Copper cathodes produced at Boliden’s Rönnskär smelter in Sweden. (Photo courtesy of Boliden)

Base Metals: What Lies Ahead?

A look at current developments and the future potential for copper, zinc and lead

By Simon Walker, European Editor

In response, the world’s major mining companies have pushed ahead with new developments, particularly in copper, committing to both new mines and brownfield expansions of existing opera-tions. The big question now, however, is whether their enthusiasm for capacity growth has been well-founded, or whether Chinese demand is set to fall back as the impacts of global economic factors become more widely felt even there.

In April, the U.K. newspaper The Daily Telegraph reported that hedge funds had been increasingly cutting back on their exposure to commodities in gen-eral, and to metals in particular, reflect-ing growing concern within the invest-ment community that slower economic growth in China would depress demand. That has, of course, to be placed in the context of the Chinese government hav-ing earlier this year cut its growth target to just 7.5%, the lowest rate in nearly a decade—and one that most other coun-tries would still watch with envy.

The Chinese forecast revision followed another from the International Monetary Fund, which suggested 8.2% growth there this year, rising to 9.2% in 2013, driven by increasing domestic demand.

Copper, the Bellwether

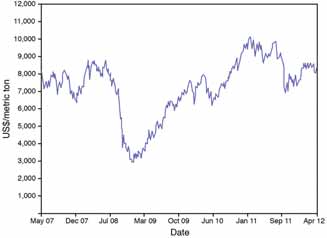

As shown in Graph 1, the London Metal

Exchange (LME) three-months copper

price plunged during the second half of

2009 from a high of nearly $9,000/met-ric ton (mt) to barely $3,000. After that,

though, the metal gained ground fairly

steadily, briefly breaching $10,000 at

the beginning of 2011. A $2,000 slip

from around $9,000 to $7,000 in the

third quarter of last year has been fol-lowed by a period of reasonable stability,

with perhaps the signs of a reaction to

concerns over the Chinese economy visi-ble in the graph in March-April.

Perhaps more interesting has been the relative performance of cash metal versus three-months, with a brief backwardation spike in late February having been the forerunner of a sustained period of backwardation—rising to more than $100/mt—through most of March and April. According to IntierraRMG in the May edition of its Copper Briefing Report, the cause of this premium for cash metal was unlikely to have been tightness in the world market, since Chinese buyers had been building up stocks over the first quarter of the year. During the period, Shanghai stocks more than doubled to some 250,000 mt. More likely, the com-pany surmised, was the presence of one dominant stock-holder on the LME.

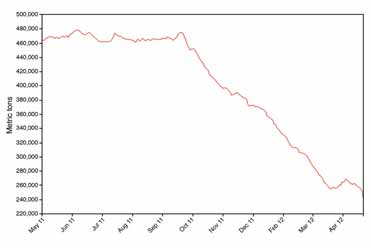

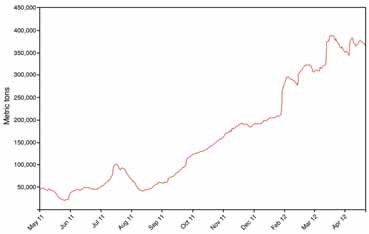

Turning to copper stocks, Graph 2 shows that LME copper stocks remained fairly constant between 460,000 and 480,000 mt between May and October 2011, before starting a sharp reduction to stand at around 250,000 mt by the beginning of May this year. However, as IntierraRMG points out, LME stocks are by no means the whole picture. Add in Shanghai stocks of some 250,000 mt, plus those held by Comex in the United States (around 75,000 mt at the begin-ning of May), and the overall position is more of global exchange stocks remain-ing between 550,000 and 700,000 mt over much of the past year. In fact, what appears to have happened is a transfer of stocks from the LME warehouses to Shanghai.

