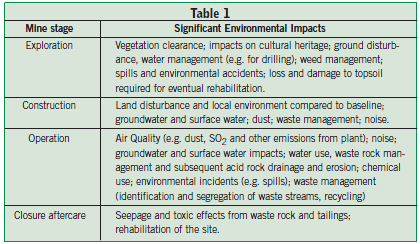

In mining, as in many other industries, the

drivers of environmental management are

many. EHS Data Ltd. provides software

solutions to help clients manage data associated

with environmental performance,

and this article has been written based on

the experiences of users from different mining

companies and geographies. The most

significant environmental impacts at different

stages of the mine’s life, as identified by

clients, are summarized in Table 1.

Mines have an environmental impact

which is, of course, obvious. But so what?

What are the drivers that require these

companies to manage their impacts and

what do they actually do?

Permits

The first and most obvious drivers are permits.

These impose conditions on an operation

which force it to manage its environmental

impacts responsibly. There are various

regulatory bodies around the world

who grant permits that can be something

of a minefield to navigate. But navigated

it must be since no permit equates to no

operation.

In the U.S. and Canada, clients operate

under different regulators at regional and

federal levels. In Canada, for example,

regional regulators include the Ministry of

the Environment, Department of Natural

Resources and Ministry of Energy and

Mines. The types of permit issued may be

different at different stages of a mine’s life

and exploration permits will be granted for

drilling and taking of bulk test samples as

well as the reclamation of works postexploration.

During construction and operation

a single permit exists which will

include details of a post-operation reclamation

plan. Posting of financial security/

bond for eventual reclamation costs may

also be needed. The operation permit will

usually be amended for closure and aftercare

but will, on occasion, be reissued as a

reclamation permit. Such is the case for

Inmet Mining’s closed operation at

Samatosum, British Columbia.

In Western Australia, the Department

of Mines and Petroleum is responsible

as the main regulator at various stages

in a mine’s life. Construction may also

require approval at national government

level via the Environment Protection and

Biodiversity Act of 1999 which requires an Environmental Impact Assessment, project

plans and other documentation. Other permit

obligations are placed on the operators

by the Department of Environment and

Conservation and Department of Water.

In Papua New Guinea, mines are regulated

by the PNG Department of Environment

and Conservation and the PNG

Mineral Resources Authority which govern

the entire operation. Prior to construction,

an Environmental Impact Assessment also

needs to be prepared.

In Europe, member states of the

European Union must comply with the

Integrated Pollution Prevention and

Control regime and issue permits which

consider a mass balance of impacts to the

environment (air, land and water). These

are administered by the regulatory bodies

in each member state. In the U.K., for

example, the permits are referred to as

Environmental Permits and are regulated

by the U.K. Environment Agency.

These permits require of the permit

holder certain operational procedures and

practices including management details

for unusual occurrences. Some regimes

(e.g. Europe and U.S.) also introduce the

need to use particular technology (Best

Available Technology, or BAT in Europe)

which, for example, will produce the least

waste, use less hazardous materials,

enable recycling etc.

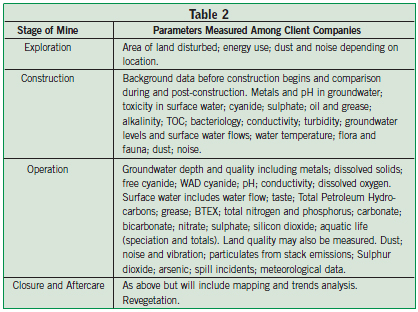

Permits also all require an ongoing

monitoring program, with defined targets

for many of the variables measured (Table

2). The frequency of the monitoring

required can be anything from continuous

(dust, vibration and weather, etc.), hourly,

daily, weekly, monthly, quarterly, half yearly

or annually. Particular sampling may be

required around waste rock dumps, tailings

facilities and sewage outfalls. Breaches need to be addressed and reported to regulators,

sometimes within 24 hours of a

breach occurring. Remedial measures

need to be put in place and repeatedly

exceeding a limit or limits can, in extreme

cases, result in prosecution and withdrawal

of permits. The data also needs to be

reported both internally and externally in

differing formats and at regular intervals

(monthly, quarterly, biannually and annually).

Such processes create a large burden

on many companies.

Stakeholder Expectation

In addition to statutory permits many companies’

stakeholders are also making ever

increasing demands that environmental

impacts are well managed. Neighbors, for

example, are likely to be concerned about

the local environment and will not be

backward in making their feelings known.

In some cases litigation may follow and

there are a number of widely reported

cases where, for example, blood concentrations

of heavy metals in children are

high and the finger of blame is pointed at

the local mine site. The presence of a

robust environmental management

approach with supporting data can enable

the mine site to mount a staunch defense

to such accusations.

Even so, such stories are nothing but

bad news and investors may well stay

clear of companies blighted in this way.

Indeed, there are a number of examples

where significant investors in mining

companies have withdrawn their stake as

a result of environmental performance

which might be regarded as poor or even

negligent. Conversely, a good level of

environmental performance can be

attractive to some investors.

