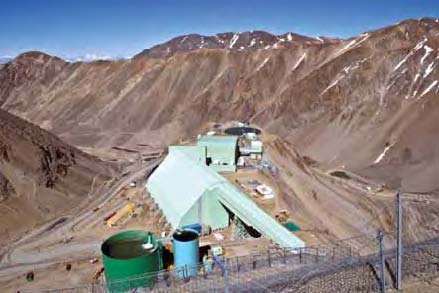

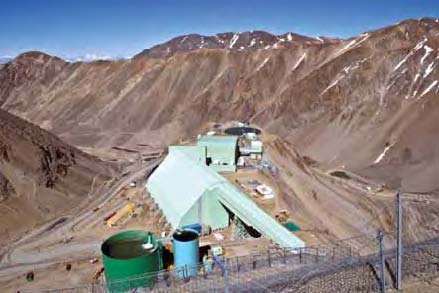

Shown here is the new Confluencia grinding plant at Anglo American's Los Bronces copper mine in Chile.

Shown here is the new Confluencia grinding plant at Anglo American's Los Bronces copper mine in Chile.

The facil-ity comprises a stockpile, mill building (containing one SAG mill and two ball mills), thickeners and

other associ-ated equipment. Anglo and Chilean national producer Codelco are embroiled in a disagreement

over the recent sale of a 24.5% share of Anglo American Sur—the assets of which include Los Bronces

and El Soldado mines— to Mitsubishi. (Photo courtesy of Anglo American)

Anglo American announced November 9

completion of the sale of a 24.5% interest

in Anglo American Sur SA (AAS) to

Mitsubishi for $5.39 billion. AAS assets

include the Los Bronces and El Soldado

copper mines and the Chagres copper

smelter in Chile. The sale brought Anglo

American into dispute with Chilean state

copper producer Codelco, which had

announced October 12 that it had secured

financing of up to $6.75 billion from

Mitsui for use in exercising an option to

purchase 49% of AAS in January 2012.

Anglo American's transaction with

Mitsubishi valued 100% of AAS at $22

billion. The $5.39-billion sale price was

paid in the form of a promissory note deliv-ered by Mitsubishi. The transaction was

unconditional and was completed immedi-ately following agreement on the terms of

the transaction.

Anglo American stated the transaction

is fully compliant with the provisions of the

Codelco option agreement, "...which

expressly contemplates the eventuality of

Anglo American disposing of its AAS

shares at any time prior to the date on

which the option may be exercised and

therefore no longer holding 100% of the

shares in AAS. In such an eventuality, the

percentage of shares in AAS over which

Codelco may exercise its option is reduced

by the percentage of shares in AAS not

held by Anglo American at the time of exer-cise. The option is exercisable only during

the month of January every three years

until January 2027."

Codelco immediately took issue with

Anglo American, saying its option on 49%

of AAS was not compromised by the sale of

the 24.5% interest in Mitsubishi. Anglo

American disagreed. As of late November,

the issue appeared to be headed to court.

Meanwhile, Anglo American announced

November 23 that AAS's Los Bronces

expansion project had delivered its first cop-per production on schedule. The expansion

is expected, on average, to more than dou-ble the mine's existing copper production of

221,000 mt/y over the first three years of

full production. Processing plant throughput

will increase from 61,000 to 148,000 mt/d.

Los Bronces is an open-pit copper and

molybdenum mine located approximately

65 km northeast of Santiago at an altitude

of about 4,000 m above sea level. The ore

is extracted, crushed, and transported down

a 56-km slurry pipeline to the Las Tórtolas

flotation concentrator, where copper and

molybdenum concentrates are produced.

The mine also produces copper cathodes.

The Los Bronces expansion project

involved several sub-projects that spanned

various geographical areas. A new primary

crusher was installed near the Los Bronces

open-pit, with crushed ore being fed by

conveyer through a 4.4-km tunnel to the

grinding plant at an area known as

Confluencia. At Confluencia, a new stock-pile, a grinding building (with one SAG mill

and two ball mills), thickeners and other

associated equipment were installed to

produce the slurry.

The slurry is then transported through a

56-km pipeline from the Confluencia

grinding plant to a new copper and molyb-denum flotation concentrator built next to

the existing concentrator at the Las

Tórtolas complex about 45 km from

Santiago at about 750 m above sea level.

Due to the more than 3,000-m differ-ence in elevation between Confluencia

and Las Tórtolas, the pipeline system also

required the construction of five choke

stations to control the gravitational force

of the descending slurry, and five pump

stations to return water from Las Tórtolas

to Confluencia.

The project also called for the con-struction of new 220-kV electric power

lines to satisfy increased energy require-ments, in addition to improvements to the

operation's tailings dam, fresh water sup-ply and water recirculation systems.

At its peak of construction the Los

Bronces project employed approximately

16,000 workers directly and indirectly.

As featured in Womp 2011 Vol 10 - www.womp-int.com