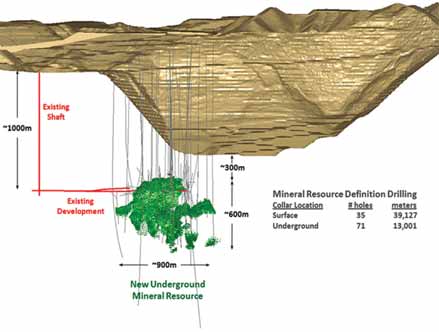

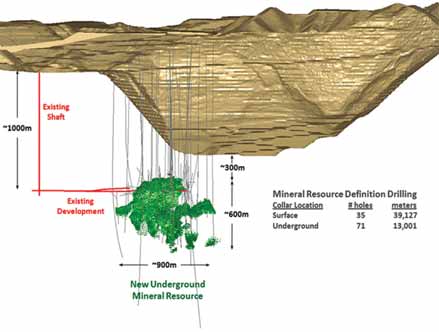

This schematic diagram provided by Kennecott Utah Copper shows the location of the North Rim Skarn

This schematic diagram provided by Kennecott Utah Copper shows the location of the North Rim Skarn

deposit

300 m below the floor of the Bingham Canyon open-pit. Kennecott said the deposit, first drilled

in the 1980s,

contains an estimated 20 million mt of copper resources grading 3.5% Cu.

Rio Tinto recently added 20 million mt

of copper mineral resources grading

3.5% copper at its Kennecott Utah

Copper Bingham Canyon mine near Salt

Lake City, Utah, USA. The resource addition, known as the North Rim Skarn,

increases the property's contained metal

in mineral resources by 730,000 mt of

copper, 1 million oz of gold and 13 million oz of silver over year-end 2010.

The North Rim Skarn is a high-grade, copper-gold skarn deposit located approximately 300 m below the current Bingham Canyon pit and is expected to be developed by underground

methods. The deposit was initially

explored by a surface and underground

drilling program that was completed in

the mid-1980s. Further surface drilling

has more recently been completed, with

the combined data set of 35 surface

and 71 underground drill holes (total

lengths of 39,127 m and 13,001 m,

respectively) forming the basis for this

new resource estimate.

Rio Tinto has committed $165 million to complete the next stage of North

Rim Skarn exploration and development studies by 2014. This prefeasibility program includes final shaft rehabilitation, an access decline from the

pit, and further underground exploration drilling.

The investment is in addition to

$238 million currently being spent to

advance studies to extend Bingham

Canyon open-pit life and to purchase

associated long-lead time equipment.

Rio Tinto is evaluating the potential for

extending the life of the pit to 2028

and studying additional extensions that

may allow continued mining to 2030 or

2040. Called the Cornerstone project,

the extension would allow Kennecott to

maintain current production levels. The

company expects the evaluation process

to take two years. Approval by the Rio

Tinto board of directors will be required

before the project gets under way.

The Cornerstone project entails

pushing back the south wall of the

Bingham Canyon mine about 1,000 ft

and deepening the mine about 300 ft

to reach 700 million tons of ore

resource. This will require increasing

the size of the pit's haul fleet, adding

an in-pit crusher, and adding another

grinding line and supporting equipment at the Copperton concentrator.

Kennecott will also need to generate or

procure another 100 MW of electricity

to power these improvements. The

existing refinery and smelter will not

require expansion.

Announcement of the underground

resource at Bingham Canyon coincided

with a Rio Tinto investor seminar in

London and New York. At the seminar,

Rio Tinto Chief Executive Tom Albanese

said: "We've been saying for quite some

time that we expected to see patterns of

increased price volatility amidst turbulent financial markets, and that scenario is playing out. Our order books are

full, and pricing is strong, but it is

noticeable that markets are somewhat

weaker than they were six months ago.

We are realistic and well-positioned for

any number of scenarios. Our high-quality growth program is in full swing

to capture the expected increases in

longer-term demand, and our balance

sheet is very strong and well able to

withstand any near-term decline.

"Our long-term view of demand growth

is unchanged. As the metal-hungry developing economies grow, demand for copper, aluminum and iron ore will double

over 15 to 20 years," said Albanese.

"But challenges on the supply side

are limiting the speed of new supply to

market. Project finance is tight because

of the current market jitters. Permitting

delays, labor and equipment shortages,

and technically-challenging ore bodies

are all contributing factors."

As featured in Womp 2011 Vol 08 - www.womp-int.com