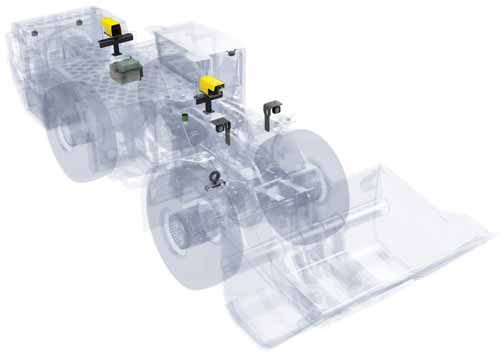

In the underground environment, much of the attention has been on the development of control systems that

enable LHDs to tram and dump autonomously. (Photo courtesy of Caterpillar)

The Drivers of Autonomy

Both underground and on surface, autonomous mining machines are becoming increasingly attractive

By Simon Walker, European Editor

The incentives for increasing levels of autonomy are varied, depending on the mine type and geographical location, but essentially boil down to two main drivers: removing people from potential hazards, and overcoming shortages of skilled per-sonnel. In general terms, the safety aspect is more significant in underground operations, while attracting trained oper-ators to work long shifts is a major headache for companies who have sur-face mines in remote locations—as in Western Australia’s iron-ore industry.

In addition, there is another big plus-point in having machines that can run by themselves: they can do it for longer and they do not need lunch breaks. In conse-quence, a mine can squeeze more pro-ductive time out of each shift, increase the utilization of the equipment, and earn more from its initial investment in the equipment. And that is music to any CFO’s ears.

As Juliana Parreira from the Norman B. Keevil Institute of Mining Engineering at the University of British Columbia pointed out in a paper on mine simula-tions presented at the 2010 CIM meeting in Vancouver, “Automation does not always result in people replacement; on the contrary, it can elevate human capac-ity into higher level decision-making. Whatever the case, workers need a differ-ent set of skills to handle the specialized tasks related to automation and the new technical challenges.

“While at first glance, automation appears to devalue labor by replacing people with machines, in fact, automa-tion leads to advancement in intellectual capacity and higher-skilled mine opera-tors,” she said. “Automation leads to an improved quality of life and better work-space for people, as risks and exposure to unsafe environments are minimized. Automation increases equipment utiliza-tion and efficiency.”

Up to now, the focus in developing autonomous mining systems has been predominantly on drilling and haulage, so it is hardly surprising that the principal players have been the world’s leaders in these fields—Sandvik, Atlas Copco and Caterpillar underground, and Caterpillar and Komatsu on surface. However, none of these companies has been working in isolation, with major input from a raft of specialist suppliers and from academia, especially in the areas of machine control and guidance systems.

Today’s Automated Operations

Although early attempts at increasing the

autonomous capabilities of underground

equipment—in particular LHDs—dated

from before the 1990s, it is fair to say

that few achieved sufficient advantage

over manual operation to be worthwhile.

Where significant progress was made,

however, was with remote-control systems that would at least allow an LHD

operator to load the machine at a draw-point from a place of greater safety.

Tramming was still under direct operator

control, which remains the case for the

vast majority of underground mines.

Higher levels of autonomy are best-suited

to operations such as block caves where

the drawpoint and haulage infrastructure

are developed on a regular grid layout.

Hence, unsurprisingly, mines such as Codelco’s El Teniente and Rio Tinto’s Northparkes were early entrants to using automated LHD systems, while De Beers’ [now Petra Diamonds’] Finsch diamond mine in South Africa has proved the suc-cess of autonomous LHD and truck haulage underground since its introduc-tion there in 2005.

That is not to say, of course, that auto-mated transport systems had not been successful before that—indeed they had, given that LKAB has been using auto-mated trains at its Kiruna iron-ore mine since the 1970s. The key development here has been the massive jump from automating rail-bound transport to track-less haulage, with the requirement for highly accurate guidance systems that can navigate multi-dimensionally.

