A recent study indicates that overall mine-fleet machine productivity may be declining, despite advances in

equip-ment and data-acquisition capabilities that potentially bolster fleet-management performance

improvements.

Fleet Management: Challenges and Choices

Regardless of whether it’s done in-house or by an outside organization, experts say successful fleet management starts with a basic premise: know your operation

By Russell A. Carter, Managing Editor

Taking into account the industry’s impressive physical capabilities to move dirt and rock, along with its ability to har-vest mountains of data from its ongoing operations, it would seem that mining fleet management and optimization would be relatively straightforward routines—just a matter of plugging in the collected data, comparing the results with objectives, and making needed adjustments. Unfortun-ately, on-the-ground realities such as unscheduled downtime for critical equip-ment, operator error, adverse weather—not to mention equipment-purchase budget limitations—can highjack the most care-fully laid plans. Even the basic definition of what constitutes fleet-optimization success can differ significantly from company to company, and site to site.

In some cases, a notable increase in fleet optimization might be achieved simply by identifying and correcting a downstream process bottleneck that skews fleet per-formance negatively; or it may be as com-plex as adjusting a long-term mine plan to provide higher overall excavation efficiency and more favorable real-world haulage routes and times. From a management per-spective, the goal is generally to see a rela-tively smooth fleet-purchase curve, rising gradually from mine startup and declining in its final years, avoiding abrupt peaks and valleys that often represent reactive reme-dies to unforeseen problems.

Like most measures of mining activity, fleet optimization is an exercise judged by numbers. Numbers that “look good” upon cursory review may conceal ongoing, site-specific inefficiencies that rob productivi-ty—but also may leave room for significant optimization improvements (See Un-earthing Hidden Opportunity in Mobile Mining Equipment Utilization, p. 90). However, on a ‘big picture’ basis encom-passing global industry performance, a recent analysis by a productivity expert indicates that general machine productivi-ty is decreasing rather than improving, despite technological advances.

Adjusting Expectations

In many instances of unrealized machine

productivity, the underlying cause may

simply be unreasonable expectations,

according to Graham Lumley, CEO of GBI

Mining Intelligence, a Brisbane, Australia-based consulting company specializing in

mining equipment productivity. The com-pany has been gathering production data

from trucks, rope shovels, front end load-ers, hydraulic excavators, backhoes and

drills since 1988.

In a 2011 paper titled Mine Planners Lie with Numbers 1 , Lumley asserted that the mining industry’s practice of bench-marking against industry standards—i.e., forecasting equipment performance based on data from a population of similar machines—can lead to wildly over-opti-mistic predictions of equipment perform-ance rates. “This similar population may reflect make and model of equipment, commodity, geographic location, diggabili-ty, pit layout, etc.,” Lumley said. “This should not try to forecast what events will impact a particular piece of equipment but should rather attempt to place the piece of equipment on a statistical distribution of current outcomes for the population.

“Planners, in conjunction with [project] owners, must develop a rationale for likely performance,” he said. “It is the author’s experience that nearly all mine people believe they can perform in the 75 th per-centile or above, and this is where fore-casts are often targeted. Logically, only 25% of mines using a particular make and model of equipment achieve this rate. This should not provide comfort to financiers and shareholders.”

In another recent paper 2 , Lumley exam-ined surface-mine equipment performance data collected from the 1980s through 2010 in Australia and globally, and came to the startling conclusion that after a major rise in productivity that peaked in 2000–2001, productivity has declined steadily ever since—not just in Australian mines but in every major mining region of the world. The productivity slump essen-tially wiped out the gains achieved earlier and has left the industry performing at lev-els last seen in the mid-1980s.

The dropoff includes all major produc-tion equipment categories, including draglines. A sampling of the results:

• Median performance (defined as repre-senting collectively what the industry is

actually doing with a certain class or

model of equipment, as opposed to best

practice, described as theoretically what

the class of equipment is demonstrably

capable of) of rope shovels in hardrock

and coal has dropped noticeably, ranging

from Australia’s 47% decline to South

America’s 28% falloff since 2000.

• For hydraulic excavators, the decline is

as high as 69% (Africa) in 2010 after

peaking in 2006-2007. Australia, North

and South America all follow the same

general trend, falling between the higher

productivity (Asia) and lower productivity

(Africa) extremes.

• Globally, median wheel loader output has

dropped 39% during the past three

years, topped only by a 41% slump in

median haul-truck output over the past

four years.

• When comparing median performance

for all the above machine categories with

best practice results (i.e., the average of

the top 10% of machine performance)

over the past several years, the difference

between the median and best-practice

population is widening, with the gap

growing in some cases to low triple-digit

percentages.