Graph 1—London Metal Exchange three-months copper price trends, 2007-2012. (Source: LME)

Graph 2—LME warehouse copper stock levels, May 2011 - May 2012. (Source: LME)

Graph 3—LME three-months zinc price trends, 2007-2012. (Source: LME)

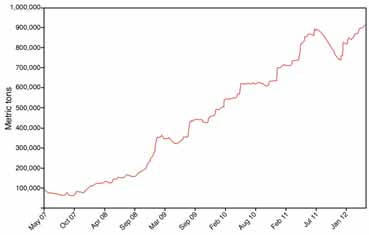

Graph 4—LME warehouse zinc stock levels, 2007-2012. (Source: LME)

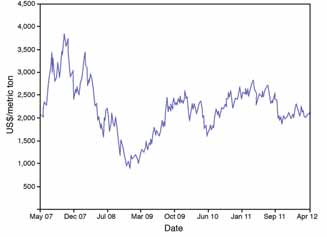

Graph 5—LME three-months lead price trends, 2007-2012. (Source: LME)

Graph 6—LME warehouse lead stock levels, 2007-2012. (Source: LME)

Zinc, Galvanizing the Market

LME three-months zinc prices have

maintained a fairly steady course over the

past six months, trading at $2,000/mt

plus-or-minus 10%. The relative stability

has come, however, after a fairly torrid

time for zinc producers, who saw their

per-ton revenues fall from a high of more

than $4,000/mt in mid-2007 to barely

above $1,000 a year or so later (see

Graph 3). Since then, a return to $2,500

was followed by a period of considerable

volatility before the price fluctuations

appear to have calmed somewhat. Not

that that is much consolation to produc-ers, with zinc having been the worst-per-forming metal on the LME since 2008.

With zinc having been in oversupply for the past five years, it is surprising at first sight to see the price as high as it is. However, as a number of analysts have pointed out, even at $2,000/mt the price is barely adequate to cover mining costs in more than a few cases, with income contributions from co-products helping to balance the books. In addition, the annual surplus has been falling as demand has increased, although the International Lead and Zinc Study Group (ILZSG) is still predicting that supply will again outstrip demand this year.

Galvanizing takes over half of all zinc consumption, so any upturn in steel demand has the potential to stimulate zinc usage. And, with China holding pole position in terms of steel production, all eyes remain firmly fixed on that market for signs of renewed buoyancy.

In the mean time, stocks worldwide remain uncomfortably high. As Graph 4 shows, the fall in LME stocks that occurred in the second half of 2011 did little to stem the seemingly inexorable rise that began in late 2007 and has con-tinued almost unabated since. By April of this year, the LME warehouses held over 900,000 mt of zinc, with metal held at the Shanghai Futures Exchange increasing this total to some 1.2 million mt— equivalent to more than a year of U.S. demand, according to Bloomberg.

Lead, with Capacity to Spare

With lead usage so closely aligned to

automotive battery production—some

85% of the total consumption world-wide—producers are largely dependent

on the fortunes of the car industry for any

buoyancy in the market. And, with much

of the world’s primary lead being a co-product with zinc and copper, there is lit-tle opportunity for producers to constrain

their output when prices are low, as

might be the case with other metals.

LME lead prices (see Graph 5) reached a peak in early 2007, with a subsequent decline from an admittedly unusual near-$4,000/mt to less than $1,000 two years later. Subsequent gains have, as with zinc, tended to stabi-lize at or just above $2,000/mt since the third quarter of last year, with the market going into backwardation during the first half of 2011 before returning to normal trading thereafter.

It is worth remembering, of course, that the lead market is different from that in other commodities because such a high proportion of the metal is recycled. According to one presentation at the ILZSG annual meeting last September, the lead-acid battery recycling rate in North America stands at around 98% with, presumably, other developed mar-kets also achieving a high recycling rate. The same is probably less true, however, for developing markets, which conversely have the principal growth in consumption as transport systems expand and vehicle ownership increases.

ILZSG data suggest that primary lead production has exceeded demand since 2008, with no sign of the market regain-ing balance this year either. As a result, world stocks (producers, consumers and exchange warehouses) have risen steadily, from around 250,000 mt in 2007 to the current position above 600,000 mt. Of this, the LME holds more than 350,000 mt, as shown in Graph 6. The Shanghai Futures Exchange is a relatively recent entrant as a lead stock-holder, its stocks having grown from nothing to around 70,000 mt over the past two years.

