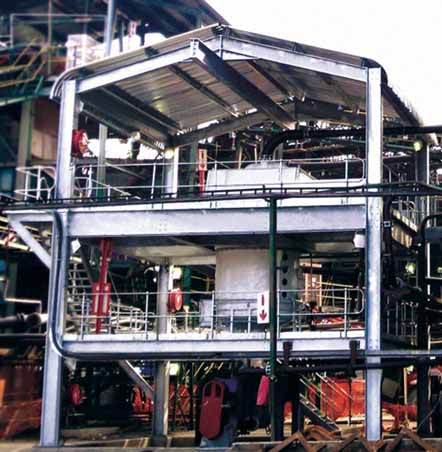

Sedgman is an Australian engineering firm exporting its expertise, with its coal plant at the UHG project in

Mongolia being a recent example.

Australian Expertise Comes with the Raw Materials

By John Miller, Australian Editor

Australia is not only supplying many of the raw materials feeding the ongoing economic development of emerging nations such as China and India, and supporting the industrial powers of Japan and South Korea, it is arguably the world's premier supplier of mining technologies and services.

The importance of Australia's mining technology, services and equipment sector domestically and internationally was outlined at Austmine 2011 in Brisbane, Queensland. An under-recognized segment of Australia's world-class minerals industry, the sector has expanded rapidly in the past decade, such that it is now estimated to generate A$30 billion a year of sales with annual exports worth more than A$8 billion.

Significant offshore growth in the sector propelled by record global investment by mining companies in new capacity has positioned many Australian engineering, contracting, consulting, equipment supply and technology companies to play even more important roles in mine development and expansion activity but constrained by skills, energy and water shortages, environmental and socio-economic factors, and geometallurgical complexities.

"Given the context that we see coming at us, there is a requirement for technology innovation over a time frame unprecedented in our industry," John McGagh, Rio Tinto's head of innovation, told conference delegates.

Xstrata Copper's Global Chief Charlie Sartain said the company was already employing technology to help deliver major projects faster and at lower capital cost per unit of installed production capacity. "Our proprietary technologies and the strategic links we have with service companies to deploy those technologies will actually help us as an industry resolve the metallurgical, environmental and social challenges that all of these projects face."

Vale Senior Coal Division Executive Chris Coombes said truckless mining and dry processing of iron ore at the US$11-billion S11D project in Brazil was set to deliver significant capital and operating cost efficiencies as well as shrinking the project's development footprint and environmental impact. "We will perhaps see the application of that technology in some of our other projects across the globe being able to both assist in reducing capital and operating costs, and in fact enabling projects to come on line a lot sooner," Coombes said.

McGagh said new technologies—some step-change and others just refined versions of what had worked so far—were needed to address mounting challenges facing the industry, ranging from the remoteness and complexity of deeper ore bodies, to energy and water supply constraints, and rising costs to find and access next-generation mineral and coal deposits. "We're going to need some technologies to address those challenges. It's not going to be possible for one company or one individual group to do it. It's going to need lots of minds—as in minds, not mines," McGagh said.

A consistent theme at Austmine 2011 was that while offshore sales growth continues in the 'traditional' mining markets of North America, southern Africa, Indonesia and Western Europe, opportunities are mushrooming in emerging markets. Central Asia, Russia and the former Soviet republics, South America, West Africa and China are opening up to Australian mining technology, services and equipment companies like never before.

BRIC Countries have High Barriers

Austmine, an industry association which

promotes innovative Australian mining

equipment, technology and services

(METS) to global markets, has found that

many companies would like to do business

with BRIC markets but can't because of

high barriers. In a recent Austmine member survey, more than 50% of those who

participated said high barriers restricted

business dealings with Brazil, Russia,

India and China. Brazil topped the list with

23% of companies seeing it as the market

with most difficulties.

"BRIC countries are very rich in natural resources with new mining projects being developed every day," said Austmine's Chairman Alan Broome. "Not only are new mines being developed, but many of the largest mining companies are headquartered in BRIC countries. These companies are looking for innovative mining technology, and have the financial means to afford the best equipment, technology and services in the world. That is what our members have to offer.

"We recently took a mission to Russia and found projects in both coal and base metals that would benefit from Australian technologies and services being available at competitive prices to improve productivity, increase safety and gain cost efficiencies," said Broome. "Australian technology has a lot to offer, and those participating on the mission made sales and were very pleased with the level of interest received.

