Detour Gold has entered into an agreement

with Toromont Industries, a Caterpillar dealer

in Ontario, for the life-of-mine requirement

of up to 36 350-ton class Caterpillar

795F AC haulage trucks for its 100%-

owned open-pit Detour Lake gold project in

northeastern Ontario. The agreement calls

for delivery of the first six trucks in the fourth

quarter of 2011, followed by delivery of 12

trucks during the second half of 2012. The

agreement also includes purchase of mine

support equipment, with an initial order for

approximately 15 pieces of mine support

equipment to be made prior to the end of

2010. The total value of the 18 trucks and

support equipment is about C$125 million.

Detour Gold President and CEO Gerald

Panneton said, “With this order, the company

has now entered into commitments of

approximately C$304 million for the development

of the Detour Lake project over the

next 27 months.”

In a September 21 presentation at the

Denver Gold Forum, Panneton said permitting

for the Detour Lake project is being

finalized, and full-scale construction could

begin by year-end.

AMEC Americas has the procurement,

construction and management contract, and

BBA Inc. has the detailed engineering contract

for the Detour Lake project. Both firms

have been involved in the project since the

pre-feasibility study in 2009 and participated

in the completion of the feasibility study

for the planned 55,000- to 61,000-mt/d

open-pit operation. Production is planned at

649,000 oz/y of gold, using conventional

mining and gold processing technology.

The Detour Lake project is located 180

km north of Cochrane, Ontario, and 8 km

west of the Ontario-Quebec border. Project

development is based on 11.4 million oz of

gold in proven and probable open-pit

reserves at an $850/oz gold price and a

cut-off grade of 0.5 g/mt gold. Start-up

capital costs are estimated at $992 million,

and life-of-mine operating costs are

estimated at $437/oz. Cash operating costs

during the first three years of operation are

expected to average $386/oz for production

totaling 1.9 million oz of gold. Initial production

is targeted for early 2013.

The Detour Lake open-pit design incorporates

10-m-high benches and a 35-mwide

main haul road at a maximum grade

of 10%. Inter-ramp pit slopes will vary

from 49° to 56°, depending on rock type

and structure orientation. The estimated

proven and probable reserves assume a

95% mining recovery rate and an additional

mining dilution of 3.8%.

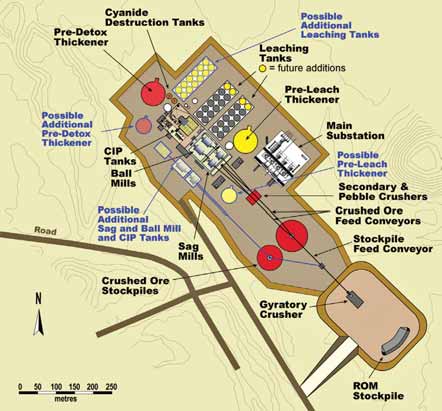

BBA developed the Detour Lake plant

design from testwork conducted mainly at

SGS Lakefield. Processing is based on a

conventional gravity, cyanidation and carbon-

in-pulp facility. The grinding circuit will

include two parallel lines, each having one

36- by 20-ft twin-pinion semi-autogenous

(SAG) mill and one 26- by 40.5-ft twin-pinion

ball mill. The target grind for years one

to three is set at 95 microns. In year four,

circuit throughput will be taken from

55,000 to 61,000 mt/d by adjusting the

grind target to 105 microns and completing

a small expansion of the leach circuit.

Detour Gold anticipates mineral reserves

at Detour Lake will increase as a

result of ongoing drilling. Space has been

allocated in the plant and infrastructure

design to accommodate a third grinding

line for potential future expansion.

As featured in Womp 2010 Vol 08 - www.womp-int.com