Global iron ore production rose by more than 17% in 2010, reaching a record level of 1.8-plus billion mt. Shown here are mining activities in the Green Pit at

Global iron ore production rose by more than 17% in 2010, reaching a record level of 1.8-plus billion mt. Shown here are mining activities in the Green Pit at

Fortescue Metals Group's Cloudbreak iron ore operations in Australia's Pilbara district. (Photo courtesy of Fortescue Metals Group)

The world iron ore market in 2010 was

dominated by a resurgence after the

stimuli packages, put in place in 2009

following the global financial crisis,

took effect. However, the industry experienced

rough times in 2009 and the

resulting changes following the economic

slump produced effects that

probably will live on as permanent features.

Trading patterns have been transformed,

and Chinese dominance has

become even more massive.

Steel Production: Up Globally, Growth Slower in China

World crude steel production increased

to 1.396 billion mt in 2010 from 1.201

billion mt in 2009, a change of 6.2%,

driven by the recovery of the world

economy and rising industrial production,

mainly in emerging countries but

also in the OECD area. Production was

well above the 2007 peak.

While China accounted for the entire

increase in 2009, production recovered

dramatically in the rest of the world in

2010, and it increased at a higher rate

than in China. Crude steel production

in China increased by 10.4%, a lower

rate than the 13.5% achieved in 2009.

Production in the rest of Asia increased

by a strong 20.5% and has now

regained pre-crisis levels, although it is

still lower than the peaks attained in

2005–2006. In Europe, production

rose by 18.7% but is still 10% below

that of 2008. In the Americas, production

grew by 30%, but was well below

the level reached before the recession.

All major producers experienced large

increases in production.

Monthly world crude steel production

had regained the pre-crisis peak by

May 2010. This was however almost

entirely due to China, where previous

peaks in monthly production were

matched already in April 2009. The rest

of the world had still not reached precrisis

production rates in May 2011.

The recovery is well under way and

appears to be solidly based, although

growth rates have declined from the

very high numbers reached in the early

stages of the upswing.

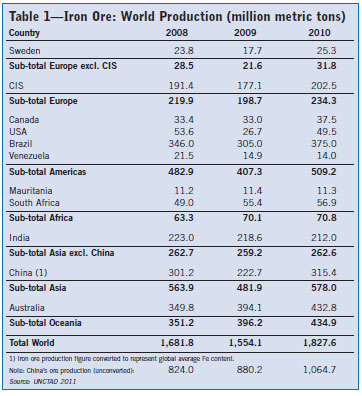

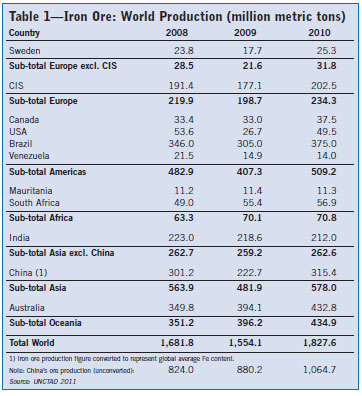

Record Iron Ore Production

A new all-time high for iron ore production

was achieved in 2010, at 1.827

billion mt (See Table 1). Production

grew by 17.6% over 2009's level and

well above 2008's previous high of

1.682 billion mt. Output increased in

most regions and countries except

Africa and Asia, excluding China, where

production in 2010 remained relatively

constant. Europe and North America

(Canada and United States) experienced

the highest growth rates, approaching

50%. Among the major producers Australian, Brazilian and Chinese production

was increased by 9.8%, 23%

and 41.6%, respectively. Indian production

declined somewhat to just above

210 million mt. Production in the CIS

countries grew by 14.4%.

Developing countries accounted for

58.6% of world iron ore production in

2010 (up from 57.8% in 2009), the

CIS republics for just over 11.1% and

the industrialized economies for almost

30.3%. The increase in the share of the

developing countries was due mainly to

growth in Brazil—up more than 70 million

mt—and China, up 96 million mt.

Chinese production, on a comparable

grade basis, was 315 million mt, or

17.3% of total world production in

2010, up from 14.3% in 2009 but

below the top level in 2007 of 370 million

mt.

World pellet production rose by 32%

in 2010 to 388 million mt up from 296

million mt in 2009 reaching a new

record level. This reflects a sharp

increase in demand for pellets in most

countries except the U.S. World exports

were 145 million mt, an increase of

46% over 2009. The share of pellets in

total iron ore production rose to 21% in

2010. Worldwide, several new pellet

plants are being planned or are under

construction.

Higher Demand Drives Record Iron Ore Trade

In 2010, international iron ore trade

reached a new record level as exports

increased for the ninth year in a row

and reached 1,053 million mt, up

12%. The increase was the result of

higher demand in the wake of the

recession. However, most countries

have not regained their 2008 import

levels. Developing countries accounted

for 49% of total iron ore exports in

2010, developed countries accounted

for 51%, including the CIS republics at

about 7%. Australia's exports increased

by 11% to 403 million mt in 2010.