"Brazil is the largest iron ore producer in the world, and is increasing its gold and copper production. Our members have found that high tariffs, complicated logistics and bureaucratic red-tape make it very difficult to do business there. Despite the high barriers, Austmine members are determined to succeed and see the greatest export opportunities in Latin America, in particular, Brazil. Many indicated they would be expanding into Brazil and China in the next 12 to 24 months.

"Members also indicated Free Trade Agreements (FTAs) had a positive impact on their export business," Broome said. "FTAs opened up markets such as Chile, made business dealings more transparent and brought down tariffs, making Australian products more competitive offshore.

"Given the positive impact, we call on the Australian Government to conclude the current FTA negotiations with China, which have been under way since 2005. We further applaud the government for commencing FTA negotiations with India, and would like to encourage its speedy negotiation. We would also like the government to seriously consider a FTA with Brazil," Broome said.

New Process for Stronger Steel

Diversified Australian-based miner Astra

Mining has received an independent expert

opinion from Hungary's University of

Miskolc confirming the potential of its revolutionary new steel manufacturing

process. The end product, T-Steel, is significantly stronger than regular steel and

provides vast production, operational and

environmental benefits. T-Steel was used

commercially to strengthen steel for non-civilian use and Astra has taken the opportunity with the devolution of the Eastern

bloc countries to acquire the technology

and roll it out globally.

Astra Mining CEO Dr. Jaydeep Biswas said independent verification of the steel's unique properties comes from one of the University of Miskolc's leading metallurgical engineers, Professor Emeritus Dr. Farkas Otto. "This expert opinion on a study into the preparation of the production of T-Steel confirms it has better qualities compared to traditional steels," Biswas said.

"It also confirms the CO2 emission in its manufacture can be up to two times less than with traditional steel making technologies, reducing a manufacturing plants carbon footprint which is highly beneficial to the environment. Astra has a substantial 30% ownership of T-Steel's IP and has full operational and management control of its business, so we are very excited to receive this independent verification."

T-Steel is a direct, high category replacement for currently produced equivalent steel types and has immediate benefits in high use countries such as China and India. It can also play a large role in countries trying to reduce C02 emissions such as Australia. The basic product, which includes the use of unique alloy based formulas invented over a 30-year period in Hungary, is based on a process which can modify the metallurgical properties of steel at a molecular level.

The cost and value benefits are due to reduced raw materials use (coking coal, iron ore for same strength), reduced CO2 emissions, reduced cost of alloys, better physical properties, and reduced heat treatment during manufacturing. The key is a combination of highly specialized processes and special alloying technologies.

"T-Steel can be produced by existing steel mills with little or no retrofitting needed, however this can only be done if the mills have access to the T-Steel technology and the correct steel plant operation conditions," Biswas said. "This makes T-Steel nearly impossible to replicate, as attempts to meet all necessary conditions would cost many hundreds of millions, something that would not be cost effective for individual steel manufacturing companies.

"Astra is in negotiations for a long term co-operation agreement with one of the world's largest steel traders for the DAM Steel Works in Hungary which will annually produce 500,000 metric tons of T-Steel annually. Acquisition of the DAM plant is not a pre-requisite for rollout of the technology, it is one part of a comprehensive business plan, however the relationship would position Astra ideally to capitalize on its strategic growth plan and market T-Steel products worldwide."

Astra Mining's global portfolio also includes gold and tin interests in South East Asia and southern India, coal mines in Australia, and iron ore in India.

"South East Asia has a wealth of nickel laterite deposits—through the Philippines, Indonesia, Papua New Guinea, the Solomon Islands and New Caledonia," said Malnic. "The great genie on the back of laterites, however, is that on the most part they've been failures. People have a perception that laterites are intrinsically difficult metallurgically but with our new process, they are absolutely not. We have a revolutionary process and have positioned ourselves as a nickel company, so we won't sit back and wait for the technology to be exploited by others. We are rolling it out ourselves and we'll own a funding interest in every project where the technology is used."

Direct Nickel sees a significant change in the future of laterites in Indonesia, for instance, because after 2014 there are going to be no more exports of unprocessed ore from the country. "This decision has resulted in intense interest for our technology," Malnic said. "The Philippines is trying to come up with ways to create the same constraint, which is certain to lead to further interest in the Direct Nickel process.

