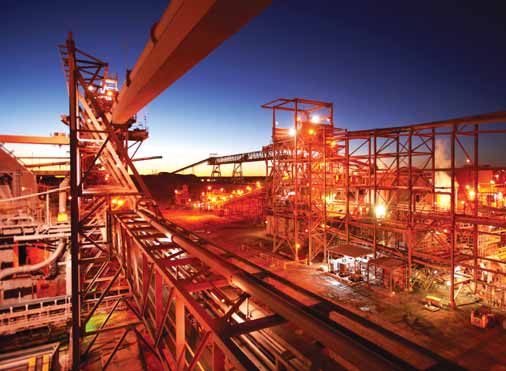

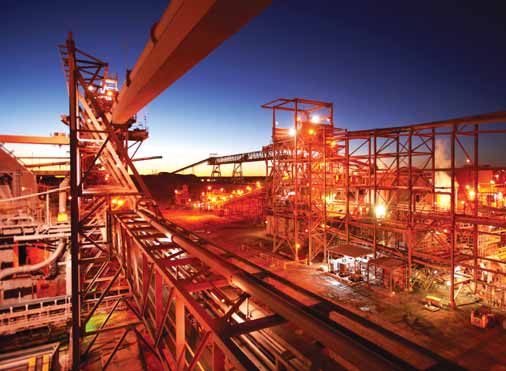

Declining commodity prices and a changing economic picture prompted BHP Billiton to delay advancement of a massive,

Declining commodity prices and a changing economic picture prompted BHP Billiton to delay advancement of a massive,

$30-billion expansion project at the company’s Olympic Dam mining and processing complex (pictured here) in

South Australia. (Photo courtesy BHP Billiton)

Lower commodity prices and higher costs

of production were major contributors to

a 34.8% fall in BHP Billiton’s attributa-ble profit in its financial year ending

June 30, 2012, down to $15.4 billion

from $23.6 billion a year earlier.

Reporting on August 22, 2012, the com-pany noted that attributable profit for the

year included a number of exceptional

items: an impairment of $1.8 billion for

the Fayetteville (United States) dry gas

assets acquired from Chesapeake Energy

in March 2011; an impairment of $355

million for its Nickel West (Australia)

assets; and a $342-million charge for the

suspension or early closure of operations

and the change in status of specific pro-jects, which included an impairment of

the Olympic Dam expansion project

(Australia).

The company is investigating an alter-native, less capital-intensive design for

its huge open-pit Olympic Dam expan-sion project in South Australia, including

possible inclusion of new technologies to

substantially improve the economics of

the project. As a result, it will not be

ready to approve the project before the

December 15, 2012, deadline in its

indenture agreement with the govern-ment of South Australia.

Capital cost of the proposed project

as currently designed has been estimat-ed at about $30 billion. This design

includes a new open-pit mine that would

eventually consume the existing under-ground mine, with potential to increase

production from 180,000 mt/y to

750,000 mt/y of refined copper, plus

associated uranium oxide, gold and sil-ver; expansion of the existing smelter

and construction of new concentrator

and hydrometallurgical plants to process

the additional ore; construction of a

waste rock storage facility; construction

of a new tailings storage facility; and

major infrastructure projects.

BHP Billiton CEO Marius Kloppers

said current market conditions, including

subdued commodity prices and higher

capital costs, led to the decision to

extend the study period for the Olympic

Dam expansion. “As we finalized all the

details of the project in the context of

current market conditions, our strategy,

and capital management priorities, it

became clear that the right decision for

the company and its shareholders was to

continue studies to develop a less-capi-tal-intensive option to replace the under-ground mine at Olympic Dam.”

BHP Billiton currently has 20 major

projects in execution, with a combined

budget of $22.8 billion for its current

2012-2013 financial year. The majority

of these projects are scheduled to deliver

first production before the end of the its

2015 financial year. The company does

not expect to approve any major projects

during its current financial year.

While the past financial year was eco-nomically challenging, BHP Billiton con-tinued to report strong production across

most of its operations. Its West Australia

iron ore operations, in particular, set a

12th consecutive annual production

record, and annual production records

were also set at another nine operations.

Regarding commodity prices, the

BHP Billiton year-end statement said,

“In the short term, we expect volatility in

commodity markets to persist as tempo-rary weakness in the manufacturing and

construction sectors across all key mar-kets is expected to weigh on market sen-timent. However, in the medium term we

expect supportive economic policy and a broad growth bias, particularly in China,

to lead to measured improvement in the

external environment.”

BHP Billiton expects growth in fixed-asset investment in China over this time-frame to support demand for steel-mak-ing raw materials and iron ore prices

specifically, and the company sees the

long-term dynamics for copper as being

particularly positive. Structural operating

and capital cost pressures associated

with rising strip ratios and declining ore

grades at many copper mines suggest

that a relatively steep copper cost curve

should be maintained. “Furthermore, the

need to attract substantial new capacity

into the market every year, if supply is to

keep pace with demand, should provide

long-term support for the copper price.”

As featured in Womp 2012 Vol 09 - www.womp-int.com