Potash: The New 'Hot' Commodity

Having seen their markets shrink dramatically during 2009, potash producers are once

again predicting strong sales as the world's farmers catch up on their fertilizer application.

By Simon Walker, European Editor

A panoramic view of one of Belarusian Potash Co.'s processing plants. The company was established in 2005 by 50:50 partners Belaruskali and Uralkali; three years later

another investor acquired 5% of

A panoramic view of one of Belarusian Potash Co.'s processing plants. The company was established in 2005 by 50:50 partners Belaruskali and Uralkali; three years later

another investor acquired 5% of

Belaruskali's share, leaving Uralkali's 50% holding intact. (Photo courtesy of BPC)

The global financial crisis that began in

2008 unleashed market uncertainty

across the mining industry, as in other

major economic sectors. Its effect on

agriculture was marked by a significant

slow-down in fertilizer application, as

the financial institutions tightened

farmers' credit, and farmers themselves

drew back from spending too much on

fertilizers in times of economic uncertainty. And, while most of the mining

industry bounced back promptly from

the general downturn as demand for

commodities such as base metals and

iron ore returned strongly, potash producers continued to have a difficult

time right though 2009 and into 2010

as they waited for their customers to

come back.

Right at the beginning of the downturn, the main potash companies

retained a sense of optimism, at least

for the longer term. Speaking in early

2009, the CEO of U.S.-based Mosiac

Co., Jim Prokopanko, provided an upbeat assessment of the future. "Despite

the turmoil in the commodity markets,

"we remain confident that long-term

agricultural fundamentals are excellent," he said. "This is a self-correcting

cycle because demand for crop nutrients can only be delayed for so long.

Large crops are still required to secure

the world's food supply, and crop nutrients will play an essential role in

achieving that objective."

And so it has turned out to be, with

agricultural demand for potash—one of

the three key nutrients needed by crops

across the board—having picked up

again as 2010 progressed.

To illustrate this, the world's largest

potash producer, Canada's PotashCorp,

reported potash production and sales

for the fourth quarter of the year running at double the levels for fourth

quarter 2009. "Our industry moved

past an important inflection point in

the third quarter and, as farmers

around the world became more active in

addressing the critical issue of soil fertility, we demonstrated our ability to

deliver in a strengthening market environment," said company President and

CEO Bill Doyle. "With global food

demand as the powerful engine, we

believe we have moved into the next

stage of growth for our business."

For many years, potash was widely

perceived as a Cinderella commodity—

something real mining companies did

not really want to be involved with.

Since the start of the 21st century, that

has all changed, initially through acquisitions of operations that led to some

consolidation, but more recently as

some of the majors—notably Vale and

BHP Billiton—seem to have realized

there are market opportunities to be

gained here. Although BHPB failed

rather spectacularly in its attempt last

year to buy PotashCorp, smaller players

in the field have been picked off one by

one, as the allure of strong long-term

markets has attracted the industry's big

fish to the potash pond.

Supplying the World

Despite its universal demand, potash

production is concentrated, with just

13 companies operating in 12 countries having a significant level of production. Of these 12, Canada, Russia

and Belarus account for more than two thirds of the world's potash production,

according to PotashCorp, and between

them hold more than 80% of the

world's reserve base.

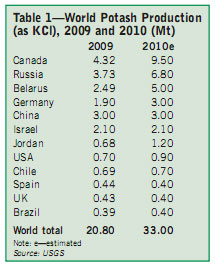

Data from the USGS show world

potash production reached an estimated 33 million metric tons (mt) (as muriate of potash, or KCl) last year, compared with the dismal 20.8 million mt

achieved in 2009 as companies across

the board cut back on their capacity in

response to markets that had evaporated. Top producer-country data are

shown in Table 1.

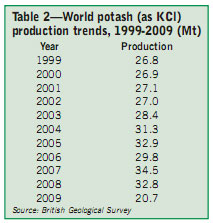

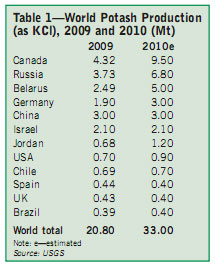

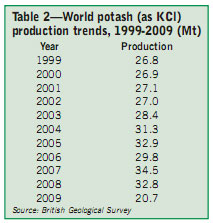

Longer-term data compiled by the

British Geological Survey show potash

production remained on a gradual upward trend over most of the past 10 to

12 years, as shown in Table 2.