"Australia also has a lot of laterites and we have a test plant under construction in Perth, which means the company's major focuses are within the couple of time zones encompassing Australia and Asia. However, this has potential to spread much further and we are negotiating with a Brazilian property while two African operations have asked us to test their ore.

"We are very enthusiastic about Indonesia as a result of our ongoing discussions but are open to talk to anyone with laterite deposits," said Malnic. "Sulawesi presents many opportunities and has three sources of energy—hydrocarbon, geothermal and hydro. The whole laterite sector is relatively untouched, there's 120 years of nickel supply sitting there, drilled out. Nickel is quite a precious base metal and I can't think of another metal so over-discovered but yet still largely unexploited because there has not been an accessible metallurgical key to open the value.

"We've had the fiascos with pressure acid leach using sulphuric acid and the battlefield is strewn with the carcases of dead projects. This has created a lot of skepticism around the laterite business but we're used to dealing with skeptics and like to take them through the process we've developed to transform the technical teams we work with into believers."

The company has investment from Canada's largest international miner, Teck Resources, and Australia's governmental scientific body, CSIRO, both of which are also technical partners. Regency Mines is the company's Papua New Guinea joint venture partner with the Mambare project where drilling is under way.

As well as the test work at the test plant, which is expected to be completed in the first quarter of 2012, and discussing the technology with interested parties, Direct Nickel is proceeding with the reverse takeover of an ASX-listed shell company. "Our agreed value is $82 million and the shell has a value of $1 million so we are going to merge with and then re-list that shell," Malnic said.

Since signing a participants agreement in July 2005, which gave it exclusive global rights to commercialize Coldry and the subsequent purchase of the intellectual property (IP), ECT has substantially advanced the commerciality and the ability to deliver Coldry to market on a commercial scale.

ECT has validated the characteristics of the Coldry BCE product via independent testing and has organized for in-situ testing of the product in one of China's leading black coal-fired power stations. It has also produced commercial quantities of product at a pilot plant at Bacchus Marsh, west of Melbourne in Victoria, Australia. The company has built partnerships across engineering, construction, technology development, finance, marketing and sales that will underpin commercialization of the Coldry technology, and has demonstrably advanced its position along the technical, relationship and organizational experience curves critical to achieving commercialization.

ECT is also advancing its Coldry Patent application in the Unites States. Through its Patent Attorney Davies Collison Cave and its U.S. associate, ECT has been issued a Notice of Allowance for its application to register the Coldry IP as a patent. "This is the final step prior to the issuance of our patent in the U.S.," said Ashley Moore, business manager, ECT. "Following the payment of the required fees, we expect our U.S. patent will be issued within the normal processing timeframe by the end of September, strengthening IP protection in this significant market."

This development follows a series of engagements with U.S. examiners over the past few years to move the patent application forward. Various 'prior art' documents referenced during the examination process were compared with the Coldry technology to establish its unique features and confirm its 'novelty' and patentability.

"We're very pleased the Coldry technology has met all of the criteria required to allow the issuing of the patent in the U.S.," said Kos Galtos, chief executive, ECT. "This builds nicely on the progress made with the issue of our patent in China last August and we look forward to the advancement of our patent application in other jurisdictions, including Europe, India and Australia.

"Currently underpinning ECT's high level IP strategy is our commercialization focus on Coldry technology in Victoria's Latrobe Valley, with work ongoing to progress to the Design for Tender (DFT) for deployment of a 2-million-mt/y plant by 2014. The U.S. patent, in concert with the Latrobe Valley DFT will provide a sound basis for future discussions around the deployment of Coldry," said Galtos.

"Coldry technology is the first of its kind—an economically attractive brown coal beneficiation technology with a net improvement in terms of end-to-end CO2 exposure. We have made great strides in Coldry's further development, and are ready to proceed to our first commercial project," said Moore.

With this aim ECT has recently appointed Warrick Boyle as manager of product development and operations, underpinning the expanded production role of the Coldry pilot plant and advancement of the Coldry project in the Latrobe Valley. His immediate focus will be on the transition of the pilot plant to 24x7 operations to deliver the 2,000-mt lot of Coldry product from the Bacchus Marsh facility for the impending test burn with China Datang.

