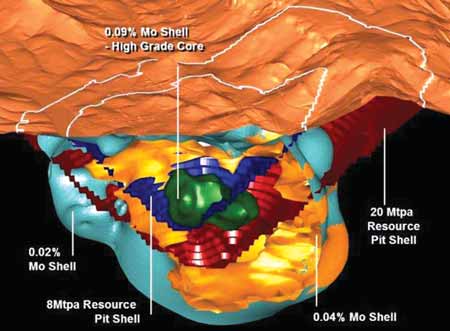

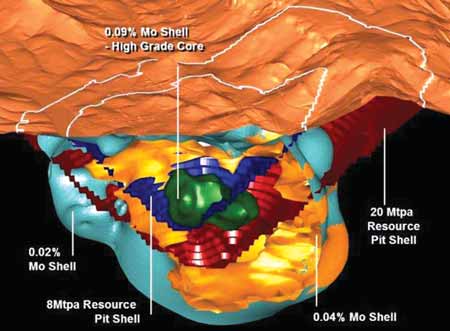

Three-dimensional diagram illustrates the location of the 10-million-mt/y Spinifex Ridge project’s current

molybdenum reserves and resources. (Illustration courtesy of Moly Mines Ltd.)

Mining Startup Anticipated at Spinifex Ridge Moly Project

According to the company, site construction works have commenced and work on the Utah Point export facility at Port Hedland is on schedule. The export facilities will be available to receive Spinifex Ridge ore from October 31, 2010.

The first tender has been awarded for water delivery to the site from the De-Gray borefield, 60 km north of Spinifex Ridge. Tender packages for mining, crushing and haulage are being finalized. Santos (BOL) Pty. Ltd. will provide gas for power generation for the project.

Hanlong Mining, part of Sichuan Hanlong Group, has announced a strategic plan to invest A$5 billion in Australian steel-related raw materials and agriculture and renewable energy projects. Moly Mines has become the cornerstone for Hanlong’s investment plans for Australia. Hanlong had committed to procure a US$500-million project finance loan facility for development of the Spinifex Ridge project by September 30, 2010.

Development activities at Spinifex Ridge will coincide with the launch of the Spinifex Ridge iron project, also managed by Moly Mines.

Moly Mines initially planned to develop and operate a 20-million-mt/y mining operation at the Spinifex Ridge molybdenum project, based on a 24-year mine life. A dramatic fall in molybdenum prices in late 2008 led to the company revising its plans for a smaller 10-million-mt/y operation, with a view to a future expansion to 20 million mt/y.

The mine’s measured resources are 207 million mt of ore at 0.06% molybdenum, 0.10% copper and 1.5 g/t of silver. Indicated resources are 445 million mt of ore, at 0.04% molybdenum, 0.07% copper and 1.1 g/t of silver.

The project involves development of an open-cut mine, transport tunnel, diversion tunnel, processing plant, tailings storage facility, waste dumps, accommodation camp, airstrip and other associated infrastructure. Mining of overburden and ore will use conventional mining equipment and techniques such as drill and blast, and load and haul. The location of the pit intersects Coppin Creek, requiring construction of a diversion. Ore will be conveyed via a transport tunnel through the Talga Range to secondary crushing facilities. Crushed ore will be drawn from stockpiles and fed to a mill circuit to prepare it for processing by flotation, followed by thickening, leaching and filtration.

The results from a pilot plant metallurgical program have enabled finalization of a flow sheet for a processing plant, leading to the selection of high pressure grinding rolls (HPGR) as tertiary crushers for the treatment plant.

Operating costs for moly production are predicted at US$7.80/lb. According to Moly Mines, molybdenum prices rose 45% between December 31, 2009, and March 31, 2010. Molybdenum oxide was traded in the range of US$17/lb- US$18/lb during March and April 2010.