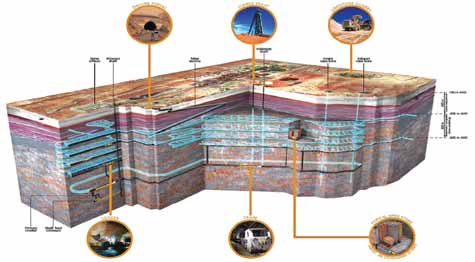

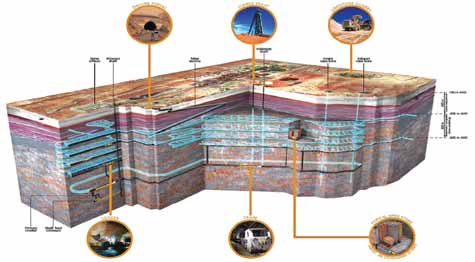

A mechanical failure that occurred in early October at Olympic Dam will keep the BHP Billiton mine’s

Clarke shaft (shown here in the middle of the mine layout diagram) out of commission for several months.

(Photo courtesy of BHP Billiton).

Shaft Accident to Impact Olympic Dam Production

On October 21, in a brief statement included in its production report for its fiscal first quarter (ended September 30, 2009), BHP Billiton said it expected the damaged shaft to remain out of production until sometime during its fiscal third quarter (ending March 31, 2010). Hoisting is continuing at a secondary shaft, which will allow the mine to produce at about 25% of capacity.

Olympic Dam is located 560 km north of Adelaide and is Australia’s largest underground mine. During BHP Billiton’s fiscal year to June 30, 2009, the mine produced 9.9 million mt of ore and the integrated metallurgical operations produced 194,000 mt of copper cathodes, 4,000 mt of U3O8 in concentrate, 108,000 oz of refined gold and 937,000 oz of refined silver. In May 2009, BHP Billiton released a Draft Environmental Impact Statement to seek government approvals for a potential six-fold expansion of its Olympic Dam operations.

Olympic Dam’s copper production is sold to customers in Europe, Australia and Asia under contracts that are negotiated annually, with pricing based on the LME cash settlement price. Olympic Dam has long-term contracts for the sale of uranium oxide concentrates to customers in the United Kingdom, France, Sweden, Finland, Belgium, Japan, South Korea, Taiwan, Canada, the United States and Spain. BHP Billiton declared force majeure on some of its Olympic Dam copper and uranium contracts.

The impact of lost production from Olympic Dam on copper and uranium markets was the subject of speculation in the mining and business press during the second half of October. The relatively small spot market for uranium was expected see the sharpest rise in prices, because Olympic Dam in recent years has been supplying 7% to 10% of the world’s mined uranium.