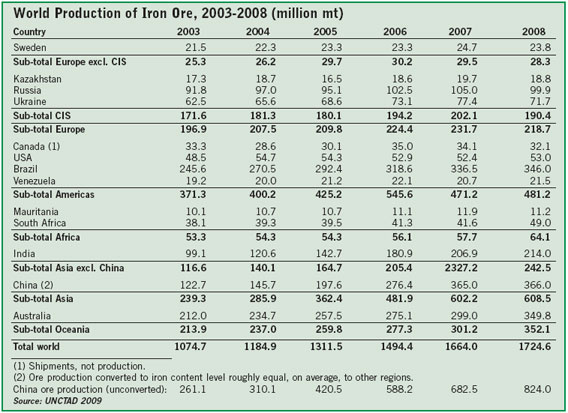

Despite a drop in demand late in the year, global iron

ore production rose by 3.6% in 2008 to more than 1.7

billion tons.

Iron Ore Outlook: Facing a Slow Climb Out of the Pit

A review of 2008–2009 market developments concludes that an oversupply

situation will continue for the remainder of this year and into the next, when

prices could begin to stabilize in preparation for a possible upturn in 2011

By Magnus Ericsson and Anton Löf

World crude steel production decreased by 1.5% to 1,325 million metric tons (mt) in 2008. China now accounts for more than a third of world production (38%), but while Chinese production is still rising (1.9%), growth was much slower than the 16% rate achieved in 2007. All world regions except Asia reported production decreases. In Europe, production fell by 6.4%, in Africa by 8.8%, in the Americas by 4.9% and in Oceania by 4.1%. The Asian nations increased output by 1.5% taking into account Chinese production. Among the larger producers, the United States, Russia and Germany experienced production decreases of 5.4%–7% while Japan had a decline of 1.2%. China, India and the Republic of Korea all had increases of between 1.9%–4.1%.

Since 1999, the global iron ore market has grown by 95% or 840 million mt. More than 78% of this growth occurred in the last five years and 61 million mt in 2008 alone. In developed market economies (including Eastern Europe), excluding Australia and Sweden, iron ore production fell by 6.6% during the same period. Australian and Swedish production grew by 130% and 26%, respectively. Iron ore production from the CIS republics increased by 37% during the same period. However, production from those countries still has far to go to reach the record level of 250 million mt attained in the mid-1980s, despite some recovery in recent years. In Western Europe, production appears to have bottomed out and has remained just below 30 million mt for the past couple of years. In North America, production remained stable at 85– to 90–million-mt.

Pellet production reached 317 million mt in 2008, a 3% fall from 2007’s record 326 million mt. This drop-off confirms that pellet production was hit harder than other iron ore production in late 2008 when the financial crisis hit and steel producers chose to maintain their blast furnace operations— but at minimum capacity and without using high-grade raw materials such as pellets. World exports were 137 million mt, a decrease of 2.9% compared with 2007.

Brazil’s exports increased by 4.5% to 282 million mt in 2008. The increase was smaller than the previous year and dropped Brazil to second place among iron-ore exporting countries. With more than 300 million mt and an increase on 2007 of 16%, Australia regained the top spot among ore exporters. Indian exports grew for the ninth consecutive year and it is now, at 101 million mt, the third largest exporter. South Africa, Canada, Russia, Ukraine and Iran follow, each with exports at 25– to 35–million-mt. Swedish exports reached 18 million mt, a decrease from 2007. In Africa, Mauritanian exports decreased by 7.2% in 2008, while South African exports rose by 8%. The last few years have been successful for Kazakhstan and Russia in terms of iron ore exports, but in 2008 exports decreased from both countries. Exports from Ukraine, on the other hand, increased by 5.4% to 22 million mt.