GTL Coal Technology for New Zealand

Australian-based private coal technology

company GTL Energy has signed a license

agreement with Solid Energy New Zealand

which enables it to use GTL's coal upgrading technology in New Zealand. The technology converts low-grade coal into higher-rank fuel by removal of moisture and conversion into briquettes which feature higher energy content, reduced emissions,

improved handling and transportation characteristics and increased market value.

Solid Energy selected GTL Energy technology after several years of evaluations, engineering studies, coal upgrading trials and combustion trials. Solid Energy's coal was successfully tested at GTL's commercial scale demonstration plant in North Dakota, USA.

"We have worked closely with GTL Energy to determine the best means of upgrading our substantial lignite resources in the Southland into higher energy briquettes. Signing of the agreement is an important step in bringing this technology to New Zealand and in developing our domestic briquette plant in Mataura," said Brett Gamble, group manager of new developments, Solid Energy.

"This is a very exciting stage for GTL Energy, having brought this innovative technology through the path of research and development now to commercial deployment," said Fred Schulte, CEO, GTL Energy. "We have a very strong partner in Solid Energy who have a great opportunity in New Zealand to promote a more efficient and value-added utilization of low-rank high moisture coals. This is an important step in GTL Energy's growth plans which include further plant development in other parts of the world in the near term."

Solid Energy is completing the permitting of its briquetting plant using GTL technology in Mataura in Eastern Southland in the South Island of New Zealand. Construction will start at completion of the permitting process with first production in 2012. High energy briquettes will be sold into the domestic New Zealand coal market and be used in export market trials.

GTL Energy was established in Adelaide, Australia, and since 2004 has developed its coal upgrading technology at its pilot plant in Colorado, USA, and its commercial scale demonstration plant in North Dakota which was completed in 2010.

Proven Classifier Technology

Ludowici is revolutionizing the mining

industry with technologies in fine coal beneficiation known as the Reflux Classifier

(RC), which was developed through a joint

venture with the University of Newcastle.

This equipment can be configured for separating fine particles on the basis of either

density or size.

According to Ludowici, the Reflux Classifier is the perfect alternative to spiral technology and has a footprint up to six times smaller than spirals. Used in coal and minerals processing, it combines three technologies—a Lamella Settler, an Autogenous Dense Medium Separator and a Fluidized Bed Separator. It comprises inclined lamellar channels that deliver better hydraulics compared to conventional technologies.

Ludowici's Classifier technology has been proven with the RC300, RC600 Mk2 and RC2020 units applying the latest in gravity-based separation engineering. The RC2020 model has been enhanced for fine coal and minerals applications and comprises a more easily scalable design incorporating a new 'laminar high shear rate' mechanism. Ludowici is unveiling the RC2020 during AIMEX, September 6-9, 2011.

Ludowici's Reflux Classifier technology can be 'test driven' through the smaller, pilot RC300 scaled unit. The RC300 is designed for in-plant test work in coal and minerals applications and provides an opportunity for engineers to observe how RC technology is one of the more exciting developments in mineral processing for decades.

Ludowici has RC300 pilot units used in minerals field-testing throughout Australia, North America, China, India and South Africa. The Reflux Classifiers offer enhanced functionality with features incorporating a new cone-shaped base for improving underflow, a round mixing section, additional wear-resistant lining as well as improved internal launder adjustment and instrumentation.

Ludowici was founded in 1858 and is one of Australia's most established companies. Today it is a leader in the design, manufacture and supply of minerals processing and materials handling equipment. Products servicing the mining industry include vibrating screens and feeders, the patented Reflux Classifier, centrifuges, screening media and consumables, various piping solutions and wear resistant materials.

Ludowici's Managing Director Patrick Largier said the diverse suite of products and services is testimony to the company's reputation for innovation founded more than 150 years ago with continued dedication to manufacturing quality and service excellence. "Ludowici is trusted in international markets and our vision is to build an international business by innovating for our customers, sharing the knowledge of our people and developing our own technology," said Largier.

From its head office in Brisbane, Ludowici's global footprint now includes wholly-owned subsidiaries in South Africa, Chile, Peru, the United States, China, India and agents in other mining resource countries. Ludowici has placed special emphasis on driving sales growth in Asia through its operations in India and China, its agents in Indonesia, Vietnam, Philippines and its customers in Thailand, Laos and PNG. "Ludowici continues to target sales growth as the mining industry expands in the region," said Largier.

