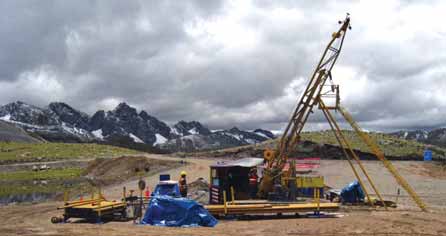

Exploration drilling at the Santander property in Peru uncovered high-grade zinc-lead-silver mineralization

to the north of a former mine which operated from 1958 to 1991. (Photo courtesy of Trevali Resources)

Trevali and Glencore Agree to Develop Santander

The Trevali-Glencore development agreement calls for Trevali to retain 100% ownership of the Santander project. Glencore will provide, construct and operate a modern 2,000-mt/d mill and flotation plant to produce zinc and lead-silver concentrates. Glencore will also provide project management and operational expertise on a contractor basis to design, develop and operate the future mine, using an anticipated combination of open-pit and underground mining techniques. Trevali will provide exploration, permitting and community relations expertise to the partnership.

Trevali will acquire full ownership of the new Santander plant and associated infrastructure over a four-year period following start of commercial concentrate production. Trevali has the right, at any time, to pre-pay the outstanding cost of the plant subject to payment plus 10%.

Glencore has signed a life-of-mine offtake agreement for Santander concentrate production. Glencore has also provided a $2-million credit debenture facility to Trevali, of which $500,000 was advanced to help fund a recently completed resource expansion program. Upon closing the development agreement outlined above, Trevali elected to draw down the remaining funds, which will be utilized to advance exploration and development of the Santander project and to fulfill the company’s 18-month budgetary requirements for its Toronto Stock Exchange listing application.