China is still by far the world’s largest iron ore importer. In 2008, it imported 444 million mt, an increase of 16% over 2007. Japan’s imports increased by a comparatively modest 1.1% to 140 million mt. Together with the third and fourth largest importers—Germany and the Republic of Korea—these countries accounted for around 75% (678 million mt) of total world imports. European imports (excluding the CIS countries which fell by 5% in 2008), reached 164 million mt, corresponding to 18% of world imports. France imported slightly less than half as much as Germany, and the remaining countries with imports exceeding 10 million mt are Italy, the United Kingdom, Belgium, Luxembourg and the Netherlands. The CIS republics do not yet import iron ore from outside the CIS, and their internal trade was about 1.7% of the world total. Given Russian overseas projects, however, imports from the rest of the world will soon be a fact there.

Price Negotiations: Not Over

‘til the Chinese Lady Sings

The 2009 price negotiations have been

lengthy and at the time of writing (late

June) were still not fully completed. Initially

voices were heard, in particular from the

Chinese steel mills led by Baosteel and

backed by CISA representing more than

100 steelworks, demanding a sharp decrease

in prices to offset lower profits for

the steel companies. Some buyers demanded

iron ore prices to be cut at least to 2007

levels and some even expected price reductions

would be as large as 50%–60%, but

when Chinese spot prices later increased,

expectations were moderated.

While the “Big Three” producers—Vale, Rio Tinto and BHP Billiton, have all reached agreements with some of their customers, no deals have yet been made with Chinese steel companies. The Japanese steel industry continued to be first to sign when Nippon Steel concluded the first deal with Rio Tinto on May 26. The agreement was accepted as a benchmark price by BHP Billiton which signed its first agreement, with Japanese JFE, on the June 12. Meanwhile, Vale had settled for a 28.2% reduction in the price of fines and a cut of 44.47% in the price of lump ore. Southeastern fines prices declined to US85.43¢/dmtu and Carajas fines to US89.87¢/dmtu. Lump prices went down by 44.47% to US99.42¢/dmtu. Vale also concluded the first pellet deal at US110.43¢/dmtu, a decrease of 48.3%.

The smaller reduction for Brazilian ore reflects elimination of the Australian “freight premium” that was added in 2008, and which had lost its justification with the fall in freight rates. The final outcome of negotiations for prices to China is still uncertain. It is possible that there will be no agreement at all—which would not be totally controversial as a large portion of Chinese imports are already traded on a spot basis—but it may be more likely that agreement will be reached at the rates already negotiated with the producers by other Asian steel makers.

The benchmark pricing system continues to be fiercely discussed and its future is uncertain, to say the least. A new price setting mechanism will, however, not be introduced overnight. It will take several years to find a new model and it is more likely that there will be several models in use in parallel.

Industry Consolidation Tapers

Off—for the Time Being

The total market share of the Big Three producers

dropped to 34% in 2008. They have

not managed to increase their production

quite as fast as total world production,

mainly because of rapid expansion by small

producers in India and China in 2005–

2007, but also due to production curtailments

by the same Big Three in late 2008.

To measure corporate control at the production stage underestimates the concentration of the iron ore sector, because large portions of total production do not enter the market due to vertical integration. An alternative is to look at share of seaborne trade. Measured this way, the shares of the major companies are considerably higher. Vale alone controls 33% of the total world market for seaborne iron ore and the three largest companies control 69%. This number is quoted by those who argue that this concentration could lead to control by major producers over prices, particularly under the present benchmark negotiating system. While the proposed merger between BHP Billiton and Rio Tinto failed, it was announced in early June 2009 that Rio Tinto and BHP Billiton had entered into a non-binding joint venture agreement covering the entirety of both companies’ iron ore operations and infrastructure in Western Australia. This agreement has also raised concern in some quarters about the growing bargaining power of the large producers.

Vale remains the world’s largest iron ore producer. In 2008, Vale controlled 303 million mt of iron ore production, a slight drop from a peak of 308 million mt in 2007. Vale’s share of total world production was 17.3% in 2008, down from 18.8% in 2007. The decrease was due to drastic cuts in production in the last quarter because of the collapse in the North American and European steel markets, which hit Vale harder than its Australian competitors; and to the quick growth in total world production resulting from higher production in Western Australia and South Africa. Rio Tinto increased its production by only 8 million mt after having cut down in the last quarter of 2008 and this resulted in a marginal loss of market share, to 8.7%. BHP Billiton, in third place, increased its total output by 15 million mt and its market share to 7.8%.