With important markets in Europe and

the Americas picking up pace, Brazilian

exports, which fell in 2009, recovered

and increased 17% in 2010 to 311

million mt, up from 266 million mt.

Indian exports fell for the first time in

11 years but the country is still at 96

million mt, the third most important

exporter. Ukraine, Kazakhstan and

Russia increased their exports in 2010;

China has become an important market

for all three countries, but transport

capacity has been a limiting factor for

further expansion.

China is the world's largest iron ore

importer. In 2010, its imports were

619 million mt, a slight decrease compared

with 2009—but still representing

59% of total world imports. Almost

everywhere else, imports rose. Japan's

imports increased by 27% to 134 million

mt, and the Republic of Korea's by

34% to 56 million mt. European

imports (excluding the CIS countries),

increased by 40% in 2010, reaching

134 million mt. Seaborne trade in iron

ore reached a new high at 995 million

mt in 2010.

Vale, the leading iron ore producer, accounted for almost 17% of world iron ore output last year. Pictured

Vale, the leading iron ore producer, accounted for almost 17% of world iron ore output last year. Pictured

here is construction of Vale's newest iron ore beneficiation plant, located in the Itabira region of Brazil.

(Photo courtesy of Vale)

Pricing: Higher Volatility Ahead

The demise of the annual benchmark

pricing system was confirmed in 2010.

Currently, annual prices are still negotiated

between a small number of mining

companies, most importantly LKAB in

Sweden, and steel mills. The impact of

the disappearance of benchmark prices

on market transparency is mixed. On

one hand, there is very little information

about prices actually agreed-to by

identified parties. Full details about the

quarterly pricing system used by Vale,

for instance, have still not been published,

although the prices applied are

relatively widely known. On the other

hand, the introduction of at least three

competing price indices (Metal

Bulletin, Platts and The Steel Index)

has made it somewhat easier for market

participants to follow price movement

and trends.

Hedging opportunities have multiplied

rapidly and there are now several

marketplaces for the clearing of OTC

iron ore swaps. Two existing futures

contracts for iron ore (at the Indian

Commodity Exchange (ICEX) and the

Multi Commodity Exchange of India

(MCX)) will shortly be joined by a third,

at the Singapore Mercantile Exchange

(SMX), which will provide additional

hedging opportunities as well as a possibility

for investors to participate, something that should improve market

liquidity and give better assurance to

hedgers. In spite of the rapid growth in

the range of possible derivatives trades,

both iron ore mining companies and

steel mills have so far been relatively

slow to begin using the hedging facilities.

Based on experiences from other

markets, however, it is likely that modern

price risk management will play an

increasingly important role also in the

iron ore market.

When considering the future of iron

ore pricing, it is however also important

to understand that most iron ore is

still sold on long-term contracts and

that buying iron ore is not like buying

other metal concentrates. One of the

most important considerations for steel

mills is the consistency of quality of

the iron ore.

The full effects of the new pricing

mechanisms are not clear, but it is

unlikely the new model will have any

major effect on price levels. It is, however,

clear volatility will increase.

Moreover, steel companies from all

parts of the world will have added

incentive to increase captive production.

Chinese steel mills will invest

heavily in both domestic and overseas

projects. The contradictions building

between Vale, Rio Tinto and BHP

Billiton—the Big 3—and the Chinese

will not be resolved in the near future.

It will most likely take a few years to

settle them and the end could very well

be quite dramatic.

Except for a short decline in

April–June 2010, spot prices in China

have increased almost continuously

since early 2009. During the first half

of 2011, prices stagnated somewhat,

although they remain at levels that

must be characterized as extremely

high in a historical perspective.

Corporate Concentration Remains Stable

Vale, Rio Tinto and BHP Billiton together

controlled 35% of world production

in 2010 (See Table 2). However, their

current market share is still lower than

the peak in 2005 at 36.4%. The

decline is the result of new production

being started in many countries as iron

ore prices returned to previous high levels

and in particular many of the small

Chinese producers restarted their production

in late 2009 and early 2010.

Brazil's Vale once again confirmed

its position as the world's largest iron

ore producer by increasing output by 54

million mt to reach an all-time high of

309 million mt and a market share of

16.9%. The second largest producer,

Rio Tinto, has a market share of 9.9%.

BHP Billiton increased its production

by 12 million mt to reach 149 million

mt in 2010.

Vale increased its market share and

is by far the top producer. Corporate consolidation decreased marginally

both at the level of the three largest

and the 10 largest companies. The

trend between 2005 and 2008 of

decreasing concentration has been broken

and we see a consolidation among

the top 10 producers. Corporate concentration

will resume its growth when

prices fall and many small Chinese producers

are forced to close.

To measure corporate control at the

production stage underestimates the

concentration of the iron ore sector

because large amounts of production do

not enter the market, but are produced

in captive mines or mines which have a

protected or restricted market. An alternative

way to measure the control is to

monitor the share of global seaborne

trade of the leading companies.