The BGS data reinforce the dominance of Canada's producers in terms

of world supply: with the exception of

2009, Canada's mines have supplied

over 8 million mt of potash year after

year. Chinese production has increased

the most during the period, on a relative basis, from a low base level of

218,000 mt in 1999 to 2.1 million mt

10 years later (or nearer 3 million mt if

the USGS data are more accurate).

Russian output has also risen, while

production in Belarus has remained

remarkably consistent, perhaps reflecting a lack of investment to take production to the next stage.

The doubling in output from Chile,

from an estimated 345,000 mt in

1999 to some 700,000 mt last year,

reflects the growing development of the

country's salar resources, as described

in the review of lithium markets in the

March edition of E&MJ (pp.102-109).

As noted there, lithium is usually a by-

product from brine production, with

potash salts comprising the bulk of the

product mix.

The World's Potash Endowment

With the exception of salar brines, the

world relies on vast evaporite-hosted

resources for its potash. The first recognition of the potential of this type of

deposit came in Germany in the 1840s,

but it took a further 20 years for the

first commercial extraction plant to be

built. The development of

potash industries in both

Germany and

France was a

result of a new

understanding

over the role of

potassium in

plant growth,

and as agricultural demand

worldwide increased, so new potash

resources were brought on stream.

U.S. production began during World

War I, initially from brines, with the

first mine to work the major deposits in

New Mexico coming on stream in 1931.

Coincidentally, the first mine in the

Urals was commissioned the same year,

with new production also being won

from operations in Poland and Spain,

and from the Dead Sea, by that time.

Development of the potash resources in Saskatchewan began in

1958, and although the first mine to be

commissioned was short-lived, it paved

the way for the current portfolio of operations in the province. Mining began in

Italy in 1959, in what is now Belarus in

1963, in the Republic of Congo in

1969, in Australia in 1973 and in the

UK in 1974, while the recovery of

potash from the Jordanian side of the

Dead Sea dates from the 1980s. Some

operations were successful; others less

so for a variety of reasons, including

flooding. The last operations in France

closed in the 1990s.

By the 1980s, however, potash was

in serious over-supply, a situation that

was not helped by the collapse of the

Soviet Union and the subsequent fall-off in demand from farmers in the CIS

countries. Prices slumped as producers

fought for market share, higher-cost

capacity was weeded out and there was

producer consolidation. For much of

the late 20th century, prices stayed at

levels that really did not provide any

incentive for either expansions at existing operations, or the entry of new players into the market.

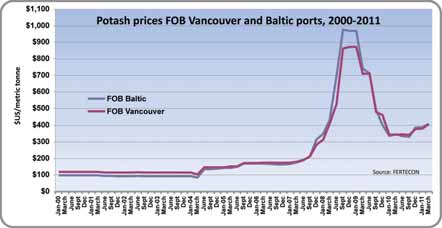

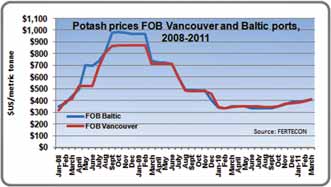

This situation continued into the

2000s. As illustrated in the graphs on

p. 37, data from the potash-industry

consultancy, Fertecon, show that

between 2000 and 2004, the FOB

Vancouver price was constant at around

$120/mt, with a gradual increase that

started in mid-2004 and broke through

$200/mt at the beginning of 2008.

After that, the picture changed dramatically: by late 2008, potash prices

had reached around $870/mt as

demand surged—especially from developing markets such as China (see

graph). And, following their peak, prices

plummeted precipitously as farmers

across the board postponed their fertilizer purchases. Producers cut their

prices to $700/mt in early 2009, and to

below $500/mt later in the year, with

the market bottoming out at just over

$300/mt in the first quarter of 2010.

Since then, Fertecon's data show, there

has been a gradual recovery, such that

FOB Vancouver prices stood at just

under $400/mt in February.

The Juniors Fall Prey...

