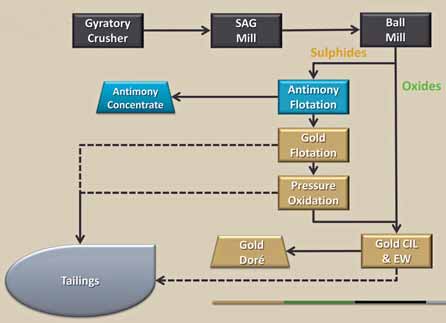

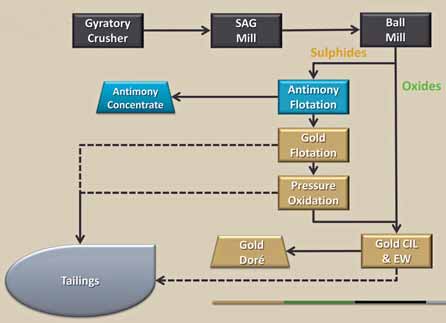

Midas Gold’s Golden Meadows gold project in Central Idaho, USA, will mine both oxide and sulphide ores

Midas Gold’s Golden Meadows gold project in Central Idaho, USA, will mine both oxide and sulphide ores

that will require separate extraction processes, as shown here in a simplified process design diagram.

The projects’s PEA assumes mill feed will be about 20,000 mt/d. (Photo courtesy of Midas Gold Corp.)

Midas Gold Corp., a Canadian junior com-pany headquartered in Vancouver, has

announced the results of an independent,

NI 43-101-compliant preliminary econom-ic assessment (PEA) of its Golden

Meadows project near the historic mining

town of Stibnite in central Idaho. The

Golden Meadows project, as currently envi-sioned, consists of three gold mineral

resources, Yellow Pine, Hangar Flats and

West End, with zones of antimony and sil-ver mineralization. Conventional open-pit

methods are recommended for mining the

three deposits, which are located within 3

km of each other.

The deposits contain oxides and sul-phides that are contemplated to be treated

using different extraction processes. The

oxide material is amenable to milling and

then vat leaching to recover gold and silver

only. Sulphide materialization would be

milled and treated by sequential flotation

to produce two products, an antimony con-centrate for shipment to a third-party

smelter and a gold concentrate that would

be processed on site using pressure oxida-tion followed by vat leaching and cyanide

destruction within the plant building to

produce gold-silver doré.

Mill feed is assumed to be about

20,000 mt/d. At this production rate, mine

life would be approximately 14.2 years.

The mine would have an overall strip ratio

of 3.7:1, waste to ore. Gold accounts for

approximately 93% of the value of the

payable metals; antimony accounts for

about 7%; and silver makes a negligible

economic contribution.

Life-of-mine gold production for Golden

Meadows is estimated at 4.9 million oz,

and life-of-mine antimony production is

estimated at 90.6 million lb. Cash gold

productions costs, net of byproduct cred-its, are estimated at $425/oz of gold.

Initial capital to develop the project is esti-mated at $879 million.

The Golden Meadows property has been

the site of extensive open-pit and underground mining for almost 100 years and, as

such, has seen considerable disturbance

and environmental impact. Midas Gold’s

approach to the conceptual design of the

project has been to mitigate and minimize

the results of its proposed activities, to

remediate considerable amounts of legacy

disturbance, and to develop a closure and

reclamation concept that leaves the site

with enhanced fisheries, wetlands and

other productive environmental attributes.

As featured in Womp 2012 Vol 10 - www.womp-int.com