Attendees at The Mining Forum, held in mid-October in Johannesburg, South Africa, were offered more

Attendees at The Mining Forum, held in mid-October in Johannesburg, South Africa, were offered more

than two dozen pre-sentations on drilling and blasting technology and best practices. Inset: During the

event, sponsored by Sandvik and sup-ported by AEL and Thunderbird Pacific, a check from forum

proceeds for more than $12,000 was presented to Compass, a South African charity organization focused

on care and education of abused women and children.

The success or failure of an individual

blasthole to achieve its intended effect

doesn't carry much statistical clout in a

blast pattern comprising up to 1,500

holes, or at a mine that routinely conducts

multiple daily blasts—or across a global

industry that measures total daily blasthole

production in the five-figure range or high-er. It's only when the reasons for consistent

drilling and blasting (D&B) success or fail-ure become systemic to an operation that a

noticeable change in productivity becomes

apparent, occasionally leading to spirited

discussions within and between mine

departments about "what are we doing

wrong?" or much less frequently, "What are

we doing right?"

As described by an experienced appli-cations engineer for one of the major drill-equipment suppliers, D&B is "all about

putting the right amount of energy in the

right place at the right time at minimum

cost to achieve maximum control over the

shot rock volume and the resulting particle

size distribution in the muck pile." The

benefits of a well-designed blast—or the

repercussions of a poorly executed D&B

plan—reverberate far away from the actual

blast site, as shown in the accompanying

diagram that depicts how various elements

of D&B practice can influence downstream

operations

.

Although the physics of sinking a sim-ple hole into the ground seem straightfor-ward, the path to consistently effective

D&B strategy meanders through a thicket

of thorny issues that demand attention,

ranging from an understanding of local geo-logical conditions, proper drilling equip-ment selection and climate considerations,

to the type of explosives required or locally

available, for example. Accompanying

those considerations are other factors such

as volume of material to be excavated

according to mine plan, hole diameter,

optimum bench height, stemming material

source, fragmentation requirements, and

desired level of equipment utilization and

availability, among others.

Adding to the technical difficulty is the

quick pace of daily job duties, technologi-cal progress and product introductions

that can make it hard for mine personnel

to stay current on best practices for D&B

success. In October, Sandvik Mining &

Construction convened its first Mining

Forum, aimed at bringing participants up

to date by focusing on fundamentals as

well as recent technological developments

in surface-mine drilling and blasting oper-ations. The three-day event, which includ-ed 112 participants from 25 mineral pro-ducers and mining contractors, was held

in Johannesburg, South Africa, against the

backdrop of the African continent's vast

mineral potential—and equally immense

needs for drilling and blasting equipment,

techniques and management strategies to

effectively cope with its widely varying

mine-site conditions.

Realizing Regional Potential

Although most forum presentations

addressed specific aspects of D&B prac-tice, leadoff speaker Chris Brindley, presi-dent of Sandvik Mining & Construction

Region Africa, began by highlighting

Africa's strengths and weaknesses as they

relate to the global mining industry.

Noting that it's somewhat difficult to men-tally grasp the sheer size of the continent,

Brindley displayed a slide showing how

outline maps of the United States,

Western Europe, China, India and

Argentina could all be superimposed upon

a map of Africa—with room to spare. Its

30.3-million km2 of land area contain

mineralization currently representing about 90% of the world's known platinum

resources, 80% of its chromite, 65% of

diamonds and 40% of gold. Its 2010 esti-mated population of 1.013 billion people

account for 14.8% of world population—a

share that is expected to grow to 24% by

2050—and 60% of the current popula-tion is under the age of 24.

The positive or negative effects of a mine's drilling and blasting methods extend far beyond the blasthole

or blast pattern. (All figures courtesy of Sandvik Mining and Construction.)

However, the challenges facing African

economic development are equally expan-sive, including the threat of nationalization

of private assets, political corruption and

instability, the prospect of increased taxa-tion on mining, a shortage of skilled work-ers and difficult logistics.

