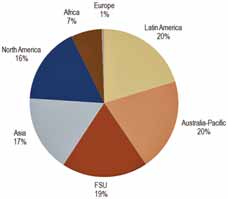

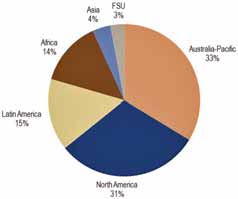

Left, base metals acquisitions by region, 2010 (total in-situ value acquired: $668.4 billion); right, gold acquisitions by

region, 2010 (total in-situ value acquired: $222.7 billion). Source: Metals Economics Group, 2011

2010 Base Metals and Gold Acquisitions Report

The worldwide 2010 dollar value of large ($25-million minimum) base metals and gold acquisitions totaled $50.7 billion, the third highest annual total in the past 10 years, according to a recent Metals Economics Group (MEG) Strategic Report. Comparable totals for 2008 and 2009 were $41 billion and $14 billion, respectively. The 2010 total signified a general return of confidence to the industry after a period of significant strategic retrenchment and caution due to the worldwide recession and sharply lower metals prices that began in late 2008 and lasted into early 2010 MEG stated.

The value of gold transactions in 2010 jumped 298%, year-on-year, to a historical high of $28.9 billion, 57% of the gold-base metals acquisition spending during the year.The price paid in base metals transactions (copper, nickel and zinc) increased 220% to $21.8 billion, 43% of the year's total.

Of the 60 primary gold transactions, the Australia-Pacific region accounted for 10 deals containing $75 billion of in-situ value, 33% of the $222.7-billion 2010 value for gold in the ground. Australia-Pacific was followed closely by North America (mostly Canada), with 11 transactions accounting for 31% of the in situ value.

The price paid as a percentage of in-situ value in 2010 averaged 13% for the 60 gold deals, a 71% increase over 2009. The most expensive region for gold acquisitions was Africa at 26.9%; the least expensive region for acquiring gold in the ground was North America, with prices averaging only 3% of in-situ value.

Geographic distribution of the 66 base metals acquisition targets considered by MEG in 2010 was almost even among all regions: North America, Latin America, Asia, Australia-Pacific and former Soviet Union. The exception was Africa, which accounted for 22% of the value of transactions in 2009 but only 7% in 2010.

The acquired value of reserves and

resources in 2010 base metals transactions totaled $668.4 billion, with copper

company and project acquisitions accounting for $371.4 billion of the total. Each

region, except Europe, hosted at least onevery large deal in terms of in-situ value .

As featured in Womp 2011 Vol 05 - www.womp-int.com