The growth in potash prices since 2004

acted as a catalyst both for existing producers to look at expansions, and for a

crop of junior companies to get new

projects off the drawing-board. Among

the majors, Rio Tinto pushed ahead

with its Potasio Rio Colorado project in

Argentina, while in Canada, juniors

such as Potash One, Anglo Potash and

Athabasca Potash all increased the

exposure of their respective projects.

One by one, though, several of the

juniors have gone, while Vale was quick

off the mark in acquiring Potasio Rio

Colorado and some Saskatchewan

exploration properties from Rio Tinto

during Rio's fire-sale of assets in early

2009. BHP Billiton also moved further

in to Saskatchewan by buying out first

Anglo Potash, with which it had been in

joint venture in the province, and then

in March last year, Athabasca Potash,

which held land adjacent to BHPB's

Jansen project. Russian fertilizer company JSC Acron bought the oddly

named 101109718 Saskatchewan Ltd.

in 2008 with the aim of gaining exploration ground in the province, with a

name change to a more modest Pacific

Potash Corp. in early 2011. The most

recent of the juniors to have been

snapped up has been Potash One,

whose shareholders received a C$430

million payout earlier this year from the

German potash producer Kali & Salz.

And it has not only been junior companies being eyed up by predators.

Earlier this year, the oligarchs behind

Russia's big potash producers, Uralkali

and Silvinit, announced a merger that

would propel the new company to No.2

in the world league, behind Potash-

Corp. There is some history here, since

the two were part of one Soviet-era

organization until 1983.

The merger involves Uralkali buying

a 20% holding in Silvinit, which it

completed in February at a cost of

$1.4 billion. The plan is for the two

companies then to merge under the

name of Uralkali to create a single firm

with a market capitalization of some

$24 billion. However, not everything

has gone smoothly, with one of the

minority shareholders in Silvinit, JSC

Acron, having gone to litigation over

what it considered to be an under-valuing of the company during the merger.

A final court hearing was scheduled for

early April, although with 90% of

Silvinit shares having been voted in

favor of the merger, it is hard to see

what impact any judgment would have

on the outcome.

...but PotashCorp Escaped

DThe face of world potash production

could well have been changed in a big

way if BHP Billiton had succeeded

with its $39 billion bid for PotashCorp

last year. The fact that BHPB was prepared to spend this amount on securing access to a commodity that only a

few years ago was considered to be

wholly uninteresting speaks volumes

for the recent turnaround in corporate

perceptions.

In the event BHPB was unsuccessful

with the Canadian government effectively blocking the takeover on the

grounds it would not have been in the

national interest. BHPB's $39 billion

bid equated to a value of $130 per

PotashCorp share, a value PotashCorp

rejected outright as being significantly

too low, despite the price representing

a 20% premium on the company's

share listing at the time.

The bulk carrier U-Sea Saskatchewan loaded its first potash cargo for Canpotex late last year, taking 58,000 mt

to

The bulk carrier U-Sea Saskatchewan loaded its first potash cargo for Canpotex late last year, taking 58,000 mt

to

Thailand and Indonesia. (Photo courtesy of Canpotex)

The cost of the failure was high to

both sides, with BHPB booking some

$350 million on its part, and PotashCorp a further $64 million for its defense. With BHPB's bid out of the way,

PotashCorp promptly carried out a $2billion buyback of its shares, then a three-for-one split to improve liquidity.

In the event, it seems as though its

defense was soundly based, since by

April its stock had moved ahead to give

it a market capitalization of over $50

billion—well above BHPB's valuation

and the premium offered.

The Big Players

As several of the major potash producers point out, published numbers can

be confusing, with some companies citing nameplate capacities while others

use operational capabilities as their

yardstick. Actual output is another matter, dependent on market demand. The

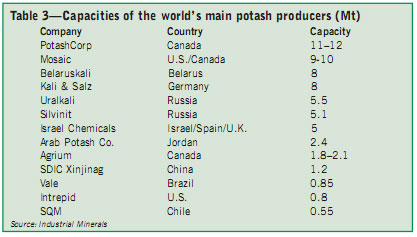

world ranking for producers is shown in

Table 3.