Major Developments in Copper

In March, Stockholm-based Raw

Materials Group (part of IntierraRMG)

made the observation that although mine

and refinery copper production has con-tinued to rise, production from large-sized

mines has not increased in the last 10

years. Current production growth, the

company said, is the result of an increase

in smaller-sized mines.

That statement could, in fairness, be tempered with the rider that a number of large producers have increased capaci-ties with expansion projects, but the point remains valid: few big greenfield copper projects have come on stream during that timeframe.

According to preliminary figures from the International Copper Study Group (ICSG), world primary copper production stood at 16.04 million mt in 2011, vir-tually the same as the previous year. This represented a 79% capacity utilization rate, the organization believes, with nameplate mine capacity standing at 20.3 million mt. Total refined copper production, including secondary materi-al, reached 19.65 million mt, 650,000 mt more than in 2010.

The leading world producers last year included Codelco (1.79 million mt), Freeport McMoRan Copper & Gold (1.35 million mt), BHP Billiton (1.05 million mt), Xstrata (889,000 mt), Anto-fagasta (640,500 mt), Anglo American (599,000 mt), KGHM (571,000 mt) and Rio Tinto (520,000 mt).

Looking first at brownfield projects, a number of the copper majors have capac-ity expansions at various stages of study or construction. Having already given approval for an upgrade there, mid-last year Anglo American and its partners began new studies into a further expan-sion at Collahuasi in northern Chile. This would increase its annual output to between 800,000 mt and 1 million mt, depending on the scale of the project, with commissioning in 2017.

The Collahuasi expansions have been undertaken in parallel with those at other Anglo American operations in Chile, with the first production from its capacity increase at Los Bronces having arrived last November. Anglo is aiming to double its copper output from the mine to near 450,000 mt/y with the project. However, the company’s decision to sell a 24.5% holding in Anglo American Sur (AAS) to Mitsubishi for $5.39 billion at the end of last year strained its relationship with Codelco, which has a long-standing option over a holding in AAS.

Codelco itself plans to invest $4.3 bil-lion at its operations this year, with $1.15 billion targeted at construction of the Ministro Hales mine and $400 million at El Teniente. More than $230 million will be spent on the feasibility study for taking Chuquicamata underground, with other studies under way on projects at Andina, Radimiro Tomic and San Antonio.

In the U.S., BHP Billiton is spending $195 million on restarting its Pinto Valley operation in Arizona, with a year-end start scheduled for a 60,000 mt/y operation. In Chile, it has committed $4.5 billion (along with its partners) for two projects that will expand Escondida’s output even further, while confirming new increases in the operation’s reserve base. However, the company’s major cop-per-orientated development project remains Olympic Dam, where a feasibili-ty study is now in progress. The project, which includes a new open-pit mine and expanded plant facilities, has the poten-tial to increase copper production there from 180,000 mt/y to 750,000 mt/y, plus gold and uranium, with a provision-al price tag of some $8.2 billion.

In southern Peru, the first blast at Xstrata Copper’s Antapaccay project took place in March. In 2010, the company committed $1.47 billion in capex to develop the deposit, which is 9 km from its existing Tintaya mine. Based on a re-source of 817 million mt grading 0.51% copper, Antapaccay will produce an average 143,000 mt/y of copper over a 22-year life.

Greenfield Copper Projects

Major new greenfield copper projects that

are currently at various stages of devel-opment include Antofagasta and Barrick

Gold’s Riko Diq in Pakistan, Barrick’s

Jabal Sayid in Saudi Arabia, and

Xstrata’s Tempakan in the Philippines. In

Mongolia, Rio Tinto and Ivanhoe Mines

are developing Oyu Tolgoi, while Rio Tinto

and BHP Billiton have their Resolution

Copper project in Arizona. In Chile,

Antofagasta gave the go-ahead in

December for the development of

Antucoya at a cost of $1.3 billion and

sold a 30% stake in the project to

Marubeni—with whom it is already in

partnership at its Los Pelambres, El

Tesoro and Esperanza mines.