The expectations of voters have also

resulted in governments in some cases

making it obligatory to collect and report

nationally on the release of pollution. The

National Pollution Inventory (NPI) in

Australia, for example, requires qualifying

companies to report on the release of 93

substances identified as a result of their

potential impacts on the environment and

health. Similarly the Toxics Release

Inventory in the U.S., born from the

Emergency Planning and Community Right

to Know legislation, places obligations on

industry, including mine sites, to report

information; firms have to produce particular

reports to fulfil this requirement, such

as Discharge Monitoring Reports (DMR). It

seems likely that Canadian mine sites will

soon also have to report releases from tailings

and waste rock under the Canadian

National Pollution Release Inventory. In

Europe similarly, such data is reported

through the European Pollutant Release

and Transfer Register (E-PRTR) which contains

data reported annually from some

24,000 industrial facilities covering 65

economic activities across Europe.

Company and

Industry Values

Much of the increasing drive for environmental

performance is consistent with stated

company values and many mining companies

have on their Web sites details in

support of the triple bottom line philosophy.

Implicit in this is the organization’s

focus on social responsibility that brings

with it an obligation to report on ecological/

environmental and social performance as

well as financial performance.

A number of mining companies have

achieved accreditation to internationally

recognized standards of environmental performance

such as ISO 14001. This

auditable process requires a company to

identify and manage its environmental

impacts more broadly than just the mine

operation itself and to create a virtuous circle

of continuous improvement through

setting of objectives and targets, monitoring

and review.

There are also examples of sector-specific

voluntary programs which aim to

manage environmental and other impacts.

A good example of this is the International

Cyanide Management Code for the

Manufacture, Transport and Use of

Cyanide in the Production of Gold

(Cyanide Code). Signatories to the code

need to meet an auditable standard for

cradle-to-grave cyanide management from

purchase through operations, training and

emergency response including an obligation

to implement environmental monitoring

programs.

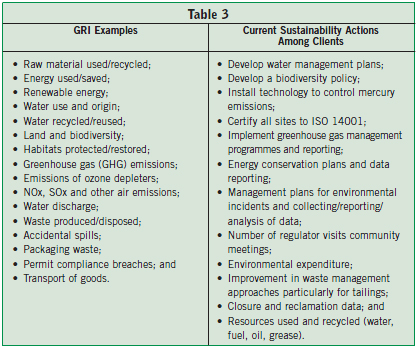

Sustainability

Company values dovetail into sustainability

management in many companies and

there is no question that sustainability

and corporate social responsibility are

becoming ever more common as agenda

items in boardrooms across the globe.

The Global Reporting Initiative (GRI) has

invited companies who report on this to

submit their reports and GRI makes

these records available via its Web site

www.globalreporting.org. Since 2000,

the number of reports filed has doubled

every two years or so. In 2009, for example,

1,289 reports were filed from separate

companies with 57 (4.4%) coming

from the mining community.

Sustainability is a broader concept than

environmental management and a company

needs to develop its own Key Performance

Indicators. There are various guidelines

as to how these should be developed. Many EHS Data clients have their own

national and sector-specific groups developing

these approaches (e.g. the Mining

Association of Canada’s ‘Toward Sustainable

Mining’ initiative, or MAC TSM).

Globally, perhaps the most widely recognized

international guidelines are those

produced by GRI, which is also producing

mining-specific information. Some of these

are qualitative whereas others are based on

clear data generated within the business.

Table 3 illustrates examples of environmental

data (taken from the GRI G3 guidelines)

as well as that considered by a number

of our clients.

Many countries also report data nationally

on greenhouse gas emissions. On a

voluntary basis the MAC TSM, for example,

collects and reports on data from its

membership. Reporting on a statutory

basis also takes place through emissions

trading schemes in both Europe and North

America as well as through the pollution

release processes discussed earlier. In

Australia the National Greenhouse Gas

and Energy Reporting Act 2007 (NGER)

has created a national framework for

reporting emissions and makes it obligate

for companies to report. With the international

emphasis on global warming this

can only increase.

So How Much

Does This Cost?

The drivers for environmental performance

are so significant that the question is not

so much “what does it cost to do it?” but

rather “what does it cost not to do it—in

terms of compliance with legislation, managing

corporate risk and attracting

investors?”

Each year mining companies spend

millions of dollars on environmental management

and many EHS Data clients

spend up to $350,000 per year just on

monitoring a single site. With this investment,

however, we find frequently that the

value in the information that exists is often

not realized. Typically, and by default,

companies will often begin to collate data

in spreadsheet packages but very soon

begin to suffer under the weight of large

amounts of data collected over many years

by different staff, contractors and laboratories.

Often nomenclature has become corrupted

over time and clients frequently

state “our data’s in a mess.” This means,

for example, historical data is often in no

condition to present a defense for a company’s

historical environmental performance.

Further, the day-to-day task involving

adherence to an obligate data collection

reporting timetable is also frequently error

prone, labor intensive and costly, as staff

struggle to manage data, contractors and

regulatory requirements. EHS Data Ltd.

has a range of products in use across the

world to assist with this task and reduce

risk and cost for our clients.

Acknowledgements

Clients assisting in the production of this

article include Catherine Wharton of

Kalgoorlie Consolidated Gold Mines and

president of Goldfields Environmental

Management Group (Western Australia);

Cheyne Mann of Newmont’s Jundee

Operation; Ben Ferris of Harmony Gold,

Papua New Guinea; and Brent Hamblin of

Inmet Mining, Canada.

Graham Holtom (graham.holtom@

ehsdata.com) is a senior consultant for

EHS Data Ltd., a U.K.-based company

which assists customers in all aspects of

managing environment, health and safety

monitoring information.

As featured in Womp 2010 Vol 03 - www.womp-int.com