With five mines in operation plus

the mineral rights to the Esterhazy

property in Saskatchewan, and one

mine in New Brunswick, with strategic

holdings in Israel Chemicals, the Arab

Potash Company (APC) in Jordan and

SQM in Chile, PotashCorp is the

world's leading potash producer. The

company estimated that last year its

operations represented 17% of world

production and 20% of world potash

capacity, with attributable production

totaling 8.08 million mt of KCl. Its

Canadian operations include both conventional mining and solution-mining

units, with its ore output having

rebounded from cutbacks announced

in 2009 to 22.4 million mt at an average grade of 22.62% K2O.

PotashCorp increased its stake in

Israel Chemicals from 11% to 14% last

year, while holding 28% of APC and

32% of SQM. It also has a 22% stake

in Sinofert, a Chinese fertilizer company, which gives it exposure to the end

market in China as well as supplying

the raw material.

Current development projects, all

scheduled to come on stream by 2015,

include the construction of a new 1.8million-mt/y mine in New Brunswick, at

a cost of C$1.66 billion. Capacity is

being expanded to 2.7 million mt/y at

both the Allan and Cory mines in

Saskatchewan, while capacity at Rocanville is being increased by 2.9 million mt/y to 5.7 million mt/y. In all,

PotashCorp is investing more than C$7

billion to increase its capacity to 17.1

million mt/y, with the company claiming it is developing more than 50% of

the world's incremental capacity that

will be commissioned by 2015.

Meanwhile, at Esterhazy, which

Mosaic operates under a long-term

lease agreement from PotashCorp,

capacity was expanded by 1.1 million

mt/y in 2006. Two further expansion

phases will add an extra 1.8 million

mt/y by 2016, by which time capacity

will have reached 6.36 million mt/y.

Sinking work on the K3 shaft is scheduled to begin next year, with the operation's fleet of five four-rotor miners

being increased to nine.

Mosaic is also increasing capacity

at its Belle Plaine solution mine in the

province, from 2.8 million mt/y to 3.5

million mt/y, with a further 3 million

mt/y of additional capacity scheduled

to come on stream at Belle Plaine and

at its Colonsay mine between 2016

and 2020.

In the U.S., Mosaic operates one of

the nation's largest underground mines

at Carlsbad, New Mexico, which produces two separate potassium minerals,

sylvite and langbeinite, and a potash

salt solution mine at Hersey, Michigan.

In total, the company reports its attributable output of 5.2 million mt of

potash products from 19.3 million mt

of ore last year represented around

12% of world production, with its 10.2

million mt/y capacity equivalent to

14% of world capacity.

Third in the production league table,

Belarus Potash Co. (BPC) is majority-

held by the Belarus state and the

Russian potash producer, Uralkali. BPC

operates four mines in the Starobin

evaporite basin at Soligorsk, 130 km

south of the national capital, Minsk.

Capacity that is being lost through

reserve depletion at some of the company's older mines is being replaced by

the development of two new ones,

Krasnaya Sloboda and Beryozovski,

Both Uralkali and Silvinit have their

operations in the Perm region of central

Russia. Uralkali is currently working on

a 27% capacity expansion from 5.5 to

7 million mt/y of KCl, with completion

scheduled for next year, and in the

longer term has expansion opportunities at its Ust-Yayvinsky project, which

lies near its existing operations.

Silvinit is also in expansion mode,

with an increase in capacity from 5.1 to

5.6 million mt planned for this year and

to 6 million mt for 2012. It also has

greenfield development potential at its

Polovodovsky prospect. The proposed

merger between the two companies

would result in Uralkali having some 13

million mt/y of KCl capacity by 2013,

with five mines in operation.

In Germany, some of Kali & Salz's

operations date from the late 19th and

early 20th centuries. Output from the

company's six mines make it the largest

potash supplier in Europe, with

reserves remaining for a further 38

years at current production rates. In

2010, however, potash accounted for

around one-third of its revenues, with

rock salt taking an increasing share—

reflecting its acquisition of U.S. salt

producer, Morton Salt, the year before.

Its buyout of Potash One also signals

further geographical diversification,

and gives it access to the Legacy solution mining project. Situated next to

Mosaic's Belle Plaine operation, this

has the potential to produce up to 2.7

million mt/y of potash, albeit at an investment cost of around $2.5 billion,

with production beginning sometime

after 2015.

Also Important are...