In 2011, Anna Gustafson at Luleå Technical University in Sweden prepared a report on the history and progress achieved to date in LHD automation. Early work was carried out at Mt. Isa in Queensland, Australia, by the German potash producer, Kali & Salz and, from the late 1980s, by LKAB in northern Sweden. By 2003, LKAB had automated haulage and dumping for around half of its LHD fleet, she said, although loading at draw-points was still under manual control.

In fact, this seems to be a common thread within many of the applications where LHDs have been given some degree of autonomy, ranging from radio-remote to tele-remote, and onward toward complete automation of the load-haul-dump pro-cess. Unless the ore in a drawpoint is very uniform, automated systems find it chal-lenging to achieve a full bucket-load, so the clear trend within the industry appears to have been to maintain operator control of loading. After all, it is less than ideal to gain the benefits of autonomous tramming if the bucket on the machine is only partially full.

Other mines that have either carried out trials on LHDs that run at least part-ly on an automated cycle, or have installed production systems, include BHP Billiton’s Olympic Dam, Malmberget (LKAB), Jundee (Newmont), Stobie and Creighton (Vale Inco), Pyhäsalmi (Inmet), Stawell (Northgate Minerals) and Garpenberg (Boliden). In addition, Rio Tinto evaluated a system at its Diavik dia-mond mine in 2008, while Sandvik recently reported an order from Newcrest Mining for a fleet of AutoMine-equipped LHDs for its Cadia East mine, comple-menting the machines already in use at its Ridgeway Deeps operation nearby.

Heading the Right Way?

With an operator on board, an LHD or

mine truck follows the path set for it,

based on what he or she can see, the

condition of the roadway, and where the

destination is. Following a winding

course is relatively straightforward,

although the risk always remains of

machine damage from running over

spillage or hitting the haulage side walls.

Without an operator, the machine has to navigate itself, which in the main is straightforward if the haulage itself is straight, but presents major challenges once it has to negotiate turns or inter-sections. The development of accurate, reliable navigation systems has been key to the wider implementation of autonomous equipment underground, with each of the leading suppliers— Atlas Copco, Sandvik and Caterpillar— having their own integrated systems that not only guide the machine safely from A to B and back, but also monitor its sta-tus and health and provide management reporting capabilities.

Caterpillar uses MineGem, which it developed in cooperation with the CSIRO in Australia, Sandvik has AutoMine and, more recently, AutoMine Lite, while Atlas Copco uses its Scooptram Automation System on its LHDs and trucks. A signif-icant difference here, Gustafson noted, is that AutoMine is based on absolute navi-gation while the other two systems use reactive navigation concepts. This is im-portant in terms of the guidance infra-structure required, since absolute naviga-tion relies on predetermined coordinates to establish the route a machine needs to take, while reactive navigation uses information gathered continuously by sensors (such as laser distance-measure-ment) mounted on the machine to deter-mine its path.

Driving toward full autonomy thus requires large amounts of data to be transmitted between the machine and its control system, which simply would not be possible without today’s communica-tion networks. Reactive navigation sys-tems, in particular, are iterative in approach, with constant re-evaluation of the machine’s position needed in relation to its environment in order to keep it on the right course.

In one sense, LHDs and mine trucks have an advantage over other vehicles in that they are articulated, with a center pivot rather than individual axle steering. With turning correctly at junctions and bends being critical to the success of an autonomous system, movement of the cen-ter hinge has to be calibrated accurately, as Magnus Olofsson reported in his 2011 thesis for Chalmers University in Sweden.

The thesis, Sensor Calibration for Autonomous Mine Vehicles, described the development of calibration algorithms for the laser sensors and hinge-angle sensors used on LHDs. In addition, Olofsson noted, data for the control system are pro-vided by an odometer and a gyro, with all of the sensors requiring calibration because of the possibility of errors occur-ring from the high tolerances involved in machine construction. With these algo-rithms, calibration data to within the required accuracy can now be obtained by a simple, short-distance journey by the machine, rather than the hazardous task of having to have measurements taken manually while the machine is moving.

