Report Outlines Major Silver Prospect in Southeastern Guatemala

Escobal’s mine life is estimated at 18 years at a planned production rate of 3,500 mt/d. Total cash cost of produc- tion is expected to average $3.05/oz of silver produced over the 18-year mine life, net of gold and base metal by-prod- uct credits. Over the life of the project, mine production is expected to total 22.6 million mt at average diluted grades of 415 g/mt silver, 0.47 g/mt gold, 0.71% lead and 1.22% zinc. Capital cost to develop the project is estimated at $326.6 million.

The Escobal project feasibility study is currently under way, and Tahoe expects to complete it in 2011. Baseline studies and environmental documentation have been ongoing for nearly two years. Permitting for full mine operations is scheduled con- currently with the feasibility study, and Tahoe anticipates the project can be fully financed and ready for a construction decision by May 2012.

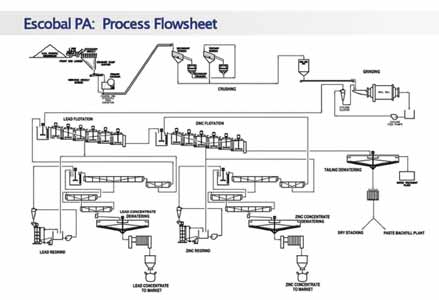

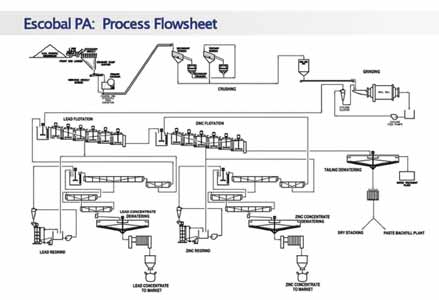

Mining at Escobal will utilize longhole stoping methods, with paste backfill used to fill open voids. The mine will be developed via two primary development declines for the transportation of person- nel, equipment and materials, as well as transport of the mined resources to the surface for processing. Additional pri- mary development will include two venti- lation shafts and drifts connecting the primary declines. A total of 13,000 m of primary and secondary underground development is contemplated during the 18-year mine life. The primary declines will also serve as platforms for explo- ration and definition drilling during the feasibility phase of the project.

Mineral processing will use differen- tial flotation to produce lead and zinc concentrates for sale to a third-party smelter.