"Africa is probably the wealthiest conti-nent in the world when it comes to miner-als," said Brindley. "But as you can see, it

faces a lot of challenges. Until [these chal-lenges] are resolved, it will be difficult to

get major capital funding for projects in

this part of the world."

On the other hand, he noted, "Africa is

one of the best places in the world to find

new orebodies."

Brindley said Sandvik currently has

business operations in 12 African coun-tries, employing roughly 3,250 workers;

and eight distributors throughout the

continent.

Determining Drillability

In addition to the regional macro-eco-nomic trends and political issues, Africa-based mineral producers share mine-site

operational challenges that are common

throughout the global industry. Among

these, the search for improvement in D&B

economics may not be paramount in the

list of cost-cutting concerns but is defi-nitely rising rapidly in importance.

Several of the forum's presentations dwelt

on fundamental aspects of identifying

and selecting the most appropriate

drilling equipment and methods for a

given application.

Charles Deacon, Sandvik's vice presi-dent of marketing for the Africa region,

explained that D&B activities may account

for as much as 15% of total production

costs, and are actually the most control-lable of these costs. Across an entire oper-ation, D&B can affect excavation rates,

cost of loading, secondary breakage

requirements, ore grade dilution, process-ing rates, slope stability concerns and mine

site safety.

One of the basic informational needs

for determining the best drilling approach

for the application, said Deacon, is knowl-edge of rock mass "drillability"—defined

by three factors: drilling rate (penetration),

bit wear rate (time elapsed between

regrinds), and bit life (distance drilled

before reaching end of economic bit life).

The most well-known indicator of drillabil-ity is the Drilling Rate Index, a relative

measure of penetration rates in a given

rock type. DRI is determined by two com-mon tests that measure rock toughness

and rock surface hardness. In general, the

lower the DRI, the lower the drilling rate

that can be expected, and vice versa.

Armed with knowledge of local rock

characteristics, the customer still faces a

long list of factors that must be considered

when choosing the proper drilling method.

These involve both technical and commer-cial issues, according to Deacon, and

include:

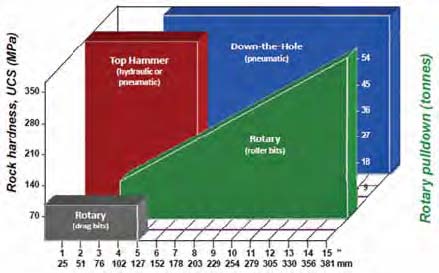

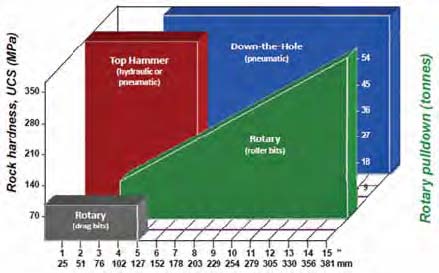

Recommended effective material and hole-diameter ranges for each major drilling method.

Technical:

• Hole diameter

• Hole depth/bench height

• Production rate

• Size of operation

• Terrain/mobility/flexibility

• Special techniques required

• Legal requirements – dust, noise, etc.

Commercial

• Rock hardness

• Hole angle

• Power availability

• Ownership

• Price

• Fleet size

• Economic life

• Technical support

• Parts supply

• Training

• Operating cost

Putting Together the Right Rotary String

For those operators considering rotary

drilling methods, Mark Baker, Sandvik's

global product line manager for rotary tools,

highlighted the physical limits of the equip-ment and the importance of using the prop-er drill string and bit setup. He emphasized

that effective control of the feed and rota-tion applied by a rotary drill rig are essen-tial to productive and cost effective opera-tion of the drill. Excessive loading by either

parameter will significantly reduce con-sumable life and increase mining costs.

In addition, careful selection of every drill

string component is vital to achieve accurate

holes, optimal fragmentation and opera-tional efficiency. A complete rotary drill

string assembly can include the following:

• Shock sub (optional) – Recommended

for use in applications with high levels of

axial and lateral vibration (>10g) such as

drilling in fractured formations. Benefits

include increased drill availability, re-duced mast maintenance and less rotary

drive head repairs, smoother on-bottom

running and improved torque control.