Both Israel Chemicals Ltd. (ICL) and

the Arab Potash Co. (APC) win their

potash from the salt waters of the Dead

Sea. In addition, ICL has production

capacity in Spain, which it acquired in

1998, and in the UK, where it bought

Cleveland Potash from Anglo American

in 2002. APC, meanwhile, is planning

to produce at above its nameplate

capacity this year, as it continues to

fine-tune its solar evaporation and

refining facilities on the Dead Sea

shores.

An LHD transports a bucketload of potash at the Kali & Salz Hattorf-Wintershall mine.

(Photo courtesy of K & S)

The smallest of the Saskatchewan-

based producers, Agrium is currently in

the process of expanding its Vanscoy

operation in the province from 2.1 to

2.8 million mt/y of KCl, with completion targeted for 2015. U.S.-based

Intrepid Potash is also working on

capacity expansions, aiming to augment production from its existing

mines in New Mexico and Utah with

solution mining and solar evaporation

at its mothballed HB underground mine

in New Mexico. The company already

uses this system at Cane Creek in Utah,

while at Wendover (Utah), it recycles

salt brine from its solar potash production unit to resurface the Bonneville

Salt Flats.

As well as potash, Intrepid produces

langbeinite (potassium magnesium sulphate) from its operations in New

Mexico, and in 2010 committed capex

of some $85–$90 million to improve

langbeinite recoveries at its plants

there.

In Brazil, Vale has set itself the

challenge of becoming one of the

world's largest fertilizer producers over

the next seven years, with the target of

producing 10.7 million mt/y of potash

by 2017. Given that last year's output

from its only operation, Taquari-

Vassouras, was just 662,000 mt—8%

lower than in 2009—this seems to be

ambitious, especially with the recent

appointment of new, more domestic-

focused senior corporate executives.

Nonetheless, the company has an

impressive project pipeline that

includes Carnallita in Brazil (1.2 million mt/y by 2014), Regina (Saskatchewan; 2.8 million mt/y by 2015),

and two projects in Argentina: Rio

Colorado (2.4 million mt/y by 2013)

and Neuquén (1 million mt/y). All of

these remain subject to corporate

investment approval.

As noted in the lithium review in

March's E&MJ, Sociedad Química y

Minera (SQM) is Chile's principal

potash producer, recovering potash

from salar brines. The company produces both potassium chloride and

potassium sulphate, which between

them contributed nearly 30% to its pre- tax profits last year.

And so to China, the world's largest

potash consumer and the largest importer as well, with imports running at

8-9 million mt/y. Domestic production

has increased significantly over the

past 10 years, with a number of companies now recovering potash and

potassium sulphate from Qarhan Lake

in Qinghai province. The state holding

company, SDIC, is one of the larger producers, with SDIC Xinjiang Luobupo

Potash Co. currently developing a

3 million mt/y potassium sulphate

brine-based operation at the Luo Bu Po

salt lake.

Exploring Elsewhere

Aside from the relatively few, but extensive, deposits that support current production, other parts of the world host

potash potential. Potash mineralization

is known to occur, and in some cases

has been evaluated in the past to the

point of production, in countries as

geographically diverse as Mexico,

Morocco, Tunisia, Libya, Ethiopia,

Republic of Congo, Gabon, Laos,

Thailand and Italy.

Of these, the deposits that lie inland

from the Congolese port of Pointe

Noire, are currently attracting significant interest. Congo is a past producer

of potash, with the Holle mine having

operated briefly in the 1970s before it

was flooded.

Companies now involved in project

development there include Canada's

MagMinerals, which has received permitting for its 1.2-million-mt/y Kouilou

solution-mining project. The company

plans to develop this in stages in conjunction with an adjacent 600,000 mt/y magnesium-production plant. Late

last year, however, it said it was re-evaluating its options for the project, following the failure of a Chinese company that had agreed to buy a majority

holding to get approvals from SDIC.

According to at least one industry observer, world potash shipments could reach 55-60 million mt in 2011,

driven

by rising agricultural demands. (Photo courtesy of Vale S.A.) (Photo courtesy of K & S)

Also from Canada, privately held

Congo Potash Co. has been working on

a 500,000-mt/y project at Holle, with

indications that it plans to begin production in 2013 to supply the Brazilian

market. Holle Potash Corp., also privately held, is another player in this

area, having acquired the Tchitondi and

Manenga concessions from local company, Afrimines, in 2008. Elsewhere in the country, Australian-listed Elemental

Minerals is exploring its Sintoukola

prospect.

