2011 Mining M&A: Blistering First Half, Slower After Mid-year

PricewaterhouseCoopers (PwC) released its biannual review of mining sector merger and acquisition (M&A) activity in early September 2011. The 33-page report outlines a record first half for mining deals, with 1,379 deals announced worth $71 billion, making it the busiest half year of M&A in the mining sector's history. However, this blistering pace slowed markedly after mid-year, the report notes, primarily as a result of jittery global equity markets.

Titled "Riders on the Storm…," the PwC report notes that first-half mining M&A activity was not all that it appeared to be. The majority of activity was confined to an American-led rush to secure scale in the coal and iron ore sectors. Many buyers in Australia, the United Kingdom, and Canada remained on the sidelines and, while most Western markets were betting on the strength of China, Chinese entities firmly focused on value, retreated from iconic Western takeovers.

2011 has yet to see a 'mega' mining takeover, greater than $10 billion, PwC reports; and the top 10 mining deals during the first half were worth, in aggregate, about $9.2 billion less that the top 10 deals in 2010. "As majors shifted their focus to bolton transactions, the mid-size deal segment was clearly driving volume," the report states. "In the $500 million to $1 billion segment, for example, 18 deals were announced, a 50% increase over the same period in the prior year."

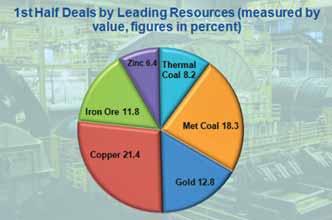

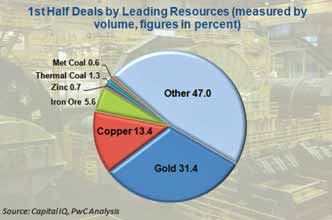

Measured by aggregate deal value, coal surpassed gold to become the most actively targeted resource during of the first half of 2011. Together, metallurgical coal and iron ore represented more than 30% of all announced deals by value. "Exemplifying just how critical steelmaking inputs are, even niobium, a rare metal that can be utilized in steelmaking, made it into the top 10 deal list for the first half," the report states.

While China was somewhat less active in mining M&A during the first half of 2011, PwC expects the country to remain an important presence in the market, acquiring quality industrial resource assets that can provide secure sources of raw material inputs for its long-term industrialization and urbanization processes, especially iron ore, metallurgical coal, fertilizer minerals and base metals. "Deals that can permit China to increase its bargaining power in negotiating raw material prices and provide good financial returns will be preferred," the report states. "In fact, a late 2011 market correction may be just the right opportunity to achieve the latter."

Does PwC think slower mining M&A during the second half of 2011 represents the end of an era of unprecedented global mining M&A? It does not.

"It is important to recognize that the industrial revolutions underpinning record commodity demand (and record M&A) are not Western-led," PwC states. "Chinese demand is, by and large, the most critical factor in formulating commodity market (and therefore mining M&A market) expectations. While Western worlds operate on three-month forecasts, the Chinese are operating on much longer-term horizons, making the second half of 2011 largely irrelevant in the grand scheme of things." (Editor's Note: The PwC report is available as a free pdf download at www.pwc.com)