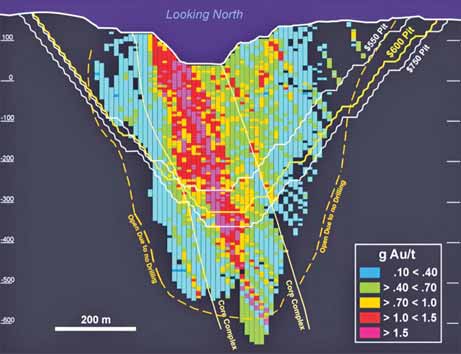

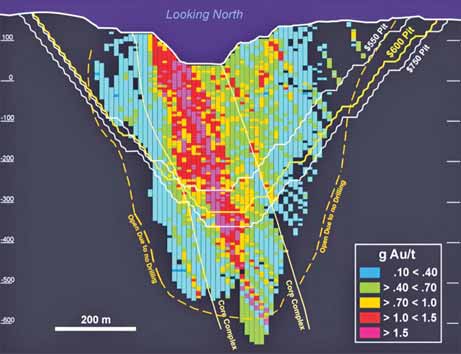

Diagram of the Mt. Todd orebody. Its owner, Vista Gold, estimates it will initially cost about $441 million to

reactivate mining at the Northern Territory, Australia, gold property. (Photo courtesy of Vista Gold).

Vista Reports Positive PFS for Mt. Todd

The Mt. Todd project is located 230 km southeast of Darwin and 56 km by road north-northeast of the regional center of Katherine. Pegasus Gold developed and operated the open-pit gold mine from 1993 to 1997, when the mine was closed because of technical difficulties and low gold prices. The plant and most of the equipment from the Pegasus operation were sold in 2001, but the tailings facility, fresh water storage reservoir, natural gas pipeline for power generation, and various buildings and useful foundations remain on site.

Vista acquired the Mt. Todd property in February 2006 for approximately $2 million and since that time has undertaken more than 26,000 m of diamond drilling, extensive metallurgical testing, mine design and a number of preliminary engineering studies. TetraTech MM Inc. of Golden, Colorado, USA, managed the Mt. Todd PFS.

The PFS base case was evaluated using the three-year trailing average gold price of $950/oz and a foreign exchange rate of $0.85 = A$1.00. Highlights include an open-pit mining rate of 2 million mt/y and mill throughput of 18,500 mt/d to produce an average of 187,500 oz/y of gold over an 8.9-year mine life. Proven and probable reserves total 60 mt, grading 1.05 g/mt gold. The waste:ore stripping ratio is 2.37:1.

Pre-production capital cost is estimated at about $441 million, and average total cash production costs are estimated at $487/oz.

The project will be mined using conventional open-pit mining equipment. A waste mining fleet consisting of 180-mt trucks and 21-m3 shovels has been selected to complement a 140-mt truck and loader ore mining fleet. Vista will be the owner and operator of the mining fleets and expects to enter into maintenance and repair contracts for the major mining equipment. Waste rock will be placed in a single waste dump, and concurrent reclamation is planned for the lower benches of the dump.

The proposed flowsheet includes a large primary gyratory crusher, a secondary cone crusher, a single high-pressure grinding rolls unit and a single ball mill. The circuit has been designed to reflect leach test results that indicate the optimum grind size should be 80% passing 100 mesh, coarser than used in previous operations.

Following grinding, the slurried ore will be sized by cyclones, thickened, preaerated and then leached in tanks prior to gold recovery in a hybrid carbon-inpulp circuit. Gold will be stripped from the carbon and precipitated in an electrowinning cell prior to refining into doré bars. The tailings will be detoxified using the SO2/Air process and deposited in the existing tailings impoundment facility.

Vista controls a large land package (160,878 hectares) surrounding the Mt. Todd gold project, and company geologists have identified and are currently investigating four new exploration targets. At the Quigleys deposit 3.5 km northeast of the Batman deposit, an initial gold mineral resource has been estimated at 179,000 oz measured and indicated and 277,000 oz inferred.