Measured this way, the shares of the

major companies are considerably higher.

Vale alone controls 26% of the total

world market for seaborne iron ore.

With the market shares of Rio Tinto and

BHP Billiton dropping in 2010, the

overall share controlled by the Big 3 fell

from 60% in 2009 to 58% in 2010.

New Capacity Onstream by 2013

New iron ore mining capacity that went

onstream in 2010, as identified at the

individual project level, reached 90 million

mt globally. This is up by 25 million

mt compared with 2009. The total project

pipeline in May 2011 included 815

million mt of new production capacity

that will come onstream between 2011

and 2013. Of this total, around 340

million mt falls into the "certain" category,

195 million mt "probable" and

280 million mt "possible."

Looking at the certain-category projects,

43% can be found in Oceania,

27% in Latin America, 6% in North

America, 16% in Europe and 9% for

Africa. The Raw Materials Group has

produced these estimates for a number

of years, and over this period an average

of some 75% of the total, including

all categories, has been recorded as

completed. This figure fell to 50% in

2011 as the effects of the financial crisis

limited new capacity coming

onstream in both 2009 and 2010.

Despite the uncertainties of each individual

project it may be assumed with a

reasonable degree of confidence that at

least 500 million mt and probably over

600 million mt of new capacity will

come onstream in the period up to and

including 2013. In the three-year period

following 2013, more than 325 million

mt of additional iron ore capacity is

listed with a completion date.

Given present circumstances and

extreme optimism in the market, most

of the projects in the pipeline will

advance and many new ones will be

announced. Were it not for the ability

of the Big 3 to regulate the pace at

which their projects are moved into

operation, the danger of reaching overcapacity

would seem considerable, particularly

if there are any hiccups in the

growth of steel production in the next

three years.

Outlook: Big Producers Gain More Leverage

The world economic outlook remained

uncertain as of mid-2011 and appears

less favorable than at this time last

year. The World Steel Association's latest

short-term forecast for world steel

use, presented in April 2011, anticipated

a rise in steel use by 5.9% in

2011, following the sharp increase by

13.2% in 2010. The increase in 2010

was higher than expected, due to the

unexpectedly good performance of the

world economy.

The industry experienced rough

times in 2009 and the changes that

took place brought on some effects that

probably will live on as permanent features,

mainly that the Chinese dominance

has now become even more massive.

It seems as if the Chinese economy

is capable of changing direction

toward internal growth and is in the

process of doing so, meaning it will be

less dependent on world demand for its

manufactured exports. Domestic

Chinese iron ore production is highly

sensitive to prices; domestic producers

will probably not be able to increase

output much beyond present levels and

production will drop precipitously when

iron ore prices start to fall.

The new pricing system gives major

producers more leverage. While the

international steel industry is not cohesive

and producers do not act in unison,

the three large iron ore producers

don't have to collude in order to exercise

considerable control over the market

and ensure that they are pursuing

mutually consistent strategies. Their

objective is obvious—to maximize profits—

and their method of achieving the

objective equally so: keeping prices

high enough to pay for new investment

but low enough so that new entrants do

not become realistic alternative

sources of product. The control exercised

by the Big 3 will, to some extent,

counteract the tendency to greater

price instability that will result from

the new pricing methods.

The Raw Materials Group estimates

iron ore use will increase from 1.818

billion tons in 2010 to about 1.910 billion

tons in 2011 and 1.990 billion mt

in 2012.

The background material for this article

is extracted from The Iron Ore Market

2010-2012, published by UNCTAD in

July 2011. This study was researched

and compiled by Raw Materials Group

for UNCTAD, and can be ordered by

e-mail at ironore@unctad.org, or by

fax from Amelie Zethelius Mermet at

+41-22 9170509. |

Despite a massive pipeline of investment

projects, the market will remain

tight over the next few years because

large iron ore producers can implement

their expansion plans with a great deal

of flexibility, and a considerable segment

of the Chinese iron ore mining

industry—probably representing as

much as 200 million mt in annual

capacity—would shut down if prices

were to fall much below present levels.

Accordingly, we believe that while the

market is certainly moving toward a balanced

supply and demand situation,

equilibrium will be reached in 2013 at

the earliest, and quite possibly not until

beyond that date. Prices, while declining

slowly, will stay sufficiently high to

keep the Chinese iron ore mining industry

operating at lower, but not disastrously

low, output. Thus, prices will

remain at levels that must be considered

high from a historical perspective,

with a floor at around $110-$120/mt

delivered in China.

Magnus Ericsson is a professor at the

Luleå University of Technology and a

senior partner and co-founder of Raw

Materials Group, Stockholm, Sweden

(www.rmg.se). Anton Löf is a research

analyst with RMG, specializing in the

global iron ore trade. Olle Östensson is

a senior adviser ar RMG.