New Mine Capacity Growth

Drops by Almost a Third

New iron ore mining capacity brought into

operation in 2008, as identified at the

individual project level, reached around 90

million mt globally. This is a considerably

lower figure than in 2007 when some 130

million mt of new capacity was recorded.

The year preceding that saw 70 million mt

of added capacity and even farther back in

the past only 30– to 40–million-mt was

typically reported.

These totals include known brownfield (expansion) projects. However the estimates for both years exclude many small, locally owned projects, mostly in China and India but also in Brazil, which are not publicly disclosed and described in the same manner as a project sponsored by a listed company. Neither do the figures include incremental capacity increases in existing mines, such as de-bottlenecking or capacity increases due to reorganization, sometimes called “capacity creep.” The driving forces for refilling the pipeline with new projects increased considerably in the years of high prices. The coming years will see fewer projects announced but there are still many projects in the pipeline.

Vale has taken major steps to remain the largest producer. Among its projects are expansions in Carajás, first by 10 million mt in 2009 and later by 30 million mt by 2011. The company’s Serra Sul project, with an addition of 90 million mt to be ready in 2013, is still subject to approval by the board of directors. Apolo is a 24-million-mt/y project, also to be finalized in 2013. The combined cost of these projects is roughly $16.6 billion. If all Vale’s projects revolving around iron ore, including infrastructure capacity increases and pellet plants, are added together, the total comes to about $20 billion. These projects are all part of Vale's plan to compete with Chinese producers by increasing output and possibly producing pellets directly on the Chinese market. The ore will be transported by new, very large ore carriers with long-term shipping contracts to avoid the volatility of freight charges. Vale has also decided to enter the coal business on a massive scale, aiming at 30-million-mt production in 2010. In this way Vale will be able, as have Rio Tinto and BHP Billiton, to supply both major inputs for steel making coke and iron ore.

Current Rio Tinto iron ore projects include the Hope Downs, Mesa A and Brockman 4 mine in Australia, which are all key priorities, while the Simandou project in Guinea, the collaboration with state-owned Orissa Mining Corp. in India and the Canadian projects within the IOCC are all on hold or being operated at lower levels than earlier. The Corumba project in Brazil was sold to Vale in early 2009.

In 2008, BHP Billiton announced approval of $1,094 million of capital investment to accelerate the growth of its iron ore operations in Western Australia. This investment— Rapid Growth Project (RGP) 5—is expected to increase capacity to more than 200 million mt during 2011. The actual capacity increase is 50 million mt/y. At present some 50% of engineering is complete and construction activities have commenced. BHP Billiton’s long-term plan is to increase iron ore capacity to more than 300 million mt, but there are already plans to increase the capacity of Port Hedland, the export port, to over 350 million mt. In the last quarter of 2008, BHP Billiton delivered RGP 3 which expanded the capacity at Area C by 20 million mt. RGP 4 is on track with engineering more than 95% complete and construction is nearing 80% completion. RGP 4 will increase installed capacity by 26 million mt to approximately 155 million mt in the first half of 2010.

Fortescue Metals Group (FMG) has reached its planned production capacity of 55 million mt/y within a year after its first shipment. Australia now has a third force in iron ore mining after Rio Tinto and BHP Billiton. Most other Australian projects are at an early stage or considerably smaller. FMG’s plans for expansion are set on ramping up capacity from today’s 55 million mt/y, to 75 million, 95 million and then 155 million mt/y. This involves expanding the Chichester range and putting the Firetail, Investigator, Solomon East and Serenity deposits into production. According to the company, this could be done within a period of about four to five years.