Lumley did not attempt to list or inter-pret any specific causes of the productivity decline, leaving his results as a challenge to others in the industry to use the infor-mation to improve future performance.

Start with the Basics

Companies intent upon improving their fleet

optimization performance can follow two

separate avenues: do it in-house by select-ing and applying either internally developed

policies and criteria or adopting a commer-cial software solution; or, contracting part or

all of its fleet management requirements to

an FMS specialist organization.

Vivien Hui, a mining engineer who has written extensively on fleet management and optimization, recommends that a mine facing demands for increased production and reduced operating costs—both to be achieved without additional capital equip-ment—should look first at harvesting any ‘low-hanging fruit.’

Hui, who also publishes a blog from her website www.vivienhui.com, offers a list of basic, performance-related questions that should be asked and answered before con-sidering more drastic alternatives. With regard to loading and haulage, she recom-mends mine managers ascertain:

• What is our shovel operators’ one-pass time?

• What is the bucket fill percentage? Are our

operators filling the bucket so that a five

pass load doesn’t turn into six passes?

• Is the operator getting the face ready

while waiting for the new truck?

• How often is our loading unit sitting idle?

Are we over or under trucked?

• Are we losing shovel teeth that are jam-ming the crusher? If so, should we be

looking at technology to detect the metal

and get to it before it gets to the crusher?

• Are we tracking shovel payload to more

accurately reconcile our end of month

surveyed tons?

• What are, and how long are, our major

haul truck delays, including shift change?

• Are we hot-changing to reduce equip-ment downtime and if not, is this some-thing we should be considering?

• What is our truck operators’ spotting time?

• How many trucks do we have running at

any given time and is this adequate to

feed the crusher? Do we need to start

parking some trucks because of frequent

queuing at the shovels?

• Do we have enough manpower for our

equipment or are we parking equipment

because we don’t have anyone to run it

when there are no downstream restric-tions (e.g., crusher capacity)?

• What is the truck load profile? Are we

leaving enough room at the back so we

are not spilling rock on the haul road?

• Are our truck scales calibrated? Do we

check struts for calibration regularly

during PM?

• Is there carryback in our trucks that we

should address with a specific type of

lining or a new truck box design?

• Are we entering our haul routes along

with our equipment parameters into a

haulage program to determine the target

cycle time? Are we achieving this cycle

time? If not, why?

If a decision is made to acquire a fleet management system, Hui warns there is not a single, universal objective that applies to every mine site; there are always different reasons behind each project: higher production, lower costs, better material blending, production monitoring, tire management, etc.

The key is to find the best fit, and the opening stratagem is to explore a list of evaluation criteria and functional require-ments against which fleet management systems can be compared. A evaluation committee should determine the priority of each item listed; i.e., how important is this feature or that capability for the mine/com-pany right now? Invite FMS vendors to respond to your functional requirements list, then calculate a weighted score of each based on the priorities of your busi-ness. Company culture, global footprint, challenges and vision will dictate which factors are more important than others.

Hui’s suggested list of evaluation crite-ria and functional requirements of fleet management systems is as follows:

• Data collection, recording and produc-tion reporting.

• Truck optimization algorithm.

• Machine health/real time condition

monitoring.

• Machine guidance for LP and HPGPS.

• Operator training capability and fast

feedback.

• Underground R&D–for companies that

want to standardize systems at both sur-face and underground mines, this may

be an important factor.

• Sustainability–ongoing development, sta-bility of company, vision and business

plan, upgrade paths offered for next gen-eration technology.

• Integration with other systems (e.g., ERP,

reporting software, maintenance user

interface, machine sensors, etc.).

• Regional service and support.

• Cost–compare apples to apples (e.g., a

turnkey proposal should be compared

against a turnkey proposal including all,

if any, integration costs).

• Regular training programs offered.

• Change management: in-house or third

party.

• Support modules available: payload, tire,

consumables, fuel, material blending,

languages, etc.

• Requirements for dispatch personnel;

option to run the system unmanned?

Under each subject above, there should be a subset of requirements that are further detailed; this subset of requirements may be created by the respective departments or by a third-party consultant if you do not have in-house expertise. For example, under payload monitoring, a mine may list payload moni-toring system, payload recording events, car-ryback weight and conversion of wet weights as its second-level requirements.

Finally, after receiving responses from a vendor and creating a weighted scoring system, contact other clients using the vendor’s products or services to validate the information you’ve been given.

Setting Up an Effective FMS Contract

For companies that are interested in explor-ing the benefits of transferring the burden

of fleet management to a specialist organi-zation, thus allowing closer focus on its

core business of extracting value from min-eral deposits, the recent announcement of

a £100-million ($158-million), 10-year

fleet management contract between con-struction-materials giant Lafarge and U.K.-based Babcock Group International pro-vides an example of the groundwork, infor-mation exchange and ongoing interaction

between vendor and client needed to

implement an effective FMS arrangement.