According to Antofagasta, Riko Diq now has a porphyry-hosted resource of 5,900 million mt grading 0.41% copper and 0.22 g/mt gold. A feasibility study has indicated an initial output of 190,000 mt/y of copper and 270,000 oz/y of gold from a 110,000 mt/d operation, with a $3.3-billion capex cost. Last November, however, the Balochistan government refused an application for a mining lease for the project, with the joint venture oper-ating company, Tethyan Copper Co., hav-ing subsequently sought international arbitration to protect its rights.

Due on stream mid-this year, Jabal Sayid will add between 45,000 and 60,000 mt/y to Barrick’s copper output, which is currently sourced from its Zaldivar mine in Chile and from Lumwana in Zambia, acquired with its takeover of Equinox Minerals last year. Jabal Sayid carries a $400 million con-struction cost, and is based on a 550,000 mt copper reserve.

Tempakan, which Xstrata controls through its subsidiary, Sagittarius Mines Inc., has a total resource of 2,940 mil-lion mt grading 0.51% copper and 0.19 g/mt gold. A feasibility study, completed in 2010, envisages an operation with a capacity of 375,000 mt/y of copper and 360,000 oz/y of gold over an initial 17-year life, with a capex cost of $5.9 bil-lion. If permitting is achieved, production could start by 2016, Xstrata believes.

Meanwhile, Xstrata is also involved in the Frieda River project in Papua New Guinea, in partnership with Highlands Pacific. The most recent resource esti-mate, covering the Horse-Ivaal-Trukai (HIT) deposit, totals 2,090 million mt grading 0.45% copper and 0.22 g/mt gold. A pre-feasibility study was delivered on the project in 2010, with a full feasi-bility study now scheduled for completion by the end of this year as the partners eval-uate alternative power-supply options. The earlier study envisaged an operation capa-ble of producing 190,000 mt/y of copper and 280,000 oz/y of gold for 20 years.

In April, Rio Tinto announced the provi-sion of a further $3.3 billion in interim financing to 51%-held Ivanhoe Mines, to enable it to complete construction at Oyu Tolgoi. Commercial production is sched-uled to begin next year, with the mine set to become one of the world’s 10 largest copper producers, the company says. Reserves of 1,400 million mt grade 0.94% copper and 0.35 g/mt gold. An annual out-put of 450,000 mt of copper and 330,000 oz of gold will come from both open-pit and underground operations, with the pre-pro-duction cost of development having been put at some $6 billion. Of this, $4 billion had been spent by the end of last year.

Other Rio Tinto copper projects include Resolution, close to the old Magma mine in Arizona. Two words ade-quately sum up the potential there: ‘big’ and ‘deep.’ The project has an inferred resource of 1,624 million mt grading 1.47% copper and 0.037% molybde-num. Current work involves sinking an exploration shaft to more than 2,100 m (7,000 ft), with a pre-feasibility study scheduled for completion by the year-end and an initial target for production from 2021. Production at a rate of more than 450,000 mt/y would satisfy a quarter of U.S. copper demand. Project optimiza-tion depends in part on the successful outcome of a proposed land-trade with various government agencies.

And this is by no means the complete list of copper-focused projects currently at various stages of evaluation or devel-opment. Indeed, the Raw Materials Group, in E&MJ’s annual mining invest-ment survey (January 2012, pp.24-29), listed no fewer than 37 significant cop-per projects worldwide, each carrying a price tag of at least $1.5 billion. Pebble East (Alaska), Agua Rica and El Pachón (Argentina), Las Bambas, Quellaveco, Toromocho and La Granja, (Peru), Cobre Panamá (Panama), El Arco (Mexico) and Udokan (Russia) are just some of these.

Zinc and Lead: New Capacity Needed

Three companies dominate world zinc pro-duction: Vedanta Resources, Xstrata and

Teck, with other significant players in the

market including Minmetals Resources,

Glencore, Volcan Cia Minera, Boliden and

Sumitomo. In terms of zinc smelting,

Nyrstar is the individual leader by a con-siderable margin, followed in capacity

terms by Korea Zinc, Xstrata, Boliden,

Glencore, Votorantim and Vedanta.

