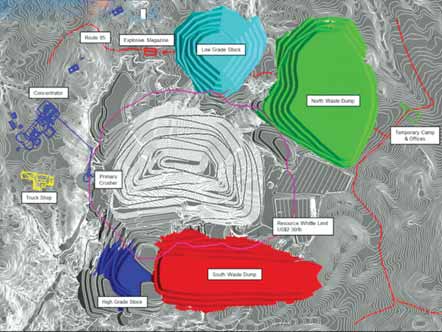

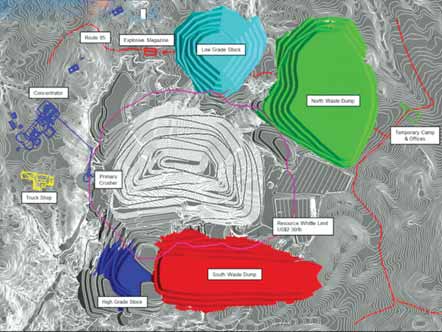

Plan view of mine layout for the Quebrada Blanca Phase 2 expansion project, which will cost an estimated

$5.6 billion. (Photo courtesy of Teck Resources)

Teck Advancing Quebrada Blanca Phase 2

The Quebrada Blanca Phase 2 mine plan includes a mine life of 39 years with-in the designed pit, including mining of mineral reserves, inferred mineral re-sources, leach (supergene) resources, and associated low-grade material. Marginal material would be stockpiled in the early years of operation and fed to the mill in later years. Significant mineral resources outside the mine-plan pit provide potential for expansion in future years, and the mine facilities have been designed with this in mind.

Production of copper in concentrates based on this mine plan is estimated at 250,000 mt/y during years 1 to 5 and 200,000 mt/y life of mine. Production of molybdenum in concentrates is projected at 6,000 mt/y during years 1 to 5 and 5,000 mt/y life of mine. Cash costs for copper, including a byproduct credit, are estimated at $1.07/lb during years 1 to 5 and $1.35/lb life of mine.

Metallurgical test work has confirmed that marketable copper concentrates can be produced, with no anticipated deleteri-ous penalty elements. Copper-molybde-num separation test work has established that saleable molybdenum concentrates can be produced at acceptable recoveries.

The Quebrada Blanca Phase 2 project includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. However, based on the nature of the min-eralization, Teck believes the feasibility mine plan, which includes inferred miner-al resources, represents the most likely ini-tial development scenario for the Quebrada Blanca hypogene deposit.

Teck is in discussions with the other shareholders of Quebrada Blanca concern-ing financing options for the hypogene pro-ject, which may include limited recourse project financing and, possibly, bringing in a new funding partner. A decision to pro-ceed with development will depend on the outcome of these discussions.