Ludowici products are widely recognized for their quality and value, and are backed by significant investments in research, development and service. "Ludowici represents leading edge innovation for our customers, sharing the knowledge of our people and developing our own technology."

These values were recognized when Ludowici was announced as winner of Ai Group's 2011 Icon of Industry award in Brisbane, Queensland. The technology was also recognized by the IChemE2010 Awards in the UK, winning the Core Chemical Engineering category for maximizing resource efficiency.

Fast Track to Kaolin Production

The use of technology from the Commonwealth Scientific and Industrial Research

Organization (CSIRO) has helped Minotaur

Exploration put its Poochera kaolin deposit

in South Australia on a fast track to production. Initial production at the high-grade

deposit is proposed by the end of 2012 and

if this is achieved, Poochera will be

Australia's second operational kaolin mine.

There is increasing global demand for

kaolin, particularly from Asia.

Minotaur sent samples of Poochera kaolin to the CSIRO for X-ray fluorescence evaluation, which subsequently indicated extremely low base metal values. Additional samples were then sent to the facilities of Australian Laboratory Services to test for a broad range of base metals and rare earths. The results, according to Minotaur's Managing Director Andrew Woskett, compare more than favorably with premium commercial kaolin grades and also confirm exceptionally low levels of heavy metal contaminants. "This potentially put this material in a league of its own, results that Minotaur believes are superb.

"The results of these tests confirm extremely low values for any deleterious elements, including the three key elements, lead, uranium and cadmium, and at levels much lower than most commercially available kaolin products," said Woskett. "These significant results have positive implications for the development, particularly of kaolin products suitable for pharmaceuticals, typically a low volume but considerably higher margin market."

More commonly known as china clay, kaolin is a naturally occurring industrial mineral that is an essential ingredient in multiple and extremely diversified applications. It is suitable as a filler, extender, raw material and pigment in paper, paint, polymers, food, medicine and ceramics, with the very high quality kaolin sector, which is Minotaur's target market, annually accounting for about 10 million mt globally.

As part of plans to commercialize the deposit east of Streaky Bay on South Australia's west coast, Minotaur is accelerating bulk testing and has relocated a bulk sampling plant from Queensland to Streaky Bay. The plant is used in the company's extensive product testing and analysis programs.

"Our test work has clearly identified the Poochera mineralization to be of the highest quality kaolin," said Woskett. "While further test work will be ongoing, Minotaur will now move down a feasibility pathway to achieve a new mine start-up by the end of 2012. Our studies to date suggest a starting annual throughput of around 50,000 mt building to more than 100,000 mt using two wet processing modules. On the known resource at Poochera, that delivers a mine life of more than 50 years."

The company is undertaking feasibility studies and is infill drilling the resource to establish a JORC reserves statement and mine plan for incorporation in the feasibility assessment. Minotaur continues to be encouraged by the status of test results. "They consistently support our findings that our deposit can meet the requirements of specialist users at a time when the surging Asian, Chinese and Indian economies are putting volume pressures on historic sources of quality kaolin supply," said Woskett.

Growing a Solution to Mining Wastewater

New technology could help solve one of the

mining industry's biggest environmental

problems through plants tailored specifically to remove contaminants in waste

process water. Queensland-based PolyGenomX has pioneered a method that

delivers faster growth and higher yields

from plants that can also be used to extract

toxins from mining wastewater.

According to PolyGenomX Managing Director Peter Rowe, mining is one of the most important production activities in Australia, and the availability and proper management of water is a key to its long-term sustainability. "Process water from mines can contain a huge amount of salt and other contaminates, if not treated properly, represent a major problem for surrounding ecosystems and in turn the industry as a whole. Treatment of process water can be expensive, particularly in remote areas, and in many cases the water cannot be recycled well enough for further use," said Rowe. "The range of PolyGenomX solutions are significantly different to what's currently used as it's primarily biological in nature and can even rehabilitate a mine site back to its pre-existing vegetative state," said Rowe.

The core of the PolyGenomX technology is based around the activation of dormant parts of a plant's DNA without genetically modifying it in any way. The process essentially turbo-charges certain naturally existing characteristics in a plant such as rapid growth properties and predispositions to thrive in various environments and soils.