Other papers from Swedish re-searchers have looked at the development of the guidance systems needed for autonomous LHDs. At Örebro university, Johan Larsson’s 2007 thesis Reactive nav-igation of an autonomous vehicle in under-ground mines described the development of aspects of the system used by Atlas Copco, while the same author and some colleagues presented a paper at the MassMin 2008 conference that looked at the company’s guidance system as installed at its Kvarntorp test mine facility. A key area of initial concern, they said, was inaccuracy with the ability of the test machine—an ST14—to follow the desig-nated route; subsequent investigation showed that the LHD’s steering hydraulics had been modified from the original design. Following changes to the steering controller, the problem was resolved, but the example illustrates how much fine-tun-ing may be needed before an autonomous haulage system can be optimized.

Development in Practice

Rio Tinto’s Northparkes copper-gold mine

in New South Wales has been working on

various levels of automation for its LHDs

since the mid-1990s (See p. 56). Worked

as a block-caving operation, the mine has

progressed from fully manual to tele-remote to autonomous hauling and dump-ing, with operators on surface taking over

only for loading at the drawpoints.

In its 2012 sustainability report, Northparkes claims to have the most advanced underground automation system in the world operating in its E48 mine. According to the mine’s project manager for loader automation Dr. Joe Cronin, “the automation system represents 12 years of hard work and development.

“Other mines have implemented loader automation but Northparkes is the only mine in the world to have achieved the scale of automation required for a mass mining system,” he is quoted in the report.

Cronin presented reviews of the work undertaken at Northparkes at the Mine Site Automation & Communication con-ferences, held in Australia both in 2011 and this year. With an ore-production rate of 5.5-6 million mt/y, the mine intro-duced block caving technology to Australia in 1997, and commissioned its E48 orebody in 2010.

Automated LHDs are a key enabler for Rio Tinto’s underground mining ambi-tions, he said in his 2011 paper, citing the Argyle, Oyu Tolgoi, Grasberg (in which the company has a stake) and Resolution underground projects as examples. Drivers for the automation pro-gram at Northparkes included safety (removing operators from a potentially hazardous environment, such as reducing exposure to dust and to rock falls, uncon-trolled ore flows in drawpoints and whole body vibration), and productivity, since automated LHDs continue operating nor-mally during shift changes and meal breaks, and can re-enter the drawpoints sooner after blasting.

First trials of autonomous LHDs took place during 2002, then a second series in 2005–2006, with full implementation in the E48 section of the mine in 2010. Not surprisingly, problems emerged, he said, although these were sorted out through input from both the mine and the LHD OEM.

At the 2012 meeting, held in Brisbane in March, the mine technolo-gies superintendent at Xstrata’s George Fisher mine, Marc Wilkinson, was asked about the suitability of using driver-less vehicles in underground mining. Describing it as being ‘totally mine-spe-cific,’ he went on to state that one of the basic criteria for deciding whether to install such as system is: “Can you make it safe for a start?

“Have you got the backbone to do it?” he asked; “Is it feasible, since you’ve got to lock it down.”

Asked what type of risk-mitigation strategies should be in place, Wilkinson said: “Xstrata is looking at incorporating personnel avoidance on our automated loaders to detect people if they area in an area where machines are working. Collision avoidance technology allows us to detect them without human presence.” Systems that can shut down the machine automatically if they detect someone in a restricted area is something that Xstrata will be looking at carefully over the next few months, he added, saying: “It’s some-thing we’ll see in the future.”

Offering some advice to companies that are looking to use remote-controlled vehicles in their underground operations, Wilkinson said: “You’ve got to put all your resources toward it, and have a full understanding that it’s not going to be an easy path. It will take a while for it to be accepted and for the operation to see a true benefit, but with time and patience, and a lot of resources, it starts to pay for itself.”

Of course, autonomous LHDs and mine trucks can only operate safely with-in clearly defined physical limits. “We’ve got standard barricade systems that shut the loader down if it runs through them, and we also have a system where the loader shuts itself down automatically if it runs out of an area where it can pick up control signals,” Wilkinson said. Moving forward, we are looking at collision-avoid-ance systems to give us another way of protection.”