The contract covers fleet management services provided by Babcock to Lafarge’s North American aggregate and cement operations, and follows a £50-million con-tract awarded to Babcock by Lafarge in mid-2011 for similar services at its U.K. aggregate and cement sites.

Babcock’s mining and construction business director, Keith Holland, told E&MJ the scope of the Lafarge North America FMS contract covers full repair and mainte-nance service on all mobile equipment (ME) covered within the agreement, as well as procurement, condition monitoring and replacement/disposal. This applies to the ME within Lafarge’s Aggregates and Cement businesses in the U.S. and Canada covering 200 sites. Babcock will use fleet management experience from a range of industry sectors to improve performance and drive down the whole life costs.

A key part of the service, according to Holland, is management of the supplier network, from OEMs through to small busi-nesses, that provide the services and parts required to maintain Lafarge’s fleet. Babcock ensured early engagement with the supply chain, recognizing it was a crit-ical success factor for a swift and seamless transition. Suppliers were tiered 1–3 to ensure appropriate engagement reflecting their relationship with Lafarge. Before work started, Babcock established accounts with Lafarge suppliers to ensure scheduled and unscheduled maintenance never stalls through a lack of commercial agreements.

Holland explained that, currently, there are no Babcock personnel on site at Lafarge’s North American operations. Babcock’s dedicated Managed Service Center in Towson, Maryland, USA, manages calls and requests from all North American Lafarge sites. The center handles manage-ment of scheduled and unscheduled main-tenance and maintains fleet management records on each item of covered equipment. Based on requirements, all maintenance and repair work is carried out on site within Lafarge workshops or through the estab-lished supply chain. Babcock’s regional managers work closely with the customer and local suppliers, conduct regular visits to sites, and schedule regular reviews with their Lafarge counterparts to review performance and service-level agreements (SLAs).

Holland said the contract award was preceded by roughly 15 months of negotia-tions and data collection activities with Lafarge, spanning initial conversations to mobilization of the system in the U.K. and North America. “It is critical for the suc-cess of the contract that the potential cus-tomer shares data, working practice, sup-plier experience, and performance history and business targets. This is obtained through a joint working party, site visits, and engagement with regional managers/ key people and suppliers at an early stage.”

Applying customized software and ongoing interaction with Lafarge, Babcock gathered information that had previously been difficult to capture to build a view of Lafarge’s fleet. Armed with data that included a fleet list covering all assets, cat-egorization of fleet items as critical, core, spare, etc., site and regional ‘seasonality’ and operating rules hours, and environ-mental considerations, Babcock imple-mented its core program by categorizing assets according to their criticality to Lafarge’s operation.

Holland explained that the arrangement includes various guarantees in the form of SLAs on agreed delivery and availability requirements that Babcock must meet. These are reviewed on a monthly basis, with more comprehensive reviews held quarterly and annually. As the contract pro-gresses, it is expected to drive improve-ments in a number of key areas which could result in lower cost per ton for the customer, such as:

• Improved fleet utilization and availability;

• Increased machine productivity;

• Increased component lives;

• Implementation of industry and equip-ment management best practice;

• Fuel burn reduction; and

• Efficiency savings.

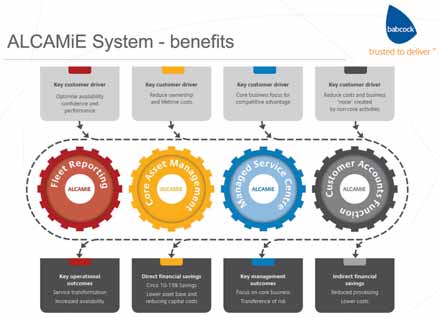

A key element of Babcock’s approach to fleet management is ALCAMiE, its propri-etary solution that includes customized Web-based software generating informa-tion to enable correct strategic and opera-tional decisions. Babcock describes ALCAMiE as a ‘transformational’ approach to managing the entire lifecycle of each asset, applying granular data and matching it with established asset-management practices (see accompanying diagram). It believes the benefits that ALCAMiE can deliver are not exclusive to one aspect of the mining and construction industry; the principles behind the approach can be used across the sector, giving customers the confidence to concentrate on adding value to their core operations.

References:

1. Lumley, Graham. Mine Planners Lie with Numbers , GBI Mining Intelligence white paper, November 30, 2011.

2. —. Trends in Performance of Open Cut Mining Equipment, GBI Mining Intelligence white paper, February 20, 2012.