"One of our many processes tailored to the mining industry is the ability to propagate trees that actively feed off salt and other contaminates, effectively stripping them out from the process water," said Rowe. "This water can then be safely used to irrigate land and crops, and even fed back into natural water courses without any recourse to the local ecosystem. Our technology provides water management practices that permit the mining industry to take a huge leap forward in efficient use of water resources."

PolyGenomX has developed a number of other applications for plant use in the mining industry including controlling seepage from various areas on a site into the water table and solutions for holding ponds at the end of their life cycle. It is in discussions to remediate a series of former mining sites that are presenting a number of environmental issues including the contamination of groundwater by chemicals leaching from mine tailings. The company is also considering the development of new bacteria-based soil-remediation technology in conjunction with the project.

According to Rowe, the PolyGenomX technology can be adapted to a range of commercially produced crops including those used in renewable energy production and pulping through to construction and fine timber such as sandalwood. "We have successfully developed a range of stable high-performance polygenomic species that grow faster and yield more than any comparable stock."

"We are able to offer a significant competitive advantage to our clients through unprecedented plant performance. This includes 30%-plus faster plant growth and 30%-plus reduction in production costs and cycles, and enhanced environmental robustness. This all results in accelerated growth and production, and significantly higher profits," said Rowe.

The company will license the superior strains of plants developed to ethical producers, farmers and other partners involved in the production of commercial crops and environmental restoration. PolyGenomX technology is a world-first and has a patent pending.

The Landtem portable exploration tool uses highly sensitive magnetic sensors. The Australian Government backed Commonwealth Scientific and Industrial Research Organization (CSIRO) is a world leader in the science of mineral exploration and mining. CSIRO aims to increase safety and productivity in mining and processing by developing high technology, distributed intelligent network sys- tems and automated mining processes which will streamline deci- sion making, remove people from hazardous environments, and ensure consistency in production systems. It hopes to help add to Australia’s collective wealth through the discovery of A$250 billion of new mineral resources by 2030 and will help transform the Australian mining industry by developing and applying the next generation of safe, geologically intelligent mining and drilling systems. CSIRO delivers productivity gains for the mineral processing industry through environmentally sustain- able technology, and delivers energy and cost-efficient technolo- gies in support of globally competitive Australian coal and metal production industries. Much of the R&D work is undertaken by the Minerals Down Under Research Flagship which works with industry and partners to help address Australia’s key national challenges and opportuni- ties in the minerals domain.

The flagship is focusing research through six research themes

to solve the technical challenges facing Australia’s future minerals

industry: The flagship is creating new knowledge and transformational technologies for the mineral sector and ensuring there are appro- priate pathways for the transfer of that knowledge and technolo- gies to industry in order to improve Australia’s global competitive position.

Saline Water Brims with

Sustainable Savings “Highly saline underground waters are often the only water available to miners in inland Australia,” Aral said. “And in north- ern Chile, seawater is pumped tens of kilometers to mine sites at higher altitudes.” Aral says in Australia the mining industry’s use of water increased about 29% between 2000–01 and 2004–05, when it reached 2% of the total national water consumption. But mining is competing with other water users such as agriculture for the scarce resource, and is also facing other challenges such as cli- matic conditions and regulatory requirements. Using saline water is seen as a practical response that will also improve the sustainability of mineral processing generally, and CSIRO’s Minerals Down Under Flagship has been investigating this area since 2008. CSIRO is examining the use of saline water in physical processes, such as crushing, grinding, flotation, mag- netic and gravity separation, and as a diluting agent in lixiviant preparation. The research concentrates on using seawater and saline underground water without any pre-treatment, and recycling available water as much as possible. While saline water can cause corrosion to pumps, pipes and other components at mine and mill sites, Aral said the advantages outweigh the disadvantages where fresh water is unavailable. “Use of seawater, with little or no desalination, could enhance the eco- nomic feasibility of mining operations.” In one case study, process flowsheets have indicated that a South Australian copper concentrate-producing company could reduce its reliance on bore water by recycling saline water from processing. The research estimated the company could reduce its bore water con- sumption by about 260 metric tons per hour (mt/h), also effectively reducing power costs and associated greenhouse gas emissions. Aral said this translates into a saving of about A$250,000 a year based on pumping 260 mt/h from the borefield to the plant at a cost of A$0.10 per kilowatt hour. The only modifications required would be some additional pumps. Potential savings would significantly stack up over the life of the mine.