Advice from the Front Line

Until recently, Northparkes was some-what unusual in that it used a hybrid sys-tem for controlling its LHDs, with

Sandvik machines and MineGem

automation. However, for the E48

automation project, it ordered a com-pletely integrated turnkey package from

Sandvik, based on a fleet of five

AutoMine-ready LH514E machines that

was delivered in late 2010. Following an

upgrade to the mine’s control room,

automation of the first zone was commis-sioned in February last year, with the sys-tem fully operational that June.

Speaking at the Brisbane meeting in March, Northparkes’ Cronin provided some information about the results achieved there so far. “Forty percent of the mine’s production comes from auto-mated loaders,” he said. “Production continues over shift change, blasting and re-entry, with no-one underground. That makes a big difference to our hoisting and production systems.

“A good automation operator driving a number of machines will be within 15% of the best manual operator, a good man-ual operator can drive one machine; a good automation operator can drive three machines at once,” he said.

Turning to the corporate and technical skills required for successful automation projects, he said: “The depth of expertise you need to play in the automation sand-pit is very high. If you want to be at the front and innovate then you need a high level of support, and there is a big potential for dis-aster if you don’t have that support.

“The level of immaturity of systems is very important. We worked out that if we want to be innovative, we are not going to be running software that has been run-ning in 10 mines for 10 years. Every-thing that we do from now on will have bugs in it—get used to it. Get a team out there to support it and make sure in terms of safety that you have a bullet-proof barrier between automation and personnel.

“Unrealistic budgets are one of the great killers of automation,” he added. “Automation and innovation require absolute top-down commitment from the very top. It takes years to build up the expertise that one needs to support these systems.”

Reinforcing the point that companies following the autonomous equipment route need in-house expertise and an innovative, ‘geek-friendly’ culture, he advised: “This stuff doesn’t come off the shelf. If you are going to do this, be ready to support it when it doesn’t do what you expect it to, and be in a position—when you have some failures or unexpected behavior—where you as an organization can be involved in working out how you and the supplier move out of that.

“You have to become actively involved,” he stated. And, by the look of things, more and more companies will be doing just that in the future.

|

A Snapshot from the Past In December 1997, the author visited Northparkes to see the operation’s first steps along the road to automated LHD operation. Published in the March 1998 edition of World Mining Equipment magazine, his article was titled “The Rock Factory.” Then operated by North Ltd., Northparkes was commis-sioned in 1994, initially as a small open-pit mine. Around $180 million of the $300 million development cost was spent developing the underground mine there, with an initial target output of 60,000 mt/y of copper and 62,000 oz/y of gold. Tamrock Australia won the contract to supply and service all the underground mobile production equipment. This, as Tamrock’s account manager for the project [at that time], Gary Lyons, told WME, was a major departure for the company. “It made us responsible not only for providing the most appropri-ate machines but also for coordinating other manufacturers and suppliers to the project,” he said. The mine used a fleet of six Tamrock 450E electric loaders that had been developed specifically for it. These were equipped with Tamrock’s CECAM onboard monitoring system, with leaky-feeder telemetry being used to transmit operating data from each unit in tum to a central monitoring station. The block-caving system was brought into production on a manual-control basis first, before moving to tele-remote work-ing. Northparkes’ mining manager at the time, Ross Bodkin, said that it was still too early to speculate on the effectiveness of tele-remote loading. The system had then been successfully commissioned at one of the four drawpoint quadrants, but its introduction as the main production method was not planned until early 1998. Then, he added, tele-remote working would be brought in on a quadrant-by-quadrant basis until all loading operations could be carried out effectively and safely from an underground control center. The article concluded: “With full tele-remote mining likely before the end of 1998, what is the next step for Northparkes? At the time of WME’s visit, Bodkin was noncommittal, but ear-lier presentations made about the project spoke of complete automation of the loading and hauling operation as being the eventual goal.” It happened. |