Progress in Canada slowed in late 2008 and early 2009, not surprising considering that most new projects are located in the Canadian Arctic. By mid-2009 most Canadian iron ore projects had been postponed because of the current financial situation.

In South Africa, Kumba Iron Ore has been plagued with problems during the last couple of years; for example, the dispute over the Falémé project in Senegal. This project was originally operated by Kumba but was later awarded to Arcelor Mittal by the Senegalese authorities, and then contested by Kumba. However, many of the problems have been resolved and the company has targeted increased production as a goal. Kumba has stated that by 2016 it will have capacity to produce 150 million mt/y and will obtain a 13% share of the total seaborne market for iron ore. This is more than double its current capacity and will be achieved by realizing the full potential of the Northern Cape Province in South Africa. The company also has access to opportunities in West Africa. Kumba's project pipeline includes both expansions and new mines: The Sishen expansion project is under way with the construction phase almost complete and full operation expected in 2009. The Sishen South project was first envisaged as a 3-million-mt/y new mine, but has been upgraded to a 9 million mt/y project, following completion of a feasibility study and an investment decision in 2008. The mine will start production in 2012 and full capacity will be reached in 2013. Assmang is the other large producer of iron ore in South Africa. Construction of its Khumani iron ore mine is complete and full production of 16 million mt will be reached by 2010.

There are a few other early-stage projects throughout Africa, some of which are probably years from completion but may contribute to making Africa more important as an iron ore producing region. Arcelor Mittal has taken an interest in the continent and is in the process of developing three different projects: Falémé in Senegal, El Agareb in Mauritania and Yekepa in Liberia. The Mbalam project is controlled by Sundance Resources. In Liberia the Bong iron ore mine is to be reopened by a Chinese company. Rio Tinto's Simandou project in Guinea could become a mine that will potentially produce 70– to 170–million-mt/y. However, in August 2008 Rio Tinto received notice from the Guinean Minister of Mines of a compulsory relinquishment of the northern part of the Simandou mining concession while confirming Rio Tinto’s right to the southern part. Rio is contesting this decision.

Possible Shakeout Will

Benefit Offshore Competitors

The World Steel Association has forecast a

drop in steel consumption of almost 15%

in 2009. That estimate can be characterized

as relatively cautious, since there are

signs that the impact of China’s very large

stimulus package may be sufficient to yield

positive growth in steel use in that country.

Similarly, the composition of macro-economic

stimuli in other countries, with an

emphasis on construction and support to

the transportation industry, is such that the

measures are likely to have a positive effect

on steel demand.

When analyzing probable developments over the medium term, the authors of this report typically employ a type of gap forecast comparing projected capacity, based on investment plans, with assumptions about steel production. This approach is less useful in the present situation. The world iron ore industry is operating far below capacity. Even under the most optimistic assumptions for steel production, demand for iron ore will surely be lower in 2009 than in 2008. It is clear that the present oversupply situation will not go away soon. There are, however, two important factors that affect the outlook, although they do not eliminate the supply overhang: expected low freight rates, and high costs in Chinese iron ore mines. Small- and medium-sized Chinese producers will most likely be forced to substantially reduce their output, particularly since they are no longer protected by high freight costs for imported iron ore. It is estimated that half the Chinese iron ore mining industry is presently operating at a loss.

In the medium term, it is likely that contract prices will remain at a level corresponding to that of current spot prices; that is, $70/mt for landed ore in China. A consequence of this price shift will be a shakeout of Chinese iron ore mining. The effect of the price fall will be reinforced, as far as the Chinese mines are concerned, by rising costs for health and safety measures, environmental management and rising energy prices. As domestic production in China falls, the potential slack will be taken up by new investment, particularly by the Big Three. This will allow the industry throughout the rest of the world to maintain operating rates that generate a contribution to fixed costs, although they will not produce at full capacity.

In conclusion, the iron ore market will continue to be oversupplied through 2009 and probably also into 2010, depending on when steel demand picks up. Raw Materials Group expects iron ore prices to stabilize in 2010 and turn upward in 2011.