Field Sensor Inventors Win Award “Landtem represents a major innovation in our ability to unearth mineral deposits worth hundreds of millions of dollars—deposits which may have been missed without this technology,” Foley said. Landtem has since been licensed to Australian start-up compa- ny, Outer-Rim Exploration Services. In the past eight years, 10 Landtem systems have been built and deployed successfully on four continents to help unearth mineral deposits worth around $6 billion. According to Outer-Rim’s General Manager Andrew Carpenter, the Landtem system is an important aid to finding very conductive mineralization in complex geological environments. “It can detect deeply buried, highly conductive massive sulphides, such as nick- el, while being able to effectively minimize the response from con- ductive cover and formational conductors.” CSIRO’s persistence in developing Squids technology for geo- physics over the past decade, and the subsequent development of Landtem from the laboratory to a fully functioning commercial instrument, represents a major step forward in mineral exploration technology. Landtem’s development is an example of science teams col- laborating to deliver new technologies to multiple industry sectors. The underpinning Squids technology—delivered through CSIRO’s National Research Flagships program—has been applied to indus- tries as diverse as mineral exploration, oceanography, security and defense. The MIOTA award is presented annually to a person or team responsible for an innovative cost saving or effective mineral industry operating technique developed in Australasia, in the min- erals sector.

New Life for Old Chemistry The team investigating the chemistry of this system is led by Dr. Keith Barnard from CSIRO’s Minerals Down Under Flagship, working through the Parker CRC for Integrated Hydrometallurgy Solutions. The team has found a way to make the previously devel- oped synergistic chemical combination work more efficiently by altering the operating environment. The extractants are LIX63 and Versatic 10 with the former being the first organic extractant developed for use with copper. The Parker Centre has provided its cutting-edge, collaborative research capabilities to give a crucial insight into just how these two reagents work so well together. “From a fundamental chem- istry perspective it’s an intriguing system,” Barnard said. He and his Curtin University of Technology/Parker Center col- laborator, Professor Mark Ogden, received the 2010 Parker Center Award for Research Collaboration in recognition of work done to clarify the structure of the ‘metal complexes’ formed using the LIX63–Versatic 10 combination. The researchers created smaller versions of the metal complex (being the metal ion surrounded by the extractants), grew crystals from them, and used x-ray crystal- lography to image these structures. For the first time ever, this illuminated the force behind the synergy observed when these two reagents extract metal ions. Not only does each reagent partake in extraction of the metal, the extractants in the resulting metal complex also interact with each other via hydrogen bonding to help strengthen it. The liquid extrac- tion process is one of the main purification steps used to help recover pure metal from ore. A finite range of reagents is available for application, and selection depends on the separation required. Each extractant selects for only a specific metal or group of metals that then go through to the next stage of processing. Some extractants are more stable than others. “Each extractant has an Achilles heel,” Barnard said. In the case of LIX 63, it is degradation. Reagents are recirculated through the process and there is a cost in replacing any degraded reagent. The by-products that form during degradation also accrue and can have a negative impact on the process. The CSIRO team has developed an understanding of factors affecting LIX63 degradation and the impact of the by-products, which fortunately are minimal. They have shown that LIX63 degra- dation can be restricted by finessing operating conditions—tweaking variables such as operating temperature and pH. An additional bar- rier to the use of LIX63 has been the fact that only 60% of any batch of the extractant is active. Dr. Barnard and his team have investigat- ed this phenomenon and found ways to activate the other 40%. Serious industrial interest in this synergistic system began in 2004 when its metal selectivity properties were presented at a conference. Dr. David Dreisinger, vice president (metallurgy and process) for Canadian company Baja Mining, saw the presentation and realized the LIX 63–Versatic 10 system would be a perfect fit for a new mine in Mexico. The El Boleo mine was being planned with a construction budget close to US$1 billion. Its metals were copper, cobalt and zinc. However metal selectivity is not the only prerequisite of a good solvent extraction process. “The use of a synergistic system requires detailed understanding of the chemistry and stability of the reagents involved,” Dreisinger said. “The scientific insights derived from CSIRO’s work in these areas have given Baja Mining confidence to include the system in the Boleo process flowsheet.” These CSIRO items originally appeared in the organization’s Process magazine. |