• Top sub – The connection between the

drill pipe and rotary motor or shock sub.

• Drill pipe – Based on the outer blasthole

diameter, a proper drill string OD should

be selected that will provide the neces-sary column support to reduce flexing, as

well as sufficient annular area for cut-tings evacuation.

• Deck bushing – Guides the drill string,

reduces risk of wobbling, prevents reduc-tion of rotary head torque and supports

drill string configuration in producing

straight holes.

• Bottom sub or stabilizer – Allows for con-nection of the bit to the pipe. Roller sta-bilizers are used for improved hole sta-bility in hard and broken formations,

where hole caving is prevalent. Blade

stabilizers are used in softer formation

where the gauging and scraping of the

hole wall improves hole quality.

• Rotary bit – Proper drill bit selection is

vital for achieving desired results. Pay

attention to factors such as ground condi-tions (rock hardness, abrasiveness, com-petency and ground water); study product

specifications and local availability; deter-mine correct cutting structure, bearing

configuration (sealed or air-cooled) and

air-nozzle sizing for site conditions.

Baker cited several case studies in

which changeover to a properly configured

drill string produced significant results,

including:

• A copper-gold mine at which average drill

pipe life without a shock sub was

25,000–30,000 m with eventual break-downs usually due to thread failure from

vibration. With shock subs in place, drill

pipe life increased to 42,000 m, with

end failure resulting from eventual sur-face erosion.

• In another application, drill pipe conver-sion from 40/20 ft to 33 ft (x2) resulted

in less handling, improved ease of rota-tion and longer service life. Savings

amounted to S270,000 per year, primarily from improved efficiency.

Turning Money into Air—and Vice Versa

Compressed air requirements differ among

drilling methods. Rotary drilling requires

low-pressure, high-volume air fed through

the center of the drill pipe to the bit for hole

cleaning (cuttings removal) and bearing

cooling. Similarly, top hammer drill-rig com-pressor capacity is calculated according to

hole-cleaning requirements, but with DTH

drilling the rating of the hammer defines the

required compressor capacity. Whether a

customer chooses rotary or percussion

drilling, it's important for them to under-stand and know how to determine the right

compressed-air volume and pressure for the

selected drilling application, explained Karl

Ingmarsson, vice president of marketing for

Sandvik Mining & Construction. At a mini-mum, the user should be familiar with the

following concepts:

• The purposes of compressed air in drilling.

• How to make a quick and simple calcu-lation of correct up-hole velocity.

• Why sufficient volume is required for a

DTH hammer to perform well.

• How to match rod or tube size to topham-mer bit sizes.

• How to estimate cutting settling velocity

and target exit velocity.

• Why air nozzle selection is important for

rotary tools.

• How to interpret in-cab pressure readings.

• How to compensate for high altitude.

Stating that "air is money,"

Ingmarsson provided examples of how

much fuel a typical, small DTH drill rig

would burn in its lifetime (at 70 l/hr and

average load factor of 74%, roughly 2.8

million l or 743,000 gal), or a large rotary

blasthole drill (at 140 l/hr with same load

factor, about 5.6 million l or 1.48 million

gal)—of which about 2.3 million l and

4.5 million l, respectively, would be con-sumed to run the rig's compressor alone.

And with so much fuel being burned to

provide compressed air, is that air being

used economically?

Not usually, explained Ingmarsson. In

recent years, as diesel engine OEMs built

better monitoring systems into their prod-ucts, a rig's nondrilling fuel-burn rate has

become much more noticeable.

Traditional rigs, when in drilling mode,

provide maximum air volume regardless

of actual drilling conditions; when not

drilling, they maintain maximum pres-sure, thus loading the engine for no par-ticular benefit.

After an extended effort to find ways

to alleviate this problem, Sandvik recent-ly introduced its Compressor Manage-ment System (CMS), designed to reduce

fuel consumption, extend engine life and

reduce associated drilling costs by elec-tronically managing compressor operation

to provide the necessary amount of air

required at all times, ensuring the com-pressor runs at full volume only when

needed (See E&MJ, May 2011, "New

System Manages Main Compressor on

Rotary Drills," pp.30-34). It also provides

continuous feedback to the operator on

downhole conditions and indicates how

CMS is responding to current drill

demands.