Speaking at the ILZSG annual meet-ing, Stephen Wilkinson, executive director of the International Zinc Association, reminded delegates of the increasing role being taken by Chinese companies in world zinc production. High-profile projects involving Chinese investment include Dudar (Pakistan), Turmurtin (Mongolia), and Broken Hill, Rosebery and Century (Australia), while Chinese interests now have a 17% equity stake in the main Canadian zinc producer, Teck. Chinese control now totals around 37% of the world’s mine supply, he said, with further interests in development projects such as Izok Lake, Wolverine, Dugald River and Selwyn.

Recent consolidation within the zinc industry has included Vedanta’s purchase of Anglo American’s zinc interests, and Nyrstar’s acquisition of Breakwater Resources. Meanwhile, recent additions to supply have included Al Masane (Saudi Arabia; 25,000 mt/y), Halfmile Lake (Canada; 55,000 t/y), Wolverine (Canada; 53,000 t/y) and expansions at both Colquijirca and Antamina in Peru, which have added 115,000 t to the mar-ket. This year, the commissioning of Perkoa in Burkina Faso should bring 90,000 t of new capacity.

However, as Brian Hearne, COO for Xstrata Zinc in Australia, told analysts in a presentation last year, over the next few years new capacity coming on stream looks likely to fall well short of capacity lost through mine closures. Actual and potential closures during 2012-2013 include Brunswick, Perseverance and El Mochito, he said, while mines set to close by 2015 include Century, Lisheen, Duck Pond and Golden Grove.

With Skorpion, Myra Falls, Canning-ton, Guemassa and Cayeli probably all being exhausted by 2017, cumulative lost production will then run to 1.9 mil-lion mt of zinc and 470,000 mt of lead, he said. Against this, new projects will contribute 800,000 mt/y of zinc and 150,000 mt/y of lead.

With expected mine closures, the zinc industry will need to develop about 7 mil-lion mt of new mine capacity by 2020 and about 14 million mt by 2025 in order to meet expected demand, he added. Comparable figures for new lead-produc-tion capacity would be 2 million mt/y by 2020 and 4 million mt/y by 2025.

Xstrata is currently expanding capa-city at its George Fisher mine in Queensland, having already undertaken a deepening at its Black Star open-pit. An expansion at its McArthur River mine is targeted to come on stream in 2014, while construction began last year at its Lady Loretta deposit, where capex of A$460 million has been identified. In April, Xstrata confirmed A$87 million in addition expenditure to boost its zinc production by 5%, with accelerated development at Lady Loretta and an extension to Handlebar Hill.

Which Way Now?

Although there are concerns over the

future supply and demand balance for

zinc, much of the current attention is on

copper. According to IntierraRMG in a

report earlier this year, “new mine pro-jects will begin to impact the rate of cop-per supply growth from 2013, with annu-al rates of increase in excess of 4% per

year. However, given an expected modest

revival in consumption growth and a

reduced contribution from scrap, the

supply-driven slide into surplus will be

gradual rather than dramatic,” the com-pany suggested.

In its BME Copper Quarterly Report, IntierraRMG noted that it expects the refined copper market to remain close to balance this year and next, but to be sub-ject to larger surpluses by 2015-2016.

In terms of price predictions, the com-pany’s director for base metals, Paul Dewison said: “With the physical market for copper remaining quite tight through 2012 and 2013, prices are forecast to remain within sight of $8,000/mt. As the impending surplus becomes more evident late in 2013 and into 2014, prices should reduce to around $6,000/t in 2016.”

For zinc, the situation is somewhat different, of course, with the projected imbalance between capacity gained and lost helping to eradicate the supply sur-pluses of recent years. Quoted by Bloombergin an article published last October, Gavin Wendt, senior resource analyst at Mine Life Pty, said: “I’m bull-ish with regards to zinc over the next two to three years and even longer.

“Given the level of underlying demand for zinc and at the same time the fact that new reserves are not being added, there is going to be a supply-side problem to emerge over the next few years.”

As with so many commodities, the world’s mining companies are becoming increasingly reliant on China to keep demand for base metals strong. Because of this, producers have managed to weather the economic storm in remark-ably good economic shape. The big ques-tion remains, however—how long can they continue to do so?