Cameco Resumes Dewatering at Cigar Lake

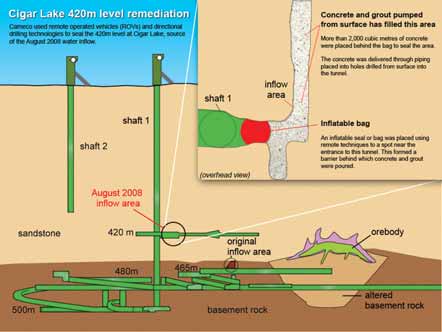

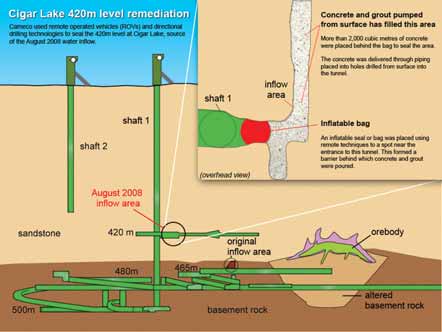

The 2008, 420-m-level source of inflow has been remediated by remotely placing an inflatable seal between the shaft and the source of the inflow and subsequently backfilling and sealing the entire development behind the seal with concrete and grout. Cameco currently anticipates that it will take six to 12 months to dewater and secure the mine, depending on what conditions are found in the shaft and the underground workings.

Cameco said its plans to dewater, reenter, and safely inspect and secure the mine. Plans were developed in consultation with Canadian Nuclear Safety Commission (CNSC) staff and the Saskatchewan ministries of Environment and Advanced Education, Employment and Labor. Cameco currently has approval from CNSC to dewater and secure the underground development and has applied to the CNSC for a license amendment to allow completion of remediation and mine construction.

Prior to the 2006 flooding, the Cigar Lake project was scheduled to begin production in 2008 and ramp up over a period of three years to design capacity of 18 million lb/y of U3O8. Project development was based on proven and probable reserves at that time of more than 232 million lb U3O8 at an average grade of 19%, making the Cigar Lake deposit the world’s largest undeveloped, high-grade uranium deposit.

Cameco is 50% owner and operator at Cigar Lake. Its partners are Areva Resources Canada (37%); Idemitsu Uranium Exploration Canada, a subsidiary of Japan’s Idemitsu Kosan (8%); and TEPCO Resources, a subsidiary of Tokyo Electric Power (5%).