According to Ingmarsson, CMS is cur-rently available as a retrofit for Sandvik's

rotary drill rig models, and will be avail-able for DTH rigs in 2012.

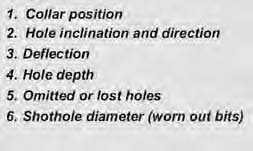

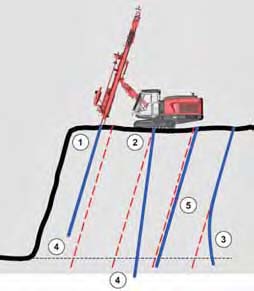

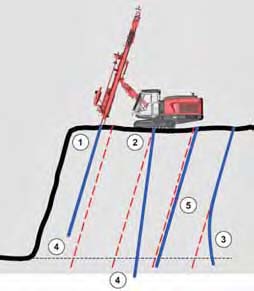

Common sources of drilling error.

Playing it Straight

No matter what drilling method is select-ed, overall D&B performance will suffer

unless holes are drilled straight and

according to plan, from collar to bottom.

When an operation "drills holes that look

like spaghetti," according to Arne

Lislerud, surface applications manager for

Sandvik, it can expect:

• Floor humps, hindering efficient loading

due to uneven pit floors;

• Unstable pit walls and difficult first-row

drilling;

• Safety concerns from flyrock;

• Stemming material blowouts that gener-ate safety, excessive dust and "bad toe"

concerns;

• Poor blast direction, affecting quality of

floors and walls;

• Shothole deflagration and/or misfires

that produce safety hazards and poor

muckpile diggability.

The keys to achieving consistent

straight hole drilling, said Lislerud, are

simple: Be aware of the numerous issues

that lead to drillhole deviation; operate

with a technically sound drill rig, drill

string and instrumentation; and motivate

drillers to strive for best results. Good

practice dictates only 2%-3% maximum

drillhole deviation in regular production

drilling operations.

For collar position error control,

Lislerud recommends:

• Using tape, optical squares or alignment

lasers for measuring-in collar positions; or

• Using GPS or total stations to measure

collar positions;

• Marking collar positions using painted

lines, not movable objects such as

rocks, etc.;

• Protecting completed drillholes with

shothole plugs to prevent holes from cav-ing in (and filling up);

• Using GPS guided collar positioning

devices, such as Sandvik's TIM3D drill

rig navigation system.

Similarly, to control drill-hole deflection:

• Select bits less influenced by rock-mass

discontinuities;

• Reduce drill string deflection by using

guide tubes, etc.;

• Reduce drill string bending by using less

feed force;

• Reduce feed foot slippage since this will

cause a misalignment of the feed and

lead to excessive drill string bending;

• Avoid gravitational effects that lead to

drill string sag when drilling inclined

shotholes (>15°);

• Avoid excessive bench heights.

Choosing the proper bit face design

can enhance drill-hole straightness, he

also noted. When a percussion bit first

starts to penetrate through a rock-joint

surface at the hole bottom, for example,

the gauge buttons tend to skid off this sur-face and thus deflect the bit. More aggres-sively shaped gauge inserts (ballistic /

chisel inserts) and bit face gauge profiles

(drop center) reduce this skidding effect

by enabling the gauge buttons to "cut"

through the joint surface quickly, thus

resulting in less overall bit deflection.

The right bit-skirt design also helps: As

the bit cuts through a joint surface, an

uneven bit face loading condition arises;

resulting in bit and drill string axial rotation

that is proportional to bit impact force

imbalance. A rear bit skirt support (retrac

type bits) reduces bit and string axial rota-tion by "centralizing" the bit.

Other deviation countermeasures

include using a longer bit body, adding

a pilot tube behind the bit, using lower

impact energy, or employing a drilling

control system that can rapidly react

to varying torque, feed and percussion

or pulldown demands based on hole

conditions.