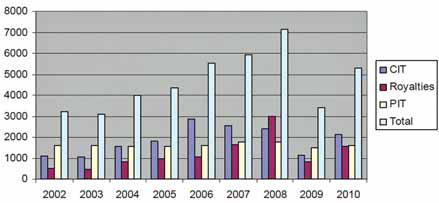

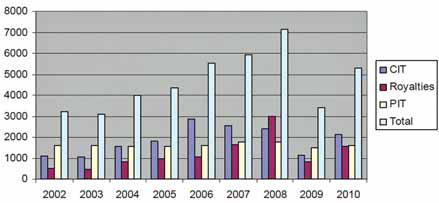

Chart 1: Recent revenues paid to Canadian governments by the mining industry, excluding oil sands

mining (vertical axis–million C$; CIT–Corporate Income Taxes; PIT–Personal Income Taxes).

Source: Mining Association of Canada/ENTRANS.

Mining Association Reports on Industry Payments to Canada’s Governments

For statistical purposes, oil sands mining is usually subsumed under oil and natural gas extraction. To allow inclusion of oil sands mining, the MAC report draws on the member surveys conducted by the Oil Sands Developers Group and the financial reports of companies involved in oil sands mining. The report stresses, however, the royalty and tax estimates for oil sands mining, although carefully constructed, are less solid than their counterparts from the other mineral industries.

The report does not include corporate income tax payments made by companies in industries that either supply services to the mining industry or are dependent upon the minerals sector for material inputs. Similarly, it does not include the personal income taxes paid by employees of such companies. Taxes levied by municipalities, such as property taxes, are also not included, although the reason is more a practical one of data availability.

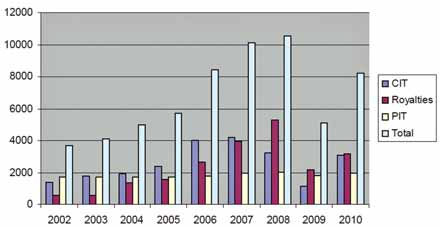

The accompanying charts offer nineyear summaries of revenues obtained by Canadian governments from the mining industry, with Chart 1 excluding oil sands mining and Chart 2 including oil sands mining. Both charts show total annual payments to federal and provincial governments increased significantly from 2002 to 2008.

In Chart 1, these payments more than doubled from $3.2 billion in 2002 to $7.1 billion in 2008 (all dollar figures in this news report are Canadian dollars.) Higher royalties/mining taxes, which increased from $500 million to $3 billion, accounted for about 60% of the increase in total revenues to governments, although corporate taxes also rose appreciably. As royalties and mining taxes accrue almost exclusively to provinces, their rapid increase was the chief reason for an increase in the provincial share of revenues from about 40% in 2002 to about 61% in 2008.

Again referring to Chart 1, in 2009, the situation changed dramatically. As a result of the U.S. financial crisis and generally collapsing metals and potash prices, revenues to governments plummeted 52% to $3.4 billion in 2009 from $7.1 billion in 2008. A $2.2-billion drop in royalties/mining taxes accounted for about 60% of the overall reduction.

The inclusion of oil sands mining in Chart 2 adds substantial revenues but does not fundamentally change the narrative. By 2008, total revenues to governments had climbed to more than $10.5 billion, an almost threefold increase over 2002. Almost 70% of this increase was associated with increases in royalties (from $580 million to $5.7 billion) of which a $2.3- billion increase in oil sands royalties was the largest contributor. Corporate taxes increased by about $1.8 billion from $1.4 billion in 2002 to $3.2 billion in 2008. Oil sands mining activities were responsible for about $600 million of this increase. As the majority of the revenues from oil sands accrued to the government of Alberta, the provincial share of revenues to governments from the mineral sector including oil sands mining was almost 70% in 2008, up from about 40% in 2002.

2010 was a recovery year, with overall revenues to governments rising significantly from their lows in 2009. Overall revenues from the mineral sector including oil sands mining increased by $3.3 billion to $8.4 billion. These levels are still well below the amounts reported in 2008, but it is clear a recovery was taking place.

“The mining industry makes a significant contribution to Canada’s economy each year, ranging from capital investment, to stock market activity, Aboriginal community jobs and training, and northern development,” MAC President and CEO Pierre Gratton said when the report was released. “The level of payments made to governments detailed in this study is another useful measure of this contribution, particularly valuable because these revenues are used to support health care, education and other critical government services.”