as periodic recessionary episodes may cause short-term oversup-ply and increase price volatility, but this will not alter the long-term growth story. While forecasts varied, there was a general assumption that for the next 20 years, volumes of seaborne coal will grow substantially, driven in particular by the demographic and economic expansion of China and India. Electrification of com-munities that are not served by the grid as well as general improvements of living standards in these countries are expected to be the drivers of growth.

The clouds beyond the horizon did not sully the sunny sky above the Bosporus, but the IMF has been muttering about a new global recession and the possibility of a financial crisis in India. The Chinese and Indians may become tired of living under clouds of dirty smog; Asia does not yet have an efficient carbon policy and emission reduction programs are less developed. If the Chinese climate control policies are enforced, the impact for the seaborne coal trade would be severe. Furthermore, consumers tired of volatility are integrating their supply chains so that India’s steel giants are mining for their own coal in foreign climes. It is thus not certain that these massive countries can live up to the ambitious expectations voiced at this assembly. The focus of the conference never drifted from the poten-tial that is China and India, but it seemed ominous that for all of the enthusiasm, only one single China man attended the conference.

Mungo Smith manages the editorial team for Global Business Reports. He is based in Istanbul, Turkey. www.gbreports.com