Another country not renowned for its

mining sector, Ethiopia has become a

focus for potash prospecting in north-

east Africa. In February, Canadian juniors Panorama Resources and Ethiopian

Potash Corp. (EPC) amalgamated in a

reverse takeover by EPC, with the C$11

million proceeds of a private placement

financing being targeted at fast-tracking exploration at the Danakil Basin

concessions in Ethiopia. Both surface-

and solution-mining potential exist

there, EPC says.

Another explorer in the basin, Allana

Potash, recently attracted a C$10 million injection from the International

Finance Corporation, and is now aiming

to carry out a feasibility study on its

Dallol project.

Both Thailand and Laos are known

to host potash resources, although

development of the main deposit in

Thailand has been on the cards for

years, but has never materialized. The

company that had been working on the

Udon Somboon project, Asia Pacific

Potash, sold its interests to local contracting company, Italian-Thai Development, in 2006 following NGO-organized opposition to its development

plans, with no recent indications of

progress.

Laotian potash resources, in the

Vientiane Basin, also remain underdeveloped, although the first Chinese-

backed project now seems to be under

way. A 50,000-mt/y plant was reportedly commissioned there late last year.

In Russia, EuroChem (which has a

15% holding in Kali & Salz) is developing its Gremyachinskoe and Verkhnekamskoe projects, with the aim of

bringing 7.7 million mt/y of capacity to

the market when both are on stream.

The fertilizer company has budgeted

some $3.2 billion to gain its own

potash production, with the first 2.3

million-mt/y stage at Gremyachinskoe

in the Volgograd Basin scheduled for

commissioning in 2013.

And so back to elephant country—

potash elephants, that is. In February,

one of the remaining independent juniors in Saskatchewan, Western Potash,

appointed Amec Americas as the lead

engineering consultant for a prefeasibility study on its Milestone solution-mining

project, close to both Belle Plaine and

Vale's Regina project. Scoping studies

completed last year indicated the potential for a 2.5-million-mt/y operation.

Notwithstanding its PotashCorp

debacle, BHP Billiton has its own

extensive portfolio of Saskatchewan

properties. Leading the field is Jansen,

already with a $240-million development budget and now the subject of a

final feasibility study. Other projects

include Boulder and Young, as well as

the Melville and Burr properties that it

acquired from Athabasca Potash last

year. In March, BHPB awarded engineering firm SNC-Lavalin a multi-year

contract to help it manage its potash

projects in the province.

World Trade Dominates

According to the International Fertilizer

Industry Association, world potash production jumped by 52% last year.

Predictions across the board suggest

that demand is growing steadily as

world agriculture resumes investment

to give higher yields. And it is not just

for food production; greater use of biofuels in countries such as Brazil is driving potash demand as well.

One fact dominates the discussion.

The world's population is continuing to

increase, and because of this, we need

to produce more food. Looked at in

such basic terms, potash producers

appear to be in a no-lose situation,

since in the long term, demand for their

output is guaranteed to grow.

Writing in February, Scotia Bank

Vice President Patricia Mohr said: "The

outlook for potash markets (demand

and prices) over the coming year is

extremely positive, with high crop

prices incentivizing farmers to apply

more fertilizer. World potash shipments

in 2011 could climb to 55-60 million

mt amid one of the best fertilizer-application environments ever seen.

"Prices will likely advance more

strongly in the second quarter, with

Canpotex [the Canadian producers'

export vehicle] announcing another

US$30 price increase for Asian and

Latin American spot markets (effective

immediately)," she said. "With Canpotex currently sold out on volumes for

overseas markets, the price increase

will go into effect around April. In addition, BPC [in Belarus] has announced

another US$50 price hike from May

onward (on top of the US$30)—a move

likely to be followed by Canpotex."

Her opinions were shared by those of

Uralkali CEO Vladislav Baumgertner.

"We see very strong fundamentals for

the potash business now and for the

next five years," he said. "The business

and economic environment is very similar to that of 2008."

A good business to be in, then.

As featured in Womp 2011 Vol 04 - www.womp-int.com